Weekly Market Prep - 1/8/2024

After a long 10-year wait, this could finally be the week that the SEC approves a spot bitcoin ETF!

Welcome back to ETF Focus!

I sincerely hope that you all had a very happy, healthy and restful holiday season over the past couple of weeks! It certainly provided me with a much needed opportunity to dial back from work and focus on the more important things!

2024 will be a year of big changes! I have plans to make improvements to the ETF Focus Substack, including more charts, graphics and easy-to-consume analysis that you can implement into your own investment strategies! And maybe even a paid subscription tier as well!

But, for now, it’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

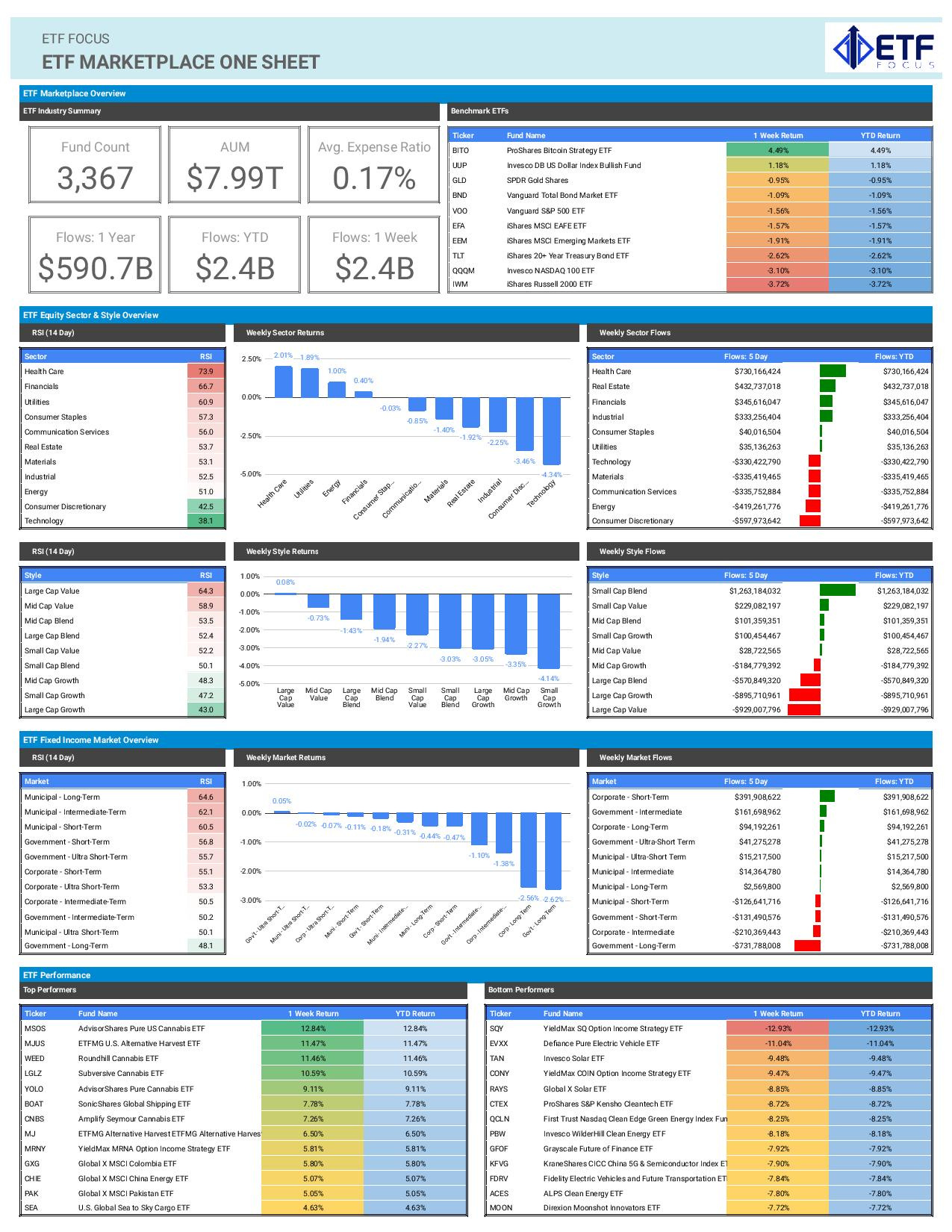

The equity market rally that closed out the last two months of 2023 has done a 180 degree reversal. I don’t think there’s much question that that rally was overdone and needed to take a breather, but the fact that defensive strategies have almost unanimously been leading since Christmas (and leading by a fairly sizable margin) is a sharp sentiment reversal from the complete euphoria that characterized the 4th quarter. The Nasdaq 100 index’s 3% loss last week was the worst start to a calendar year since 2008 and it’s effectively being confirmed by other asset classes.

There is a sense that there are some cracks in the soft landing narrative. Last week’s non-farm payroll report came in well above expectations again, which should have fueled a spike in interest rates. While that happened initially, bonds quickly rallied after the initial reaction, presumably due to the fact that the ISM services