Weekly Market Prep - 9/30/2024

The markets are in a good mood, but another jobs report looms large.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We’re Talking About This Week!

+ Weekly Market Reset

+ Key Economic Reports This Week

+ Dividend Landscape

+ Market Outlook

Weekly Market Reset

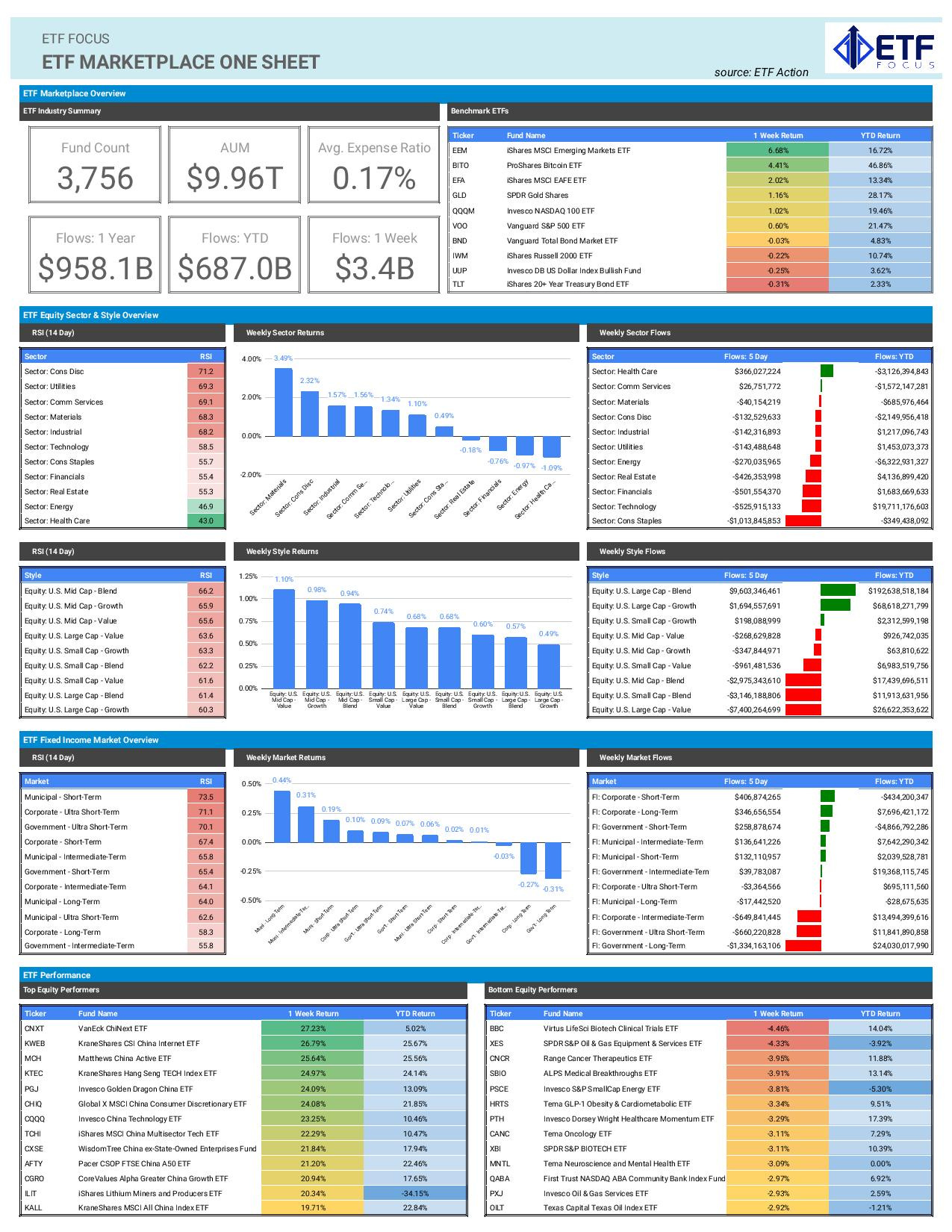

The PBoC’s decision last week to unleash a stimulus bomb on the Chinese economy was a game changer and will impact whether or not the global economy can achieve the soft landing. China was unlikely to hit its 5% annual GDP growth goal and the real estate sector is still in the midst of a significant correction. The only realistic way out of this mess was for the government to deliver a major stimulus package designed to reignite lending and consumer spending. This was about as well as the markets could have hoped for.

