Weekly Market Prep - 2/26/2024

Tech has been underperforming despite NVIDIA's big earnings report and it might have trouble getting its leadership position back.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

Weekly Market Reset

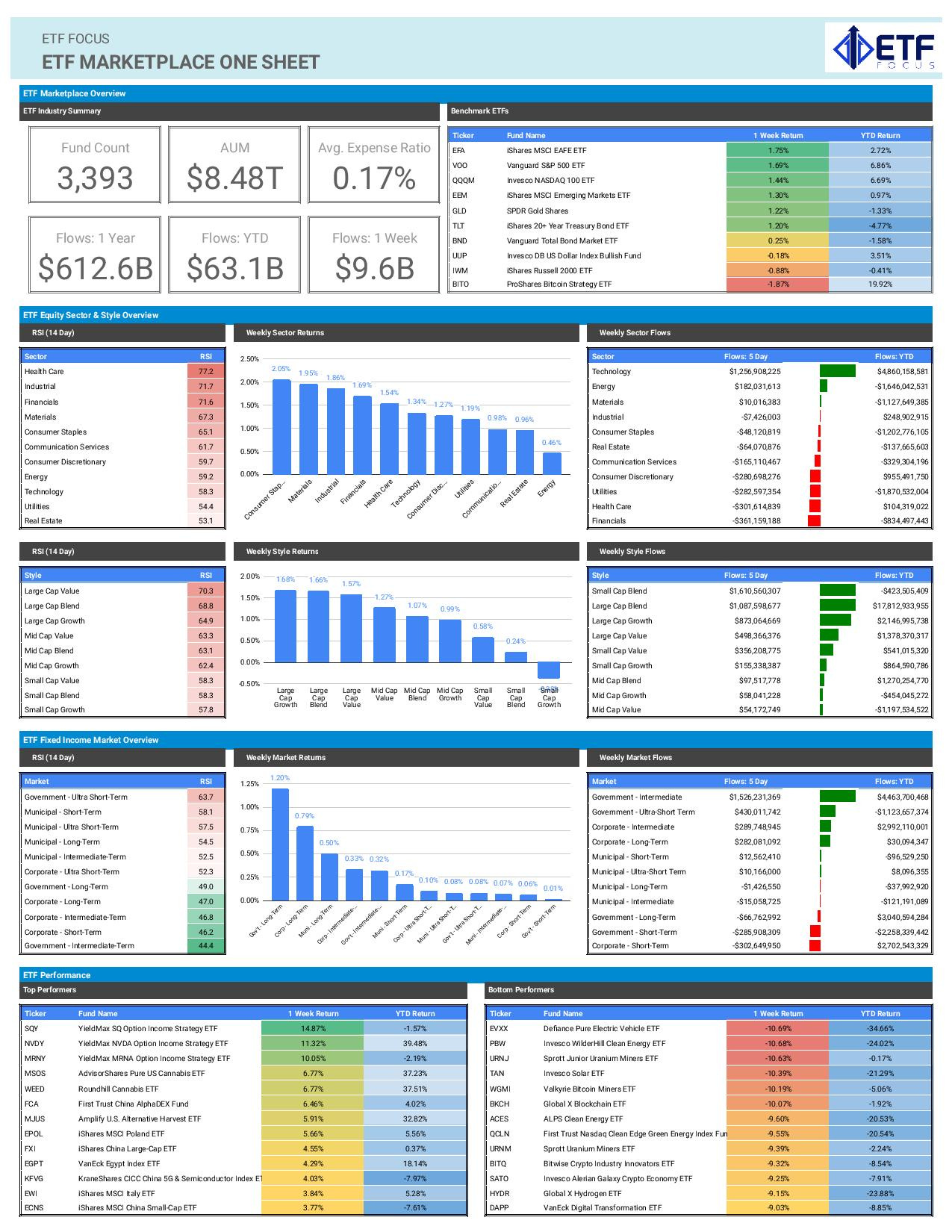

Despite an earnings report from NVIDIA that reignited the U.S. equity market, we’re still seeing cyclicals and some defensive sectors/strategies outperforming. Treasury yields continue to rise as the timing on the Fed’s rate cutting cycle continues to get pushed back and that’s taking some of the air out of the recent growth rally. Industrials and financials (and, lately, materials stocks too) are trying to step into the leadership role, banking on the idea that the U.S. economy is still on a firm growth trajectory.

