Using Covered Calls To Turn 2% Yields Into 12% Yields

Big yields are available today, but you have to be aware of the tradeoffs.

Yields are back on the rise again and that may or may not be good news for income seekers. If you’re looking to buy into bonds here, the 2.46% yield currently being offered by a 10-year Treasury note is double what it was only back in July of last year. That’s still not near the 4-5% yield that many dividend income investors are trying to generate from their portfolios, but it is the highest it’s been in nearly 3 years.

If you’ve been holding government bonds over the past two years, it’s probably an experience you’d just as soon forget. The iShares U.S. Treasury Bond ETF (GOVT), which invests in a broad range of government bond maturities, is more than 10% off of its highs of August 2020. If the pitiful yields offered by Treasuries weren’t bad enough, the capital losses shareholders have experienced on top of that are even worse.

Investors might want to take a look at other income-producing alternatives. And if we’re looking at alternatives, why not go for the big double-digit yields in the process?

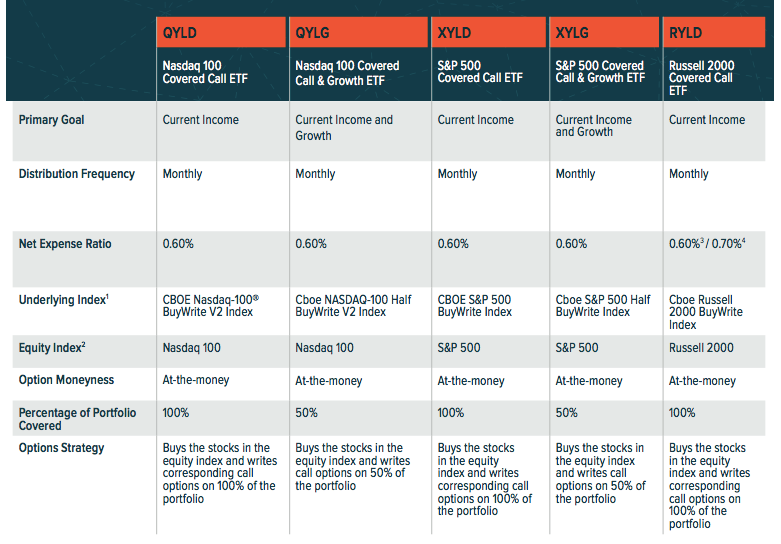

Global X offers a trio of funds that overlay a covered call strategy on top of the major indexes - the Global X S&P 500 Covered Call ETF (XYLD), the Global X Nasdaq 100 Covered Call ETF (QYLD) and the Global X Russell 2000 Covered Call ETF (RYLD). They sell/write covered call options over the entire portfolio, pocket the option premiums and pay that out to investors in the form of income. The issuer also offers the Global X Nasdaq 100 Covered Call & Growth ETF (QYLG) and the Global X S&P 500 Covered Call & Growth ETF (XYLG). The difference in these two is that they write options on only half the portfolio.

Covered call ETFs are a great option for those seeking high yields for their portfolios, but they do come with a catch.

By writing covered calls, you’re sacrificing capital appreciation upside. The more options that are written, the higher the yield but it also means lower share price growth potential. The less options coverage, the lower the yield but more share price growth potential. That’s why XYLG and QYLG are called “covered call & growth” ETFs. They offer lower yields, but more growth potential. QYLD, XYLD and RYLD write options on the entire portfolio, which means maximum yield potential but very little share price growth opportunity.

So what kind of yields are we talking about here? Each one is currently paying out roughly a 12% annualized yield.

Global X S&P 500 Covered Call ETF (XYLD) - 12.0%

Global X Nasdaq 100 Covered Call ETF (QYLD) - 11.8%

Global X Russell 2000 Covered Call ETF (RYLD) - 11.9%

Within the framework of these funds, Global X caps the monthly distribution at the lower of a) half of premiums received, or b) 1% of net asset value. Anything above that cap gets reinvested back into the fund, so there is more potential for share price growth here than in other covered call funds. This is a big part of the reason why we saw the share prices of these funds rise by 25-60% off of their COVID recession lows in 2020. I wouldn’t by any means expect that going forward since that was a very unusual time, but we can see from the current yields that each fund is effectively at or near its cap almost every month right now.

