Weekly Market Prep - 3/11/2024

Like it or not, market sentiment is turning defensive and this week's inflation data could cement the trend further.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

Weekly Market Reset

If you’re one of the many investors whose portfolios are heavily tilted towards growth, tech and the magnificent 7 stocks, you’ve probably found yourself beginning to underperform the market. Over the past several weeks, the markets have dialed down their expectations for a massive rate cutting cycle from the Fed, inflation has ticked back up again and the unemployment rate is starting to move higher. The steady expansion of the economy is propelling cyclicals into the lead here, but the sharp rallies in both gold and Treasuries can not be ignored.

The labor market may be the most important thing to watch here. While the unemployment rate is still below 4% and the economy just added another 275,000 jobs, the unemployment rate is also 0.5% higher than it was in April 2023. That kind of increase in less than a year tends to be a precursor to recession. You may not get a sense that this could be a risk given the strong GDP growth rate, but I believe that there are some serious pressures building and the renewed focus on defensive assets is a reflection of that.

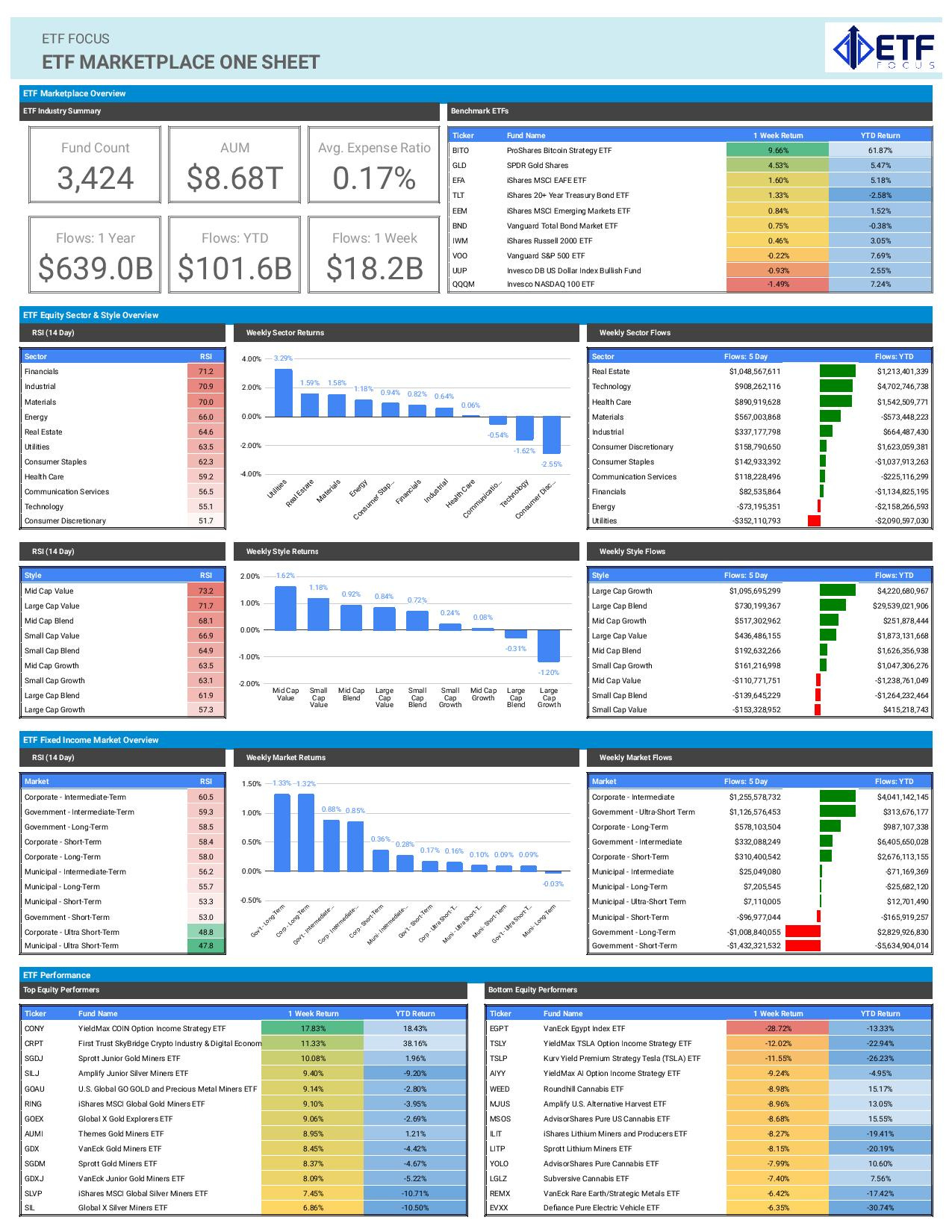

One other thing that could be taking investors’ eyes off the ball is the rally in bitcoin. While the launch of bitcoin ETFs isn’t the entire reason for this year’s 60%+ gain, it’s a driving factor. The nine new spot bitcoin ETFs launched earlier this year have seen net inflows of more than $20 billion since their inception earlier this year, half of which have gone into the iShares Bitcoin Trust (IBIT). Bitcoin ETFs have clearly brought easy, cheap access to bitcoin to a whole new universe of retail investors and that continue driving interest to these ETFs well into the future.

Unfortunately, that’s just masking the current shift happening elsewhere. As long as gold and Treasuries are making strong gains here, market sentiment will tilt towards the negative.

