Weekly Market Prep - 10/30/2023

A Treasury rebound, Apple earnings, the Fed's decision and the October jobs report will make this a volatile week.

Welcome back to ETF Focus! Hope everyone is having a great weekend!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

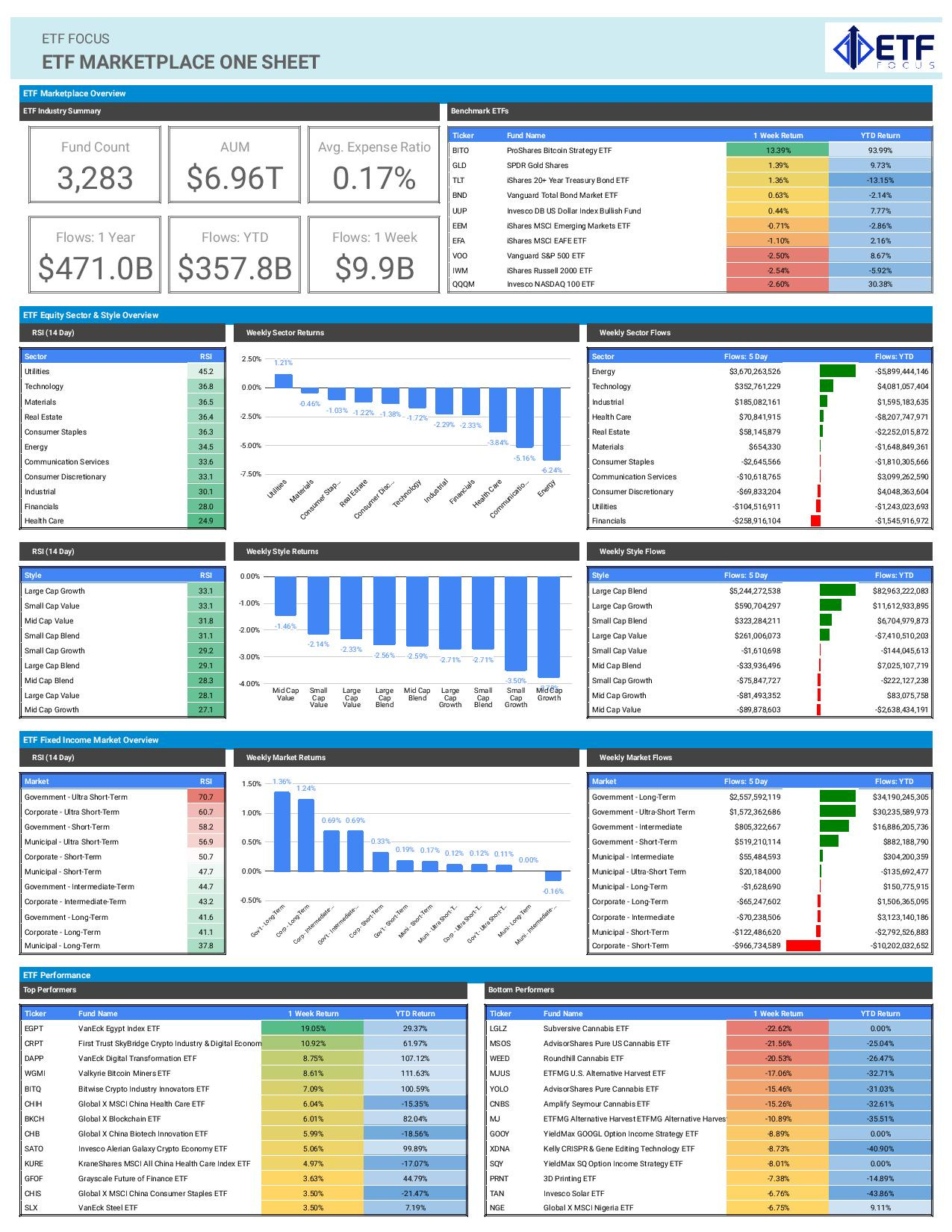

I’m getting really worried about what the market is telling us here. As has been the case over the past few weeks, the markets were decisively defensive and actually picked up speed heading in that direction. Market leadership is still coming from utilities, consumer staples, gold and low volatility stocks - all areas of the market that tend to outperform when sentiment deteriorates. Perhaps more importantly, Treasuries may be getting ready to turn. The 10-year Treasury yield hit (or came very near) the 5% level twice last week. In both instances, long-term Treasuries rallied hard. If 5% marks the psychological level that pulls bond buyers back into the market, it could lead to a big rally that finally puts an end to this multi-year bear market.

The Fed could be the catalyst that makes it happen this week. Powell has consistently said that inflation is still well above target and the Fed will stand ready to keep raising rates. I don’t suspect we’ll head much, if any, deviation from this message this week, but if Powell gives indications that the central bank is finished because rising Treasury yields are doing the job for them, it could turn things in the other direction. Treasuries haven’t really shown much of a consistent willingness to move higher here, so I put this possibility at less than 50%, but the setup is a possibility.

Last week put front and center one of the market’s biggest risks - bad news from the magnificent 7 stocks that have almost exclusively driven this market higher. Even though Amazon earnings were taken pretty positively, Alphabet and Facebook disappointed. These two stocks have been overvalued and priced for perfection for some time, so the pullbacks was steep. If you take this batch of stocks out of the equation, the market is actually performing pretty poorly this year. The equal weight S&P 500 is down 4% this year. Small-caps are down 6% and nearing 3-year lows. Breadth looks terrible and sentiment looks fearful. This is almost certainly the most challenging market environment since at least the regional banking scare in March and perhaps before that.

Key Economic Reports This Week

Bank of Japan Interest Rate Decision (Monday)

United States ISM Manufacturing PMI (Wednesday)

United States JOLTS Job Openings (Wednesday)

United States Fed Interest Rate Decision (Wednesday)

Bank of England Interest Rate Decision (Thursday)

United States ISM Services PMI (Friday)

United States Non-Farm Payrolls (Friday)

United States Unemployment Rate (Friday)

*** Also, Q3 GDP growth readings throughout the week from the Eurozone, France, Germany and Italy.

Market Outlook

I think it’s all about the bond market this week. Can Treasuries sustain the positive momentum they built up last week? Will high yield spreads continue drifting higher? The one potentially critical thing to point is the inverse relationship that stocks and bonds demonstrated last week. Those two asset classes have mostly been moving up and down in tandem for nearly two years. If we start seeing the return of negative correlation, it’s a bad sign for the financial markets. That’ll likely mean that the flight to safety trade has made a comeback and risk asset prices are continuing their slide.

It’ll also be interesting to see if last week’s tech earnings disappointments will kill momentum in one of the market’s best-performing sectors of 2023. Volatility in tech stocks has been high since the end of summer, but we’ve yet to see any extended stretch of underperformance. We’ll get Apple earnings later in the week with the Fed decision and the October non-farm payroll report getting sandwiched around it, so expect some above average volatility this week.