Weekly Market Prep - 12/4/2023

Stocks and bonds have been rallying hard for 5-6 weeks, but optimism has gotten way overdone.

Welcome back to ETF Focus! Hope everyone is having a great weekend!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

The markets have looked very solid over the past couple of weeks, but I see something that slightly concerns me. Gold pushed to an all-time high again and that traditionally signals that investors are nervous. Falling interest rates have clearly made precious metals look comparatively better over the past month, but I don’t think we should underestimate the strength of this rally. Tech is also moving counterintuitively to what we’ve seen throughout 2023. As the major averages get close to retesting new all-time highs, tech is actually struggling on a relative basis (even as it pushes into overbought territory). This could be a good test for the markets to see if they can manage to post gains without the “magnificent 7” stocks leading the way.

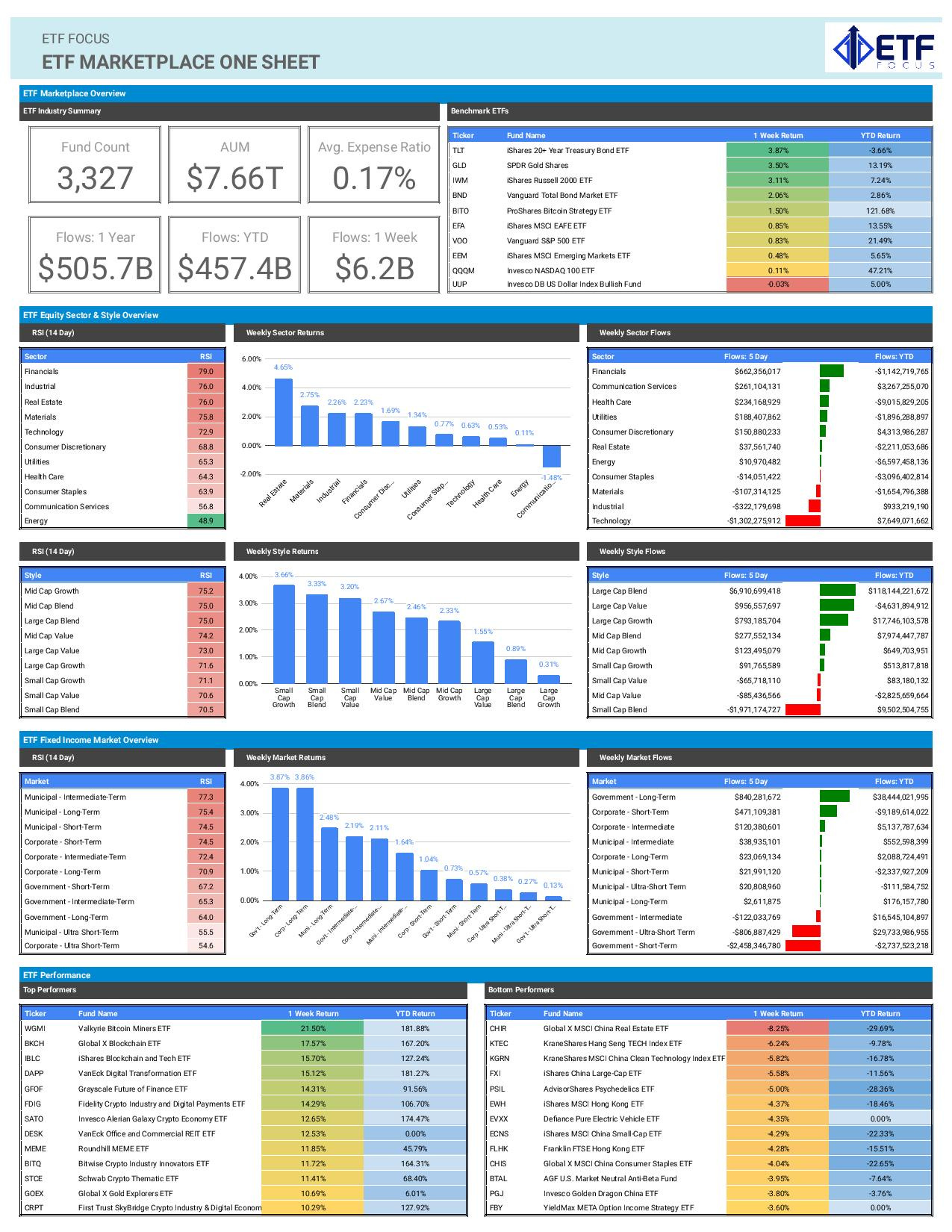

Tech ETFs are on pace for their best quarter since Q4 2021 in terms of net inflows, so investment doesn’t seem to be a factor in recent underperformance. The ETF industry could still hit a half trillion dollars of net new money before the end of the year, but it’s still Treasuries that are drawing the lion’s share of net new money. All of those investors dumping big money into long-term Treasury ETFs may finally be seeing their patience pay off. It remains a tale of two Treasury ETF flow stories though. Long-term Treasury investors are betting heavy on a big risk-off trade as recessionary pressures continue to build, while Treasury bill investors remain willing to sit on the sidelines and capture 5% yields.

As I write this on Sunday night, gold has moved higher by $50 an ounce to another record high of $2125 in a very volatile move (it went from $2070 Friday to a high of $2140 before retreating to its current level). If this move holds, it’s going to be concerning to see a traditional safe haven asset trading in such a violent manner. Treasuries have essentially been as risky as stocks for most of the past two years, which is an outlier in and of itself. If gold is joining in on the volatility party too, I have to think that the markets as a whole are beginning to grow more unsettled.

Key Economic Reports This Week

Australia Interest Rate Decision (Monday)

United States November ISM Services PMI (Tuesday)

United States October JOLTS job openings (Tuesday)

United States November Non-Farm Payrolls (Friday)

United States December UofM Consumer Sentiment (Friday)

Market Outlook

Most areas of the market are in overbought territory right now, so I could argue that risk assets are due for a breather. What we’re seeing right now is probably traders getting ahead of an anticipated December rally. The only problem is that the markets may have pulled all of the potential year-end gains for December into the past week. Over the past 5-6 weeks, Long-term Treasury yields have plunged by 80 basis points and the S&P 500 is up 12%. The gains in both stocks and bonds have been so sharp and swift that it’s very likely they’re going to be sustainable. At this point, given how overextended this run has gotten, there may be a greater likelihood of losses through the end of the year than gains.

This Friday’s jobs report will be the week’s main event. If we see further slowdown in the labor market, yields are probably heading down again, gold is probably heading higher and equities stage another rally. The market’s been been anticipating a slowdown in non-farm payrolls for some months now. So far, it’s been slow in developing. Is this the month we see a larger crack?