Weekly Market Prep - 9/16/2024

The Fed will get all the attention this week, but don't sleep on the Bank of Japan!

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We’re Talking About This Week!

+ Weekly Market Reset

+ Key Economic Reports This Week

+ Dividend Landscape

+ Market Outlook

Weekly Market Reset

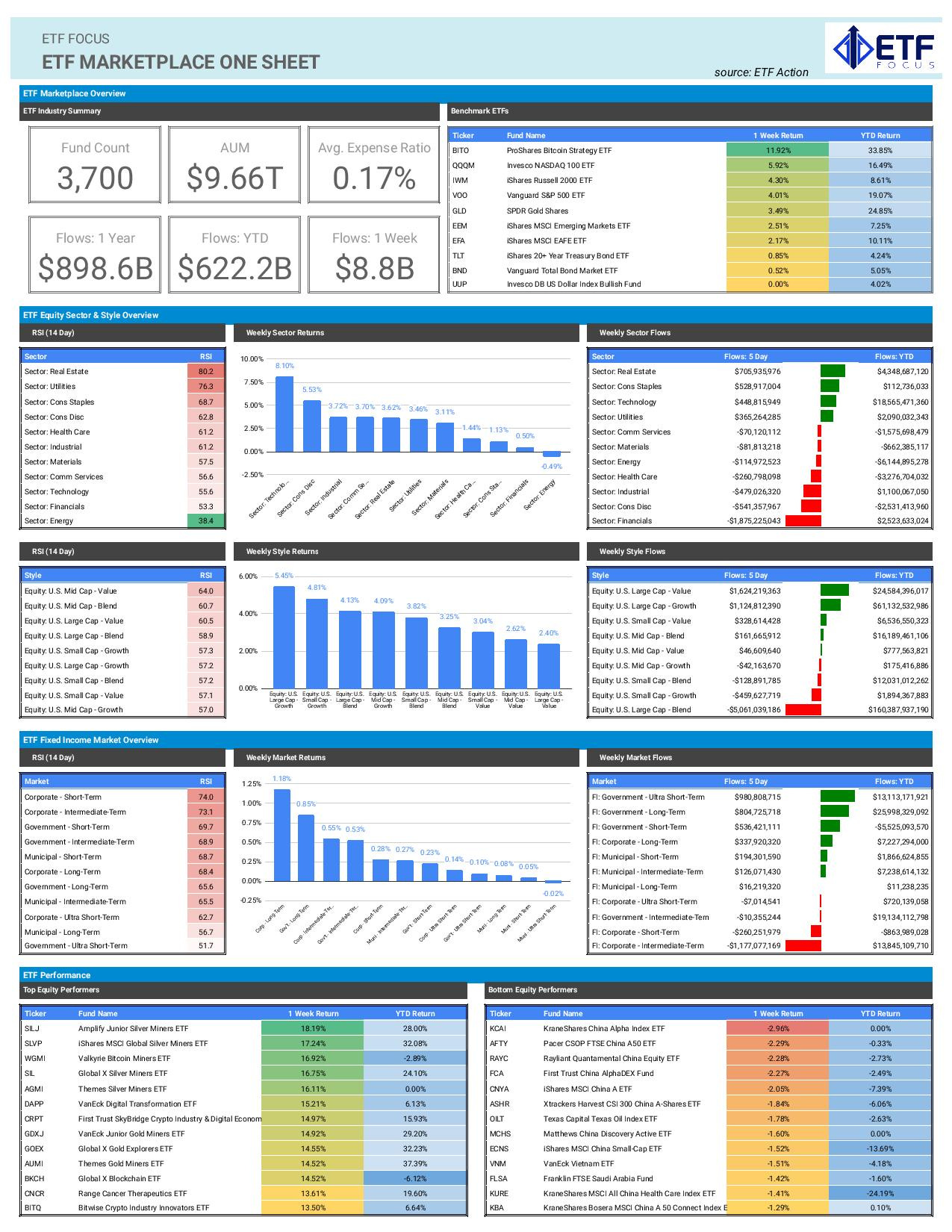

For one week at least, investors didn’t get a reminder that the economy might be slowing faster than they wanted. The CPI and PPI prints essentially confirmed that inflation is contained even if it’s not back the Fed’s 2% target. The ECB cut rates by a quarter-point, signaling a slow and progressive march towards easier monetary conditions. The Michigan consumer sentiment reading showed that people are still feeling relatively good about their situations. It was the kind of news the markets needed after the latest labor market and manufacturing readings put a bit of a scare into investor psyche.

