If you’ve followed the financial media lately, it’s a lot of doom and gloom. I’ve largely been in that camp too and have repeatedly said that I don’t how the Fed is going to be able to raise interest rates to tackle inflation without swinging the U.S. economy back into recession. I think the base case is still that a reversal to negative growth probably won’t happen in 2022. There’s a narrow window that the Fed can work with, but they’ll really have to thread the needle.

Most of the data is pointed in the wrong direction. The housing market is slowing. Consumers are showing signs of changing their spending patterns due to high inflation. The yen is plunging. The FANG stocks are breaking down. The S&P 500 may only be 10% off of its highs, but it feels like another 10-15% downside wouldn’t be all that surprising.

Note: If you haven’t already, check out my newsletter from a couple weeks ago where I lay out the bull case for Treasuries in 2022.

Yet there is still a scenario where bullish sentiment in stocks returns and prices head firmly higher again.

For the record, I think this is a low probably event in the near-term, but could happen towards the latter part of the year. I’m not saying this will happen soon or even at all. I’m merely pointing out the scenario that I think would see the bulls returning to the equity markets.

That scenario is an unexpected dovish pivot from the Fed.

We know that the Fed is in full inflation control mode. It’s not even thinking about growth at the moment. We know that since the 2-year Treasury yield has risen from 0.25% to around 2.65% today, the market is pricing nearly 250 basis points of Fed rate hikes. The markets are as hawkish today as they have been at any point during this cycle and will remain that way unless something happens to change the narrative.

I believe the Fed will continue pushing rates higher for as long as they’re able. It’s willing to let the economy bend, but it doesn’t want it to break. We have, however, seen the central bank blink in the past. The 4th quarter of 2018 comes to mind when the Fed was on a tightening path before a 20% correction in equities and the threat of a European recession resulted in a quick about-face from the central bank. Could it happen again? Don’t be surprised if it does.

Here are the two “dovish pivot” scenarios, one of which I think needs to play out in order for stocks to rally again.

Inflation Cools Faster Than Expected

The markets fear inflation above all else, but March’s core inflation rate reading that came in slightly below expectations did indeed mark peak inflation for the United States. In fact, inflation begins falling faster than expected. China’s reopening from its recent COVID lockdown eases some of the pressure on supply chains. Energy and commodity prices peak and start returning back down to earth.

The Fed no longer needs to price in an aggressive rate hiking schedule and Treasuries finally bottom. Investors start to feel like maybe we can get through this current inflation scare while keeping GDP growth numbers in positive territory. They may not necessarily be strong numbers over the next few quarters as the economy still deals with some of the fallout, but the consensus is that recession will be avoided, inflation will return back towards the Fed’s target and risk asset prices can begin the reflation process.

The Fed Decides It Can’t Risk A Recession

Powell sees that the Fed’s monetary tightening policy is indeed resulting in the recession that the markets feared. Stocks are plummeting and inflation is taking longer than expected to get under control. The impact of the Russia/Ukraine war drags on and supply chain bottlenecks are still causing problems.

The Fed effectively decides to end its laser focus on inflation and pivots to at least a partial focus on reigniting growth. Rate hikes are done and the markets start pricing in rate cuts instead. The Fed decides to stop shrinking its balance sheet in order to support the economy. The Treasury yield curve starts to normalize - short-term rates fall on a more dovish Fed and long-term rates rise as investors feel less need for safety trades.

To reiterate, I don’t think these are scenarios that have a chance of playing out at least until the 2nd half of 2022 and maybe longer. The Fed won’t get any information within the next several months that will change its mind on rate hikes, so don’t be surprised to see a Fed Funds rate of around 2% by the end of July.

But the central bank does have the power to change the narrative. Its dovish pivot in 2018/2019 sent the S&P 500 back to new highs within 4 months of correcting by 20%. Its dovish pivot in 2020 during the depths of the COVID shutdown (trillions of dollars of stimulus cash also helped here) helped the S&P 500 claw back all of its 30%+ decline within 5 months. It could very well happen again!

