Weekly Market Prep - 3/4/2024

This Friday's non-farm payroll report will be the main event, but it's unlikely to dent positive investor sentiment.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

Weekly Market Reset

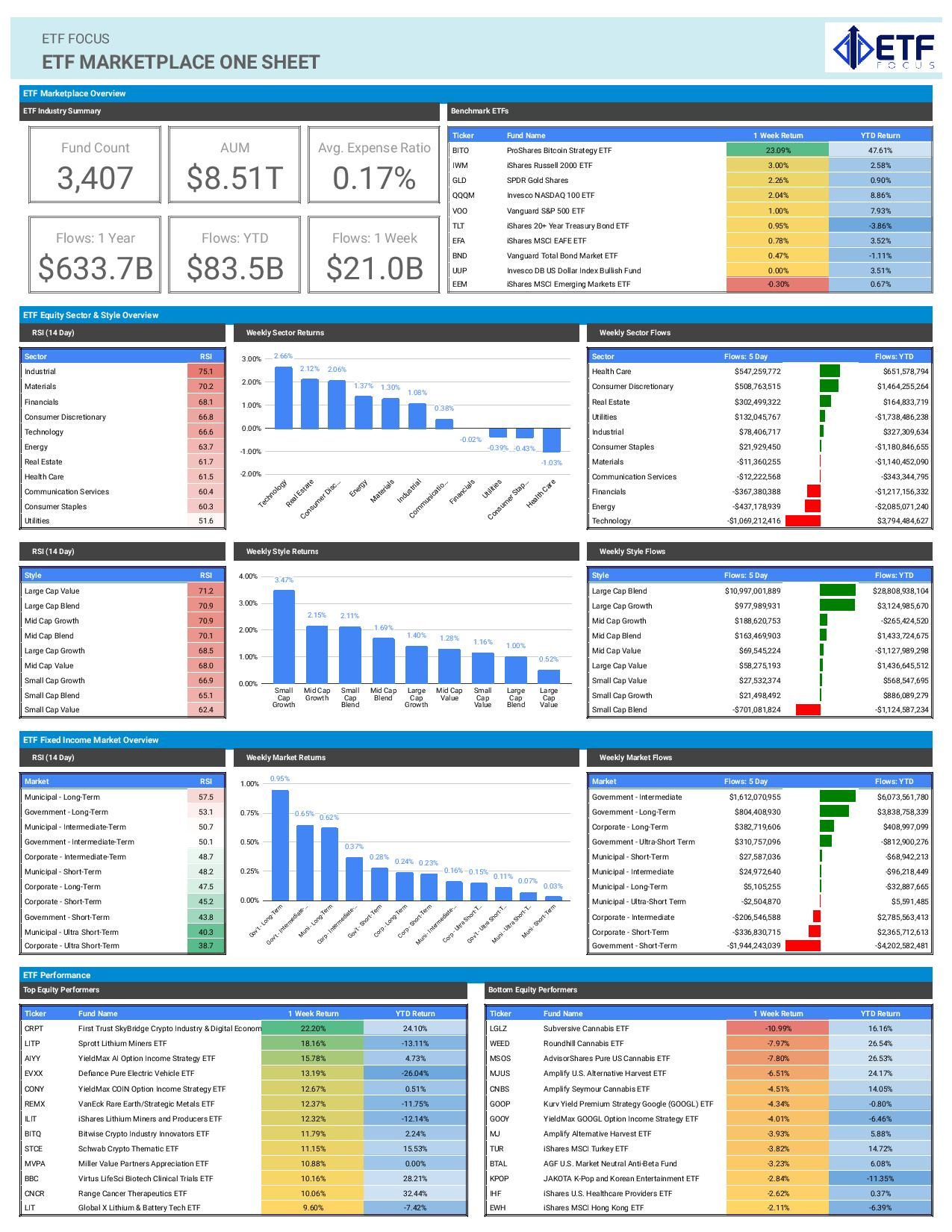

Last week marked the return of tech following a couple of underperforming weeks. The overall theme, however, remains the same. Whether it’s growth or cyclicals, riskier equities are still in demand and defensive sectors, such as utilities and consumer staples, continue to underperform. The growth, manufacturing and inflation data continue to be hit and miss on a near-term basis, but investors seem to feel confident that the growth trajectory is still intact and recession risk is low.

On the plus side, we are starting to see a broadening out of market gains. Small-caps are no longer lagging large-caps. Several of the “magnificent 7” stocks are starting to underperform. Industrials, materials and financials are starting to lead the market higher. That’s a good sign for the market overall even if the tech-heavy major averages may struggle a bit if the mag 7 struggles. The fact that the market has done this at the same time that it’s unwound some of its most dovish expectations of the Fed means that equities are advancing from a better level.

Even though bond yields have been falling here, I’m skeptical that it could continue. We’re likely to get some hawkish speak from the Fed this week culminating with a hawkish message at their meeting later this month. If Powell was indicating three cuts for the year back in December, I imagine they’re thinking fewer now given the latest round of higher than expected inflation readings.

