What Treasury Bear Market? ETF Investors Are Betting Hard On A Rebound!

I think a growing number of investors are starting to realize that the risk/reward tradeoff in long-term Treasuries is improving.

At the beginning of the year, one of my 13 predictions for 2023 was that “Treasuries Will Be The Best Trade Of The Year”. Yikes!

To be fair, the logic was pretty sound and it looked like it might play out for a while. I believed at the time that the Fed would end its rate hiking cycle in Q1, which would usher in the possibility of long-term Treasuries acting like a safe haven trade. After all, the end of Fed rate hiking cycles have historically marked a turning point for equity rallies. Of course, that never happened and the Fed is still threatening more rate hikes even today.

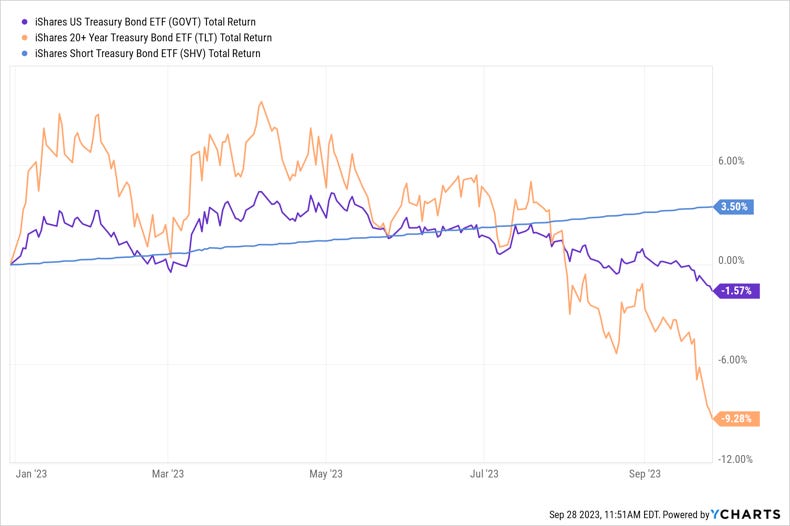

Going long long-term Treasuries actually worked for a while. The iShares 20+ Year Treasury Bond ETF (TLT) was up more than 8% by the second half of January and gained 10% at its peak. Then, the bottom fell out.

Treasury yields have been soaring, particularly on the long end of the curve where the 10-year yield now stands at its highest level in 16 years. The broader government bond market, which measures security prices across all durations, hasn’t done nearly as poorly, but it’s also down year-to-date. Treasury bills, on the other hand, have been steady risers.

With long-term Treasuries now down more than 17% from their 2023 peak, it would be reasonable to assume that investors have been running for the exits. In the ETF market, not only has that not happened, it’s the exact opposite! Investors have been moving INTO long-term Treasuries!

If you look at government bond ETF flows throughout 2023, it looks very much like a barbell curve - the strongest inflows showing up in short durations (ultra-short term & floating rate) and long durations. The interest in Treasury bills & floating rate notes is understandable. Fixed income investors are tired of seeing capital losses throughout the past two years and simply want to take the high yield and sit it out for a while.

The interest in long bonds, however, is more curious. These are the most interest rate sensitive and have experienced the biggest losses of the current cycle. On a relative basis, they’ve taken in the biggest inflows year-to-date. TLT actually has the 2nd largest ETF net inflow of ANY fund in the marketplace this year!

Unless you’re a long-term investor simply dollar cost averaging into a position, which I’m guessing most of this isn’t, these are investors who are betting on a big Treasury rally happening here soon. I actually understand and agree with their position. If you’re reading the tea leaves here and you see consumer credit getting maxed out, retailers warning about weak consumer behavior, corporate bankruptcies rising, student loan payments resuming and the impact of sharply higher interest rates on all forms of lending, you have to at least be open to the possibility that the safe haven trade could return imminently.

Plus, soaring Treasury yields happening this quickly have historically been a strong signal that pressures are building in the bond market and something could very well break. The 10Y/3M Treasury yield has shrunk considerably in the past month and that means that the Treasury curve is normalizing, something that typically happens right before a recession. What usually happens around a recession? Stocks prices fall and Treasury prices rally. In other words, all of the pieces are lining up for a rebound in long bonds.

I think a segment of fixed income investors are starting to sniff this out. They may be early on the trade right now, but these conditions can shift so rapidly that it’s usually better to be early than late.

Long-term Treasury ETF inflows have been steady and solidly positive throughout 2023, but they have cooled off recently. That coincides with the time that 10-year Treasury yields really took off, so it’s entirely possible that some of these Treasury bulls are throwing in the towel and moving elsewhere. Still, a capitulation in sentiment would typically be associated with larger outflows and we’re simply not seeing that here.

Does that mean that there’s some underlying support building for a rebound in long-dated Treasuries? A recent survey showed that asset managers are starting to dip their toes back into the water on long bonds as well, so the answer may very well be yes. There’s still some work to be done to halt the current slide in Treasuries, but I also think a growing number of investors are starting to realize that the risk/reward tradeoff in long-term Treasuries is improving.

Higher for longer till something breaks is what I reckon. Might be a tad early for this call. Good analysis overall I’ll keep this on my radar.