Managed Futures ETFs: How They Work & Why They Matter In Modern Portfolios

These have been proven to demonstrably reduce risk when paired with other risk assets while enhancing risk-adjusted returns.

In the never-ending pursuit of portfolio diversification and risk reduction, a few asset classes might come to mind as hedges for a traditional portfolio of stocks & bonds.

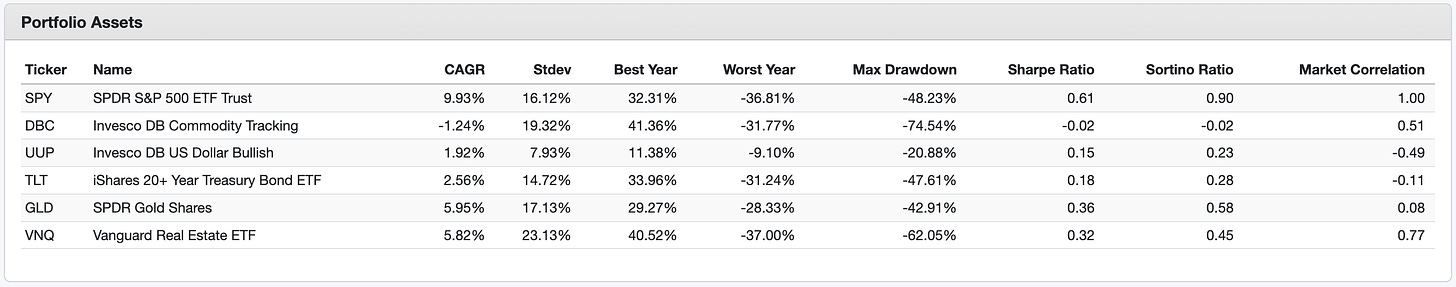

Gold - This is perhaps the best risk mitigator of all. Many investors think of gold as a hedge against a stock market correction or high inflation. In reality, its correlation to stocks is nearly zero over the long-term. In terms of performance, that means it may or may not produce positive returns when you want it to, but it does a great job of diversifying away risk.

Real Estate - Investments in “hard assets” are generally considered good diversifiers because they operates differently than stocks and may have different market cycles. That may be true of physical real estate, but REITs are usually more correlated to the broader market than you think. They may be a better risk hedge than something, such as small-caps, but it’s not as good as other assets.

Commodities - This has a much lower correlation to stocks and bonds, which is good, but it also comes with more volatility in isolation. From the launch date of the Invesco DB Commodity Tracking ETF (DBC) in 2007, the biggest risk reduction was seen with an allocation of roughly 80% U.S. stocks and 20% commodities (but it also came at the cost of lower returns).

Over the past roughly 15 years, the biggest reductions didn’t come from any of the three asset classes listed above. Instead, they came from the U.S. dollar and long-term Treasuries.

As a refresher, the Sharpe ratio and Sortino ratio are measures of risk-adjusted returns. We can see that the best risk-adjusted performance came from the S&P 500. Gold and real estate did OK. Commodities, the dollar and Treasuries did relatively poorly.

The correlation between stocks and Treasuries over this entire period is still negative, although that hasn’t been the case lately. Ever since inflation started moving higher, the correlation between stocks and bonds has turned positive, negating some of the risk-reducing diversification benefits that this pair typically enjoys.

In short, none of the traditional asset classes has worked particularly well in diversifying risk without having a major impact on total returns.

That’s why I want to take a look at managed futures ETFs because they’ve been the one thing that has been able to both reduce risk and enhance returns.

What Are Managed Futures?

