Weekly Market Prep - 10/7/2024

Investors are feeling pretty good and they have have good reasons to.

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We’re Talking About This Week!

+ Weekly Market Reset

+ Key Economic Reports This Week

+ Dividend Landscape

+ Market Outlook

Weekly Market Reset

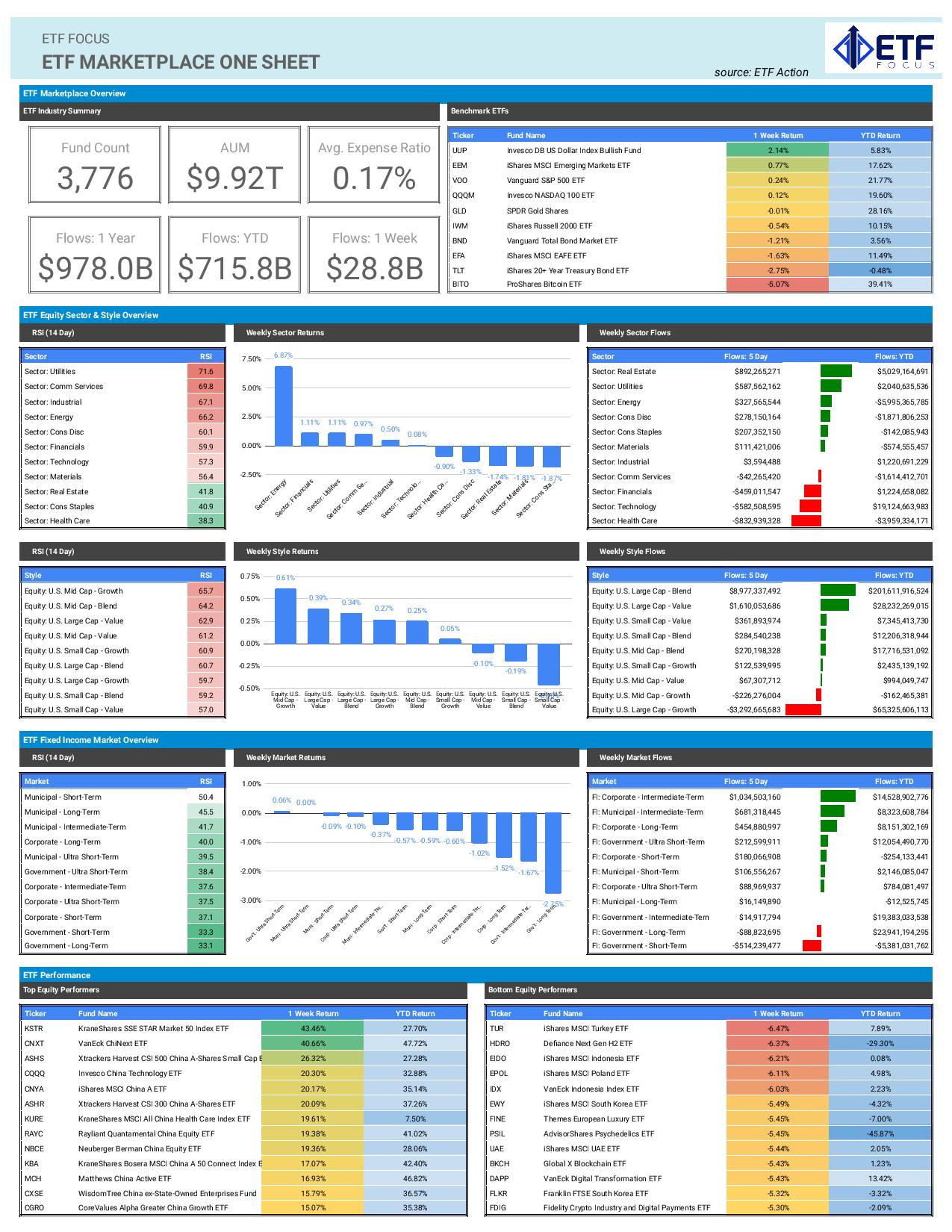

While there are still some lingering concerns in the credit market, it’s becoming clearer that the economy is still chugging forward. GDP growth is solid and expected to remain solid at least through the current quarter. Inflation is still contained even if it might not be back to the Fed’s 2% target. The one biggest threat - a deterioration of the labor market - looks like it might not be a major short-term risk following another big September jobs report. As long as the economic data continues to look healthy and the Fed is able to keep lowering interest rates in the process, the markets may enjoy this Goldilocks state for a while longer.

Geopolitics remains at the forefront globally, resulting in a big spike in energy prices that may not subside until tensions in the Middle East simmer down. It’s tough to say how long that will be, but the markets usually tend to digest these events pretty quickly. As long as there isn’t another major escalation, crude oil prices may soon settle into this range, which would likely end the recent outperformance of energy stocks. The port worker strike ended up being a short-term non-event for the markets.

With the economy looking healthy, the Fed dropping interest rates and China dropping a massive stimulus package on to its economy, conditions look pretty favorable for equity investors. A short-term risk could be inflation and that’s being reflected in rising bond yields. Last week’s strong employment report helped with that and this coming week’s CPI and PPI reports will give us the next clue. Everything should look fine for now, but rising energy prices, heavy stimulus and other factors could cause problems eventually.