The combination of rate cuts, stock market support and mortgage rate reductions should boost the economy from all angles, including lending institutions, corporations and households. The markets certainly seem enthused about the possibilities. Many China ETFs were up more than 20% on the week, while China- and stimulus-adjacent areas of the market, including emerging markets, cyclicals and commodities, all surged in the aftermath of the announcement.

The markets have been in a generally bullish mood ever since the Fed cut rates by 50 basis points recently. This will likely continue the positive momentum, although it could definitely reshape which areas of the market could outperform. Cyclicals, save for energy, have been doing comparatively well over the past month and it’s clear that this trend could continue well into the 4th quarter. It shouldn’t be surprising that materials was the best performing sector of the week on the heels of the commodities rally. There will likely be some bids for tech stocks ahead, but it doesn’t look like it will be the leader in this “new” market.

Treasury yields moving higher last week doesn’t necessarily reflect a change in trend, in my opinion, but it does likely mean a shift away from safe havens in the near-term. The one exception has been gold, which continues to benefit from lower rates globally. I wouldn’t be surprised to see yields try to move a little higher here in response to a cyclical rally, but the Fed dropping rates in the background probably caps upside for a little while.

Key Economic Reports This Week

The September non-farm payroll report could give us an idea of how truthful Jerome Powell was being when he said everything was still fine. In reality, the economy will probably continue to show modest job growth and an unemployment rate that’s unlikely to change the trajectory of the Fed’s path for the remainder of 2024. A number of less than 100,000, however, could put a scare into the markets, which would likely increase what the market’s expectation for rate cuts over the next several months. The JOLTS job opening report, which will come a couple of days before, has been trending lower for a while and will likely have done so again in September.

Other than that, the latest PMI data should show a continuation of what we’ve been seeing worldwide - the services sector showing growth, but the manufacturing side in contraction. China’s manufacturing reads on Sunday night could be taken with a grain of salt in light of the PBoC’s stimulus announcement last week. Even if it shows contraction in September, the markets will likely be looking forward to what’s ahead, not in the past.