It doesn’t look as if investors are terribly cautious or worried about what might be coming next. The traditionally defensive healthcare sector has been a steady leader throughout 2024, but we’re not seeing similar sentiment from low volatility, value, dividend or utility stocks. Once we get some of that (and I do think we’re long overdue for a touch of reality with regard to the pretty significant issues we’re seeing globally), I don’t think the S&P 500 or the Nasdaq 100 are ready to suddenly turn.

ETF flows are showing that investors are piling into tech stocks and almost nothing else at this point. One area we are seeing money moving into, however, is small-caps. On a relative basis, small-caps have drawn in more new money than both large-caps and mid-caps on a 1-week, 1-month and 3-month basis. On a performance basis, small-caps have been performing miserably, especially relative to the S&P 500, but the increase in flows could be a sign that investors are starting to dip their toes back into the water. With investors so confident that the U.S. economy is continuing to expand and a soft landing will be the ultimate outcome, it’s curious that small-caps haven’t been doing better. In a broader market advance under bullish conditions, small-caps should be leading, but they haven’t been. Perhaps this is an early sign that the trend is reversing somewhat.

Elsewhere, I think we’re finally seeing the bond market start to line up with the Fed on the interest rate outlook. Investors got way too optimistic about how many times the Fed would cut rates in 2024, despite Powell indicating otherwise. The rise in yields throughout 2024 has been a direct result of those expectations getting walked back, but I think we’re nearing the point where things are getting back to neutral. Last week’s rally in long-dated Treasuries is a sign we’re getting back into balance, but I want to see that carry forward into the coming weeks to be sure.

Key Economic Reports This Week

Japan Inflation Rate (Monday)

United States Durable Goods Orders (Tuesday)

United States Q4 GDP Growth Rate - 2nd Est. (Wednesday)

France Inflation Rate (Thursday)

Germany Inflation Rate (Thursday)

India Q4 GDP Growth Rate (Thursday)

Canada Q4 GDP Growth Rate (Thursday)

United States Core PCE Price Index (Thursday)

United States Personal Income (Thursday)

United States Personal Spending (Thursday)

China Manufacturing PMI (Thursday)

Eurozone Inflation Rate (Friday)

Italy Inflation Rate (Friday)

United States ISM Manufacturing PMI (Friday)