Key Economic Reports This Week

As mentioned, CPI and PPI reports will give us the next read on inflation in the United States. It’s unlikely we’ll see numbers that do anything but confirm the disinflationary trend is still in place. Current inflationary pressures won’t potentially show up for at least another couple months, so current positive sentiment is likely to remain intact.

Meeting minutes from the Fed will be watched closely, but they probably won’t tell us anything we don’t already know, which is that Powell and company will proceed with steady quarter-point cuts and won’t make another half-point move unless conditions really change.

Dividend Landscape

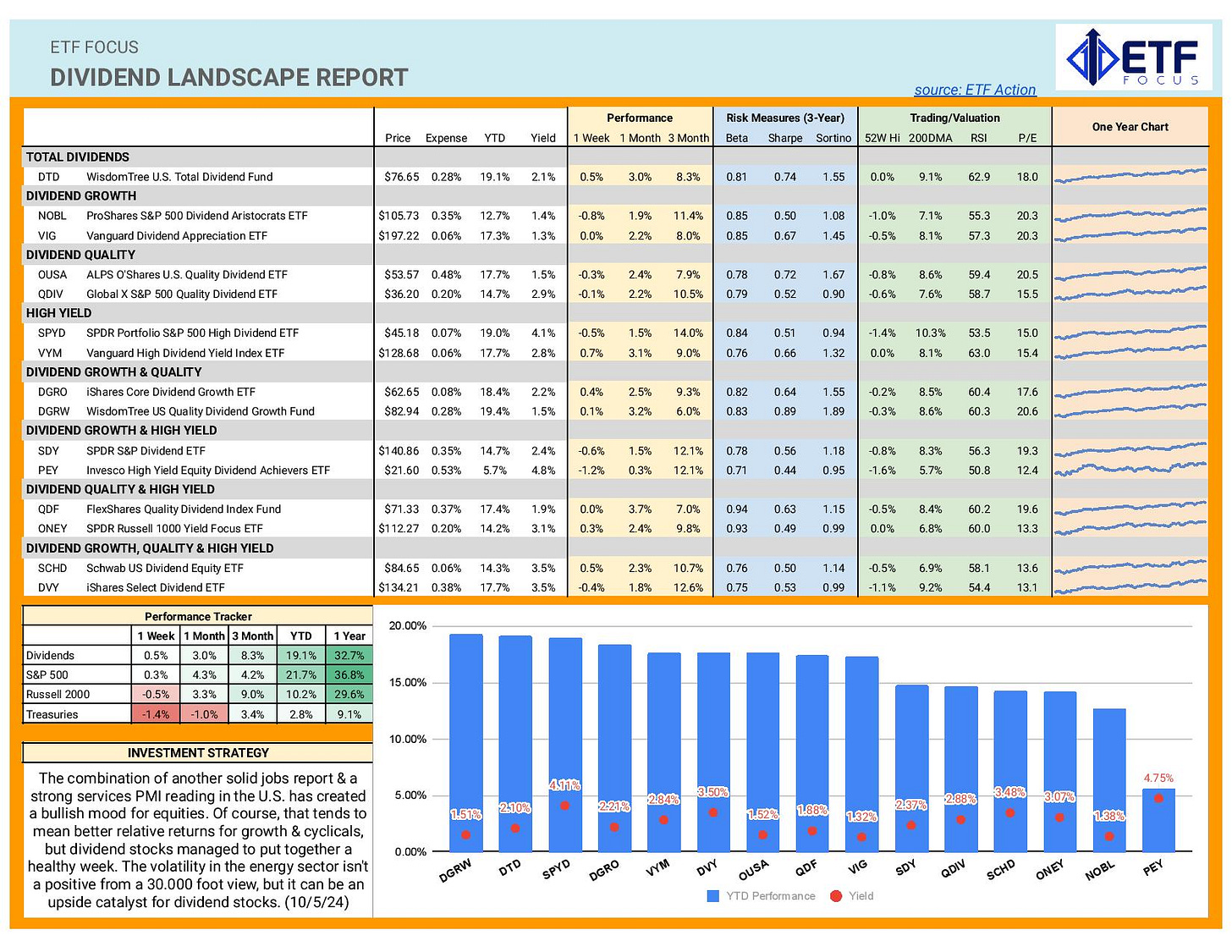

The current market environment favors reflationary plays and that could provide a spark to dividend strategies. As I’ve noted in the past, markets where cyclicals are in favor tend to benefit high yield dividend ETFs, which are typically filled up with energy, industrial and financial stocks. We’ve also seen dividend strategies also do surprisingly well even though defensive sectors haven’t necessarily been in favor. Tech is no longer the market heavyweight that it once was and the improves the opportunity set for dividend stocks relative to the S&P 500 considerably.

Market Outlook

The markets are feeling pretty good right now and there’s no obvious catalyst this week that may act as a stumbling block. Geopolitical risk is still present, but the markets seem to have largely priced that in (barring an escalation). This week’s inflation readings present some risk of a surprise, but that seems unlikely. The rise in interest rates confirm a rotation out of safe havens and into risk assets.

Unless something changes, it sure feels like the current momentum carries forward.

Looking better for: high yield bonds, tech, growth

Looking worse for: energy, long bonds, healthcare