Weekly Market Prep - 12/18/2023

Can the markets build on last week's huge rally? There might not be much standing in their way!

Welcome back to ETF Focus! Hope everyone is having a great weekend!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

Jerome Powell finally gave the markets what they were waiting for, which is the official confirmation of a Fed pivot. Prior to last week’s meeting, Powell had been fairly insistent that the Fed needed to keep monetary conditions sufficiently restrictive for a while. This was consistent with their long-held view that they’d rather keep conditions tight and risk a recession that loosen too quick and increase the possibility of another spike in inflation. It seems like the Fed had a remarkably quick change of heart, which makes me think that something else is going on here. We won’t get the meeting minutes until January 3rd, so we likely won’t get further insight into the central bank’s thought process until then, but I think skepticism should be high. Powell was steadfast in his messaging throughout the past two years that the Fed would keep raising rates and keep conditions tight, even though the markets chose to believe otherwise on multiple occasions. He followed through too, which makes me wonder why his messaging changed so suddenly this time around.

I still think Treasuries are the big story in this market. The 10-year yield has dropped by 110 basis points in less than two months, which strangely puts it only back at the levels it was at in July of this year (right before rates rose 110 basis points). It’s an extremely volatile period in the fixed income market that actually looks like involves some level of price discovery. Those kind of yield swings suggest investors don’t really know where rates should be landing right now and that says to me that more volatility is probably ahead. High yield credit spreads are back down to 20-month lows, so there’s very little default risk being priced into bonds currently. That’s been a good thing for bondholders up to this point, but it also raises the risk of a swift reversal should conditions turn. Remember, a lot of signals have been trending in the wrong direction lately (although lower rates should mitigate some of that) and that makes riskier debt worth watching for its downside risks here.

