Welcome back to ETF Focus! Hope everyone is having a great weekend!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

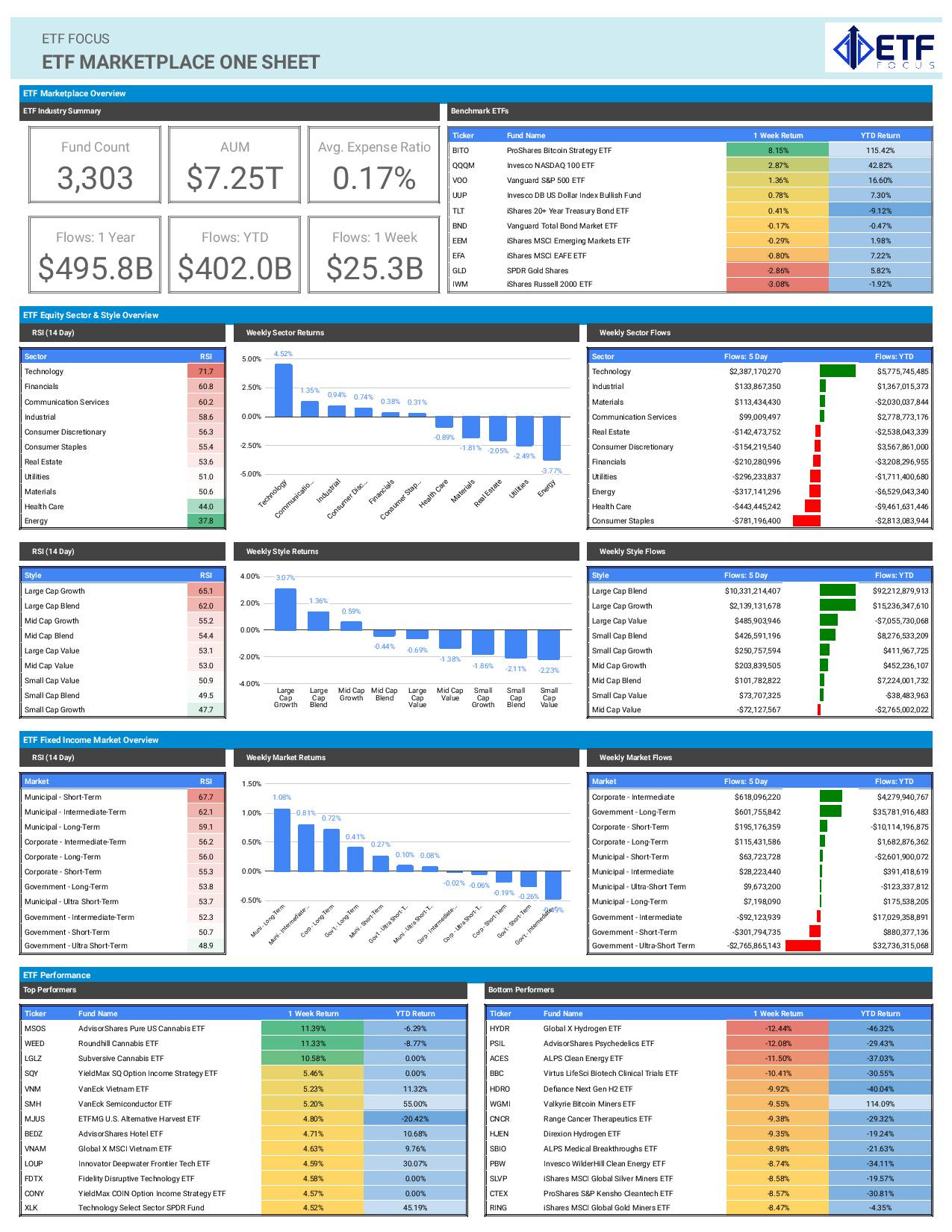

Looking at the major market averages, it’d be easy to conclude that it was another good week for equities, but it really looked more like what we’ve seen a lot of in 2023 - mega-cap tech leadership with everything else faltering. While the S&P 500 was up 1.4% and the Nasdaq 100 up nearly 3%, look at some of the other averages. The equal weight S&P 500 was down 0.6%. Small-caps were down 3%. Only one sector beat the S&P 500 last week - tech. This was an incredibly narrow rally that doesn’t really suggest strength in the way a lot of market watchers think it does.

In my opinion, the past two weeks have looked like this. Two weeks ago, all risk asset prices, stocks and bonds, gained roughly 5% in what was essentially a broad repricing higher based on the long-anticipated Fed pivot trade. We know that because utilities, real estate & even value held up relatively well and the gains were broad. Last week, equity momentum overall continued, but it was only in this year’s traditional leaders, namely the FAAMG stocks.

Despite deteriorating long-term conditions, I do think that U.S. stocks could be setting up for another year-end rally. The market has mostly been able to handle recent events & data and its got the Fed pause momentum still working in its favor. That doesn’t mean it doesn’t have any near-term obstacles to overcome. This week’s key economic numbers include October CPI, PPI and retail sales with the former will be the number the markets will be watching most closely. Headline inflation is forecast to have risen by just 0.1% to an annualized rate of 3.3%, while core is expected to have jumped by 0.3% and 4.1%, respectively. Those numbers would reinforce a couple of notions - 1) inflation continues to moderate at a level that should support the Fed pause, but 2) inflation still isn’t any closer hitting the Fed’s 2% target anytime soon. That’s likely to keep the pressure on interest rate into the beginning of 2024.

The other thing that could push rates higher in the near-term is Moody’s sneaking in a U.S. government credit rating outlook downgrade from neutral to negative after Friday’s market close. Moody’s is really only doing what the other ratings agencies have already done by expressing their concerns over the impact of higher interest rates on existing debt expense, huge deficit spending and a possible government shutdown. The flight to safety trade is likely to keep picking up momentum over the next few months, econ 101 says that higher risk leads to higher interest rates. Don’t be surprised if bonds get roiled again this week.

Key Economic Reports This Week

United States October Inflation Rate (Tuesday)

Japan Q3 GDP Growth Rate (Tuesday)

China October Retail Sales (Tuesday)

United States October Retail Sales (Wednesday)

United Kingdom October Retail Sales (Friday)

Market Outlook

If inflation comes in as expected and we don’t get any curve balls from the retail sales report, it’s setting up to be a green week for equities and a red one for bonds. The past several retail sales reports have only served to reinforce the notion that the consumer is still spending despite indications that they’re getting squeezed to the brink. With the Fed pause getting built-in to market expectations and the central bank quite unlikely to act further, the October inflation number may be a little less consequential than past CPI readings this year. At this point, even if it does tick a little hot, it’s unlikely to change expectations and that could help equity prices push higher.

It looks like bonds are going to be in trouble though. The Moody’s warning, the weak Treasury auction last week and the impact of a possible government shutdown are all negative catalysts that could push long-term yields back towards 5% again.