Weekly Market Prep - 6/3/2024

Non-farm payrolls and PMI reports could create a wide range of possible market returns this week.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We’re Talking About This Week!

+ Weekly Market Reset

+ Key Economic Reports This Week

+ Dividend Landscape

+ Market Outlook

Weekly Market Reset

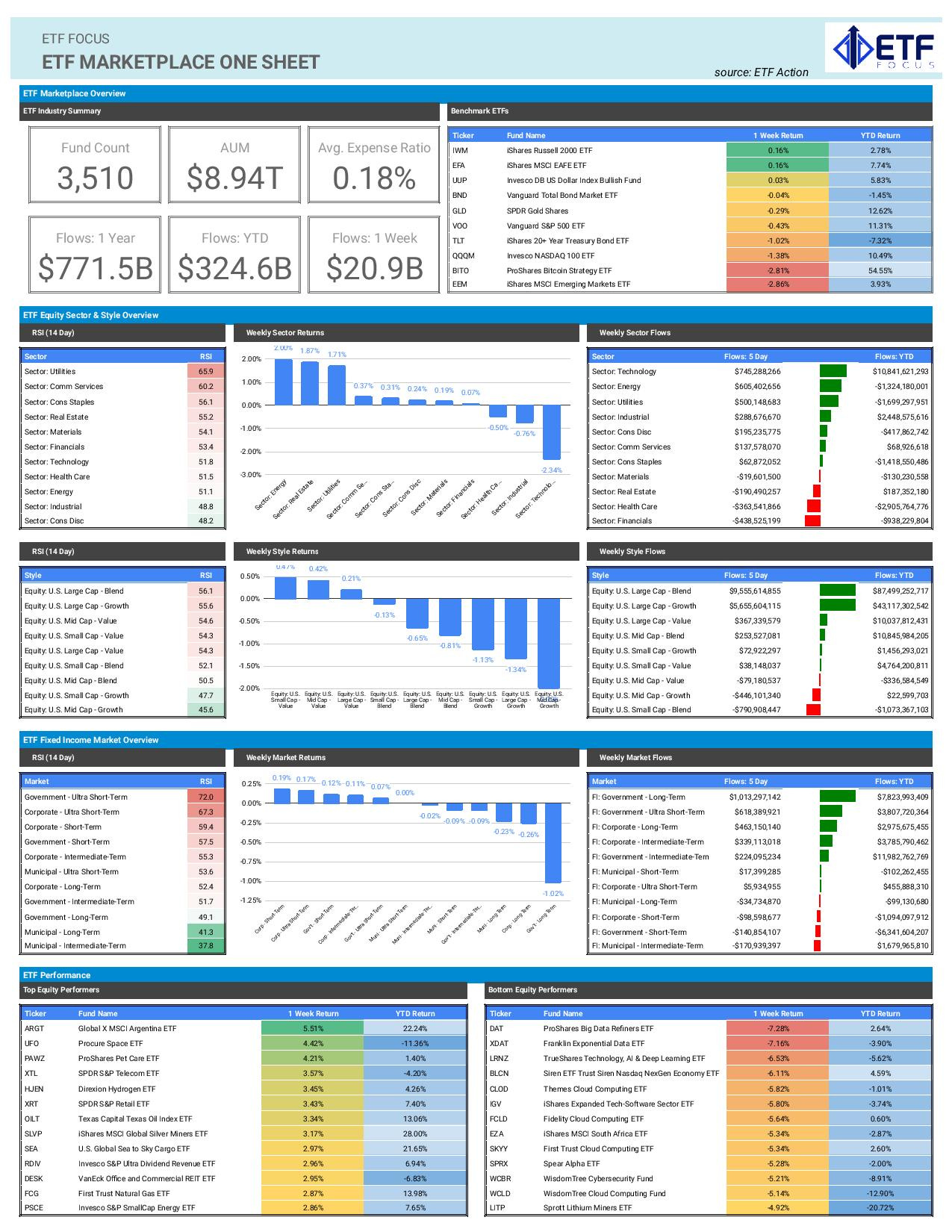

The markets wrapped up another solid month in May, although the composition of returns reflects a changing landscape. The top performing sectors - utilities (+9%) and technology (+7%) - are an odd pairing to find near the top of the leaderboard.