Key Economic Reports This Week

Japan Q4 GDP Growth Rate (Sunday)

United Kingdom Unemployment Rate (Tuesday)

United States Inflation Rate (Tuesday)

United Kingdom GDP Growth Rate (Wednesday)

United States Producer Price Index (PPI) (Thursday)

United States Retail Sales (Thursday)

United States Michigan Consumer Sentiment (Friday)

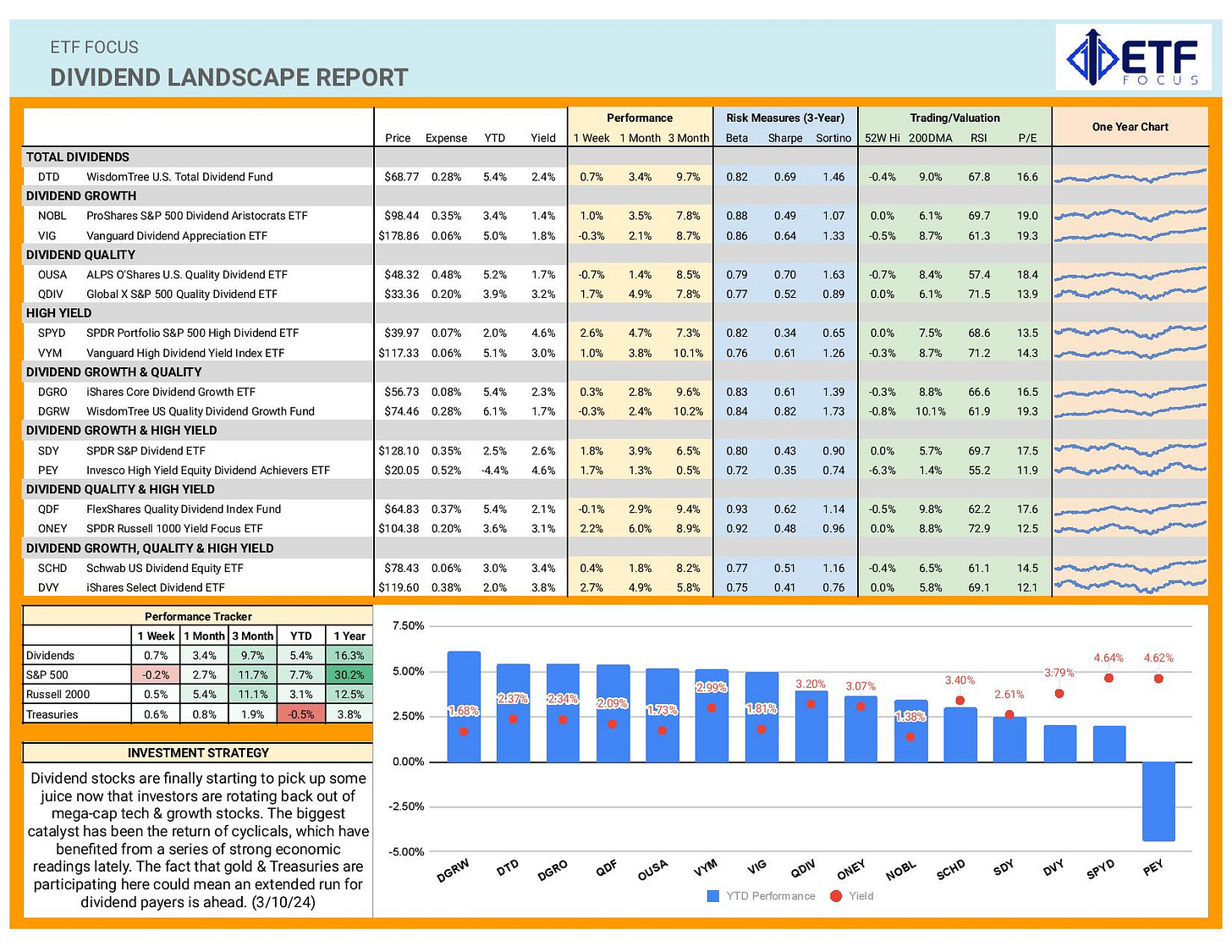

Dividend Landscape

Dividend stocks are quietly making a comeback on the heels of outperformance from industrials, utilities and real estate. High yielders have been among the worst dividend ETFs this year, but they’re actually starting to lead again in the current rebound. The cyclical influence in this category is certainly playing a big part, but so is the current leadership of value stocks. The Fed seems not at all interested in cutting rates any time and that should assist in keeping rates elevated in the absence of a genuine flight to safety trade. Those are the kinds of conditions that could result in letting some air out of the tech valuation bubble. As that happens, dividend stocks could get an extended run.

Market Outlook

It’s been two solid weeks of outperformance in utilities and gold with a continued decline in long-term Treasury yields. That’s an undeniable shift towards risk-off behavior, but two weeks still doesn’t equate to a definitive trend. We’ve seen shifts like this in the recent past only to see the markets return to tech and growth stocks once again. This time, however, utilities, gold and Treasuries are all posting solid gains together, something which we haven’t seen much of in the past couple years. If this trio continues to perform well, we have to acknowledge the possibility that we’re seeing a larger pivot in the markets.

I’ll also be watching this week’s inflation and retail sales data. January’s retail sales number was very weak and a second straight month might demonstrate that consumers are finally starting to break. Inflation is starting to trend higher again and more confirmation that we’re getting further away from the Fed’s 2% target likely pushes a Fed rate cutting cycle well into the 2nd half of this year.

I'VE BEEN DOING MY OWN FINANCES FOR 60 YEARS, IT'S NOT A VERY BIG PORFOLIO LESS THN 400k. BUT I'VE HUNG IN THERE PRETTY GOOD.

I'M A FAN OF YOUR ETF FOCUS AND AGREE WITH YOUR VIEWS.

LOOKING FORWARD TO YOUR NEXT EDITION AND AM GLAD O SEE IT

ON SUNDA

THANKS, DENNIS BENEFIELD