Treasuries Are Looking Better Than Stocks Right Now. Is This The Start Of The Big Bond Rally?

The followthrough from Treasuries this week suggests last week's rally might not have been as strong as it looked.

Last week, the Fed finally unleashed the long-anticipated pivot trade that sent virtually everything higher. The S&P 500 (SPY) gained more than 5%. Small-caps (IWM) were up nearly 8%. One of the riskiest ETFs out there, the ARK Innovation ETF (ARKK), gained more than 18%!

The biggest winner, in my opinion though, was Treasuries. The prospect of the Fed finally ending its interest rate hiking cycle (paired with a potentially slowing labor market) ignited the biggest rally in long bonds since at least the regional banking crisis back in March and quite possibly during the entire post-COVID market. The iShares 20+ Year Treasury Bond ETF (TLT), nearly gained 5%.

Of course, it’s easy to experience a sharp, quick bounce when long duration Treasuries were down nearly 50% from their highs of three years ago. But if the Fed is done with hikes, rates have peaked and the jobs market is set to cool, those are the conditions that can really trigger a big bond rally.

Why Treasuries Are Actually Leading Again

With large-cap equities and long-term Treasuries both gaining around 5% last week, which one is telling the right story? Is this a risk-on stock rally or a risk-off bond rally?

I think the answer lies in how other asset classes have performed within the stock and bond markets. Utilities nearly performed as well as the S&P 500, but that could be because interest rate sensitive sectors performed especially well. Growth & tech beat the broader market, but only by about 50-60 basis points, not exactly the level that would indicate huge bullish sentiment. That leads me to believe that last week’s risk asset rally had a strong bullish tone behind it, but it might not be as strong as the market wants to believe.

Another reason I’m buying into the Treasury rally is this week’s followthrough.

The S&P 500 has managed to hang on to last week’s gains, which is a good sign, but look at how small-caps (the red line) have performed? They’re down 2.6% in the first three days of the week. Typically, you’d see this group leading large-caps on the way up in a traditional bull market, but we’re seeing the opposite here.

Plus, look at long duration Treasuries? They’ve gained another 2% on top of last week’s 4-5% gains! The 10-year Treasury yield has dropped 50 basis points since the last week of October. A big catalyst for this rally has undoubtedly been the idea of a normalizing interest rate environment, but I also believe a big part of it is the slow return of the safe haven trade. The Fed pivot usually triggers a bond rally because the market begins anticipating eventual interest rate cuts and starts to front-run the trade. The Fed has indicated that rate cuts won’t be on the table for a while, but the Fed Funds futures market is currently pricing in a nearly 20% chance of a hike at the March meeting and a 70% chance of a cut by the June meeting. That would likely be at odds with what the Fed is thinking (they’re probably thinking well into the 2nd half of 2024 at the very earliest), but the market tends to have a better handle on these things.

Let’s look at a few other charts that are supporting the defensive narrative.

Equal Weighted S&P 500 vs. Market Cap Weighted S&P 500

This is an extension of the small-cap vs. large-cap argument. I like to use the equal weight S&P 500 as a proxy since true small-cap companies can be very different than large companies. Looking within just the large-cap universe gives a better sense of which area of the market is leading.

In this case, we’re getting the same story. Not only are smaller companies not leading here, they haven’t really registered as even a blip on the radar. Again, broader, healthy bull markets tend to feature outperformance from riskier, smaller companies. We’re still getting mega-cap leadership, which suggests a more narrow market bounce.

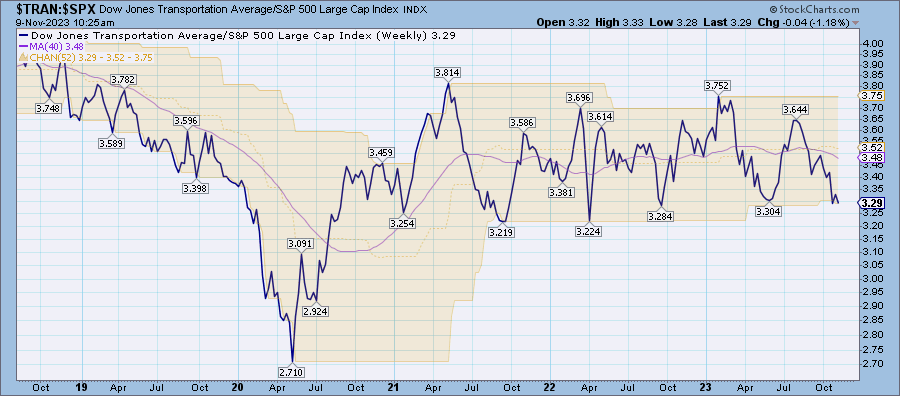

Transports vs. S&P 500

Since transports are a highly cyclical industry, this gives us a good idea of how investors feel about whether they believe that an economic rebound is ahead of us. This ratio bounces around quite a bit, but it’s notable that in the big Fed pivot trade that the markets been waiting for for months and months, transports were a big dud.

It’s not unusual to see more pure growth stocks to lead cyclicals at a market turn, but this suggests investors believe that recession risk is high. What do investors tend to flee towards under conditions like that? Safe havens, such as Treasuries.

High Beta Junk Bonds vs. Low Beta Junk Bonds

Junk bonds were perhaps the biggest beneficiary of last week’s rally since lower interest rates should benefit those companies with larger relative debt loads and more questionable financial health the most. High yield spreads plunged and bond traders removed a lot of risk premium from this sector.

In a big junk bond rally, you might, again, expect riskier assets to outperform. Not here. Lower volatility junk bonds actually led the way higher. Granted, investors should be pricing more risk into junk bonds, but it’s curious that in the sector that’s perhaps most mispriced right now, investors didn’t push harder into high beta.

High Yield Equities vs. Dividend Growth Equities

High yielders are generally considered riskier than old fashioned dividend growth stocks, so it makes sense that they might benefit more from a market rally. They did experience a brief small pop, but quickly gave a lot of it back. High yield stocks have been consistently lagging the S&P 500 for virtually the entirety of 2023, so perhaps it shouldn’t be that surprising that they didn’t suddenly shift into gear, but it’s another area of the market where riskier wasn’t necessarily better.

Conclusion

There are also sectors where riskier assets outperformed as expected, which is part of what makes the past two weeks confusing. The mixed signals, in my opinion, suggest that last week’s rally wasn’t as strong as it might have seemed. The fact that it’s long-term Treasuries that are following through stronger this week than equities are makes me think that Treasuries might be the asset class that’s really in control here.

Treasuries, however, have been very finicky over the past couple years, so I’d hesitate to say with high conviction that this is the start of the big bond market recovery. I do think the fact that Treasuries are continuing to press higher means there is a defensive undercurrent in place here that could accelerate heading into the end of the year. November & December are traditionally some of the best months of the year for equities, but don’t be surprised if Treasuries are this season’s biggest winner.