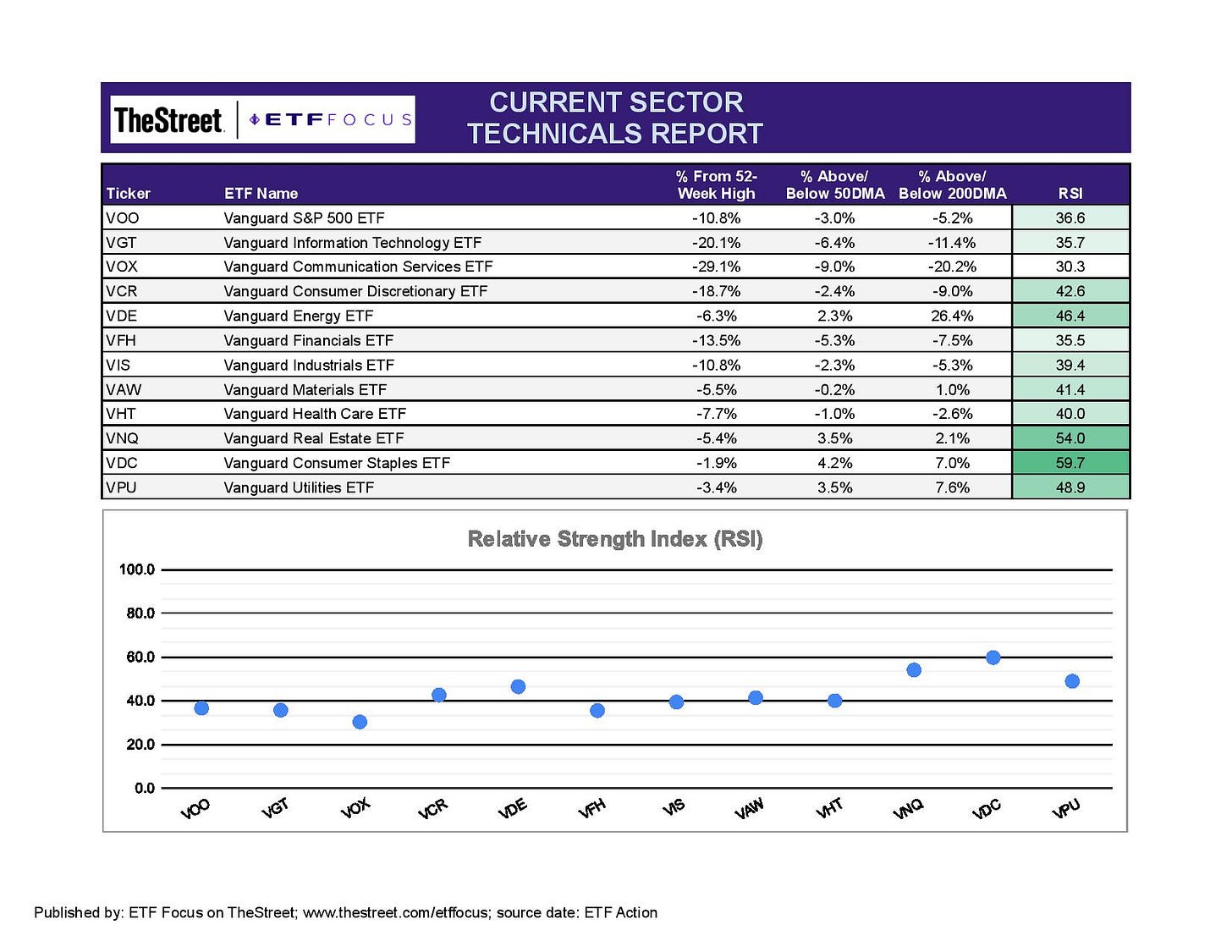

ETF Sector Breakdown

With that being said, let’s look at the markets and some ETFs.

