Weekly Market Prep - 1/15/2024

Healthcare stocks look like they're getting the early leg up in 2024.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

Weekly Market Reset

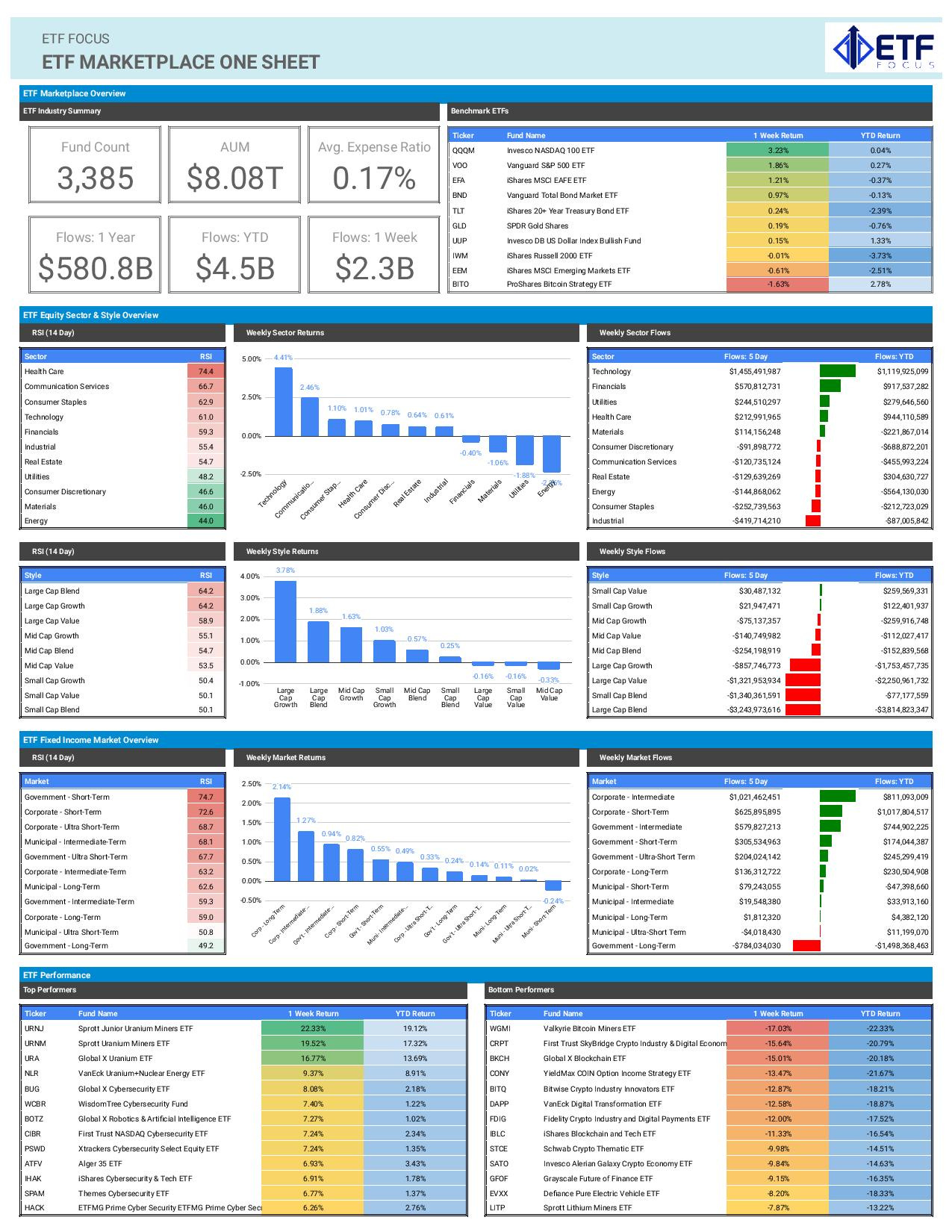

Last week’s two key economic reports were centered around inflation - December CPI and PPI - and they told two different stories. Consumer price inflation ticked back up again and demonstrated that sticky and elevated inflation will likely remain a problem in 2024, despite investors’ belief that the Fed will go on a massive rate cutting spree later this year. Producer price inflation, on the other hand, was negative for the 3rd straight month and is now up a scant 1% year-over-year. You can guess which one the markets chose to focus on! The disinflation theme resulted in mega-cap growth & tech stocks, but not a whole lot else. It’s similar to what we saw in 2023 and doesn’t indicate that last week’s move was broad or necessarily healthy. If last week’s gains were broader, I’d feel like this was more of a risk-on move. Since it wasn’t, I don’t think we ignore the defensive leadership move we saw at the start of the year.

Thursday was “Bitcoin ETF Day” and it didn’t disappoint. The SEC approved spot bitcoin ETFs in a 3-2 vote and ETF issuers were ready to go the next day. In all, 11 different bitcoin ETFs debuted generating roughly $4.5 billion in trading volume. About half of that came from the Grayscale Bitcoin Trust ETF (GBTC), which came in within an existing $27 billion in assets and had a massive step up on the competition. The problem is that a lot of money in GBTC is looking to get out. Now that there are 10 more competitors