Weekly Market Prep - 2/5/2024

We’ve been seeing T-bill ETF outflows & that could suggest investors are seeing better opportunities in equities and no longer have a need to sit on the sidelines.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

Weekly Market Reset

Investors received a modest dose of reality last week when the Fed held interest rates steady, as expected, but failed to signal that rate cuts would be imminent. This is the narrative that I’ve been talking about for weeks. With core inflation still running at a 4% annualized rate, GDP growth at 3% and the unemployment rate under 4%, there’s little reason for the Fed to be kicking off a massive monetary policy loosening at this time. This disinflationary trend is still progressing, but slowly and certainly not quickly enough that the Fed needs to consider cutting rates right away. Two or three rate cuts in 2024 seems like a reasonable pace of policy normalization, assuming that inflation keeps crawling towards the Fed’s 2% target. That would ensure that the Fed moves back towards a neutral policy rate, but still keeps conditions tight enough to make sure inflation remains under control. The market is still pricing in a May start date and five cuts in 2024, which I think is still too dovish.

The one thing that could accelerate the pace of cutting would be signs of a breakdown in the labor market. Most market watchers see a non-farm payroll report showing 300,000+ job adds for the month of January and assume that the labor market is still tight as ever. I take a much more cautious stance and one backed by the data. The biggest part of the jobs gain number came from part-time, not full-time jobs. The full-time employment rate is back down to its lowest level in more than a year. The Challenger job cuts report shot sharply higher last month. Average weekly hours has been trending lower for nearly three years and is at its lowest level since the COVID pandemic. UPS, Deutsche Bank, American Airlines, Microsoft, eBay, Corning, Macy’s, Wayfair, Citigroup, Google, Twitch and Xerox have all made layoff announcements in 2024 alone. Taken in total, I think the labor market is actually reversing here despite the strong NFP numbers. It’s been the one thing that’s held up this economy throughout. If the labor market finally cracks, I think the long awaited recession might be inevitable.

In terms of market performance, we’re still seeing the unattractive breakdown of equity market returns - the S&P 500 and Nasdaq 100 are both up 4-5% this year, while the equal weight S&P 500 is virtually unchanged and the Russell 2000 is down 3%. It’s far from the kind of market that would indicate a broad, cyclical expansion is in place. It’s more like one in the mature stages that is focused only on the cycle’s winners, which would be tech and communication stocks. Five of the 11 S&P sectors are down year-to-date and long-term Treasuries are down more than 2% again. One signal that I tend to watch fairly closely is the VVIX/VIX ratio, a relative volatility measure that tends to move higher when there is bullish market sentiment. This ratio has actually been declining pretty steadily since December and suggests this market environment isn’t nearly as healthy as the major averages would have you think.

Net flows on the year thus far still look pretty healthy, but they are following what we’ve seen in the broader market. Tech and large-cap ETFs have seen strong relative inflows in 2024, while energy, utilities, small-cap and T-bill ETFs have seen outflows. The ultra-short bond category is telling is because investors used these all throughout 2023 as a cash alternative or just a place to put their “wait and see” money when the markets hiccuped since the 5% yields being offered made it worth it. The fact that we’re seeing outflows now could suggest that investors are seeing better opportunities in equities and no longer have a need to sit on the sidelines.

Key Economic Reports This Week

United States ISM Services PMI (Monday)

Reserve Bank of Australia Interest Rate Decision (Monday)

China Inflation Rate (Wednesday)

Canada Unemployment Rate (Friday)

