Weekly Market Prep - 5/13/2024

Utilities have been on a tear, but this week's CPI report could change the narrative.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We’re Talking About This Week!

+ Weekly Market Reset

+ Key Economic Reports This Week

+ Dividend Landscape

+ Market Outlook

Weekly Market Reset

Note: Due to a data issue, this week’s investment return and flow data are all through Thursday, May 9th, not Friday, May 10th. My apologies for the discrepancy and we should have it cleared up by next week!

The S&P 500 and Nasdaq 100 posted big gains again last week and both are back to within 1% of new all-time highs. Good times for investors, right? Well, not unless you want to consider that it’s utilities and other defensive strategies that have been the biggest gainers over this time. Value is outperforming growth. Low volatility is outperforming high beta. Gold has resumed its rally. Long-term Treasury yields are well off of their late-April high. If you’re just following the major market indices, you’re missing out on the fact that there’s a definitive shift to defense happening here.

The one thing that would argue against the rise of defensive equities is the current lack of volatility in the market. The VIX finished last week at 12.5, its lowest close since January. The 1-day VIX has failed to even break 10 in each of the past five trading days. That shows a real lack of concern about any potential downside and investors tend to be buyers of risk assets in those circumstances. Based on this, I do believe that there’s a better than average chance we see another up day for the major averages, but if it happens again with sectors, such as utilities and consumer staples, in the lead, I think there are some real questions to be answered regarding the true strength of this market.

In terms of flows, we’re seeing money moving into defensive sectors as well. Utilities, consumer staples and healthcare were three of the four biggest drawing sectors, so I think investors are at least seeing what’s going on in the markets. The fixed income side is a little more mixed. The past few weeks have featured a big chunk of flows moving into Treasury bill and short-term bond funds. I don’t think there’s necessarily a big reason to get excited about bonds here. I don’t believe that rate cuts are coming anytime soon (in my opinion, December is the most realistic possibility) and the fact that inflation rates are still elevated probably puts a limit on how much lower bond yields can realistically move here. Gold is still probably the better positioned defensive asset, although retail investors really haven’t been buying in yet.

Over the remainder of 2024, I think Europe might have more potential than the S&P 500. Their economic data actually is heading in the right direction and inflation is close enough to the ECB’s 2% target that the central bank is almost certain to start cutting rates this summer. Both act as tailwinds to risk assets, but it remains to be seen if investors are willing to look beyond the U.S. and into more value-oriented stocks instead of just U.S. tech. International stocks are long overdue for a stretch of outperformance and their macro fundamentals relative to those of the U.S. are starting to turn favorable.

Key Economic Reports This Week

This week, it’s going to be all about inflation data in the United States. In my view, even if the April reading simply comes in at expectations (which is 0.3% for both core and headline), that’s still a 3-4% annualized rate, which isn’t nearly going to be enough to justify the Fed lowering interest rates at any point in the near future. The markets seem to really want to buy into the idea that rate cuts are coming though and I can picture equities having a really good day on Wednesday if the final number comes in below expectations. Given that oil prices pulled back all throughout April, I think there’s a better chance that the headline number comes in below expectations, but I’m less optimistic that the core rate shows much progress. I think investors want to think that inflation is coming down and their response to this week CPI & PPI numbers will reflect that.

The other number to watch is retail sales. This has been perhaps the most durable of all the consumer sentiment readings and it doesn’t seem like we’re going to get anything different this week. This number could be interesting with the backdrop of a potentially weakening labor market. If this is happening and consumers are becoming more concerned about job security, it stands to reason that they would trim back their spending to reflect that. There’s typically a lagged effect to this and it’s probably unlikely that the trend will change this week, but I think it will be consequential when retail activity shows further evidence of slowing down.

