Weekly Market Prep - 10/16/2023

The markets took on a significantly more cautious tone last week. If safe haven trades have another big week, it could be an ominous sign.

Welcome back to ETF Focus! Hope everyone is having a great weekend!

It’s Sunday, so let’s get prepped and ready for the week ahead!

Weekly Market Reset

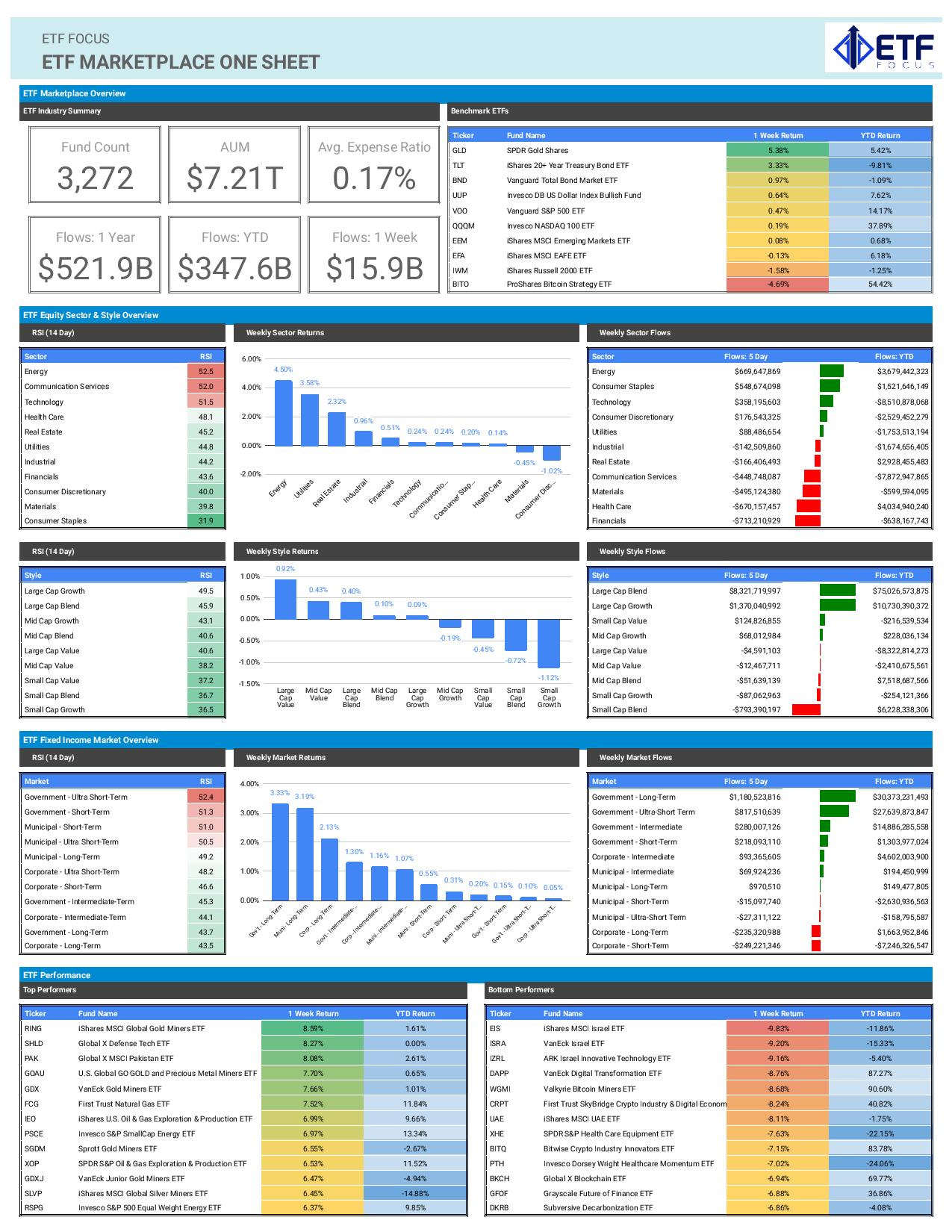

While the conflict in Israel certainly ushered in a cautious market tone last week - oil prices, gold, Treasuries and the dollar all shot higher - it’s unclear whether or not this will be the catalyst that pushes equity markets sharply lower. The S&P 500 still moved higher on the week despite geopolitical risk, but small-caps and bitcoin both lagged badly. There’s no need to panic yet, but it’s clear that a potential war in the Middle East is doing damage to investor psyche. It’s pretty clear at this point that there’s going to be no quick resolution to this conflict, but it becomes worse from a financial market standpoint if other world superpowers try to get more involved. While I don’t think the market are at immediate risk of a volatility spike that sends risk asset prices lower, I do think it becomes a “death by a thousand cuts” scenario the longer it drags on. The near-unanimous reaction from traditionally safe haven assets strongly suggests that investors should remain very cautious about adding risk here.

Category flows into fixed income ETFs are continuing to show two very clear trends - 1) almost all new segment-focused money is going into Treasury funds with virtually nothing into corporates or munis and 2) it’s all going into T-bills/floaters or long-term bonds. The motivation for the short-term money flow is probably obvious. Investors are taking advantage of 5% yields for their cash. The long-term Treasury fund flows are more interesting. People load up on long bonds, generally, because they’re anticipating a market correction or some type of flight to safety trade. Long bonds have the greatest potential for share price gains should this occur. It’s interesting that even though this group is down more than 40% from its highs, investors are still positioning themselves for something bad happening here.

Last week’s inflation report didn’t do much to calm the market’s fears that inflation is going to be sticky and last possibly into 2025. Headline inflation is now running at around a 5% annualized rate on a short-term trending basis with higher energy prices as a key driver. This is why the conflict in Israel is so important to the financial markets right now (in addition to the humanitarian impact, of course). A prolonged period of unrest is likely to keep energy prices high and the inflation rate trending much above the Fed’s ultimate 2% target. While the market is currently pricing in no more rate hikes from the Fed, it can’t be ruled out altogether. The lagged effect of past rate hikes will continue to be felt in the months ahead, but Powell and company may feel the need to make one more quarter-point move before the end of the year just to help keep things moving in the direction they want.

Key Economic Reports This Week

Canada Inflation Rate (Tuesday)

United States Retail Sales (Tuesday)

Germany ZEW Economic Sentiment Index (Tuesday)

United Kingdom Inflation Rate (Wednesday)

United States Building Permits (Wednesday)

United States Housing Starts (Wednesday)

China Q3 GDP Growth Rate (Wednesday)

Japan Inflation Rate (Thursday)

United Kingdom Retail Sales (Friday)

Market Outlook

If last week’s risk-off sentiment carries through into this week and the basket of safe haven trades continue to move higher, it’s going to be an ominous sign for the markets. Most investors are probably well aware of the fact that October is traditionally one of the worst months of the year and some be in their heads already that it’s happening again.

The market signals that I follow are actually fairly mixed at the moment. The VIX is slowly moving higher, but it closed Friday at 19, which is far from the panic zone. Bond market volatility, on the other hand, is still elevated and has been for some time. High yield spreads, a pretty reliable indicator of stress in the markets, have been moving higher since the 2nd half of September, but backed off again last week. Growth is still leading value, but high beta has been lagging low volatility since the end of last summer. Again, a lot of mixed indicators, which signals to me that the market is still confused and figuring out where it wants to go next. The economic data continues to trend worse and that’s long-term negative, but investors seem willing to hang on as long as the labor market is strong and consumer spending is resilient. The latter point will be tested this week by the release of September retail sales data. If that comes in significantly weaker than expected, we could see a sell-off.