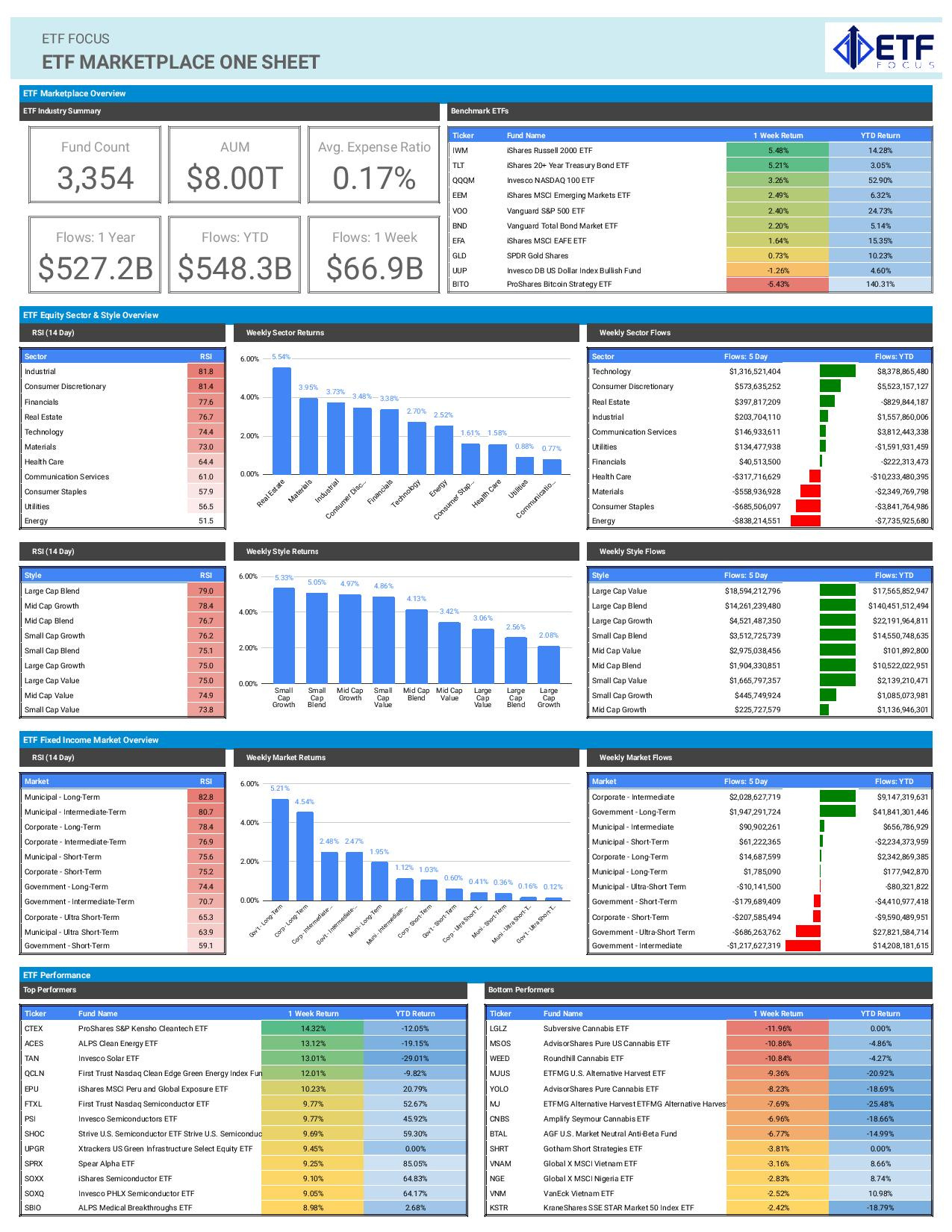

In terms of asset flows, ETFs had another huge week, pushing past the $500 billion mark year-to-date with just a couple weeks to go before the end of the year. We can see signs of investor over-enthusiasm right now looking at the latest AAII bull/bear sentiment, relative strength indicators across asset classes and ETF flows. Overconfidence tends to be punished eventually and short-term sentiment is looking a little mania-ish. I know investors have been waiting for confirmation of the Fed pivot from the Fed itself for several quarters, so it shouldn’t be too surprising that this pent-up demand is finally being unleashed. Still, I think investors are getting a little ahead of themselves here and underpricing the macro-level environment that’s suggesting more caution is warranted.

Key Economic Reports This Week

Japan BoJ Interest Rate Decision (Monday)

Canada November Inflation Rate (Tuesday)

United Kingdom November Inflation Rate (Wednesday)

Japan November Inflation Rate (Thursday)

United States Final Q3 GDP (Thursday)

United States November Core PCE Price Index (Friday)

United States November Personal Income (Friday)

United States November Personal Spending (Friday)