I’m not sure that the huge returns the market generated last week were necessarily justified. Should tech stocks be rallying by 6% just because a series of economic numbers basically delivered as expected? The prior few weeks haven’t been good for U.S. stocks, especially tech, and I think the correction in NVIDIA stock might have genuinely scared investors, especially given that it’s been the poster child for stock market success. With all that in mind, people were probably looking for any reason to feel a little more optimistic than they have been and last week provided it for them.

But it was essentially an everything rally. Long-dated Treasuries gained again as yields hit their lowest level since April. Gold rose another 3%, putting its year-to-date gain at nearly 25%. That doesn’t usually happen unless investors are either risk hedging or downside hedging. Boring old utilities is the best-performing S&P 500 sector this year and it’s beating the next closest sector by 6%. There are still a lot of signs out there than investors at their core are still nervous. Investors are still piling money into equity ETFs, but they’re doing the same into fixed income funds. Year-to-date, net inflows into stock ETFs represent about 5% of total assets. On the fixed income side, it’s 12%. And a lot of that is going into Treasuries, a traditional safe have asset class. U.S. stocks may continue to post gains here, but the underlying sentiment of investors still seems cautious at best.

It’s all eyes on the Fed this week. According to the Fed Funds market, there’s a slightly better chance that we get a 25 basis point cut instead of a 50 basis point one, but it could really go either way. Ex-NY Fed Governor Bill Dudley may have shaken things up a bit last week when he said there was a “strong case” for a half-point move. I still think the Fed will cut by a quarter-point so as to make more of a measured start to its rate cutting cycle. A half-point move would likely scare the markets and I don’t think the Fed wants to do that if it doesn’t need to.

Key Economic Reports This Week

The Fed meeting that ends on Wednesday will suck the air out of the room, but the Bank of Japan decision later in the week could be just as consequential. It’s unlikely we’ll get a hike from them this week, but a lot of people still believe we’ll get another one by the end of the year. It’ll be noteworthy if Governor Ueda gives another signal that he’s leaning in that direction. The Japanese government doesn’t necessarily want to see that right now, so it’ll be interesting to see if they get their way. Japan is in a tough spot right now. We’ll also get that economy’s August inflation reading, which is likely to show that it’s really becoming a growing problem. The BoJ doesn’t want to tip the economy into recession again, but they don’t want to let inflation drift higher either. Another hike is certainly justified, but they’re really walking a tightrope here.

The Bank of England is also meeting to set rates this week. By a 5-to-4 vote, they narrowly decided to cut rates by a quarter-point at their last meeting, but are unlikely to do so this time around. Headline inflation is down to 2.2%, which would at the margins seem to support bringing their benchmark rate down from 5%, but it’s never that simple. Services inflation is still running at north of 5% and I don’t think the BoE is going to be compelled to lower rates quickly or aggressively with that black cloud still floating over the economy. The U.K. also just printed two consecutive quarters of solid GDP growth, so I don’t think they’re necessarily going to be under a lot of pressure to cut here if it looks like the economy can hold up in the meantime.

