Which Emerging Markets ETF Pairs Best With The S&P 500? It's One That You Might Not Have Even Heard Of!

Most investors stick with funds from Vanguard, State Street and BlackRock, but the best emerging markets ETF may not come from any on them.

Since the beginning of 2008, the iShares MSCI Emerging Markets ETF (EEM) has managed a total return of 6%. No, that's not a typo. More than 15 years of investing with virtually no return to show for it! During the same time frame, the SPDR S&P 500 ETF (SPY) gained 281%.

That's not exactly a ringing endorsement for investing in emerging markets, but that doesn't mean investors shouldn't still be doing it. They provide great diversification benefits, different risk/return profiles and currently some incredible value. Right now, EEM trades at a P/E ratio of 11 compared to 20 for the S&P 500. Focus on emerging markets dividend payers and you can find several ETFs, such as the iShares Emerging Markets Dividend ETF (DVYE), that trade well into the single digits.

Plus, it's not like emerging markets have NO history of ever outperforming the S&P 500. If you look at the five years prior to 2008, EEM outperformed SPY 343% to 81%. These things work in cycles. A decade and a half of underperformance means that emerging markets are long overdue to take the lead again. In fact, when all is said and done, I think emerging markets will have a better 2020s decade than the S&P 500.

Adding Emerging Markets To The S&P 500

If you're already heavily tilted towards the S&P 500 or use a total U.S. market equity ETF as your portfolio cornerstone, you need to pick the right emerging markets ETF to pair with it. The logical choice would be to add one of the ETFs from the big issuers, such as Vanguard, iShares or Schwab. They would be logical, defensible choices too. They're the largest, cheapest and most liquid funds of all and would be easy to slide into your portfolio.

But I want to look beyond just cost, size or name recognition. I want to look at fit. How is the portfolio built? What do risk-adjusted returns look like? What are the factor tilts that are driving returns and do they make sense look forward? It's a bit of a deeper dive into the portfolio construction process, but one that ultimately proves very valuable. In some cases, when you look at ALL potential ETFs instead of just the biggest ones, it produces some unexpected results. Just like it did in this case.

Evaluating The Largest Emerging Markets ETFs

To establish a baseline, let's look at just those heavyweight emerging markets ETFs. There are five broad-based funds to consider here. I'm going to ignore the ones, for now, that are tilted towards China or low volatility or something. We'll start with just the plain vanilla ones.

We've got ETFs to consider from Vanguard, Schwab, BlackRock (iShares) and State Street (SPDR). iShares has two because it essentially spun off a retail-focused, lower cost option (the iShares Core MSCI Emerging Markets ETF (IEMG)) from the original EEM. EEM is still preferred by institutional traders, while IEMG is generally considered the choice for everyday investors.

EEM immediately stands out due to its high expense ratio. Losing roughly 60 basis points annually on fees puts the fund at an immediate disadvantage, almost an insurmountable one when you're talking about broad vanilla index funds. Comparatively poor total returns essentially confirm that, but let's look at risk and risk-adjusted returns first.