Key Economic Reports This Week

United States ISM Services PMI (Tuesday)

Australia Q4 GDP Growth Rate (Tuesday)

Bank of Canada Interest Rate Decision (Wednesday)

United States JOLTS Job Openings (Wednesday)

ECB Interest Rate Decision (Thursday)

Canada Unemployment Rate (Friday)

United States Non-Farm Payrolls (Friday)

United States Unemployment Rate (Friday)

China Inflation Rate (Friday)

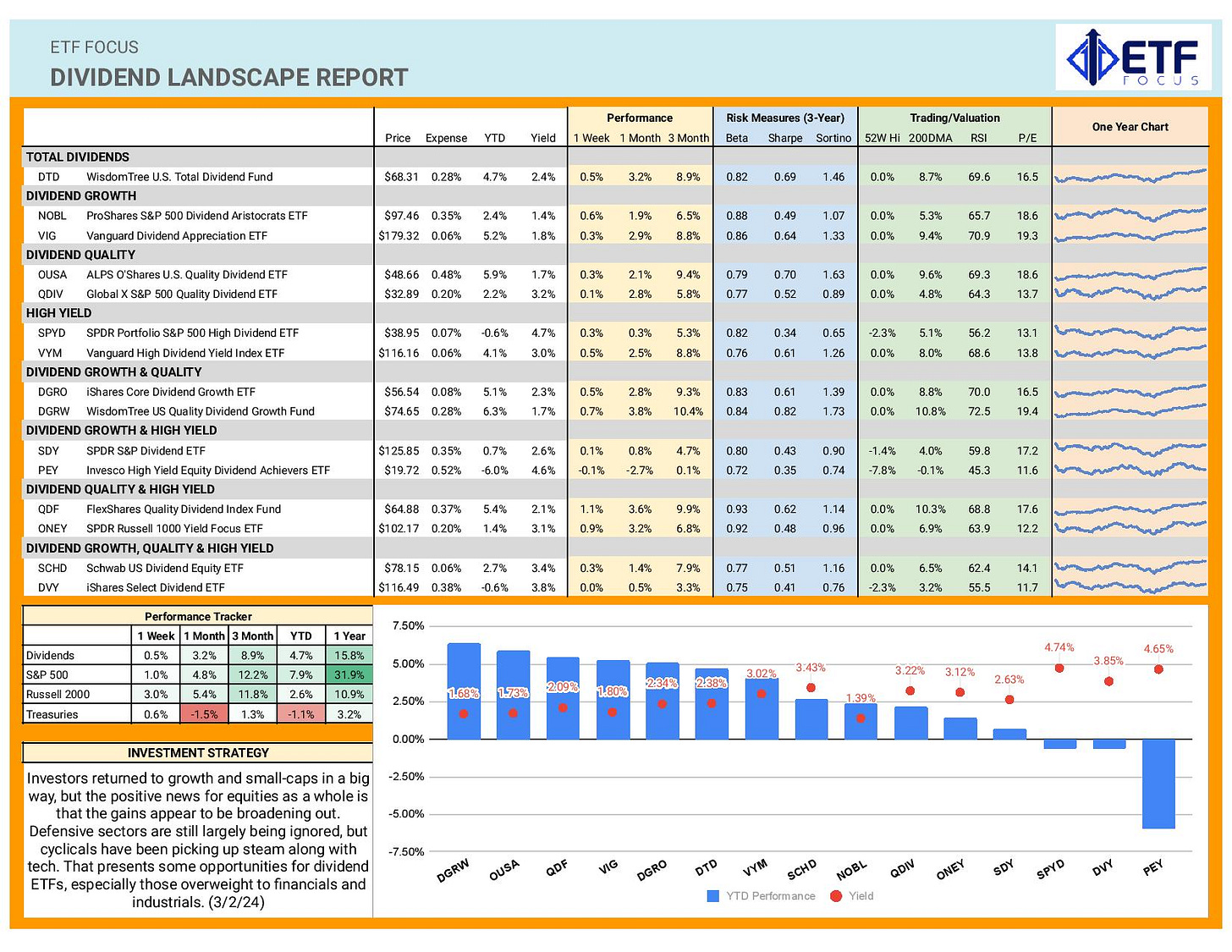

Dividend Landscape

The current rally in cyclicals is giving some juice to dividends, but investors’ general avoidance of the traditionally defensive sectors is keeping dividend stocks in the rearview. So far, not a single dividend-focused ETF is beating the S&P 500 this year and it could remain that way until we get some type of risk-off catalyst. This week’s jobs data, if it suddenly shows some surprising weakness, could be the first step in that direction, but it feels unlikely that we’re going to see anything like that. It seems as if dividend stocks are more likely to lag than not throughout the springtime months before having a better chance at outperforming heading into this summer.

Market Outlook

Market sentiment is positive, but it’s going to be all about the employment data this week. We’ll get the JOLTS number on Wednesday before the big non-farm payroll number on Friday. A crack in the labor market would likely be the thing that starts to shake investors’ confidence, but it doesn’t feel like we’re going to get it this week. The markets have been waiting for a slowdown in job growth for months only to be disappointed every time. This feels like it has the makings of another week of gains for risk assets.