Three 5-Star Morningstar Rated ETFs to Keep on Your Watchlist

Past performance doesn't predict future performance, but credit is due when its due.

One of the metrics you may have come across as an ETF investor is the "Morningstar Rating." This rating system evaluates funds based on their historical performance relative to similar funds in their category. Each fund, once it has enough performance history, is categorized (e.g., large-cap blend) and compared quantitatively against its peers.

The highest rating, five stars, is awarded to a small handful of funds that have historically outperformed their category peers on a risk-adjusted basis. This rating system is a useful tool for investors looking to identify funds that have demonstrated superior performance.

Here’s a look at three five-star ETFs that are on my personal watchlist: the Pacer US Cash Cows 100 ETF (COWZ), the WisdomTree US Quality Dividend Growth ETF (DGRW), and the Amplify CWP Enhanced Dividend Income ETF (DIVO).

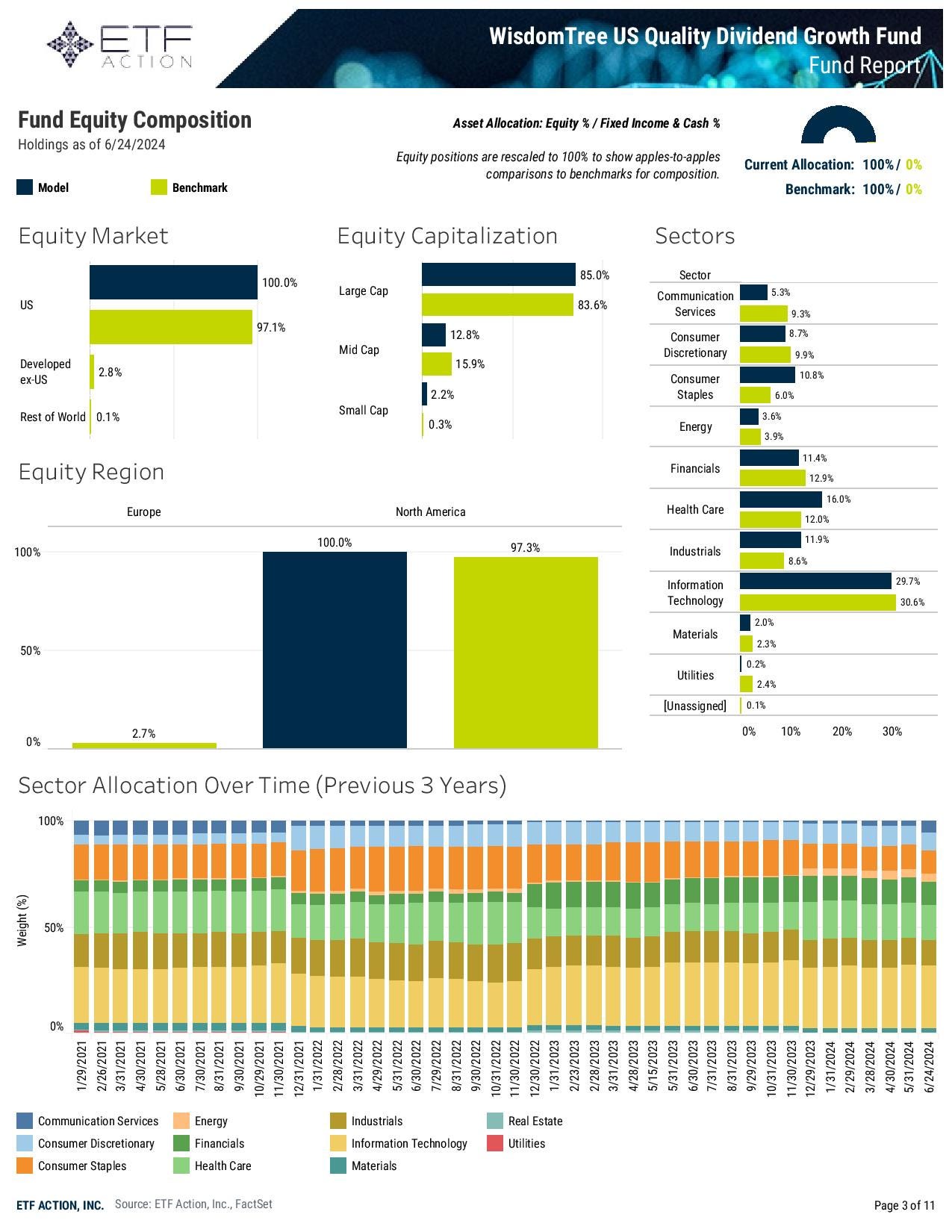

WisdomTree US Quality Dividend Growth ETF (DGRW)

I find DGRW very impressive because it competes in the "U.S. Large Blend" category, where the venerable (and hard to beat) S&P 500 index also resides. Still, it has managed to achieve that coveted five-star Morningstar rating.

How? It has to do with its "fundamental indexing" approach. Unlike market-cap-weighted indexes, DGRW screens for growth based on long-term earnings growth expectations and also checks for quality by assessing three-year historical averages for return on equity and return on assets metrics.

Finally, the ETF weights its holdings annually based on the dividends expected from each company. Currently, you get a 1.49% 30-day SEC yield along with monthly distributions for a 0.28% expense ratio. It's not a high yield fund, but has historically delivered stellar total returns.

