Tired Of Bond Market Volatility? Swapping In Some Gold & Commodities Helps Solve That

The vast majority of investors are looking for ways to always be maximizing return potential. Most don’t realize that returns can also be generated by minimizing downside risk.

Anybody who’s tried to maintain anything even close to a 60/40 portfolio over the past couple of years has gotten absolutely roasted. Honestly, only a 100/0 portfolio really had a chance at generating positive returns and even that was probably only if you overweighted energy stocks. While Treasury bills and their 5% yields have drawn a lot of interest and investor money over the past several quarters, long-term Treasury bonds are down 45% from their peak all the way back in 2020!

As the Fed has executed the most aggressive rate hiking cycle in history, it’s lifted bond market volatility to historically high levels.

The last time we’ve seen the bond market as volatile as it is today was back during the financial crisis. Plus, volatility has remained elevated for a year and a half. I probably don’t need to tell you that when market volatility is at 15-year highs and has been that way for the past six quarters, nothing good usually comes of it.

If there’s a positive outcome to take away from this, it’s that Treasury bonds may be at an attractive entry point again. With yields at around 4.7%, they’re a real income option again, plus there is A LOT of capital appreciation potential should the flight to safety trade finally kick in. The iShares 20+ Year Bond ETF (TLT) has a duration of nearly 17 years. That means if yields drop by 200 basis points, a real possibility if a recession is ahead of us, long bonds are sitting on a potential 30%+ gain.

But inflation is still a problem, as evidenced by the September CPI report, and the Fed may still not be done hiking interest rates. If that happens, volatility is likely to remain high along with yields. If you’ve had enough and are looking to take some risk off the table, you don’t necessarily need to pile into cash of T-bills here. Consider rotating part of your portfolio into gold & commodities instead.

Replacing Treasuries with Gold & Commodities

Treasuries have a long history of acting as a great diversifier to stocks (the past two years notwithstanding). Their low correlation to other riskier asset classes helps to reduce overall portfolio risk and smooth out some of the volatility that occurs on a regular basis in the financial markets.

Gold and commodities do the same thing, maybe even better. Gold has virtually no correlation at all to stocks, making it perhaps the ultimate diversifier. It’s just an asset that kind of does its own thing. Commodities also have a low correlation to stocks, but their price movements are often based more heavily on where we are in the market cycle.

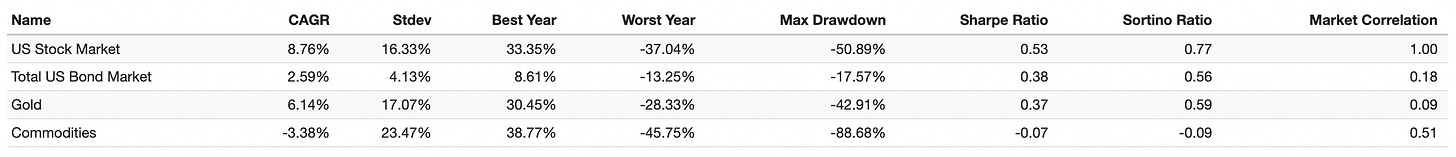

You can check out the risk/return profile of stocks, bond, gold and commodities over the past 15+ years in the graphic below.

The historical absolute returns of each asset class aren’t what’s important here since the future is likely to look very different. What’s much less likely to change are risk levels and inter-asset correlations. Equity correlation to both bonds and gold, historically, have been very low and the correlation to commodities, while higher, is still at the level where there is significant diversification benefits.

The problem today is that the correlation level between stocks and bonds is much higher than it’s been in the past. There’s evidence that the correlation today may be around 0.80. Plus, when that high correlation is associated with downside risk, it makes the portfolio construction decision that much more complicated. While the stock/bond correlation is likely to return to the long-term average eventually, but the short-term solution may be to substitute the temporarily high correlation of bonds for the low correlation of gold & commodities.

To play this out, I created three portfolios in Portfolio Visualizer.

Portfolio #1 - 100% U.S. Stock Market

Portfolio #2 - 80% U.S. Stock Market, 20% U.S. Bond Market

Portfolio #3 - 60% U.S. Stock Market, 20% U.S. Bond Market, 10% Gold, 10% Commodities

You may ask why I would take the 20% away from stocks in Portfolio #3 instead of bonds. The answer is that I believe we will soon enter a period where safe haven assets begin behaving like safe haven assets again. That likely comes with the onset of a potential recession in the next couple of quarters. If that happens, the higher return potential will be with bonds, not stocks.

The Results

Look at a backtest of these portfolios over the past 16 years delivers some relatively predictable results. The all-stock portfolio produced better returns on an absolute basis than did the more diversified portfolios, but it also came with much more risk.

The 60/20/10/10 portfolio lagged the 100/0 portfolio by about 2% annually, but it was also about 30% less volatile. Its maximum drawdown over the measurement period was also only about 2/3 of the all-stock portfolio. The most interesting finding in this backtest was the comparative risk-adjusted returns. The Sharpe and Sortino ratios for the 100/0 and 60/20/10/10 portfolios are virtually identical, which means that they’ve delivered the same amount of return for each unit of risk. The more diversified portfolio just dials things back by about 30%.

This also bears out when you look at annual returns as well. There’s a very consistent pattern (with just a few outliers) where the gain/loss on the 60/20/10/10 portfolio is less than that of the other two.

The vast majority of investors are looking for ways to always be maximizing return potential. Most don’t realize that returns can also be generated by minimizing downside risk. Losing less is just as valuable as gaining more. If we are indeed trending towards a recessionary environment, the lower risk factor of the 60/20/10/10 portfolio could be incredibly valuable.

Over the long-term, I feel confident that the inverse correlation between stocks and bonds will eventually return and that’ll make the 80/20 (or even the 60/40) portfolio more attractive. In the meantime, remember that diversifiers are always a good thing for your portfolio and can save you just when you need it most.

Great stuff!