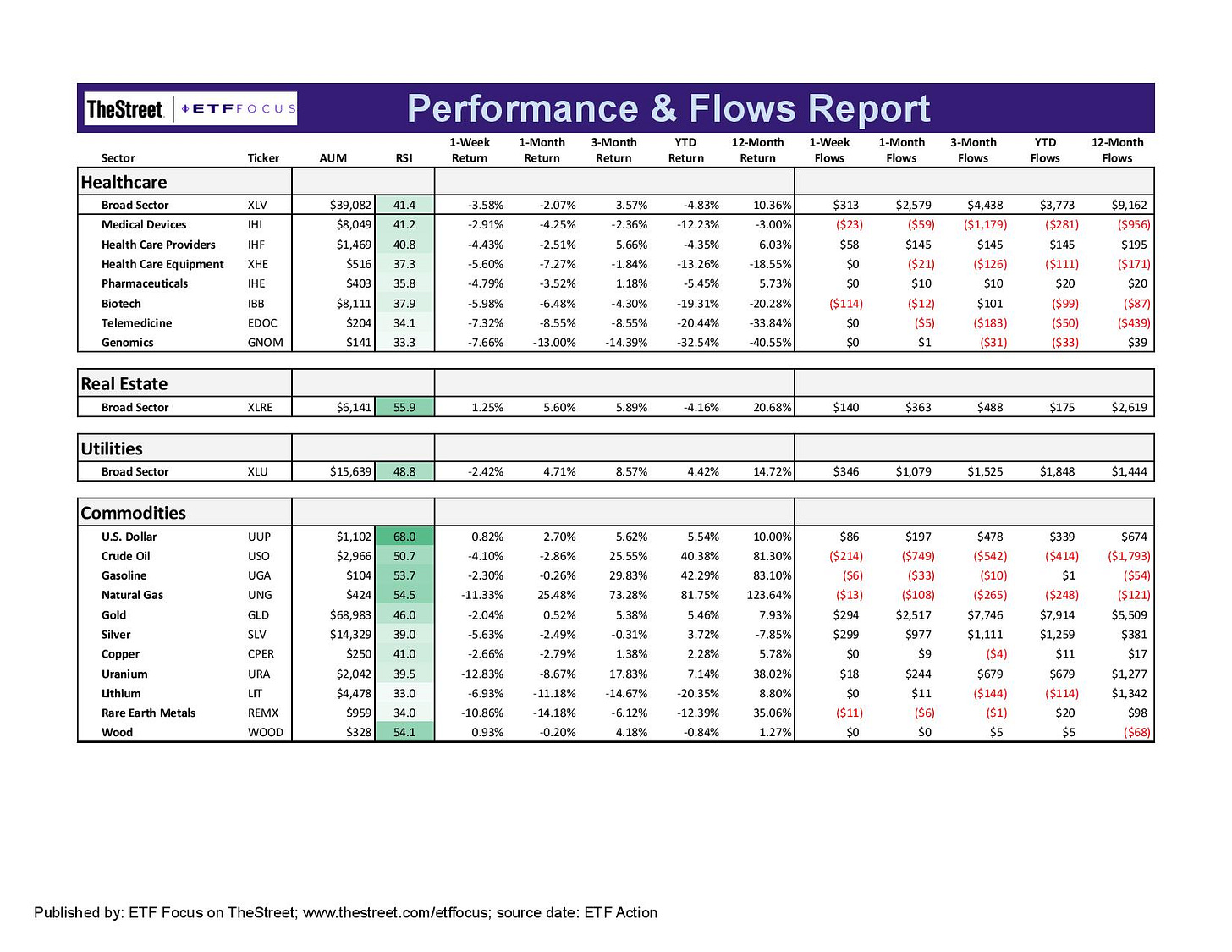

A lot of interesting stuff happening at a sector level here. There are three clear leaders in the equity market right now - utilities, consumer staples and real estate. All three have been steadily outperforming the market for about a month now and haven’t yet shown signs of slowing down. With Treasuries having cratered over the past couple months, it’s looking like investors are using these sectors as their quasi-safe haven landing spots. With the FANG stocks going bust and the air coming out of cyclicals, I expect these sectors to continue outperforming as we head into the Fed’s May meeting.