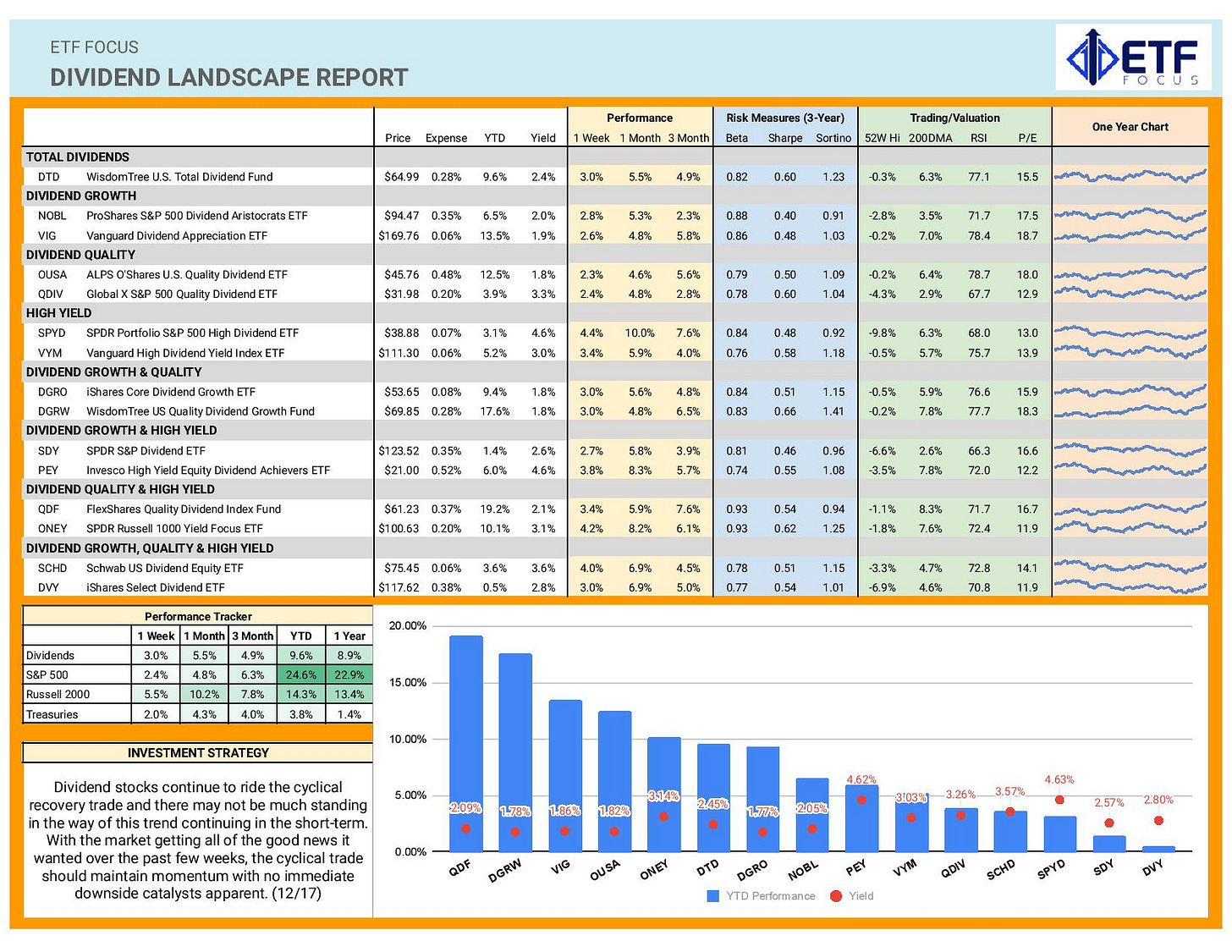

Dividend Landscape

Thanks to the cyclical rally that’s been fueled by the Fed pivot, falling inflation and the belief that the U.S. economy might actually avoid a recession after all, dividend stocks are making a comeback here. High yielders have been the clear beneficiary of the latest trend, which are much less exposed to tech and overweight to current market leaders, including financials and real estate.

It’s unclear, however, if this trend has the legs to continue. Falling interest rates have been the rising tide that’s lifted all boats throughout December, but financials and real estate are especially rate sensitive. The current decline in interest rates seems quite a bit overdone and I think there’s a good chance that we see some sort of reversal and retracement of recent bond market gains. That probably brings dividend ETFs back down to earth a bit, but I think the longer-term prognosis for outperformance is still good. Whether it’s the risk-off trade or a cyclical recovery, dividend stocks still have a case for outperforming whichever way the market goes here.

Market Outlook

I think investors have gotten out over their skis here and stocks could very well experience an oversold pullback. The market had been building up hope for three things this month - 1) confirmation of a Fed pivot, 2) evidence that inflation is still moderating and 3) some sign of consumer strength during the holidays. In just one week, investors’ Christmas list was essentially fulfilled, which resulted in a furious rally packed into a very short time frame.

The good news has probably run out in the short-term. The economic calendar is pretty empty this week and things will likely remain quite slow for the Christmas-to-New Year period. That probably favors low volatility and potentially gentle gains to finish out the year. I’m still concerned with how overvalued risk assets have gotten at the moment. It might not reverse over the next couple weeks, but it’s setting up for soon.