RYLD and QYLD have pretty consistently offered yields of 10% or higher throughout their histories, XYLD had been hovering in the 6-7% range over much of the past three years up until recently. Under calmer market conditions, I’d probably expect yields to start coming back down towards that range again, but income seekers can sure enjoy those higher yields while they last!

With that being said, let’s look at the markets and some ETFs.

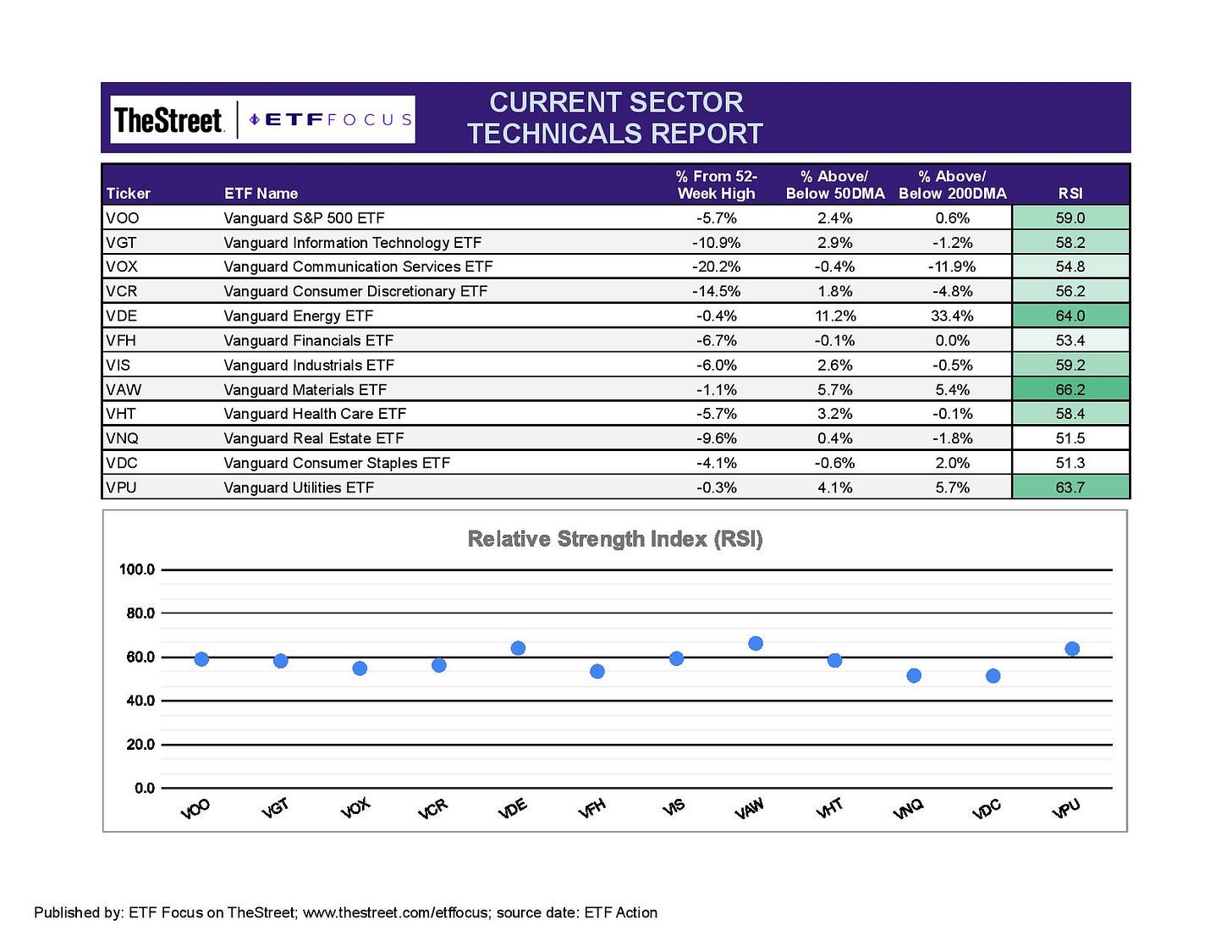

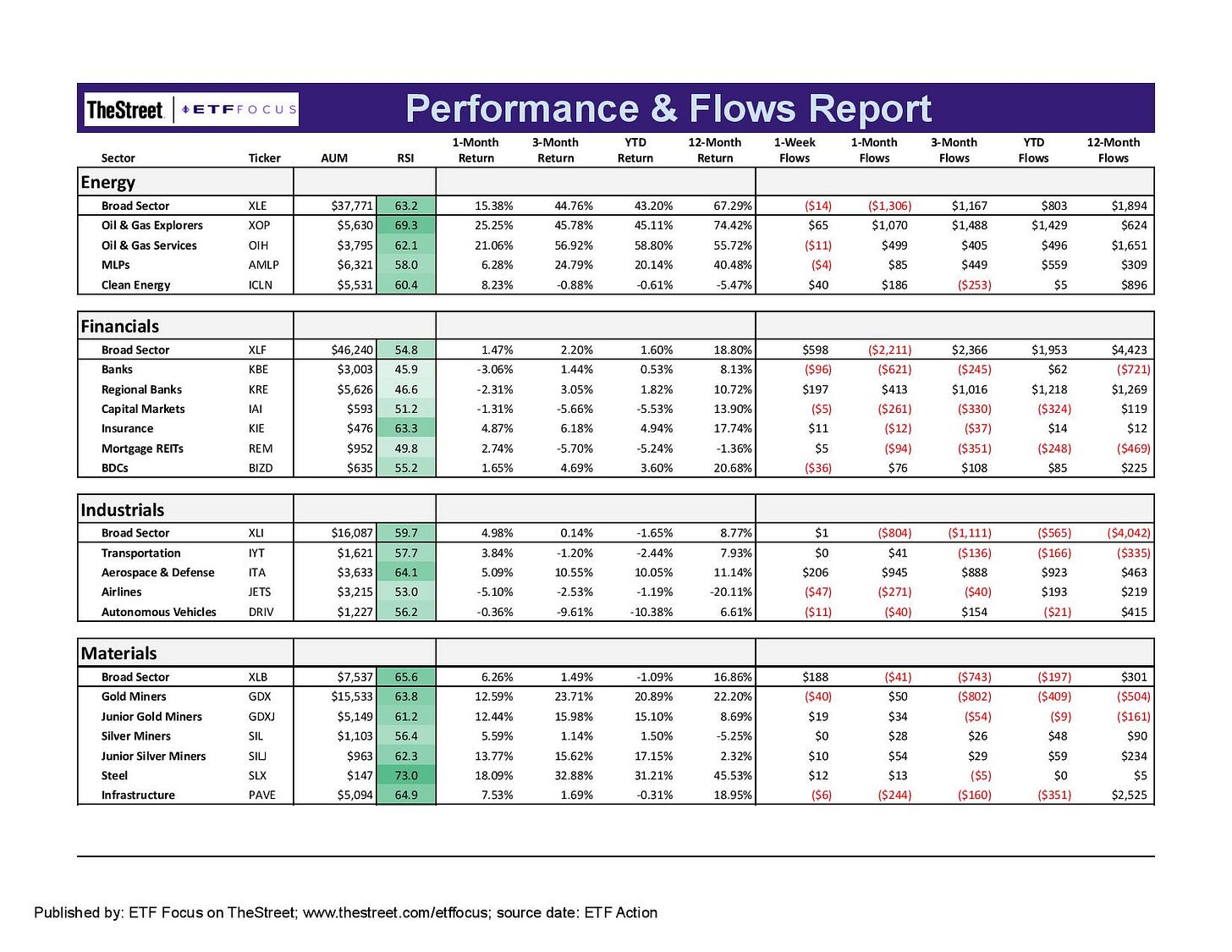

We’re still seeing strength in energy stocks, but I wonder if that’s coming to an end soon. As soon as we got news on Monday night that Russian forces may be backing off around Kyiv and there was at least some willingness to negotiate, energy stocks plunged on the notion that oil might begin flowing more freely again. There’s still a long way to go in negotiating a peace agreement and perhaps even longer to restore the energy market to its pre-invasion state, but the markets tend to react pretty quickly to news like this. I suspect there’s more downside than upside to energy stocks here in the near-term.