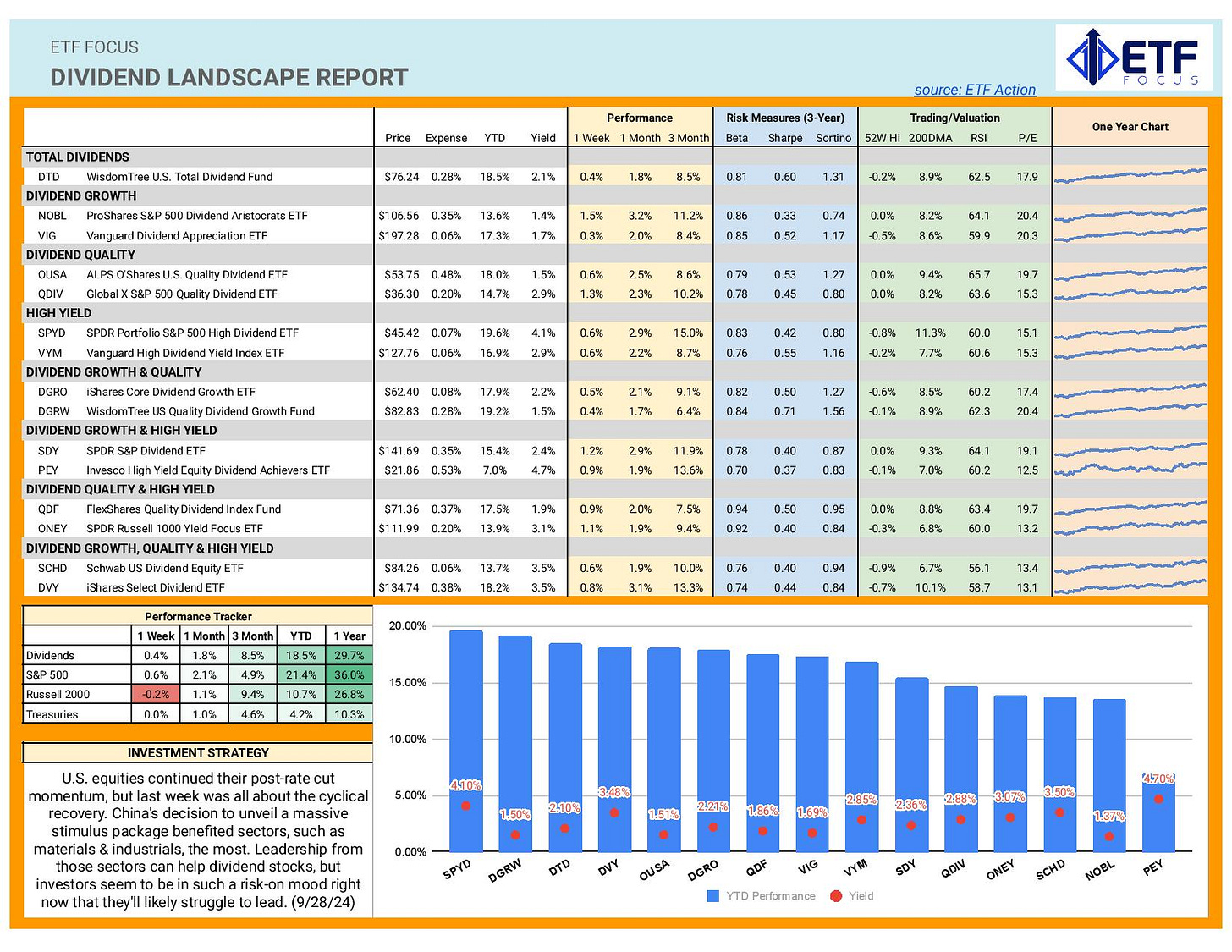

Dividend Landscape

Stocks continue to rise following the Fed’s rate cut, but the bullish enthusiasm has been leaving more defensive equities behind. I still like the potential for dividend payers even after the rate cut and the PBoC’s stimulus announcement. These two events have been very positive for cyclicals and those figure heavily into a lot of dividend strategies. If they remain in favor, that will probably end up working better for high yield strategies as opposed to dividend growth ones. It’s interesting to see, however, that the best performing dividend ETF on the list above last week was the ProShares S&P 500 Dividend Aristocrats ETF (NOBL). Even in more risk-on environments, long-term dividend growers can still do very well, so I wouldn’t discount what dividend stocks could do here.

Market Outlook

Market sentiment has been strong for multiple weeks and I feel like the positive momentum from last week could carry forward into this one. China and commodities are probably overdone in the short-term and could see an understandable pullback, but I could see cyclicals having another solid week. They’re still relatively undervalued compared to the market, so the China stimulus boost could be a little more long-lasting.

Friday will be a wild card with the jobs report. I think there’s a chance the number comes in below 100K because I’m not convinced the economy is in as good of shape as Powell insisted it was. The labor market has been trending in the wrong direction for several months and I don’t think that trend stops just because of a half-point cut that won’t be felt until at next summer. This is the big thing that I think could slow the momentum here.

Looking better for: industrials, dividends, preferreds, wide moat stocks

Looking worse for: China, consumer staples, low volatility