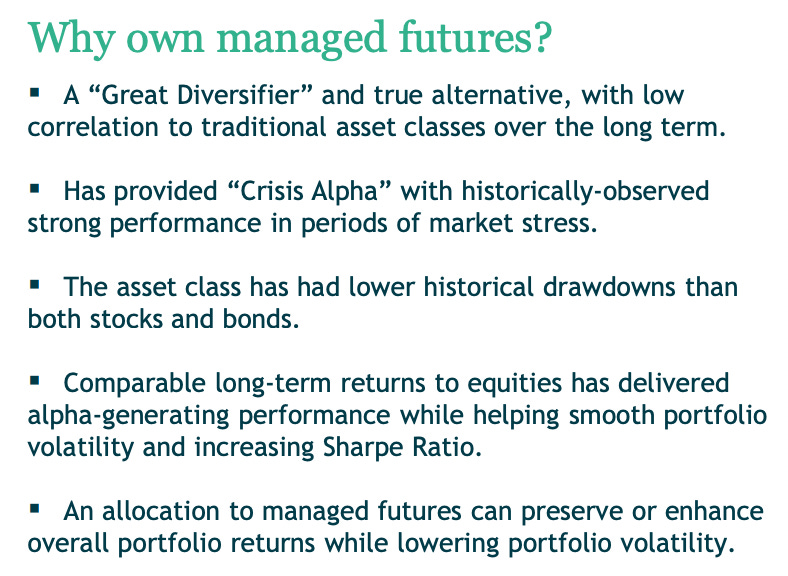

Managed futures are an alternative investment strategy that are designed to have the look and feel of hedge funds. As the name suggests, they can take long and short positions in futures contracts based on a wide variety of asset classes, including stocks, bonds, commodities, currencies and precious metals.

The exposure to non-equity, non-fixed income asset classes in both long and short positions means that there’s the potential for significant risk reduction when paired with more traditional asset classes.

The largest of the managed futures ETFs is the iMGP DBi Managed Futures Strategy ETF (DBMF). According to its website, it “seeks to replicate the pre-fee performance of leading managed futures hedge funds and outperform through fee/expense disintermediation.” In other words, you get a quasi-hedge fund, but instead of paying the traditional “2+20” fee structure, you get it for an expense ratio of 0.85%.

The current build of the portfolio has a little bit of everything.

DBMF currently has long positions in ex-U.S. developed markets equities, gold and crude oil with a very minor position in emerging markets.

It has significant short positions in Treasuries all along the curve, the S&P 500, the Japanese yen and the euro.

The biggest benefit of managed futures portfolios is that they usually don’t look anything like what most retail investors have in their portfolios. That can be uncomfortable for investors, but I don’t think there’s any question that it does a good job of reducing risk, if that’s your goal.

Can they enhance returns as well? If managed effectively, the answer is yes.

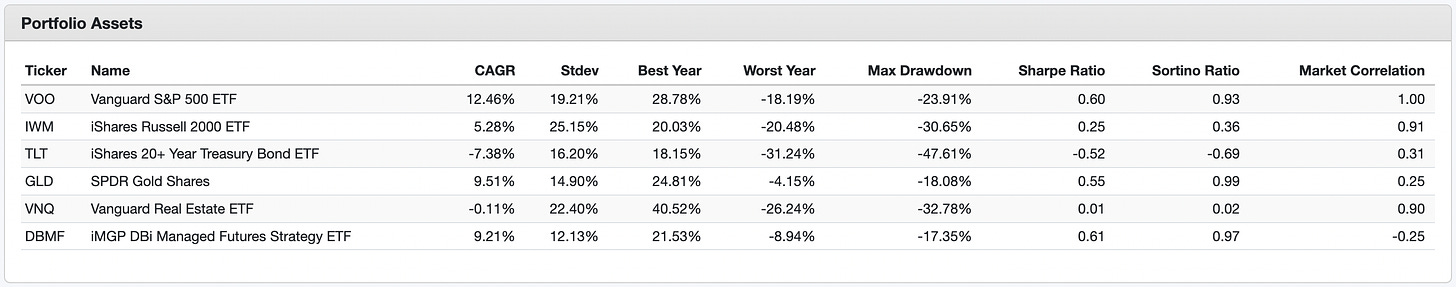

DBMF has only been around for five years, so we don’t have a great deal of history to work with. Since the start of 2020, just prior to the beginning of the COVID pandemic, we see the benefits of managed futures products pretty clearly.