available, all with MUCH lower expense ratios, expect money to continue flowing out. The biggest winners over the first couple trading days were the iShares Bitcoin ETF (IBIT), the Fidelity Wise Origin Bitcoin ETF (FBTC), the ARK 21Shares Bitcoin ETF (ARKB) and the Bitwise Bitcoin ETF (BITB), but it looks like IBIT will clearly be a step ahead of the rest. The amount of volume on these ETFs ensures that they’re here to say, although I expect a few of them won’t last for too long.

We’re just two weeks into the new year, but it sure looks like healthcare is breaking out, both in terms of performance and net flows. Its 3% year-to-date return makes it the top performer so far, but healthcare focused ETFs have already taken in nearly $1 billion of net new money. The way that the year has started makes me believe that this rally could have some legs. I think the biggest catalyst for that to happen isn’t the economic data or inflation. It’s the disconnect between investors’ expectations for rate cuts and what the Fed has been indicating. If the Fed is forecasting three rate cuts in 2024 and the market is pricing in seven, there’s going to need to be a risk asset repricing in order to get the two back in line. With core inflation still running at a 4% annualized rate, it’s hard to imagine the Fed cutting more than a half dozen times.

Key Economic Reports This Week

Germany Full Year GDP Growth (Monday)

United Kingdom Unemployment Rate (Tuesday)

Canada Inflation Rate (Tuesday)

China GDP (Tuesday)

United Kingdom Inflation Rate (Wednesday)

United States Retail Sales (Wednesday)

Japan Inflation Rate (Thursday)

United States UofM Consumer Sentiment (Friday)