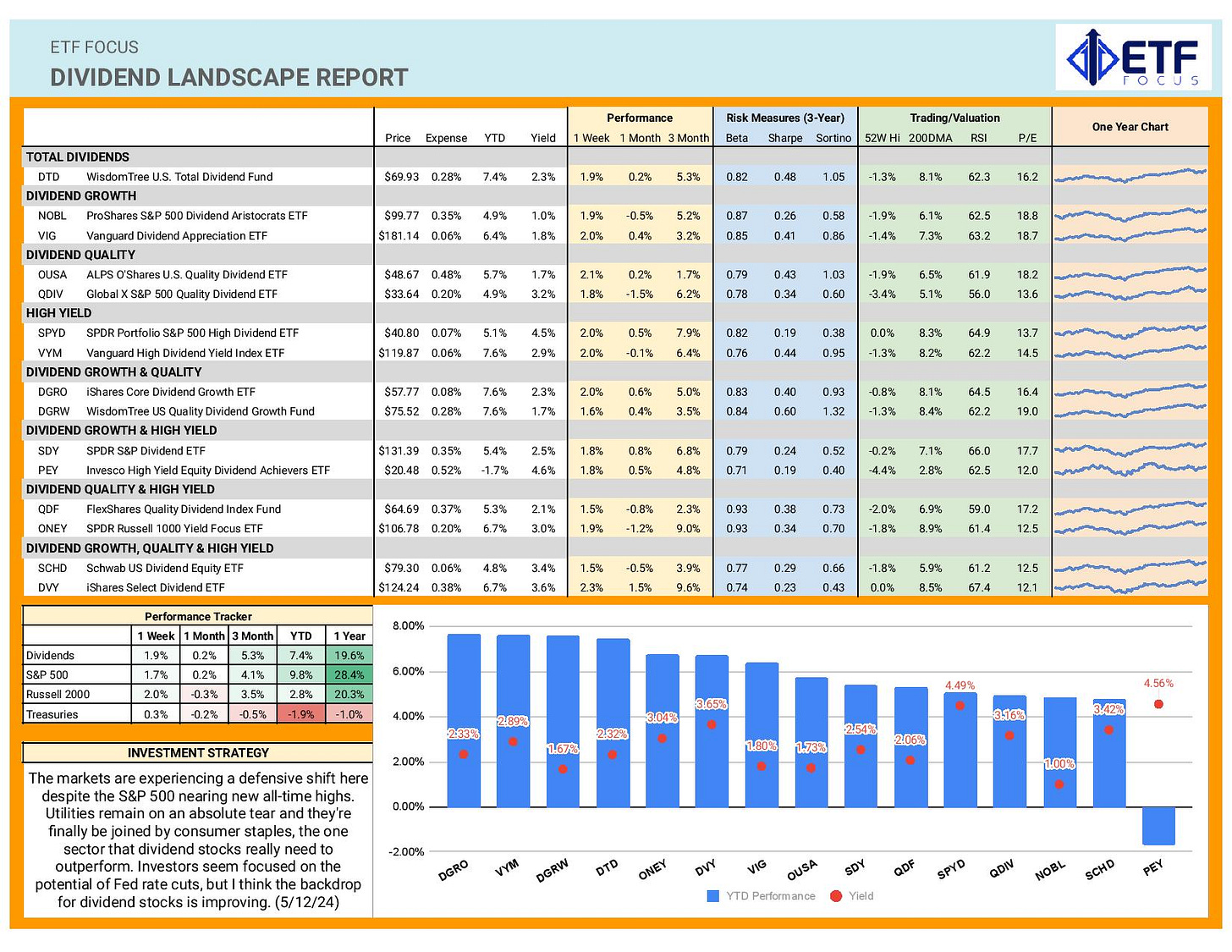

Dividend Landscape

Dividend stocks are starting to build up a little momentum during the current defensive shift. How far it can go will really depend on how broad this shift can get. Utilities have undoubtedly been the driving force here (as evidenced by their extremely overbought RSI of 79), but staples, healthcare and other conservative equities have been mixed at best. If we can see some consistent leadership out of the non-utilities stocks, dividend payers could see a nice little run here. For this week, it’ll likely depend on how the inflation numbers turn out.

Market Outlook

The major averages have have been having a good stretch here and I think there’s a good chance that it could continue. The April inflation report will be the driver and could determine whether U.S. equities are up or down on the week. I expect core inflation will remain sticky, but a cooler than expected headline rate fueled by falling crude oil prices could ignite another rally. Current ultra-low volatility suggests the backdrop is there for equities to move higher.

Looking better for: tech, junk bonds, momentum

Looking worse for: TIPS, quality, China