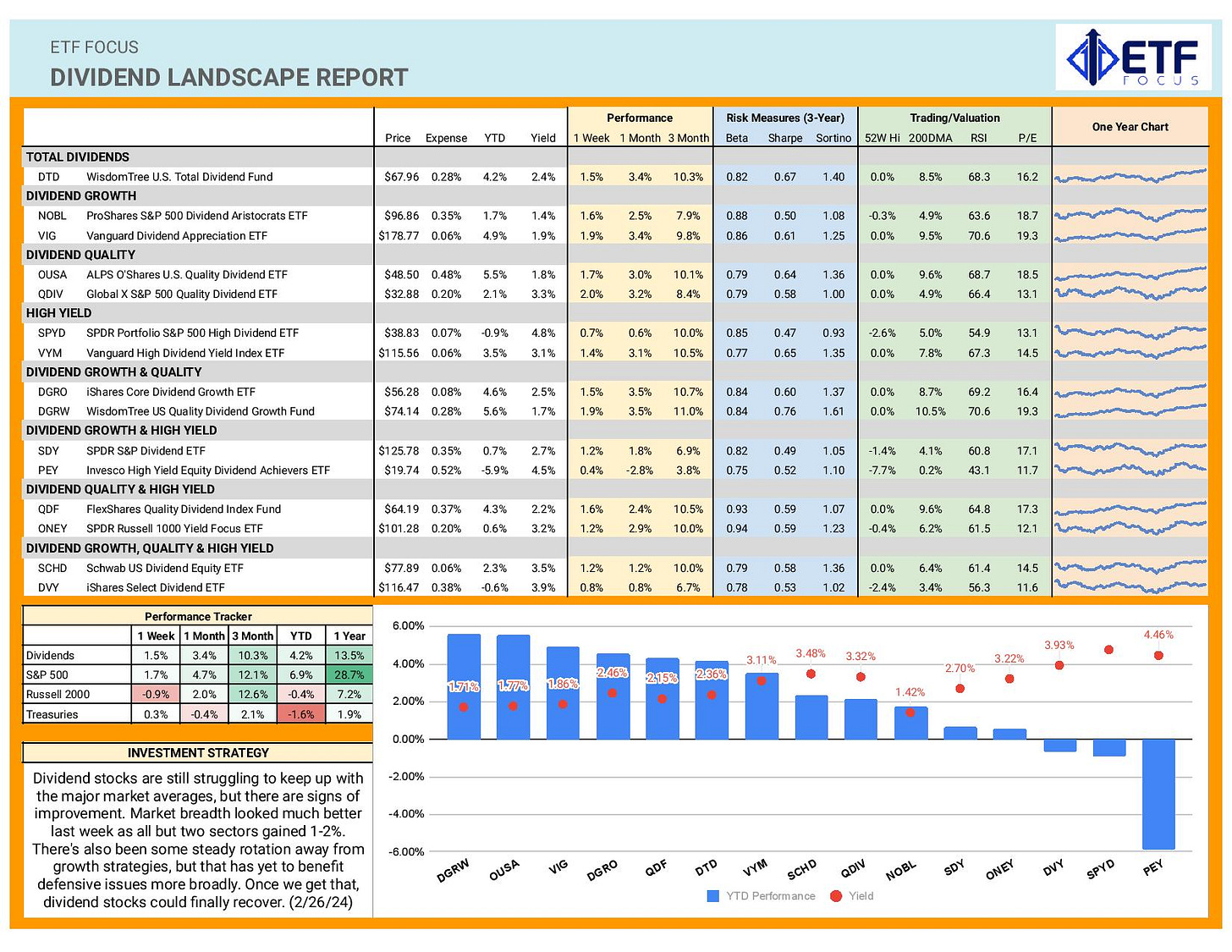

Dividend Landscape

Dividend stocks are continuing to lag the broader market here, but we have been seeing conditions improving somewhat. This group really needs to see an extended run of leadership from either cyclicals, defensives or (better yet) both to start outperforming. We have gotten the pullback from growth in recent weeks, but it’s only ex-energy cyclicals which have responded. Outside of healthcare, defensive sectors are still lagging. We did see a bit of a tick higher in several sub-groups of the dividend stock universe, but there’s still work yet to be done.

Market Outlook

There’s a lot of economic data on the docket this week. Thursday’s numbers on the PCE index as well as personal income & spending will probably get the most attention, but I’m interested in the GDP and inflation reports from overseas. The Eurozone has been on the brink of recession for a few quarters now and this week’s data could let us know if and/or how quickly conditions are getting worse. India is expected to be one of the faster growing economies over the next year and signs that it’s starting to step in where China is failing could be important.

From a U.S. equity perspective, this will be an important week to see if tech and growth will underperform again. If it weren’t for NVIDIA’s big earnings report last week, I have a feeling that the Nasdaq 100 performance would have been much worse. The tech sector won’t be able to count on these isolated mega-cap earnings reports to lift the whole group like it did last week. If Treasuries regain their footing again this week, tech could rebound, but I’m a little skeptical at this point.