Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We’re Talking About This Week!

+ Weekly Market Reset

+ Key Economic Reports This Week

+ Dividend Landscape

+ Market Outlook

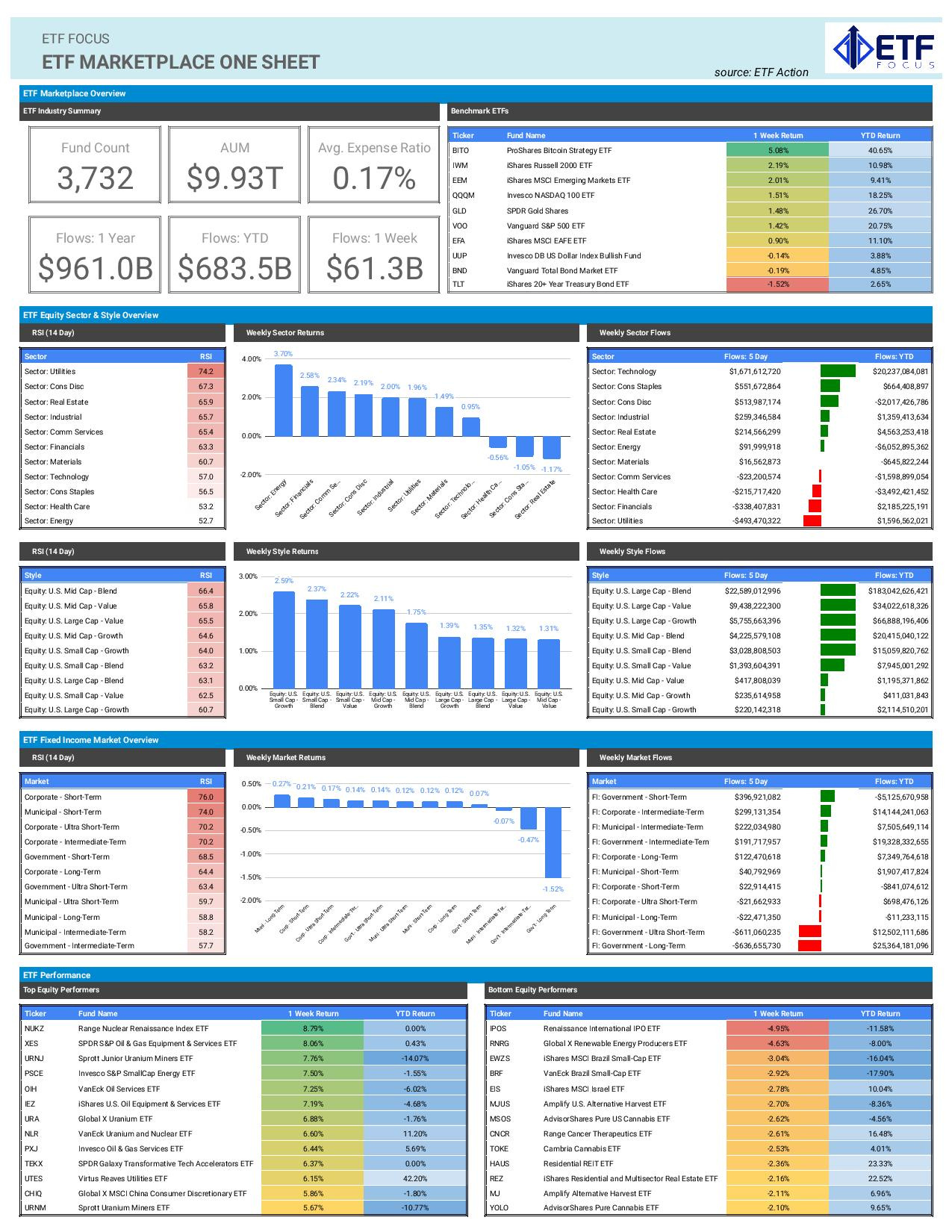

Weekly Market Reset

The Fed decided to opt for a 50 basis point cut instead of 25, but whether or not this ultimately ends up being the right move depends on what shape the economy is really in. Investors seem enthused by the move because they largely believe that the economy is in good shape. If you look at GDP growth or retail sales, you could come to that conclusion, but credit conditions are looking pretty bad here. Those may not manifest themselves right away in an economic downturn, but they tend to manifest themselves eventually. Personally, I think the rally was overdone & unjustified. I wouldn’t get too over-bullish over where things head in the short-term.

I have two reasons for this line of thinking.

First, the best-performing sector year-to-date is still utilities. That almost certainly doesn’t happen unless there’s a bearish undertone to the markets. Gold is up more than 25% year-to-date. Those are generally considered the two of the most risk-off asset classes in the financial markets (Treasuries being the other) and they’ve been soaring in value. Tech, on the other hand, has been trending lower relative to the S&P 500 for two months and it’s experienced a fair amount of volatility in the process. The markets are not signaling strength here.

Second, if you listened to that press conference, I don’t think Powell conveyed much confidence. It almost sounded as if he was trying to convince himself that the economy was still in good shape. In general, I don’t think you kick off a rate cutting cycle with a larger half-point cut unless conditions are shifting faster than you think and/or you've fallen behind already. I think it’s a realistic possibility that both are true, but we’ll only know in time if that’s the case.

Key Economic Reports This Week

After a big global central bank week, we return to more of a normal economic calendar this week. The core PCE index would probably garner more attention under normal circumstances, but it’ll be less compelling this time around given we just heard the Fed’s opinion on inflation. This number should provide no surprises and it’ll very likely signal that inflation is still steady & contained according to the central bank’s favorite measure.

