Weekly Market Prep - 12/11/2023

It's all about inflation & the Fed this week and that probably skews market risks to the downside.

Welcome back to ETF Focus! Hope everyone is having a great weekend!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

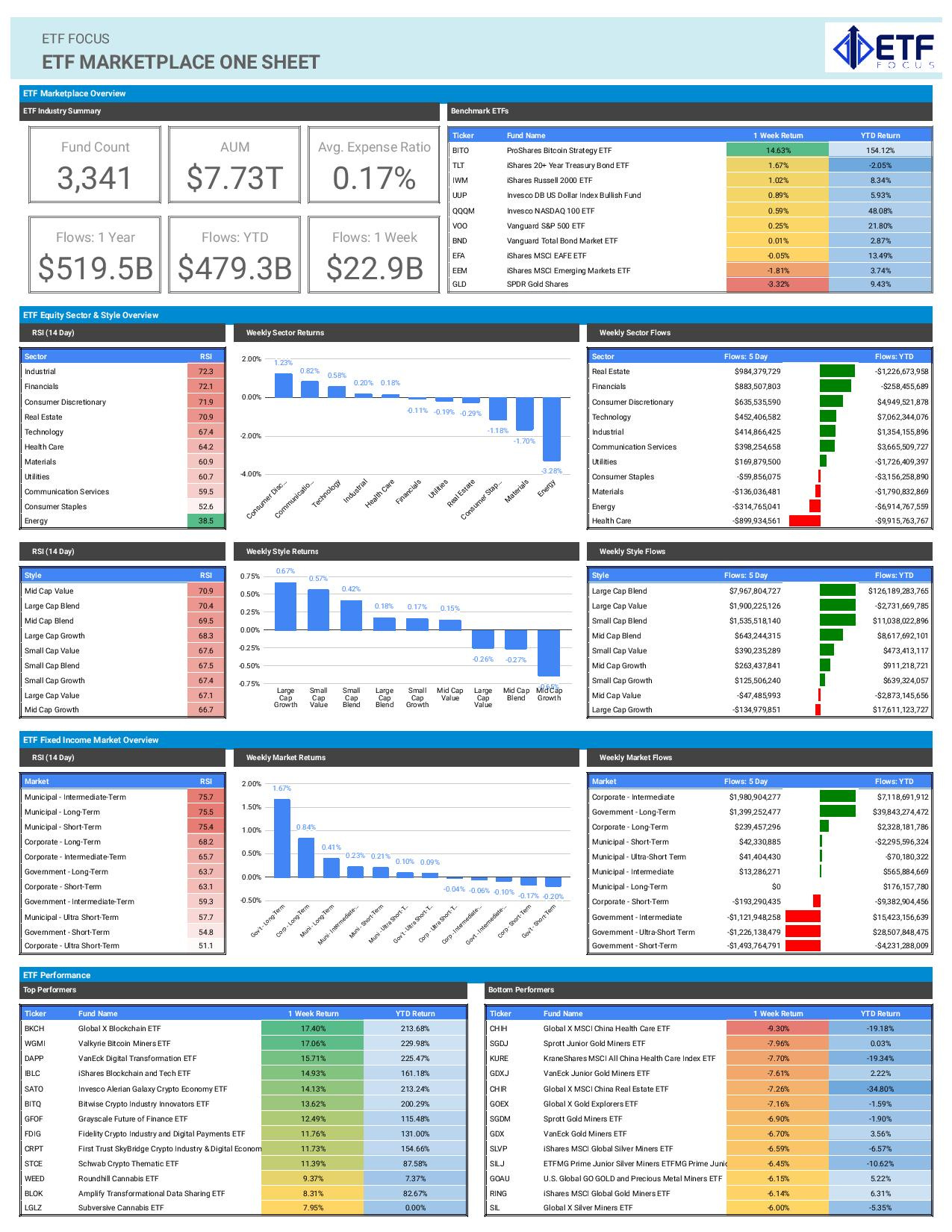

In terms of investor activity, business has picked up heading into year-end. After a strong $23 billion net inflow last week, December is on pace to be one of the better months of 2023 following up on November’s big $104 billion month. Money has been flowing in pretty steadily into both equities and fixed income, but the composition of that money flow is starting to change. On the fixed income side, investors are getting more aggressive by targeting long-term corporates and Treasuries, but backing off of the high yield Treasury bills and floating rate notes that have been wildly popular for months. On the equity side, flows are beginning to follow the market’s leading sectors - cyclicals and suddenly resurgent real sector.

Even though most areas of the equity market are in overbought or near-overbought territory, it’s the bond market that is still controlling the narrative. Long-term Treasuries, as measured by the iShares 20+ Year Treasury Bond ETF (TLT), is up nearly 4% during the month of December as the 10-year Treasury yield has fallen 80 basis points from its October peak. Obviously, this is the result of the market starting to price in several rate cuts in 2024 along with steadily cooler inflation readings. The markets are now pricing in roughly a 50% chance of at least 5 rate cuts over the next 12 months. Given that core inflation is still hovering around 4% and the labor market continues to prop up economic strength, it’s tough to imagine that outcome playing out, which means the current Treasury rally is likely short-term overdone.

If bonds are overbought, that probably means that equities could soon lean to the downside since it’s all interest rate related. While growth and high beta had a good week last week, mega-cap tech isn’t providing the leadership that it has during much of 2023. If cyclicals can continue to demonstrate strength, equities could still be OK here, but this is also a market that probably needs a breather before it attempts its next leg. Investors keep banking on a big December rally that carries forward into 2024, but I question the possibility over the last three weeks of the year. There’s a lot of economic data yet to hit this month, especially this coming week, and that’s probably going to add a degree of volatility that could work against further short-term gains.