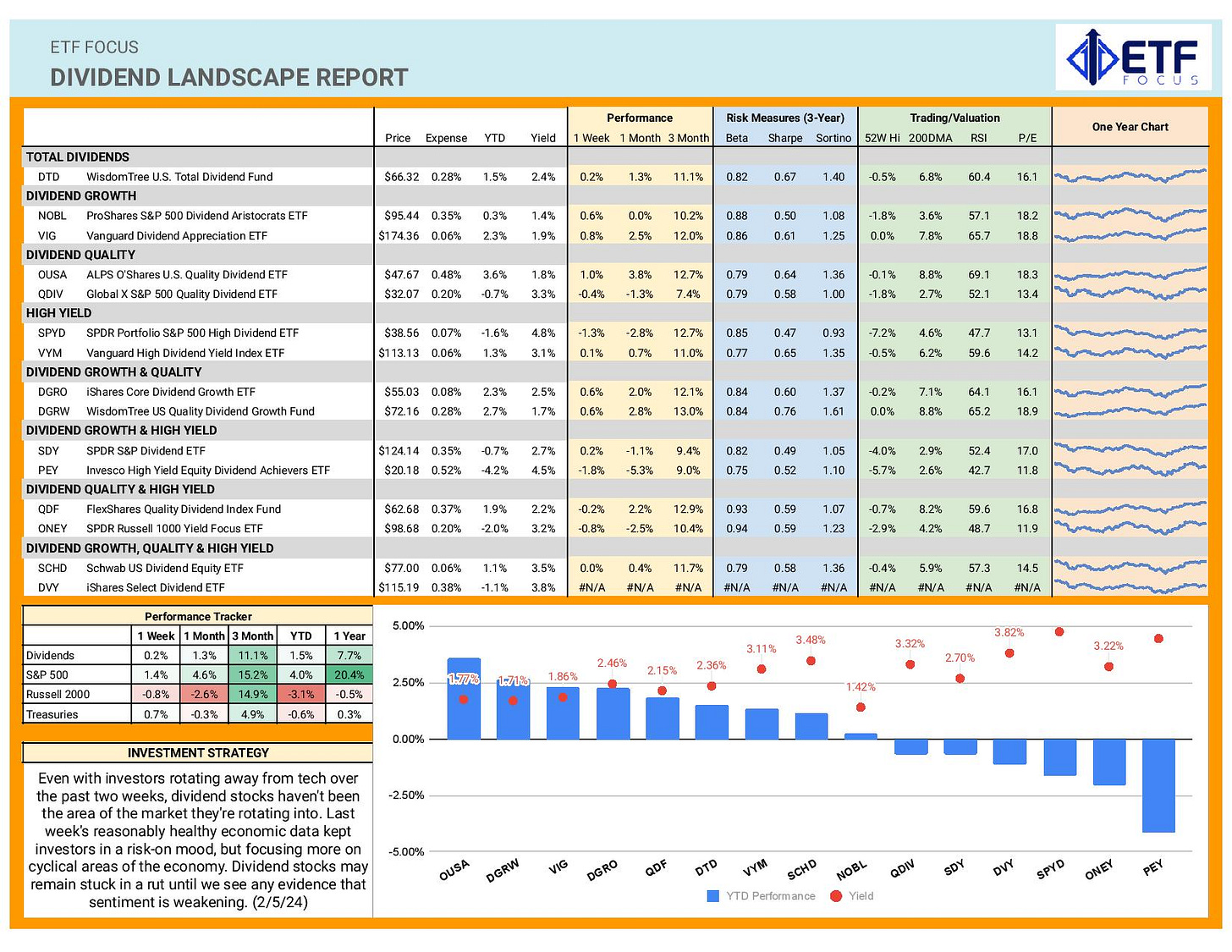

Dividend Landscape

(note: sorry, a bit of a data issue with DVY this week, but it should be fixed very soon!)

Dividend stocks are still having trouble getting things in gear in 2024, but that’ll likely remain the case if investors are focused on tech and growth. For now, performance has been driven by macro-related events and data, which have largely been pretty positive for a while. Q4 earnings have revealed problems for several companies from weak demand to softening margins. The rash of corporate layoff announcements should be taken at face value. In a highly inflationary environment, companies were able to pass on higher costs to consumers. Now that inflation has come back down and consumers’ ability to keep spending is getting tapped out, companies are focused to come up with ways to grow organically. Layoff announcements are a sign that many of them aren’t cutting it and need to cut costs as opposed to improve growth.

For now, there’s little immediate catalyst for a sea change unless the labor market breaks down quickly. We just got the GDP and jobs numbers, so it’ll take several weeks to get more data on those fronts. The latest inflation numbers don’t hit until February 13th. I just don’t see a lot of immediate triggers for a turnaround in investor sentiment that pushes dividend stocks back into the lead.

Market Outlook

The big economic data dump was last week, so this week will seem quiet by comparison. We’ll get plenty of corporate earnings announcements, but the big tech names that people were watching for were last week. This week, it’ll be a lot of consumer names, which could give us some signal as to how well household spending is holding up, but I don’t think there will be any shockers.

That probably means a relatively low volatility week that could lead to further gains for equities. The bigger question might be what happens in the bond market. Treasuries have been a little more volatile lately and have been struggling to establish a firm short-term direction. With the Fed putting a stake in the ground about where it stands on rates for 2024, I suspect yields on the long end could drift a little higher here.