Weekly Market Prep - 6/10/2024

The Wednesday combination of inflation and the Fed could finally create the volatility spike that's been missing in the markets.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We’re Talking About This Week!

+ Weekly Market Reset

+ Key Economic Reports This Week

+ Dividend Landscape

+ Market Outlook

Weekly Market Reset

It looks like we’re re-entering a period of very narrow tech sector leadership similar to what we experienced back in 2023. This is the type of market environment we get when growth is perceived as at least steady, if not strong, yet rates are expected to remain higher for the near- to intermediate-term. That’s generally a favorable environment for growth leaders, but less than ideal for cyclicals and defensive issues.

Last Friday’s non-farm payroll number beat expectations by a wide margin and that pushed the expected start date of a Fed rate cutting cycle back in the mind of investors. The markets have shifted from a likely rate cut in September to a virtual coin flip. The futures market says that the first cut is likeliest to come at the November meeting, but I’m still having trouble imagining that Powell will lower rates within days of the presidential election. My base case remains that we won’t get a cut until December. Inflation has been too sticky for too long and the labor market has yet to indicate that there are major cracks appearing just yet.

That being said, I haven’t seen this divisive of a non-farm payroll report as the one we got last week. The jobs added number looks like a real anomaly when you consider that the unemployment rate went up, labor force participation went down, ADP jobs came in below expectations and job openings dropped significantly for the 2nd straight month (oh, and there was another downward revision in the prior month’s jobs added number). The markets reacted strongly to the headline number - Treasuries, small-caps, value, gold and utilities all underperformed - and I’m not sure that was justified. I won’t go so far as to say the number was “fake” as many have suggested because I don’t think that’s true and I don’t want to go down the conspiracy theory rabbit hole even if I did. I do, however, think there are some inaccuracies and doesn’t reflect the true labor market environment. If you take all data collectively, I think there’s still a lot of slack in the jobs market and it’s confirming the slowdown we’re seeing in the latest U.S. economic data.

For as much as people are talking about a broadening out of the equity market, I’m just not seeing it. Cyclicals have badly underperformed across the board for more than a month. Small-caps are lagging badly. Defensives have struggled to gain any momentum. Utilities had been the outlier and were doing very well for a while, but it looks like even that is fading. It’s been tech, some communication services and that’s about it. Treasuries still look like they’re doing fairly well here, especially on the longer end of the curve. The overall confluence of data prior to last week’s job number was negative and I think that bodes well for long bonds hanging on to gains. This week’s inflation report, however, will probably add some volatility and could swing things in either direction.

Overall, investors seem optimistic, volatility still isn’t a factor and the markets seem willing to downplay any negative data (at least in terms of the large-cap averages). That momentum probably creates support for higher equity prices, especially now that we’re entering the traditionally calmer summer months.