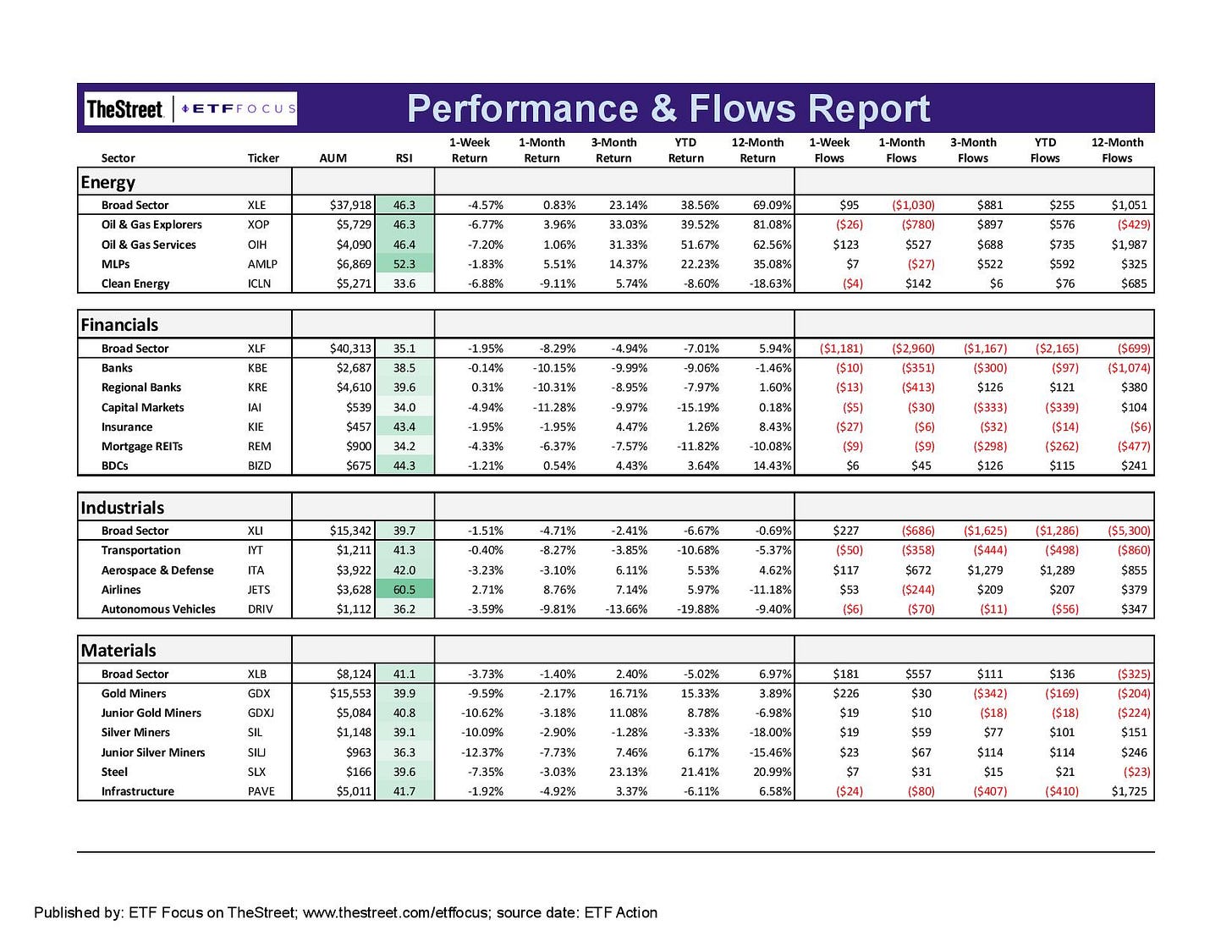

Is the party over for energy stocks? It’s sure looking that way. The sector has now underperformed the market since late February and today’s 6% decline is showing a near-term sentiment shift. Crude oil prices are coming back down and natural gas dropped 11% last week. The materials sector, also a good proxy for the commodities space, finally underperformed last week as well. Investors piling into energy thinking they can capture past gains might be sorely disappointed.

The biggest development, I think, is in Treasuries. Yields have been steadily climbing in response to the Fed, but I think we’re in the early stages of things turning around. The 10-year note looks like it’s found a ceiling at 3% and is headed back down again. This is important because it means investors are starting to view Treasuries as a safety trade again, not just a proxy for what the Fed is going to do. If that’s indeed the case and the reversal we’ve seen over the past couple trading days sticks, things in equities might start to get ugly.

