Weekly Market Prep - 9/11/2023

The markets prepare for a big August inflation report and Treasuries hang in the balance.

Happy weekend (and 1st weekend of football!) & welcome back to ETF Focus!

It’s Sunday, so let’s get ready for the week ahead!

Weekly Market Reset

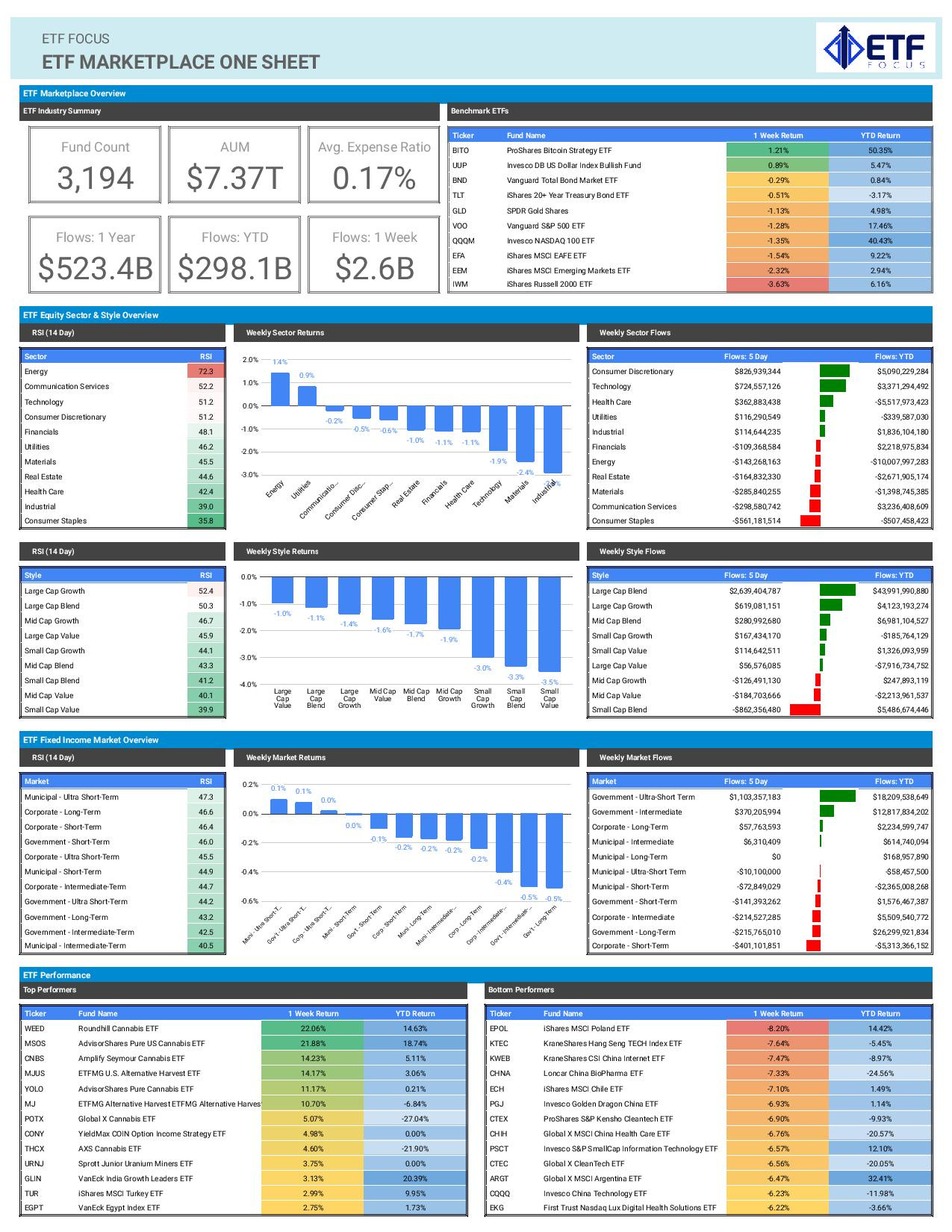

Stocks were lower again last week, led down by tech and small-caps, but bonds once again failed to capitalize. Treasuries have consistently struggled to make any sustained progress, often getting sold on any rally. Even though inflation is trending lower, the Fed is still threatening to lift rates again and there’s almost no scenario where the central bank cuts rates before last summer.

On a proportional basis, net flows are stronger for fixed income than equities, but it’s Treasury bills that keep drawing the most interest. A couple of months ago, investors were pushing into long-term bonds, perhaps anticipating that the end of the Fed’s rate hiking cycle would stop putting pressure on rates to move higher, but clearly the 5%+ yields being offered by bills are enticing.

Cannabis stocks extended their powerful rally to a second week following the news that the regulatory environment may soon be much improved. I wrote about this last week and, while the current rally seems very short-term overbought, cannabis stocks still haven’t recaptured 2023 highs. In other words, if cannabis gets rescheduled in Congress, there’s a lot of upside yet to be gained.

Key Economic Reports This Week

United States PPI (Tuesday)

United States CPI (Wednesday)

United States Retail Sales (Thursday)

United States University of Michigan Consumer Sentiment (Friday)

ECB meeting (Thursday)

Market Outlook

Treasuries will be heavily dependent on Wednesday’s inflation report. The headline rate is already expected to rise by 0.6% as low base effects get rolled off the annualized rate, but with energy prices at their highest level since November 2022, there’s a very real risk that inflation will heat up again. If Wednesday’s report still looks a little hot, don’t be surprised to see long-term rates moving higher again.

The bulls still look like they’re in control on the equity side, but it’s an increasingly narrow market again. Outside of tech, it’s really a mixed bag, but defensive strategies, including utilities, low volatility and value stocks aren’t really demonstrating that they’re ready to make a sustained move higher. China and Europe look like absolute messes and that could easily pull down U.S. equities at any time.