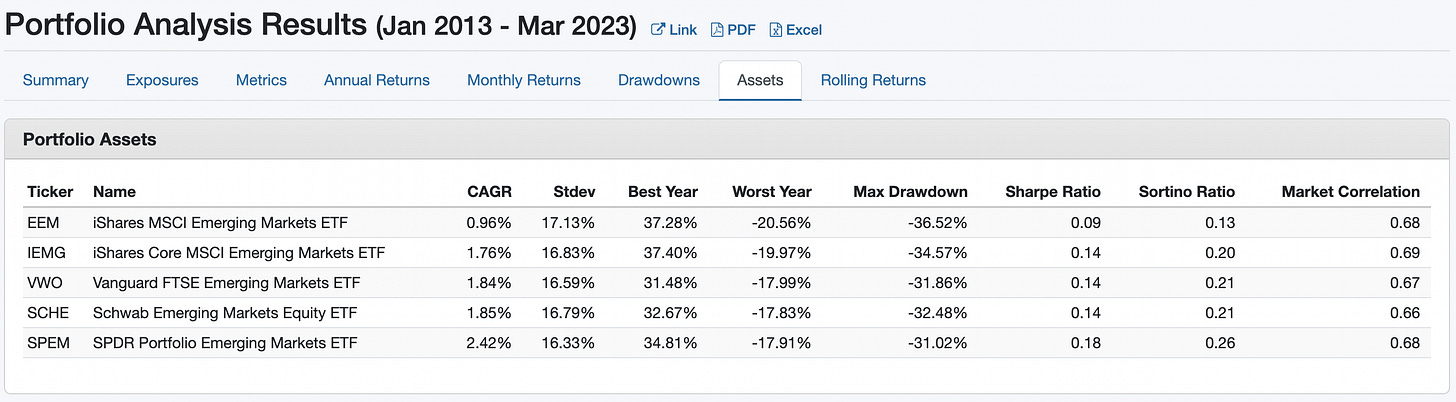

The measurement period for this is 2013-2023. 2013 is when we get the first full calendar year of results for IEMG, so this gives us an equal measurement period for all five ETFs.

The SPDR Portfolio Emerging Markets ETF (SPEM) looks like the standout of the group. It's got the highest average annual return and lowest standard deviation of returns. The fund also stands out on risk-adjusted returns, as measured by the Sharpe and Sortino ratios. The trio of IEMG, the Vanguard FTSE Emerging Markets ETF (VWO) and the Schwab Emerging Markets Equity ETF (SCHE) all look identical in terms of both returns and risk, which makes sense considering they all track broad cap-weighted indexes. The main difference is that IEMG includes South Korea and the others do not. EEM, as expected, trails the rest of the group. It's also the riskiest.

Of the five, SPEM scores best on risk-adjusted returns. EEM is pretty clearly eliminated from consideration.

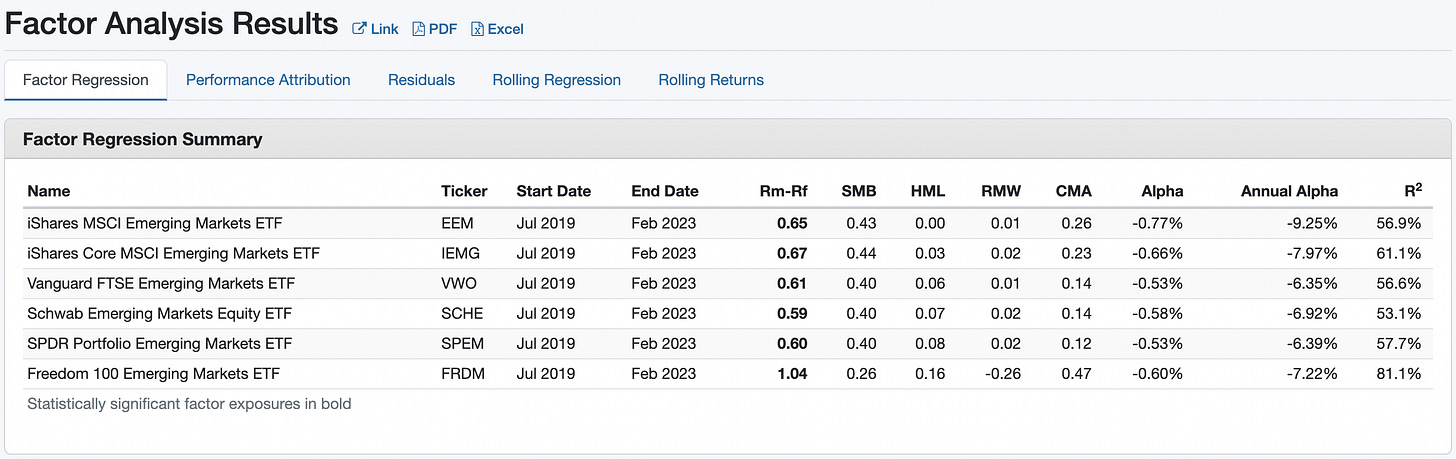

Now let's break down which factors are driving the returns for these ETFs.

Here are what each of the factors listed are...

Rm-Rf - Market Return minus Risk-Free Rate (market risk premium)

SMB - Small minus Big (size premium)

HML - High minus Low (value premium)

RMW - Robust minus Weak (profitability premium)

CMA - Conservative minus Aggressive (conservative investment premium)

The negative SMB reading shows that large-caps tend to drive a bit more return. Positive HML suggests there's a big value component to performance (something that shouldn't be surprising given the low P/E ratios). Readings are pretty flat for the RMW and CMA factors.

Although they're all negative, SPEM scores the highest alpha. It has a bit of a weaker profitability profile, but when considering returns, risk, risk-adjusted returns and alpha, SPEM comes out as the winner among the big 5 emerging markets ETFs.