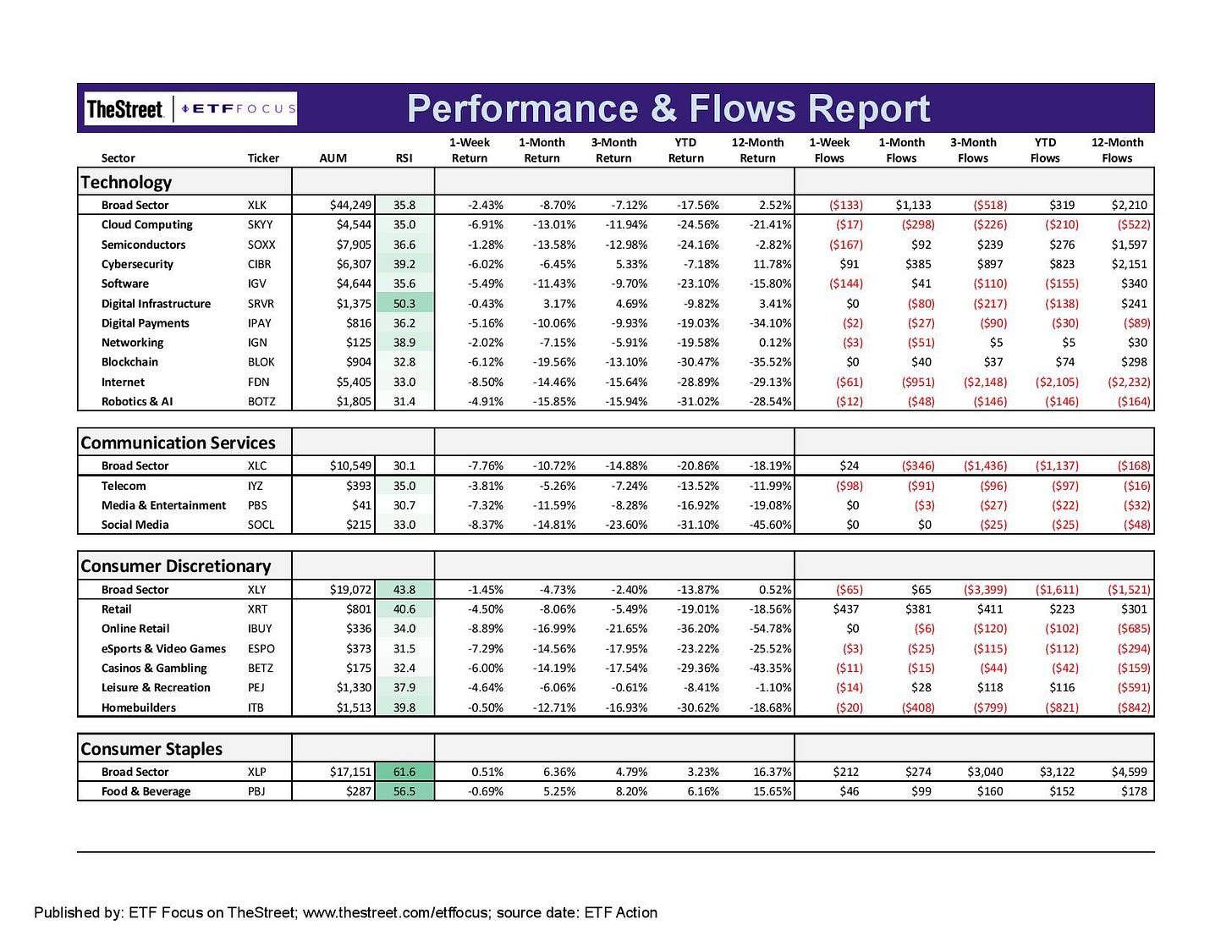

There’s very little delineation across the various subsectors within growth stocks. Everything is underperforming at the moment. Communication services continues to get hammered following the Netflix debacle, but Facebook, Alphabet and even some of the traditional telecoms were declining even before that. Are valuations getting a little attractive again following the recent pullback? There was definitely a lot of air to be let out of the balloon, but the mega-cap earnings reports coming this week should offer some guidance.

It’ll be interesting to see if tech starts making a bit of a comeback here. If Treasury yields continue drifting lower, we could see tech start to outperform the broader market again. Not necessarily produce positive returns mind you, but at least outperform the S&P 500. Lower rates tend to be positive for growth stocks and I think there’s a chance we start seeing that here again.

Even energy and materials, two of the market’s best-performing sectors this year are starting to see a sharp reversal. The miners have been one of the better trades throughout 2022, but it’s looking like the rally is going to be over at least in the short-term. If the Fed continues to push rates sharply higher and the economy speeds towards recession, there may be more room to fall for precious metals.

Banks are looking weak, but at least they had a relatively better time last week. All of the lending data, especially mortgage application data, suggests that a significant slowdown in the housing market is coming. The homebuilder stocks are already down 30% this year and slower lending activity is going to hit the bottom line. The big banks have gotten good about diversifying their revenue streams, but the smaller regional banks could have a tough time of it.

Utilities and real estate are looking relatively strong here and have performed quite impressively over the past three months. It’s been such a sharp stretch of outperformance that I think a pullback could be in order, but investor sentiment still appears to be firmly in favor of these groups.

The dollar is as strong as any asset in the market right now. The yen and yuan are both plunging. The euro and British pound have fallen behind. In the forex market, the greenback is really the only game in town. It was a pretty poor week for commodities and industrial metals across the board, but lumber prices are still swinging around. They ticked up again last week and remain very volatile.

Read More…

Happy 4/20 Day! This Is The One Cannabis ETF To Own

3 Dividend ETFs with 3% Yields And A Volatility Protection Layer

VTI vs. SPY: How Total Market ETFs Measure Up Against The S&P 500

Are Long-Term Treasuries About To Become One Of The Best Trades Of 2022?

ETF Battles: DEMZ vs. MAGA - Which Politically Driven Stock ETF Is Best?

Recession Watch Is On! 5 ETFs To Protect Your Portfolio Today

Best Performing Dividend ETFs For Q1 2022

ETF Battles: ARKK vs. FBCG vs. GK - Which High Growth Stock ETF Is Best?

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!

I can tell ya that there is a bull case for JEPI.