Weekly Market Prep - 10/23/2023

The markets took on a significantly more cautious tone last week. If safe haven trades have another big week, it could be an ominous sign.

Welcome back to ETF Focus! Hope everyone is having a great weekend!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

The unstoppable rise in interest rates combined with the geopolitical unrest in the Middle East and the stalemate in the U.S. House of Representatives regarding the appointment of a new speaker appear to finally be taking their toll on investor sentiment.

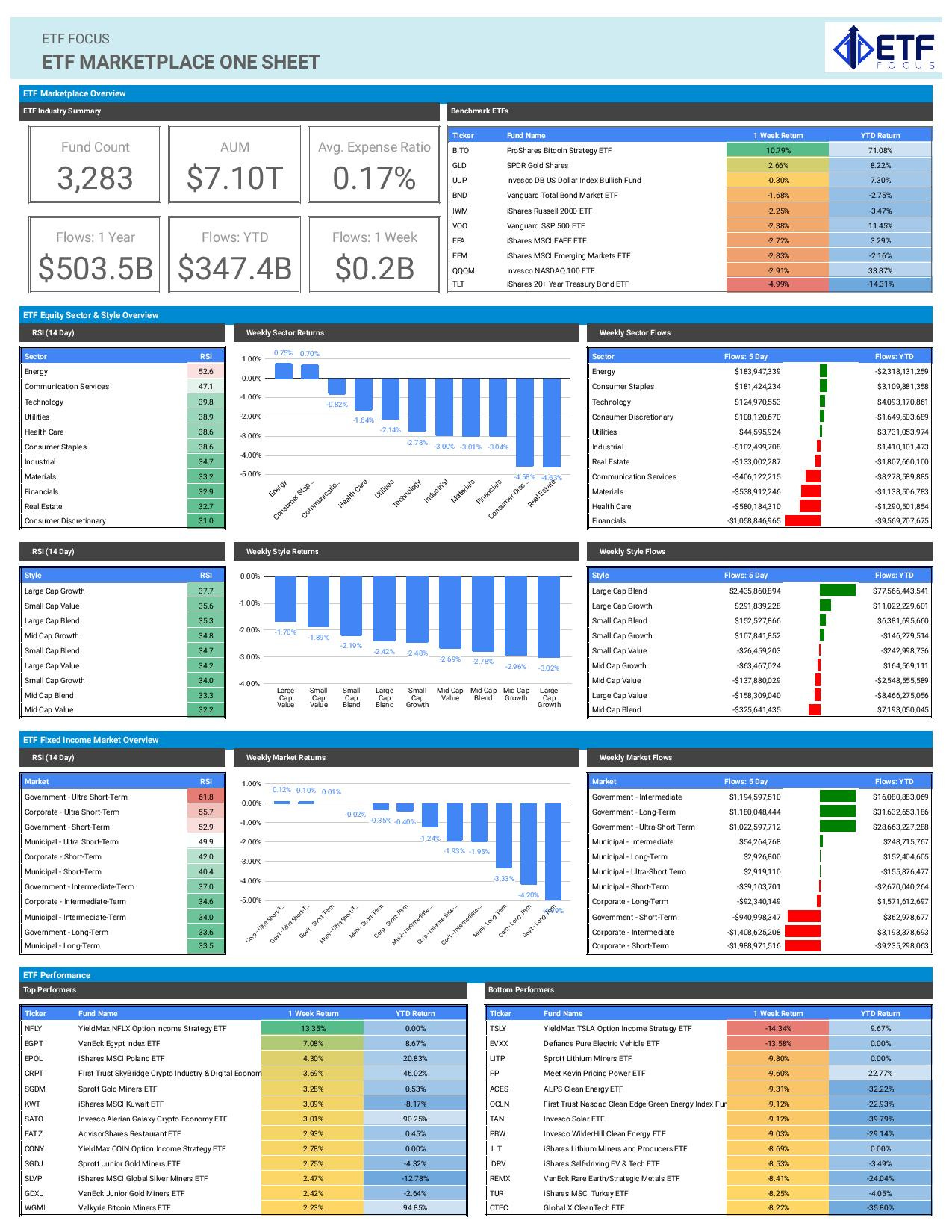

We’ve seen a flood of activity into safe haven investments, including gold, the dollar, defensive equities and even bitcoin (if you want to consider that a “safe” haven). The VIX is starting to creep higher, small cap volatility is increasing and we’ve seen elevated market risk in the bond market for several months now. The confluence of all of these events at once suggests that risk asset prices are very vulnerable to a pullback here. October is traditionally one of the worst months of the year for equities and perhaps there’s a bit of a psychological effect playing into things, but make no mistake about it. Investors are starting to look a little anxious here and I wouldn’t be at all surprised to see asset prices continue to move lower here.

The net inflows into Treasuries, I think, speaks volumes. The intermediate-term, long-term and ultra-short term government bond categories all took in more than $1 billion last week. Even though they don’t have much in the way of returns to show for their efforts, it clearly demonstrates that money is consistently moving towards the idea of safety in U.S. Treasuries. That suggests a fairly high degree of underlying support for Treasuries even though yields continue to move higher in light of challenging conditions. If investors were pulling their money out in droves while yields were taking off, I’d be more concerned that there would be no clear end point to the selloff. With money flowing in, however, I think that positions Treasuries for a potentially strong rally once the flight to safety trade spreads into the one area of the market where it’s failed to appear.

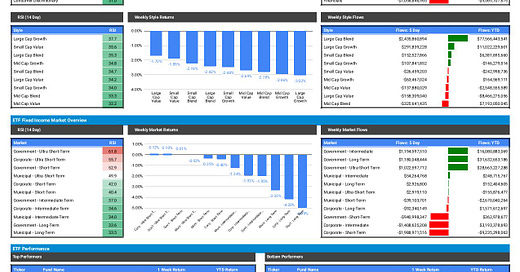