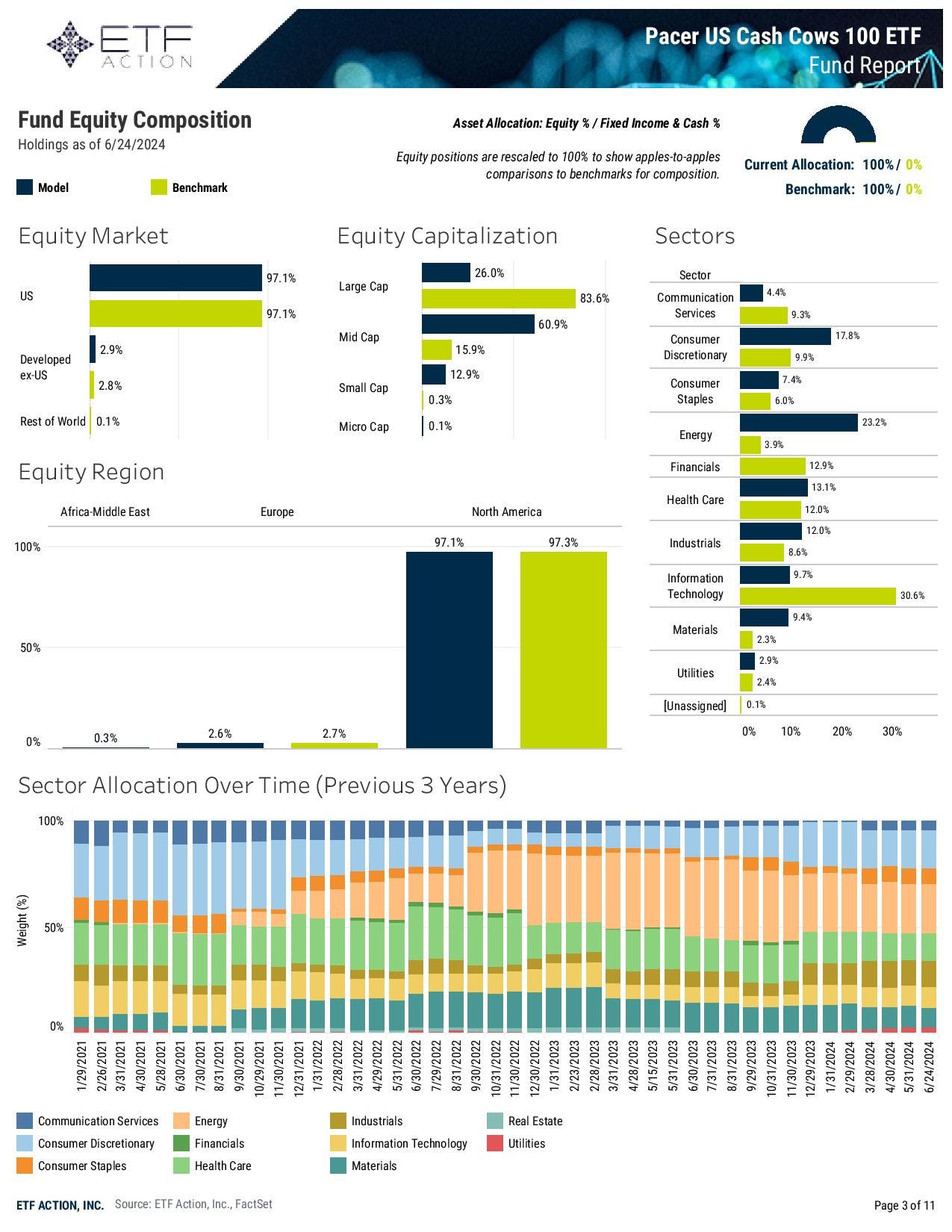

Pacer US Cash Cows 100 ETF (COWZ)

Despite its name, COWZ is actually more of a mid-cap value fund, and based on its historical performance and rating, one of the best ones.

The engine of this ETF is a methodology that takes the stocks held in the Russell 1000 index, ranks them by their trailing 12-month free cash flow yield, takes the top 100, and then weights them by free cash flow, subject to a 2% cap on individual holdings.

The result doesn't do much for dividends, but it provides ample exposure to the size and value factors, both of which have historically produced higher returns.

It's not the cheapest ETF out there at 0.49%, but its historical performance has shown that it can beat both the Russell 1000 and Russell 1000 value indexes.

Amplify CWP Enhanced Dividend Income ETF (DIVO)

The issue with many derivative income ETFs is that while most have high yields, their total returns often fall short. This is due to their typical strategy of systematically selling at-the-money (ATM) calls on a monthly basis, which caps the upside potential.

DIVO is a unique covered call ETF that circumvents this problem. Unlike most, its portfolio is actively managed and concentrated, holding high-conviction positions in 20-30 blue-chip stocks screened for quality and dividend growth.

Where DIVO truly shines is in its option-writing strategy. It employs a tactical approach, writing calls on individual stocks rather than the entire portfolio. This allows the ETF to adjust the coverage, strike price, and expiry for each holding, capitalizing on higher volatility, earnings events, or momentum, leaving some positions uncovered to retain their upside potential.

The distribution yield isn't as high as most covered call ETFs at 4.81%, but it's still substantial given the strong total returns. The 0.56% expense ratio is pretty average for its category.