Weekly Market Prep - 10/2/2023

The markets look a little confused here, but they're definitely getting more volatile.

Hope everyone had a great weekend & welcome back to ETF Focus!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

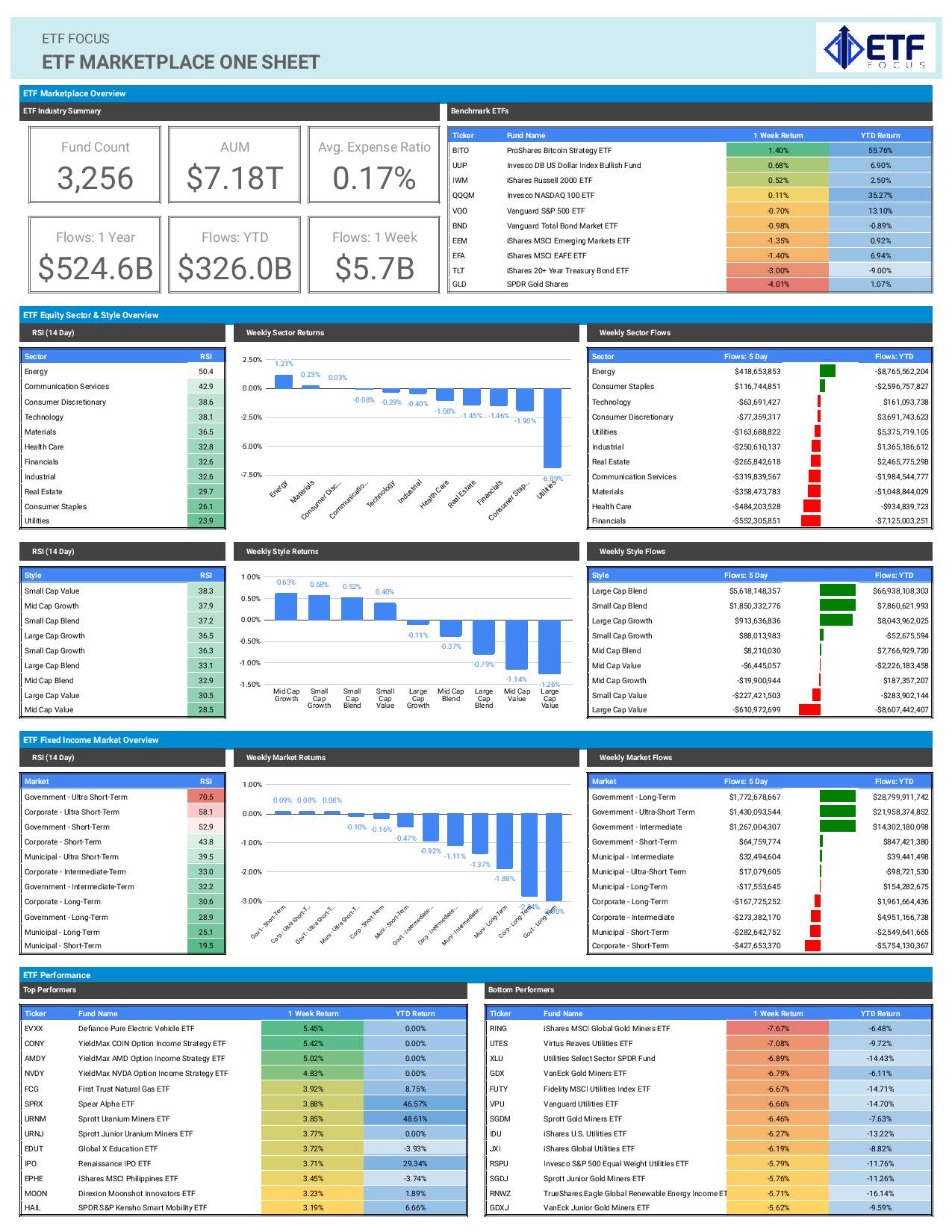

While it may not necessarily be showing up in the VIX right now, this is one of the stranger and more volatile markets we’ve seen in recent memory. 2023 has mostly featured the “stronger for longer” narrative with respect to economic activity and the “higher for longer” narrative with respect to interest rates and Fed policy. Investors have largely reacted to both by buying stocks and selling bonds. Now, it feels like the markets are trying to figure out where things are headed next. Look no further than the fact that utilities, traditionally one of the most defensive sectors of the market, was one of the biggest losers, dropping roughly 7%! Plus, this comes just a week after utilities outperformed the S&P 500 by more than 7% over the three weeks prior to that! There’s just some weird stuff going on right now and I wouldn’t be at all surprised to see volatility start picking up more now heading into October, traditionally one of the toughest months of the year for equities.

On the equity side, there’s not really much strength out there right now. Energy stocks continue to do relatively well thanks to rising crude oil prices. They’re above $90 a barrel right now and there may not be much stopping them from getting to $100 in the near- to intermediate-term given the political pressure to keep prices high. If that’s the case, energy stocks will probably remain a market leader through the end of the year.

We’re really not getting much of a message from small-caps here either. You’d typically expect to see them underperform in market downturns, but they’ve just been more choppy than anything. The story’s been pretty much the same for value stocks and low volatility, so it’s really been tough to discern any short-term equity market direction right now. The one thing we have seen since the beginning of July is a steady, although volatile, decline in the VVIX/VIX ratio. That tends to be a bearish sign for risk assets, but it’s still really not close to the levels it was throughout most of 2022, so we may yet have some room to go there. High yield spreads are also rising again, which would be another bearish sign.

Treasury bills are still the leader on the fixed income side, although ETF flows are showing heavy interest in both T-bills and long bonds. I wrote about this last week and it could be an indication that investors are positioning themselves for a deeper downturn in the markets. Given the momentum of this move, I’m not sure we’ve seen a top in long-term Treasury yields yet, but when we do I think things could accelerate quickly.

Key Economic Reports This Week

United States ISM Manufacturing PMI (Monday)

Australia RBA Interest Rate Decision (Monday)

United States JOLTS Job Openings (Tuesday)

United States ISM Services PMI (Wednesday)

United States Non-Farm Payrolls (Friday)

Market Outlook

Utilities is the sector to watch this week given its volatility over the past few weeks. The longer these swings continue to take place, the more unsteady the market as a whole gets. The VIX isn’t necessarily showing any significant signs of stress yet, but that could change quickly if the markets can’t shake this current nervous tone. Long-term Treasury yields should also begin settling a bit here. The current rise is overcooked and should begin to balance out soon.

The JOLTS report on Tuesday will be the precursor to this week’s big economic report, Friday’s non-farm payrolls number. At this point, the labor market is the one part of the economy is holding up sentiment. If that begins showing signs of breaking, there may not be a whole lot in the near-term to prop it up. I don’t anticipate we’ll see that this week given the trend in jobless claims, but it’s worth watching closely.