There’s really not much in the way of strength anywhere in the broader stock and bond markets. Energy stocks are in perhaps the best shape right now, but they’re still only at a neutral relative strength level. Diving into sub-sectors, nothing is overbought at the moment, while airlines, genomics, telemedicine, rare earth metals, infrastructure, battery tech, robotics, clean energy, biotech, online gambling, mortgage REITs, food & beverage and casinos are all oversold.

Key Economic Reports This Week

Australia Inflation Rate (Tuesday)

Canada Interest Rate Decision (Wednesday)

ECB Interest Rate Decision (Thursday)

United States Q3 GDP Advanced Reading (Thursday)

United States September Core PCE Price Index (Friday)

United States September Personal Income (Friday)

United States September Personal Spending (Friday)

*** Also, manufacturing & services PMI flash readings for October throughout the week from the Eurozone, Australia, Japan, France, Germany, the United Kingdom and the United States.

Market Outlook

We should probably get an idea pretty early in the week if last week’s risk-off sentiment carried through the weekend. We’re unlikely to hear anything on the economic front that changes the overall narrative - the U.S. economy is resilient and still in the growth phase, while inflation remains well above the Fed’s long-term target. That should keep investors in a cautious mood, especially if Treasury yields keep moving higher.

Two things I’m keeping an eye on…

High yield spreads - Last week, they resumed their move higher, suggesting that investors are taking risk off the table here and are requiring more return for every additional unit of risk. This is one metric that has been stubborn to move throughout and it’s unclear if the resilient economy narrative will be enough to keep spreads down. This has historically been a strong indicator of market stress and it’s starting to give a warning.

“Recession indicator” - The 10-year/2-year Treasury yield spread has shrunk to -14 basis points, its smallest since July 2022. This is important because over the course of history, this spread turns positive roughly 6-12 months before the official start of a recession. Recession watch has probably been on for the last year or more, but this spread turning positive would unofficially start the clock. A 6-12 month timeframe to recession feels about right given where the data is at right now and where it’s trending.