Considering Other Emerging Markets ETFs

Having looked at the major emerging markets ETFs, I looked for relatively broad EM equity funds that could beat one of them. Scanning through the universe, I few potential options popped up.

The Xtrackers MSCI Emerging Markets Hedged Equity ETF (DBEM) had a substantially lower risk profile than its peers thanks to the mitigation of currency fluctuations. In the end, risk-adjusted returns just didn't look a whole lot different than most of the funds already covered.

The Invesco PureBeta FTSE Emerging Markets ETF (PBEE) delivered lower historical risk and produced the single best calendar year result over its lifetime. Unfortunately, overall performance lagged its peers and risk-adjusted returns didn't hold up. The modestly higher mid-cap exposure was a bit of a unique feature.

The iShares Currency Hedged MSCI Emerging Markets ETF (HEEM) actually looks like a reasonable alternative. It's on par with SPEM in terms of risk-adjusted returns and overall risk is about 15% less if you're looking for a bit less volatility. It scores a bit lower on portfolio quality, but it could be considered, although the 0.69% expense ratio is a little egregious.

There are two emerging markets ETFs, however, that stand out.

WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE)

This ETF starts off with a relatively broad emerging markets index, but removes companies with heavy state ownership positions, defined as government ownership positions of greater than 20%.

Why eliminate these companies? Because governments tend to run these companies for the benefit of the public good, not necessarily to generate maximum profits. In general, they tend to generate thinner margins and operate less efficiently. Therefore, return potential is considered to be lower. By removing these from the equation, it's thought that it allows for above-average return potential.

Does the strategy work? Since the fund debuted in 2015, it has produced better risk-adjusted returns.

XSOE has delivered roughly the same absolute and risk-adjusted returns as SPEM, but it has outperformed the other big emerging markets ETFs. The one downside of this strategy, however, is risk. Because some of the "dull" companies are removed from the portfolio, it increases volatility on both the upside and downside. XSOE may have delivered the same returns as SPEM, but it also took on more risk to get them, not exactly the ideal situation.

When you dig down to the factor exposure level, you also see why XSOE is more volatile. It has one of the highest SMB and lowest HML factors. That means it derives more of its return from small-cap and growth exposures. Will that serve the fund well in the future? Well, if we eventually enter into a global recovery cycle at the other end of the current slowdown, those environments tend to be favorable for cyclicals and value stocks. That could favor some of the other ETFs on the list. A more mature growth cycle, which emerging markets haven't enjoyed in a while, may be better for XSOE.

The risk/return profile, however, looks favorable and the idea of removing lower potential SOEs from the portfolio means it could be an ideal emerging markets holding.

Here's the one though that could be the winner.

Freedom 100 Emerging Markets ETF (FRDM)

FRDM is a really interesting fund because it incorporates the ideas of corporate, civil and economic liberties into the portfolio construction process. In its simplest form, the more freedoms that are demonstrated, the greater weighting the companies are likely to receive in the ETF.

This may be the best way to approach investing in emerging markets. So many nations have so many different approaches to economic and social policy that it's smart to target only those companies that are best positioned to succeed. If a country's citizens are allowed to act freely, companies can take advantage of free market policies and there are limited restrictions on personal freedoms, these should be the areas with greater potential.

FRDM is approaching its 4th birthday, but it's been a large enough sample size to demonstrate that its strategy has been very effective.

Absolute returns have been stellar. FRDM has delivered nearly 4% more return annually than the next closest ETF on the list. As is the case with XSOE, the removal of more government-controlled entities increases volatility, but it's also managed to deliver the best worst-year return and the smallest drawdown. Plus, look at that Sharpe and Sortino ratio! Not only has FRDM produced better risk-adjusted returns, the gap is significant.

Factor analysis shows that FRDM performs differently than the broad index ETFs. It generates more return from large-caps and has a surprisingly poor RMW score. The high conservative investment factor helps balance some of that out, but it's clearly a very different portfolio.

Winner: Freedom 100 Emerging Markets ETF

Many investors probably aren't even aware that FRDM exists, but they should.

Its demonstrated ability to generate superior risk-adjusted returns in some challenging environments could easily make the argument that it's the better choice for a portfolio. The fact that it also cuts out low potential state-owned enterprises and minimizes its exposure to companies and countries that have poor track records on civil, economic and political freedoms means that you're getting a terrific emerging markets ETF and one you can feel good about as well!