Key Economic Reports This Week

United States November Inflation Rate (Tuesday)

Germany December ZEW Economic Sentiment (Tuesday)

United States November Producer Price Index (PPI) (Wednesday)

United Kingdom October GDP (Wednesday)

United States Fed Interest Rate Decision (Wednesday)

United Kingdom BoE Interest Rate Decision (Thursday)

Eurozone ECB Interest Rate Decision (Thursday)

United States November Retail Sales (Thursday)

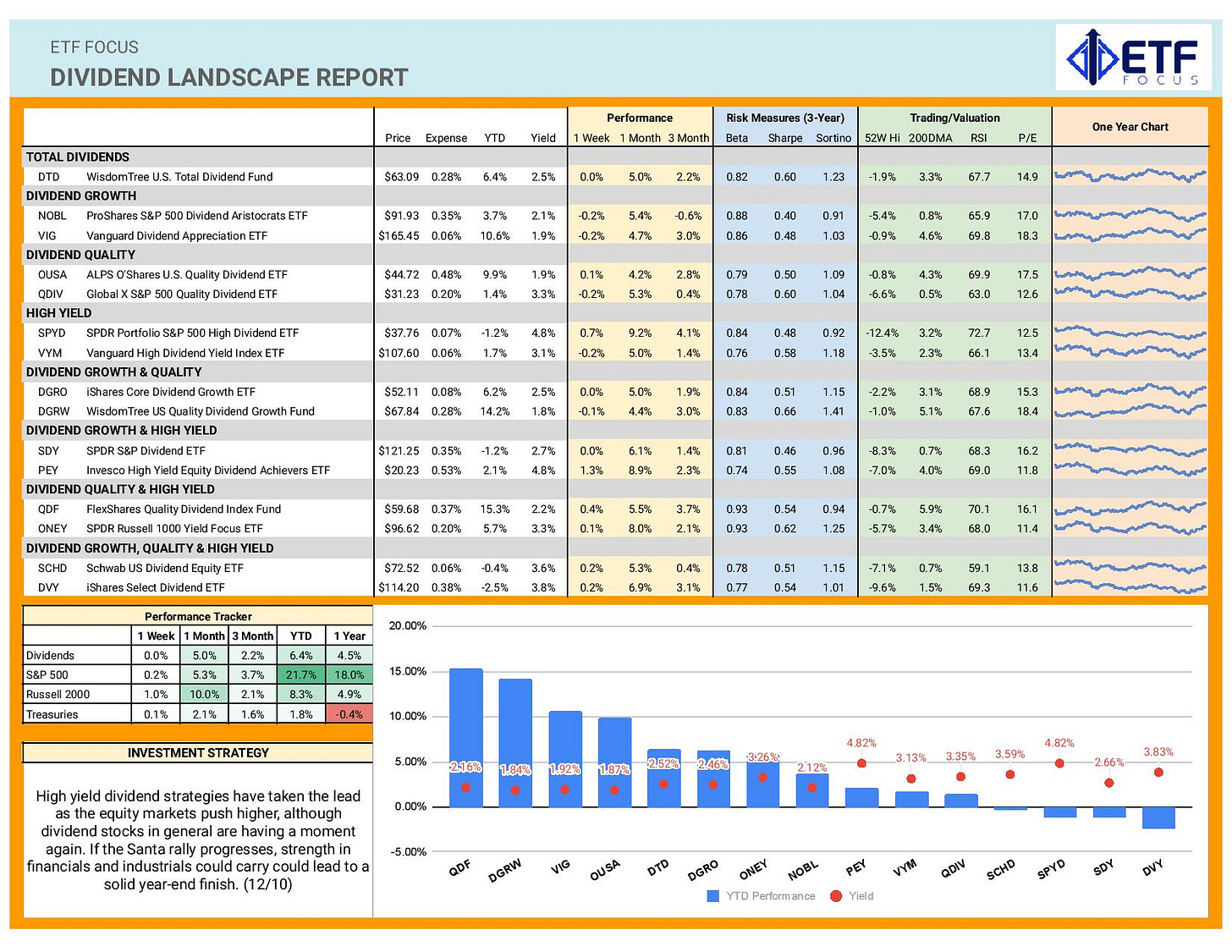

Dividend Landscape

Dividend stocks have mostly lagged throughout 2024, but they’re having a nice little run over the past several weeks. High yield equities have held a distinct advantage over the past month thanks to the rebound in financials and industrials, but the quality factor has produced the best returns of 2023.

The streak for high yielders could continue as long as the economic data supports it. The jobs report last week convinced investors that recession is still not imminent, while the latest inflation data for October confirmed that conditions are still trending in the right direction. Traditional dividend growth strategies tend to be the most defensive of the bunch and any unwelcome data this week (and there’s a lot) could quickly shift sentiment in this area.

Market Outlook

There are so many wild cards this week that it’s impossible to say with any degree of confidence where the week will ultimately end up. The main event will be the Fed meeting, which will almost certainly result in another pause. The market will be closely watching whether Powell takes a dovish or hawkish tone in his comments, but I suspect he’ll want to squash the expectation that the central bank will be aggressively cutting next year. Powell has consistently said that further rate hikes are still a possibility, although I think that’s really him trying to recapture control of the narrative instead of a genuine attempt to tighten conditions. This could be the biggest risk to the markets this week.

There are others though. Investors will want to see further progress on the inflation front, although they may not get it. The headline rate is likely to fall another tick or two thanks to falling energy prices, but the core rate is going to remain stubbornly high around the 4% area. If it stays at that level, it’s going to prevent the Fed from getting too dovish. Sticky inflation and a “not dovish enough” Fed have me feeling like risk is skewed to the downside this week.