Tech’s leadership might be a little more easily explained. This sector tends to perform best in a mature growth cycle where growth looks steady and recession risk is minimal, but the chances of monetary easing appear to be limited. Earlier this year, cyclicals performed well as the economy was in good shape AND it looked like monetary easing was imminent. That produces the type of early growth cycle where cyclicals and value stocks do particularly well. As the calendar for rate cuts gets pushed further out into the future, cyclicals have begun to lag and tech has returned to take their place. In theory, healthy GDP growth and steady interest rates should produce a positive environment for tech to continue its leadership, but as we learned last week with Salesforce’s big earnings miss, some vulnerabilities remain.

Utilities leadership is more curious. Higher interest rates should be a headwind for the sector given its high reliance on debt for operations. While rates did move lower in May, the 10-year Treasury yield is more than 60 basis points higher today than where it was at the start of the year. Yet, utilities is the best-performing sector year-to-date. So it doesn’t look like a rate-related move. Utilities are generally considered a safe haven trade, but we don’t really have much evidence of that either. Volatility is very suppressed (the VIX has only touched the 20 level on one day this year) and the S&P 500 is up 11%. That doesn’t appear to be the driver either. I’ve heard some say it’s due to the anticipated energy from AI, but I’m not so confident in that. AI stocks were booming last year and utilities stocks performed miserably. Perhaps investors are anticipating a large shift to defense in the near future, but the catalyst for May’s strong performance isn’t entirely clear.

Treasuries have been a rotten trade for a while now, but I’m encouraged by what we’ve seen in May. There were multiple catalysts that could have driven rates higher (poor Treasury auctions, slowing demand, Japan selling Treasuries to support the yen), but long bonds still generated a positive return in May. Even though I’m more hawkish on the direction of rates than many, I think Treasuries have a bit of a foundation here, if for no other reason than the Fed is going to begin dialing back its balance sheet run-off this month and that means more bond buying ahead.

Key Economic Reports This Week

In the United States, we’ll get ISM manufacturing & services PMI readings before the highly anticipated jobs report drops on Friday. Last month, services PMI dropped into contraction territory for just the 2nd time since the COVID recession. The manufacturing sector has consistently struggled to grow since late 2022 and the Chicago business barometer, which dropped at the end of last week, also hit its lowest point since the pandemic. All of this points to an economy that is demonstrating strong and consistent signs of slowing, which will make this week’s numbers an important factor in the direction of interest rates from here.

The jobs report, of course, will be the headline grabber. Monthly job growth has been settling in at around 200,000 adds per month, which suggests a steady, if not necessarily robust, labor market. Forces look much more balanced nowadays with job postings shrinking, layoffs mounting and companies indicating that hiring plans are becoming more tepid. We’ll probably see the modest job growth trend continue again in May, but I wouldn’t be surprised to see a miss and some downward revisions to previous numbers.