Materials are another sector looking pretty good right now, but I’m still watching utilities closely here. Since November, utilities has been the one sector that’s pretty consistently outperformed the S&P 500. Commodities, materials and Treasuries are behaving a little wonky right now with soaring inflation, aggressive action from the Fed and continuing supply chain bottlenecks, but utilities has been the one sector that’s correctly indicated the current volatility in the markets. When that starts breaking down again, I think we can talk about another leg higher in equities, but as long as this group remains strong, I’d be cautious about getting too bullish.

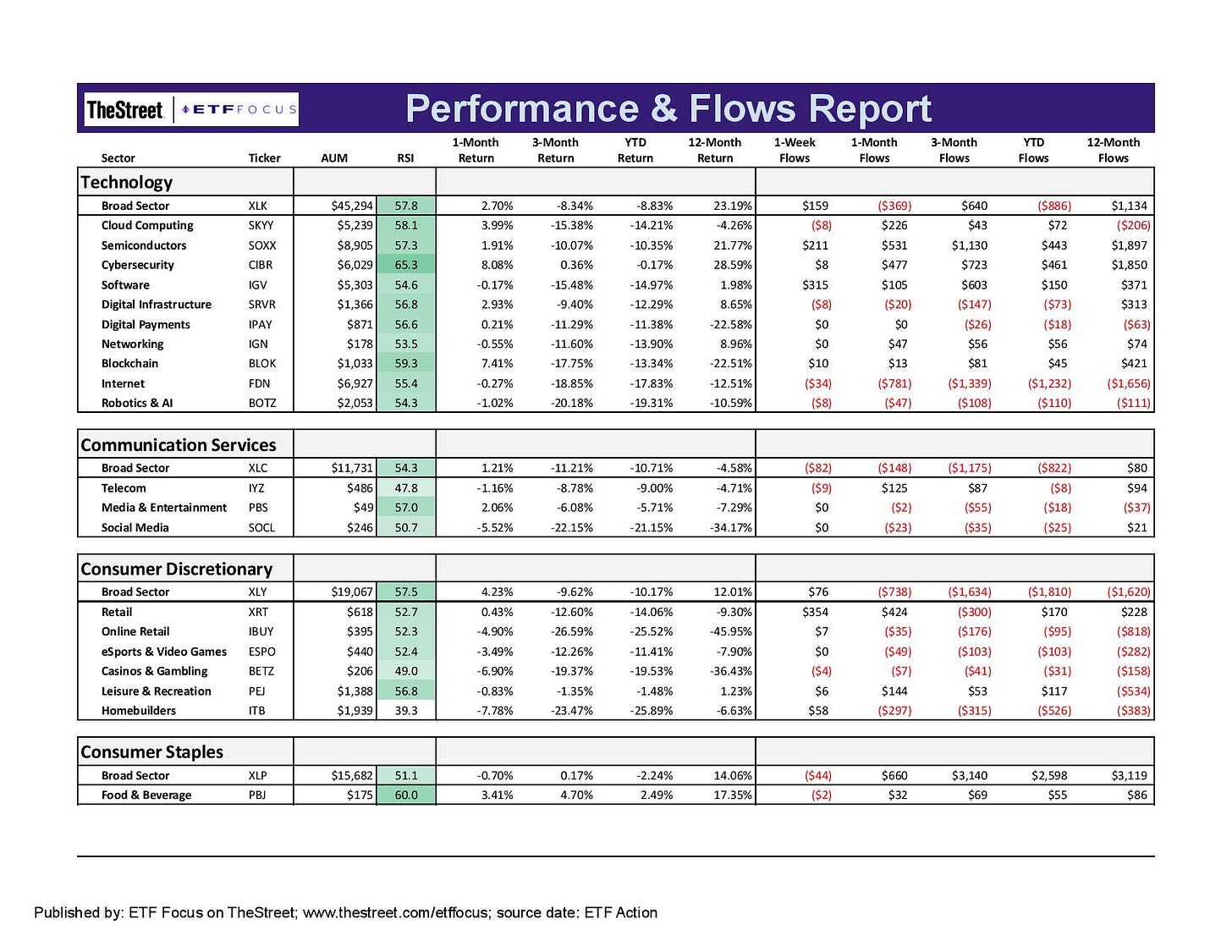

Again, we’re looking at another week where most sub-sectors of the market are in relatively neutral territory with nothing looking particularly overbought or oversold. There are a couple of outliers though. Cybersecurity stocks have been having a run over the past few weeks on the threat of attacks from Russia and perhaps even China. Blockchain has had a good month, but it remains very volatile and I’d be hesitant to declare any trends in this group. Tech, in general, has been a laggard for much of the past few months, but it’s been looking a lot better over the past couple weeks. Investors appear to have mostly digested the latest from the Fed and on inflation and they’re starting to dip their toes back into growth stocks again.

Homebuilders are the notable underperformer here. Housing data was mostly positive up until recently when pending home sales numbers came in softer than expected. Add in the impact of sharply higher mortgage rates, something which we haven’t seen reflected in the data just yet but is almost certainly coming, and you can see why investors have been selling off this group. Homebuilders had been a consistent leader, but the macro outlook looks weak and flows show that investors are leaving the party.

The energy sector and its sub-groups have continued to perform quite well, but as I mentioned above, I think there’s a good chance the short-term rip could be nearing an end. The current rally in energy prices was always predicated on geopolitical uncertainty. That means conditions could turn just as quickly in the other direction should tensions settle. It’s impossible to assess what Putin’s real intentions are and this could very well just be a head fake, but it might also be a good time for this energy bull to take a bit of a breather.

