Weekly Market Prep - 10/9/2023

Market volatility picked up last week and it's likely to be that way again this week.

Hope everyone had a great weekend & welcome back to ETF Focus!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

The big data release last week was the September non-farm payroll report, which showed that the U.S. labor market is still in good shape and may actually be expanding again. Stocks initially sold off on the news, presumably because it was likely to help push yields even higher, before rallying later in the day on Friday. Investors seem genuinely conflicted about whether to worry about the potential arrival of a recession in the next few quarters or buy into the tight labor market & “stronger for longer” economic growth narrative. The persistent volatility in both the bond market and traditionally more defensive sectors, such as utilities, is illustrating how uncertain the markets actually are right now despite a relatively depressed VIX level.

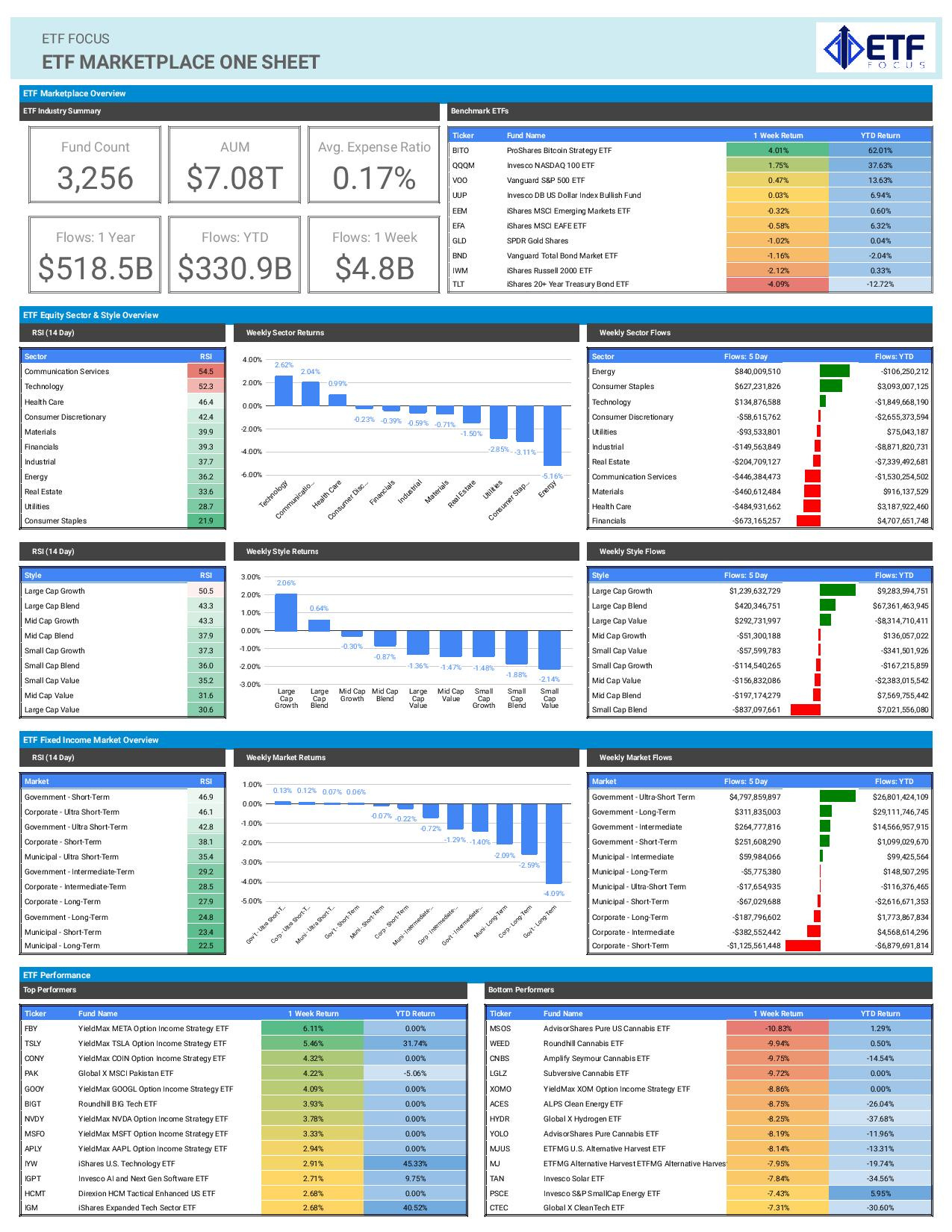

From a sector perspective, we’re still not seeing any consistent leadership (unless you maybe want to consider the outperformance trend from communication services, but I wouldn’t). Tech has been quite volatile relative to the broader market even though it’s been leading recently. Small-caps are lagging, but so are defensive issues. Energy had been doing really well, but took a dive when oil prices plunged. There’s just not any theme that’s really standing out at the moment and that’s what’s making figuring out where the market is going next so challenging.

On a relative basis, fixed income is still the biggest beneficiary of positive net inflows, but it’s mostly going into U.S. Treasuries and mostly into the extremes of the duration curve. Investors are still plowing money into 5%+ yielding Treasury bills, but they’re also adding to long bond positions despite steep losses. I think we’re seeing a segment of investors trying to call a top in interest rates and, while I think there’s probably a top coming shortly, it’s a dangerous exercise to try to predict it.

Key Economic Reports This Week

United States September PPI (Wednesday)

Fed Meeting Minutes (Wednesday)

United States September Inflation Rate (Thursday)

Canada September Inflation Rate (Thursday)

United Kingdom August GDP (Thursday)

China September Inflation Rate (Thursday)

United States October University of Michigan Consumer Sentiment (Friday)

Market Outlook

This is going to be another week where the data will likely determine the market’s direction. Last week’s jobs report moved the market higher, but it also resulted in an extra dose of volatility. I suspect that this week’s inflation report will have the same impact. The question is whether not it will show an increase that concerns the market. While core inflation is moderating, the headline rate is starting to move higher again thanks to soaring energy prices. The market is pricing in a likely end to the Fed’s rate hiking cycle already and that’s probably a good idea to let existing rate hikes get baked into the cake. Another big number like last month could, however, cause investors to rethink their expectations about another quarter-point hike. Treasury yields have already soared in the past couple months and any indication that inflation may not yet be subdued could fuel their further rise.

One thing that will be incredibly important through the end of this year and beyond is the reversion of the yield curve. The 10Y/2Y spread has been inverted since July of last year, but it has shrunk considerably in the past few months. Once that spread finally turns positive again, recession watch is officially on. Historically, recession has followed a curve reversion within roughly 12 months and we could be headed down that path again. That’s likely to mean that volatility will remain elevated and certainly higher than the remarkable calm the markets experienced this past summer and into the early fall.