Weekly Market Prep - 9/18/2023

The recent rally in utilities is concerning, but I don't think a correction is imminent just yet.

Hope everyone is having a great weekend & welcome back to ETF Focus!

It’s Sunday, so let’s get ready for the week ahead!

Weekly Market Reset

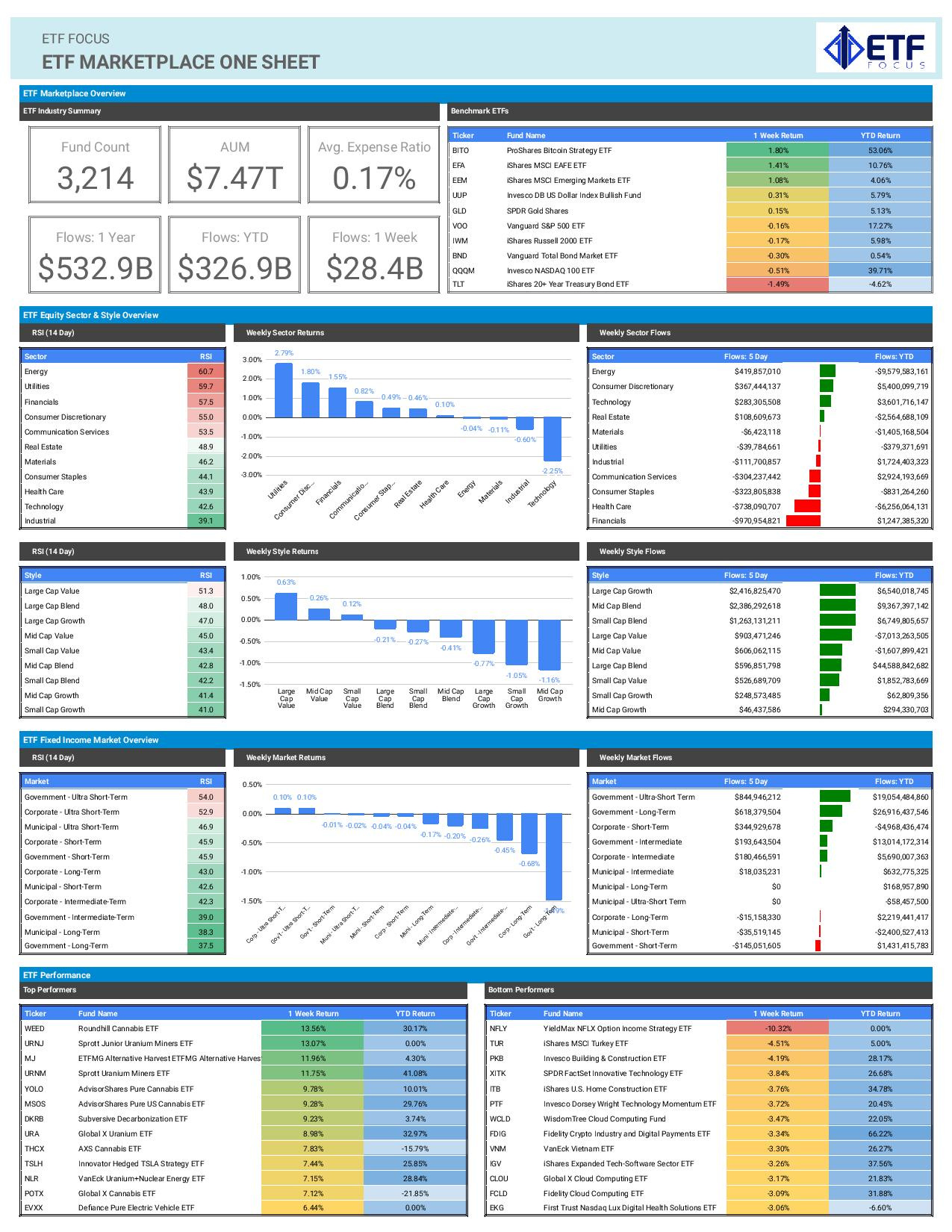

We saw a pretty significant defensive shift in U.S. equities last week with utilities outperforming tech stocks by more than 5%. Sharp and violent moves like this tend to be precursors to larger potential corrections, although I don’t think we can conclude that yet. Utilities have been incredibly up-and-down over the past few years and even the latest rally, which has seen the sector outperform the S&P 500 by 6-7% in less than two weeks, has brought us back only to August levels. We haven’t seen any capitulation in growth or high beta yet and Treasury yields are still moving higher. I think this bears watching very closely, but I don’t think anything is imminent yet.

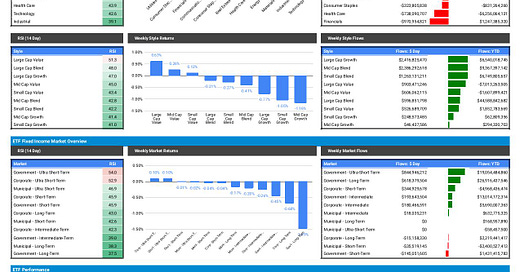

Over the past 1- and 3-month periods, we’re still seeing more money flowing into fixed income than equities on a proportional basis, but the largest relative flows are moving into ultra-short term and floating rate bonds. I think this is a yield grab more than anything and investors seem fine capturing an essentially risk-free 5% yield and sitting on the sidelines. This isn’t something that’s sustainable or advisable over the long-term, but with the Fed likely to keep rates elevated for at least another three quarters and some of the macro level data looking very concerning, I’m not surprised by this move. This is something I pondered HERE just last month.

Elsewhere, international stocks finally had a good week, but I don’t think there’s anything actionable there yet, especially with the dollar still rising. Cannabis stocks had another great week, but that’s looking really overdone at this point. I still think that the bond market, especially the junk bond side, isn’t pricing in nearly enough risk right now and the risk/reward ratio on corporate bonds remains skewed negative. I’m much more optimistic on Treasuries.

Key Economic Reports This Week

Federal Reserve interest rate decision (Wednesday)

United States Housing Starts & Building Permits (Tuesday)

United States Existing Home Sales (Thursday)

S&P Global PMI surveys (Friday)

Bank of England interest rate decision (Thursday)

Bank of Japan interest rate decision (Thursday)

Market Outlook

This could be a very interesting week. On the monetary policy front, the Fed is expected to pause, the Bank of England is expected to hike and we’re not sure exactly what to expect from the Bank of Japan. The latter will likely hold policy steady, but its recent indications that it’s contemplating ending years of ultra-loose monetary policy could add volatility to the financial markets. If the BoJ takes a hawkish stance, the bond market could take a hit.

I’m guessing we’re not really going to hear anything we don’t expect this week. We know the broader macro trends already and the major reports we’ll get this week probably just confirm a continuation of that trend. We’ll see if the utilities outperformance trend continues or it takes a breather. Other defensive areas of the market, including staples, have really only showed relatively modest gains thus far and I’d like to see a broadening of that trend before drawing any firmer conclusions.