Personal spending & personal income are likely to show modest gains again. Retail sales have been surprisingly resilient throughout this cycle and personal spending is likely to continue that trend. Even though the unemployment rate is trending higher, I suspect this number will continue to hold up until the labor market really starts to crack.

China manufacturing data coming next weekend may be the most consequential of the bunch. We know already that the Chinese economy is in big trouble and the latest batch of manufacturing data is likely to confirm that. What may be worth watching is whether or not it compels the PBoC to take additional measures to re-stimulate the economy.

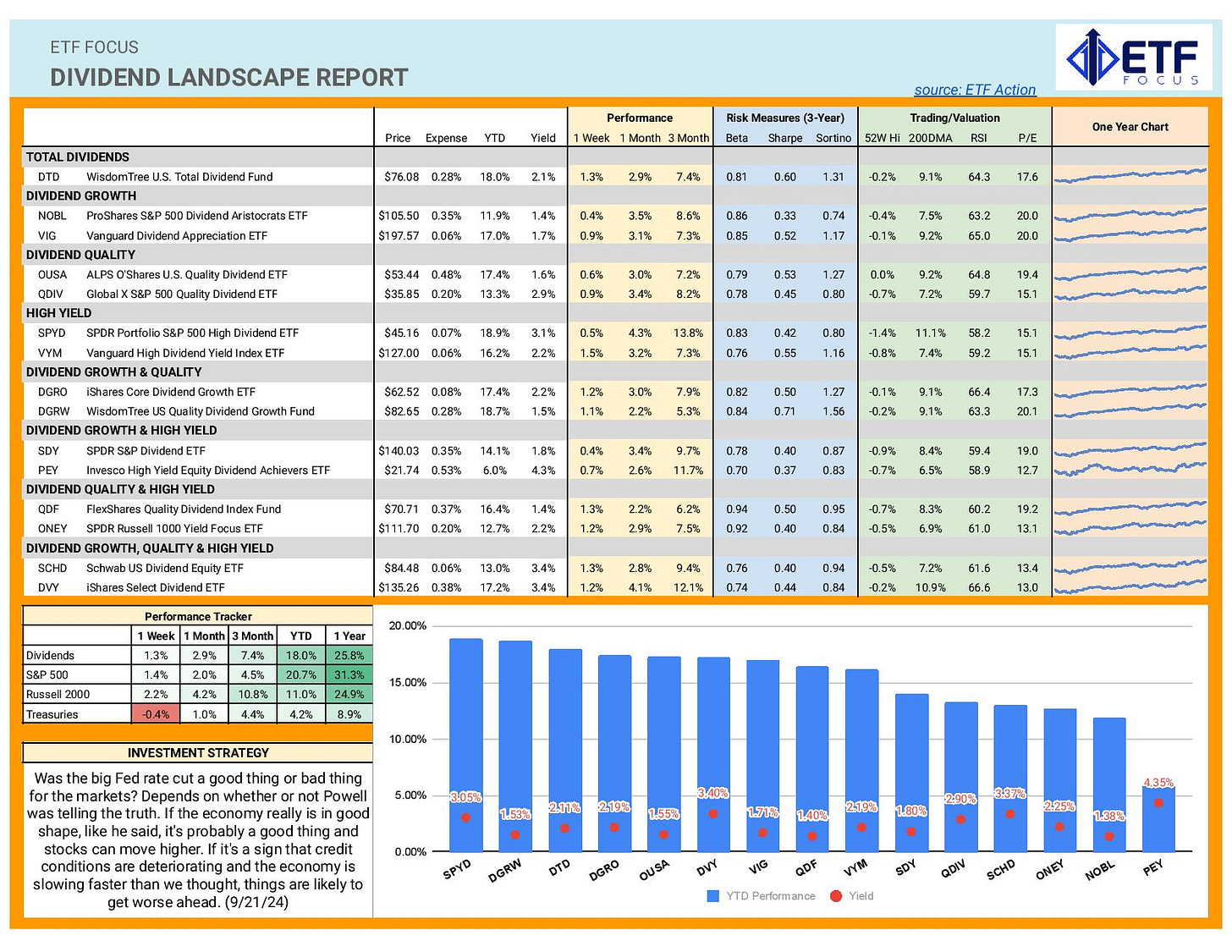

Dividend Landscape

The Fed rate cut put investors in a good mood, but the biggest beneficiary was cyclical sectors, including financials, energy and industrials. Even though traditional defensives didn’t garner much interest, leadership from cyclicals would probably play well for dividend payers, especially high yielders. I think that’s a big reason why we saw the broader dividend-paying stock universe keep up with the S&P 500 and funds, such as the Vanguard High Dividend Yield ETF (VYM), perform particularly well.

Back in July when the markets started really pricing in significant rate cuts, dividend stocks did very well compared to the broader market. We’re in a similar environment today and, while I don’t think they’ll outperform as decisively as they did a couple months ago, I do think conditions are lining up better for them.

Market Outlook

Powell’s speech this week probably won’t yield any additional clues beyond what we got last week, so I think the generally positive sentiment can carry forward again.

If there’s going to be a catalyst for volatility, I think it will come from overseas. Conditions in Japan and the yen are always lurking in the background, but I think China is still the biggest risk right now. The markets won’t be able to respond to Chinese manufacturing data this week since it won’t be released until next Sunday, but I do think it and the questions surrounding what the PBoC can or will do will loom.

Looking better for: dividends, financials, junk bonds

Looking worse for: Japan, China, healthcare