The first thing to look at is the correlation to the S&P 500. Its correlation factor of -0.25 means that DBMF and the S&P 500 (as well as the other assets shown here) generally move in the opposite direction of each other. That can be hit or miss in terms of total returns, but it has demonstrably reduced risk when combined with other risk assets.

Let’s look at an example of DBMF and the S&P 500. Again, since the beginning of 2020, the asset allocation that produced the best risk-adjusted returns was 62% DBMF and 38% VOO.

It’s important to point out just how much risk can be mitigated here. In isolation, the S&P 500 has a standard deviation of returns of 19.2% and a Sharpe ratio of 0.60.

In the 62/38 allocation, the standard deviation of returns drops all the way to 9% and the Sharpe ratio jumps to 1.01.

Translation: risk drops by more than 50%, while risk-adjusted returns jump by nearly 70%.

Obviously, this scenario is with the benefit of hindsight. We won’t know the allocation that works best until after the fact, but this still makes a strong case for why managed futures deserve a long look for your portfolio based on their ability to reduce risk, if nothing else.

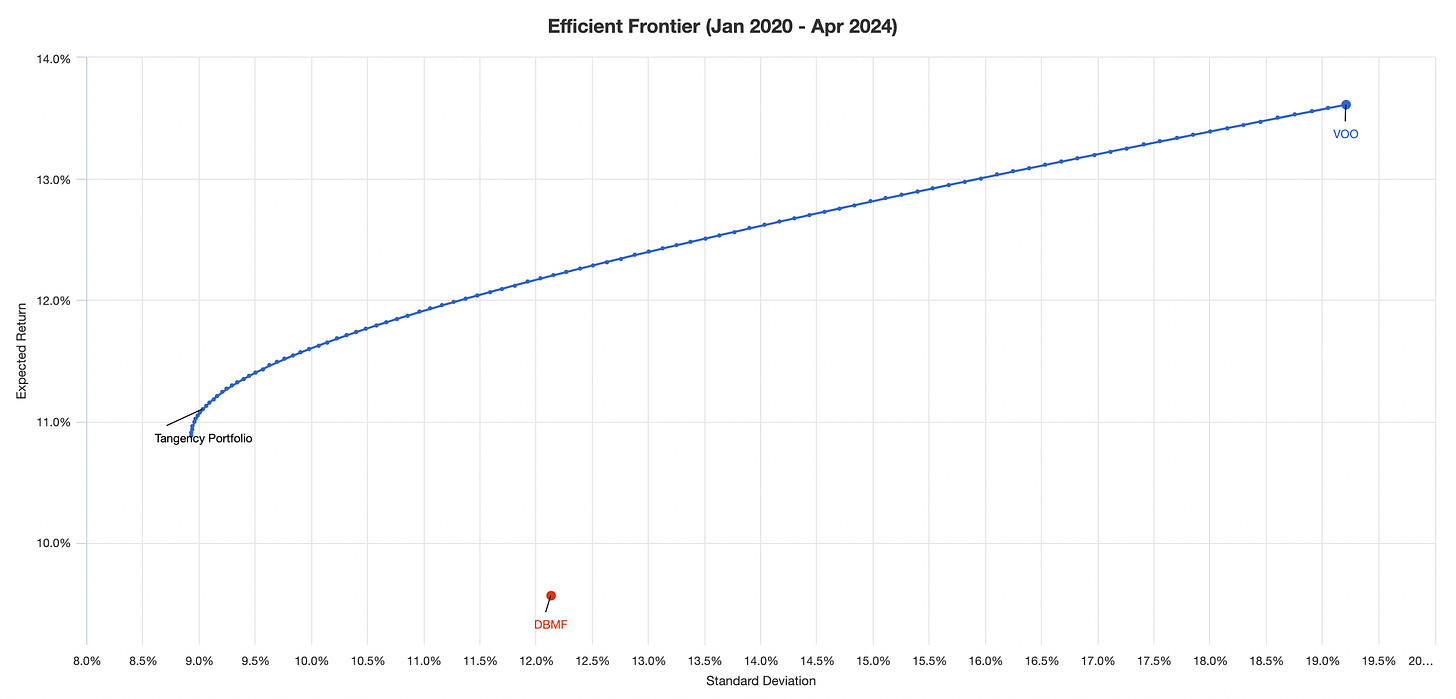

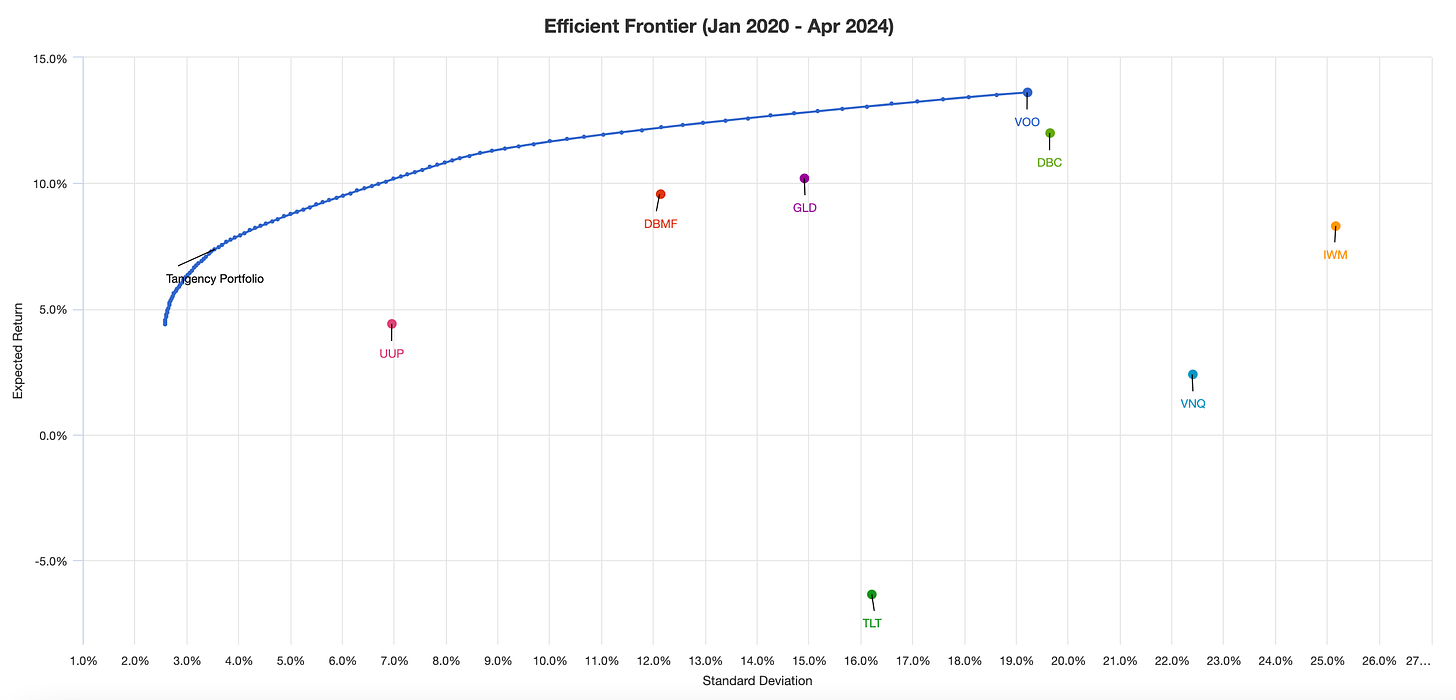

That scenario looked just at DBMF with the S&P 500. Let’s add a bunch of other asset classes - small-caps, real estate, the dollar, gold, Treasuries and commodities - to the mix and see what we can come up with.