Materials stocks continue to benefit from the commodities bull market as evidenced by the surging performance of steel stocks and, to a lesser extent, the miners. Banks are looking weaker despite sharply higher Treasury yields and I think that’s because of the near-term worries about economic growth slowing. The numbers are already showing GDP growth is slowing, perhaps even quicker than expected. Consumer confidence is low, loan rates are rising and general business sentiment is pessimistic. Loan growth has been a weak spot for banks since the start of the COVID pandemic and where conditions are headed certainly won’t make things any easier.

Not really much change across the defensive sectors in terms of short-term relative strength. Consumer staples, healthcare and utilities are all looking fine at the moment, although real estate appears to be breaking down a bit. The general narrative is that higher rates are a negative for REITs, but the sector has mostly been able to hold on relative to the broader market. I’d expect that conditions eventually become more challenging and we start seeing real estate drift lower, but there are pockets of this group, including data centers, cell towers, self-storage and even things like farmland, that could help prop the sector up.

The commodities market is still healthy, but it looks like it’s pausing a bit. Gold had a nice run from February through the first part of March, but it’s looking like it’s settling back down into its pre-invasion trading range. Crude oil, gasoline and natural gas are probably all facing short-term pressures to the downside. The dollar could be worth watching here. It’s been trending up for a while now, most recently on the heels of progressively more hawkish expectations from the Fed. Now, global central banks, particularly in Europe, are revising some of their outlooks more hawkish as well and that’s providing some strength to the euro and the pound.

Read More…

Don’t Buy Into This Equity Rally

The Fed Tightening Cycle Is Here, But Will It Work?

SPHB: The Real Damage Isn’t Done Yet

ETF Battles: What's The Better High Income Dividend ETF? JEPI vs. NUSI vs. DIVO

Vanguard Dividend Appreciation ETF (VIG) Has Turned Into One Of The Worst Dividend ETFs Of 2022

Russia ETFs Suspend Share Creations; Premiums To NAV Shoot Up To More Than 100%

6 Higher Yielding Cash Alternatives For Your Portfolio

4 Vanguard Bond ETFs For Every Market

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!