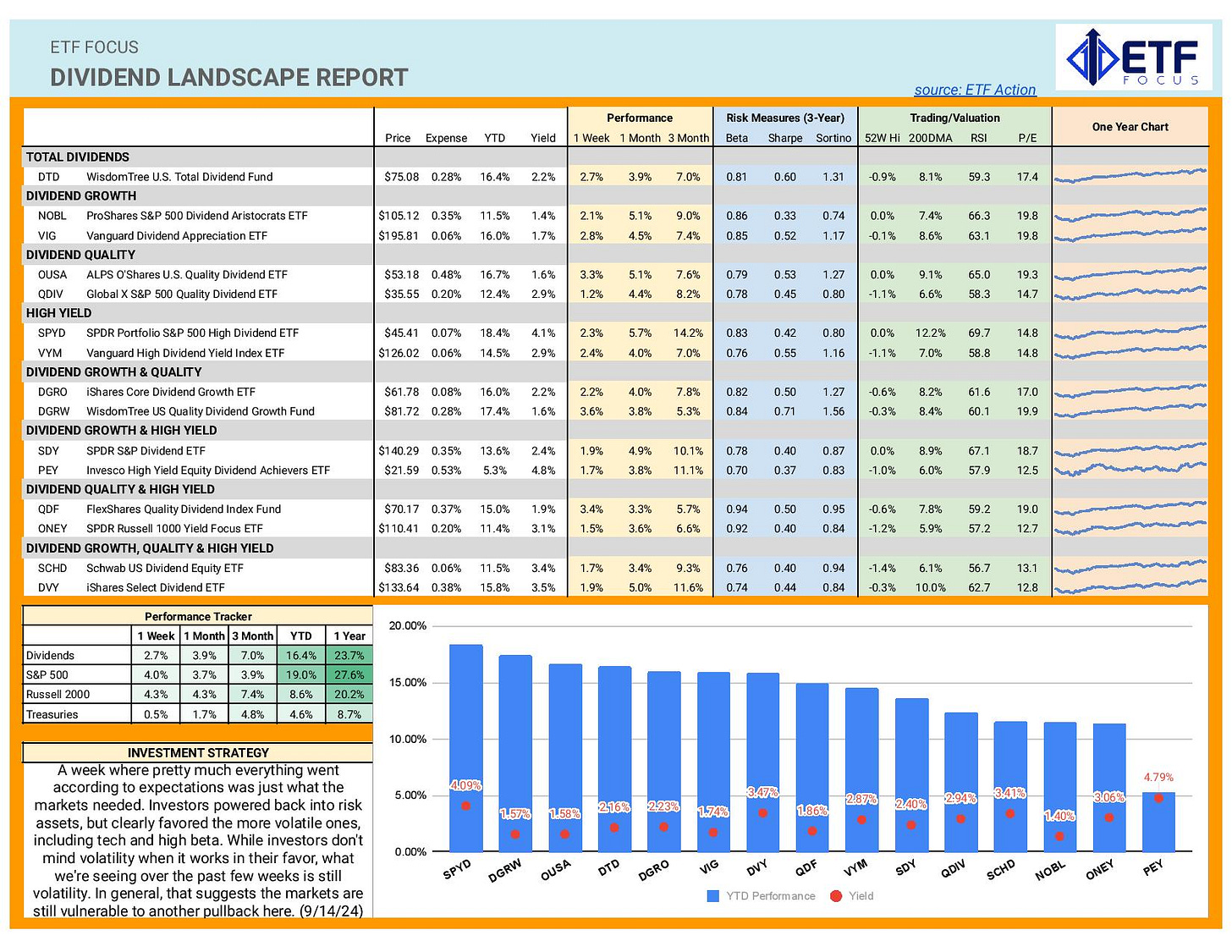

Dividend Landscape

Dividend stocks aren’t likely to outperform the market whenever tech stocks are rising by 6% in a week. Dividend stocks have been doing an OK job lately, although the gains are starting to broaden out across the different themes. Strategies that lean more heavily on defensive sectors, such as dividend growth, have been doing better, while high yielders, which tend to have larger exposures to cyclicals, have fallen back somewhat.

As long as sectors, such as utilities and consumer staples, do well, dividend stocks should do well, although just investing in them broadly might not be advisable. The underperformance of the WisdomTree U.S. Total Dividend ETF (DTD) suggests that investors should approach dividend investing with some sort of focus. If conditions are deteriorating, as I think they are, focusing on quality usually makes for a good hedge against downside risk. Dividend growth also tends to have some success as the inclusion of many durable and cash-rich companies is likelier to outperform.

Market Outlook

If the Fed delivers a quarter-point cut this week, I think the market will take it fairly well and the chances of positive returns this week are good. If the cut is a half-point, I think volatility rises and stocks probably fall, maybe even significantly. My money is still on the quarter-point move, but it’s far from a sure thing.

I’m a little less bullish on Treasuries short-term. I think a lot of the Fed’s rate cut plans over the next several months are priced in and we might need more signs of economic slowing to ignite the next leg higher. Emerging markets just seem volatile and I’m not sure I want to be making any bets either way there. Gold seems a little short-term overbought.

I’m leaning towards growth stocks having a better chance of success this week, but it’s not with high conviction. There are still just too many variables to feel strongly. The BoJ’s rate decision this week could be a stealth risk for the markets depending on which way they signal.

Looking better for: growth, tech, silver

Looking worse for: Japan, Treasuries, real estate