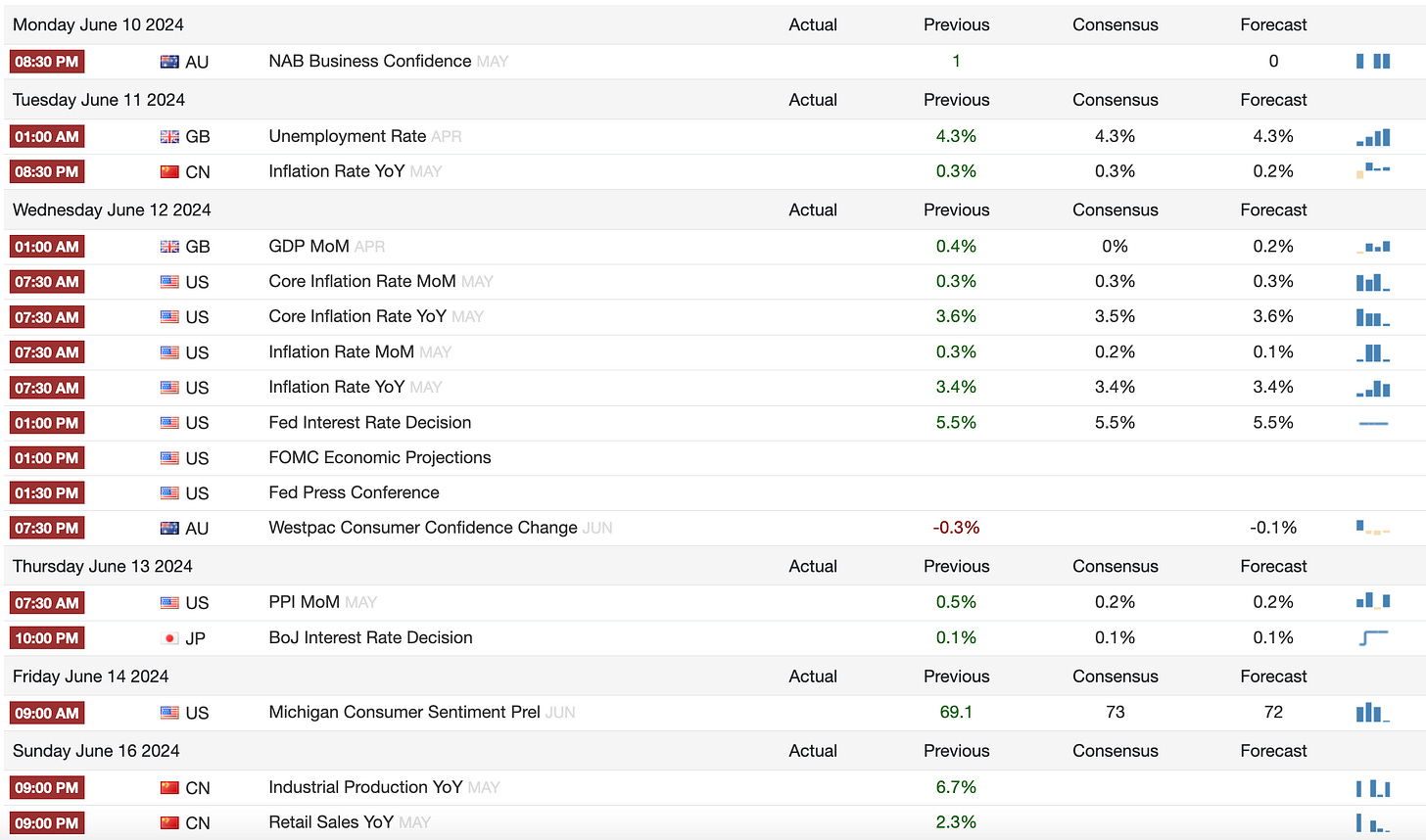

Key Economic Reports This Week

It’s going to be another busy week for global central banks. The Fed meeting on Tuesday/Wednesday will almost certainly result in no rate changes, but the economic projections are what investors will be paying close attention to. Powell has thus far reiterated the central bank’s projection of multiple rate cuts before year-end, but several governors have gone on record saying that they’re uncomfortable with the idea of rate cuts before inflation gets a little more under control. The projections are likely to come in as they always do - suggesting slow and steady long-term growth, disinflation through 2025 and no recession in sight. If anything, I’d expect the Fed to lower or delay their rate cut forecast, which would likely be market-negative, but there’s also pressure on multiple fronts to get rates lower and quicker.

The Bank of Japan meeting later this week is worth watching closely because they’re in a really tough spot. I believe they’re eventually going to have to raise interest rates to strengthen the yen, but it won’t happen this week. The markets pretty much disregarded their last last 10 basis point hike as too insignificant to do anything and the billions of dollars spent on intervening in the forex market to boost the yen has yielded virtually nothing. Growth and inflation are stalling, which would support the notion of easing, but improving the yen is likely priority #1. Rate hikes would probably swing the country’s economy back towards recession, which is why the BoJ is in a no-win situation. It’s a “pick your poison” scenario.

U.S. inflation will also be important. The disinflationary trend has stalled out and inflation is still running at around a 0.3% month-over-month clip. That’s not going to be enough to motivate the Fed to make any major policy changes and I don’t see inflation trends shifting slower any time soon. We’ve seen slower activity in manufacturing and consumer activity recently. That will eventually lead to less inflationary pressure, but it’s going to take time to play. Inflation and the Fed happening on the same day could make for a volatile Wednesday.

Dividend Landscape

A tech-only rally is not conducive to dividend stocks and we’re seeing that trend play out everywhere within this group. Durable dividends have been having a little more success recently with cyclicals struggling and signs of slower growth emerging. While we have at times seen investors show signs of concern over the past few months, there’s been nothing that’s really put a genuine scare into them. Perhaps if we get a really hot inflation report this week, that could raise fears of 1) no rate cuts in 2024 or 2) a stagflationary environment that would kill equity prices. Outside of the recent utilities rally, there’s been little steady support for defensive stocks or any of the themes that would lead to dividend stock outperformance.

I do find it interesting that the WisdomTree U.S. Total Dividend ETF (DTD), which simply targets the entire dividend stock universe, is the 2nd best performer of this group year-to-date. Sometimes casting a wide net works better!

Market Outlook

While conditions are broadly supportive of higher prices right now, the Fed meeting and Wednesday’s inflation report could really swing things in either direction depending on what’s reported. I think Powell will do his best to deliver a calming tone, but I’m going to have a tough time buying it if he says that the Fed is still expecting multiple rate cuts in 2024. If the central bank’s projections push rate cuts further out into the future, which I think is more likely than not based on what he’s said recently, the markets won’t like it.

If I were purely speculating, I’d guess it’s slightly more likely than inflation comes in above expectations than below, but anybody that tells you they know what’s going to happen in lying. I’d personally prefer to play it cautiously and stay away from making bets on what the number will be.

Wednesday looks like it could be volatile. Friday could be interesting based on what the BoJ says. The trend of slowing rising stock prices, especially as it relates to the S&P 500 and Nasdaq 100, seem more than likely to win out.

Looking better for: tech, growth, quality

Looking worse for: high beta, cyclicals, small-caps, gold