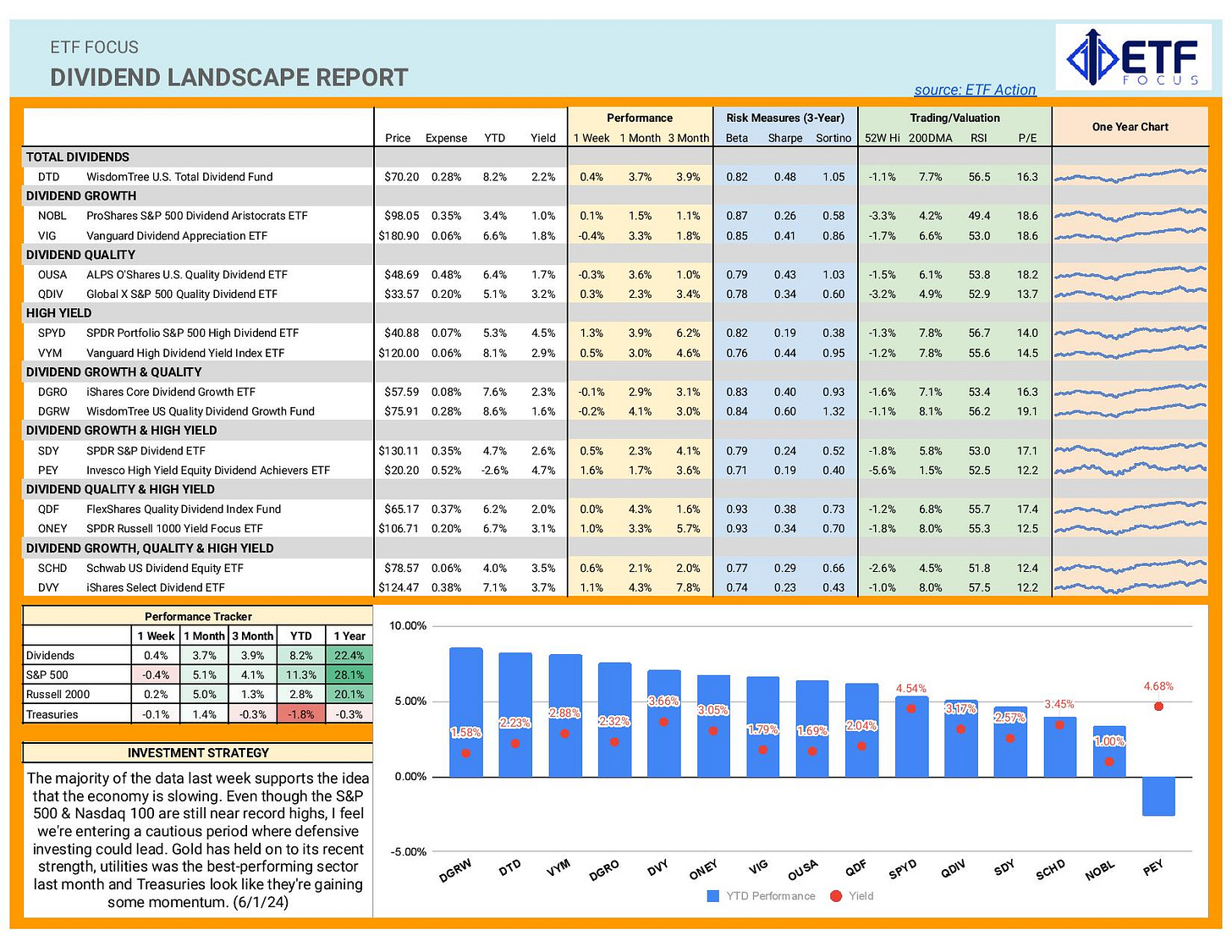

Dividend Landscape

Dividend stocks look like they’re beginning to build a little momentum with high yield strategies performing particularly well over the past month. The rebound in real estate stocks coupled with continued leadership in utilities has played a big part of that, but we’ve still yet to see a major shift away from riskier assets and into consumer staples, low volatility and other defensive stocks. We saw it for a single week a little over a month ago, but it was quickly reversed and hasn’t really returned since.

There will be plenty of opportunities for dividend stocks to outperform this week with several key economic reports set to drop. Volatility levels are still extremely low and that will make it tougher for dividend stocks to get their footing, but the fact that utilities, gold and Treasuries have had a generally strong May supports the idea that there is some defensive strength here.

Market Outlook

We have yet to see anything that resembles volatility at any point in 2024, but this week has the potential for at least a modest VIX spike. The ISM reports that will hit in the first half of the week could be market movers, but Friday’s jobs report could trigger a big move depending on where the final number lands. That makes the potential range of returns this week very wide.

Given how many economic reports we’ve seen over the past month have missed expectations, I’d caution against getting too optimistic about a labor market acceleration. Investors still seem relatively bullish and that could be a good or a bad thing. If there’s a miss in either of these reports, especially non-farm payrolls, the negative market reaction could be more aggressive than normal.

I’d maintain a cautious approach heading into this week, but, admittedly, we could see big gains, big losses or anything in between.

Looking better for: Treasuries, value, gold, quality

Looking worse for: materials, high beta, momentum