employment figure badly missed expectations, hitting its lowest level since the COVID pandemic and the 4th lowest reading of the past 25 years. While non-farm payrolls get most of the attention, the labor market looks very mixed considering the ISM number and that job openings are shrinking. The jobs market is the one thing that’s been fueling the soft landing narrative and I think investors will be disappointed when they find out it may be decelerating faster than they think.

Treasuries continue to correlate positively with stocks, which is to say that they continue to move with expectations for the Fed. The rally to finish 2023 was much appreciated by fixed income investors who’ve suffered mightily since the beginning of 2022. But if the bond market is buying into the stock market’s belief that there are 6-7 rate cuts ahead versus the Fed’s indication of three, the rally is pretty clearly overdone. I don’t think bonds have gotten quite as bullish as equities have, but the 10-year yield has fallen by around 100 basis points. That’s still a little short-term overbought and I think that’s part of the reason why we saw Treasuries pulling back last week.

As of right now, the pivot to defense is two weeks old. That’s not long enough to call it a trend just yet, but it appears as strong as anything we’ve seen since the regional bank crisis in early 2023. I’d be hesitant to venture too far out on the risk/return spectrum here.

Key Economic Reports This Week

Eurozone November Retail Sales (Monday)

United States December Inflation Rate (Thursday)

Canada December Inflation Rate (Thursday)

United States December PPI (Friday)

United Kingdom November GDP (Friday)