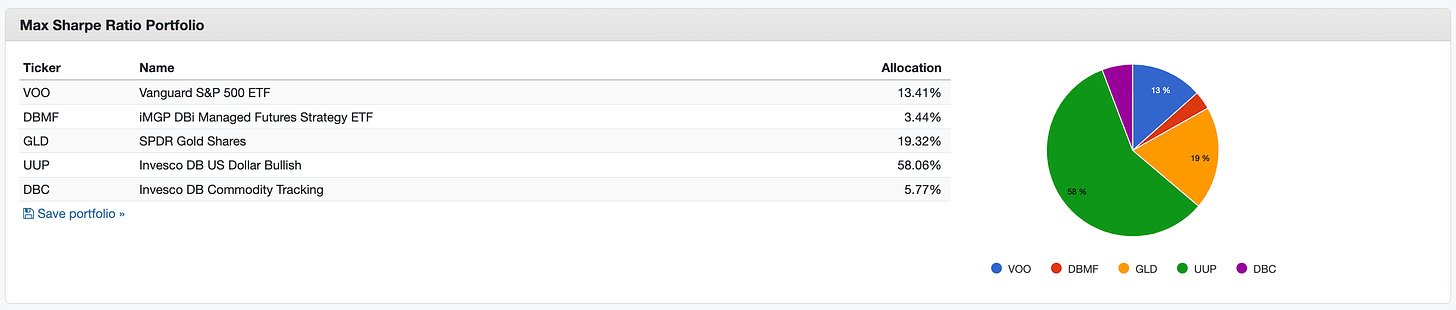

The “tangency” portfolio, which is basically the asset allocation that produces the best risk-adjusted returns, takes the standard deviation of returns all the way down to about 3%! That’s a HUGE risk reduction from any of these asset classes individually and demonstrates just how far down you can get when you start incorporating ultra-low and negatively correlated assets to your mix.

It’s interesting that the “optimized” portfolio in this case is over half U.S. dollar exposure and another 20% to gold. U.S. stocks get only a relatively minor allocation and the investments in managed futures and commodities is quite small. Again, it’s a shorter time frame than you’d probably want to draw any more conclusive findings, but it’s a clear demonstration of how much potential is available in managed futures.

In case you’re curious, the Sharpe ratio for this portfolio is 1.49!

A lot of investors, of course, will be more interested in absolute returns regardless of the risk involved, but if risk reduction is one of your primary objectives, managed futures is perhaps one of the best ways to achieve that.

Final Thoughts

At first glance, the thought of investing in a fund that can go both long and short in currencies, commodities, precious metals, stock and bonds might seem way too risky (or even like straight up gambling). In reality, the standard deviation and total range of returns is much less than that of the S&P 500, largely due to the long/short risk offset. On a risk-adjusted basis, they’ve produced similar results as the S&P 500 too.

I wouldn’t suggest a large allocation to a fund, such as DBMF, in your portfolio, but I think a 5% allocation would be worthy of consideration. The long/short nature of the portfolio would certainly limit total return potential over the long-term, but that structure also serves as a great risk reducer.

Managed futures shouldn’t necessarily be shied away from, just understood better and used judiciously in your portfolio!

Jared Dillion’s Awesome Portfolio is 20% stocks, gold, real estate, bonds, and cash (tbills). But I think going forward, DBMF instead of bonds would undoubtedly make it stronger. Why do you think UUP model allocation is so high? REITS have stunk since Covid but I think you could substitute home equity or rentals or farmland etc.

How do you feel about a managed futures ETF in a taxable account?