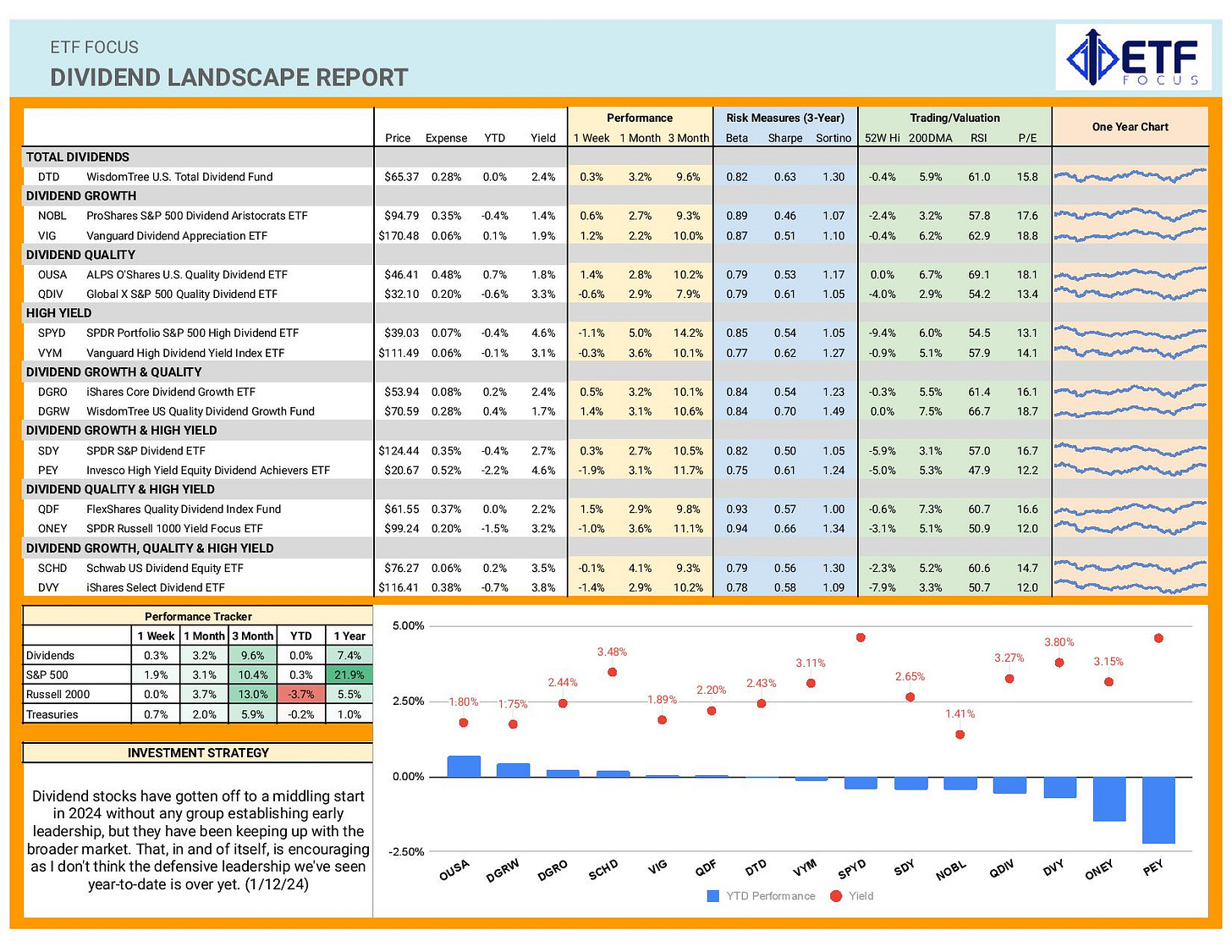

Dividend Landscape

Dividend stocks finished 2023 nicely relative to the S&P 500, but 2024 has gotten off to a slower start. There’s no real theme or segment of this space that’s emerging, but higher yielders have pulled back modestly as the cyclical rally has run out of gas. As I’ve mentioned already in my comments related to early year outperformance from defensives, I think dividend stocks are setting up for a better year. Last week proves that investors have yet to give up on the mega-cap growth trade and still fall back on it when they get the news they want.

I think dividend growth could be a group to watch here. The fact that Walgreens, of all companies, decided to cut its dividend in half should put a lot of dividend growers on watch. If companies with half century dividend growth streaks can cut (especially a big retailer), it should raise red flags that almost any company could be vulnerable. As the global economy slows as we progress through 2024, we could see dividend cuts become more common.

Market Outlook

There’s a fair amount of economic data that will drop this week, but the majority of that will be released outside the United States. In the U.S., the focus will be on the Q4 earnings season. The markets are expecting an earnings recovery and I don’t think there’s much reason to believe that we won’t get one. Retail sales figures have generally been positive. GDP growth is likely to be very solid in Q4 and the labor market still shows few signs of cracking. In the 2nd half of 2023, however, we did get warnings from several retailers that they were seeing consumer weakness. We just haven’t really seen that come to fruition unless you consider the fact that an increasing percentage of spending is being done on credit. Perhaps we’ll get more warnings over the next few weeks.