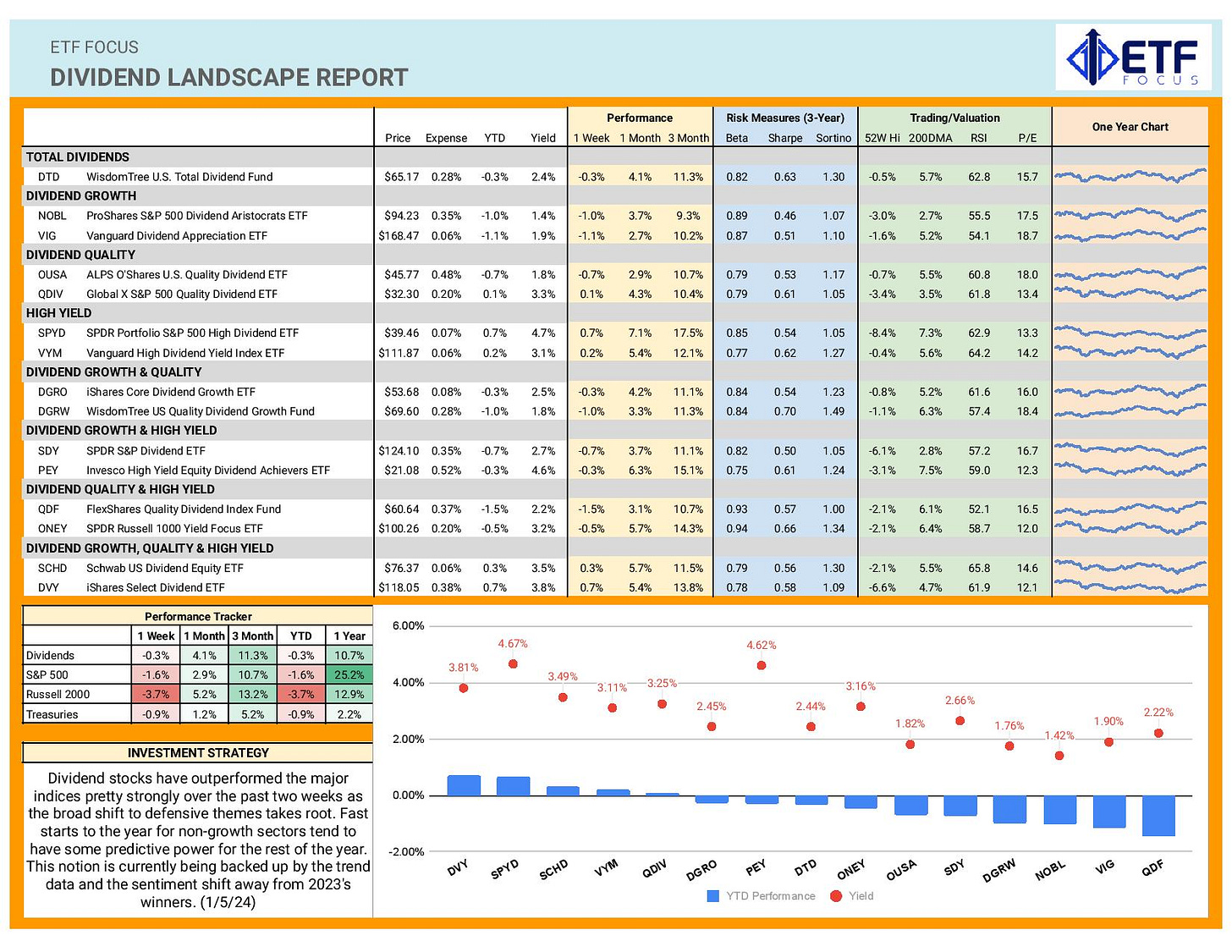

Dividend Landscape

Dividend stocks are off to a solid start relative to the S&P 500, but it’s the trend of last year’s laggards into this year’s early leaders that carries over here as well. High yielders had a comparatively rough go of it last year, but plunging Treasury yields have given high yield equities a boost. While they haven’t gotten a lot of run lately, I do think the quality factor could soon get another look. The impact of higher interest rates is still getting built into expectations and that will negatively affect companies in more challenging financial positions. If conditions steadily deteriorate throughout 2024, as I suspect they will, we’ll likely see the most durable and defensive companies outperform the rest.

Market Outlook

Within the ETF industry, the unquestioned top story to watch this week is the potential approval of the long-awaited spot bitcoin ETF by the SEC. Why this week specifically? After much haggling, delaying and amendment filing, the SEC has finally reached a decision deadline for the ARK 21Shares Bitcoin ETF (ARKB) on Wednesday.

The reason for optimism this time around is the active role that the SEC has finally taken with most of the issuers that have made bitcoin ETF filings. In the past, the regulators have simply kicked the can down the road by either delaying a decision or outright rejecting the filing. Now, issuers are working out a lot of the minor details by having direct conversations with the SEC to confirm their filings include everything it’s looking for. There’s been enough progress made that the SEC would have to really search for reasons to reject the filings this time around given how much work has been put into it.

The question is whether the SEC would approve just the ARK 21Shares ETF (it’s the only one facing a Wednesday deadline) or if they’ll approve all of the 11 current filings out there. I believe they’ll choose the latter this week with the only remaining uncertainty being when they’ll actually begin trading, whether it’s yet this week or at some point further into the future. BlackRock and Fidelity are the biggest names looking to launch a bitcoin ETF, but ARK/21Shares, VanEck, WisdomTree, Hashdex, Valkyrie, Franklin, Invesco, Bitwise and Grayscale are also in the game.

After 10 years of waiting, the day might finally be here!

LOVE the 1 page ETF and Dividend PDFs - this is the first time I have noticed those in the email newsletter. Absolutely LOVE them, thank you!!