This Week's Inflation Number Will Drive The Next Leg Of This Market

Here's what I'm watching this week regarding stocks, bonds and the Fed.

The August inflation report, which will be released on Tuesday this week, will be the only number the market cares about. It’s what’s driven the equity markets over the past year. It’s what’s driven soaring bond yields. It’s going to be what drives where the market goes throughout what’s left of 2022.

Let’s set the table first. The street expects the headline inflation rate to come in at 8.1%. That would be down from 8.5% in July and a peak of 9.1% in June. The core inflation rate, which takes out the more volatile food and energy price changes, is expected to tick up from 5.9% in July to 6.1% in August. That’s still below the 6.5% rate from March, but it’s also the same year-over-year rate we saw in May.

In other words, food and energy prices are coming back down, but the stickier parts of inflation, such as rents and healthcare costs, have not.

Food and energy prices are the most visible sources of inflation since you see those prices every week when you go to the grocery store or fill up your tank. This is a good thing as far easing immediate household budget pressures, but that headline inflation rate is going to have a hard time declining to more historically normal levels until core inflation breaks.

That, of course, is going to effect everything. The Fed will make future policy decisions based on this and equities could potentially move higher if investors feel that inflation is coming under control.

Here are three things I’m watching with respect to inflation this week.

The Fed’s Rate Hike Plans Won’t Change

Even if the August inflation rate comes in slightly lower than expected, the Fed will keep plowing forward with its tightening plans. Right now, the markets expect a 75bp hike in September, a 50bp increase in November and another quarter-point in December. I believe that’s locked in even if inflation slows down more than expected.

If inflation comes in above estimates, there’s a chance that markets could price in a terminal rate higher than the 4% rate it’s currently expecting. In that event, we’re probably looking at a negative reaction for both stocks and bonds. I suspect this outcome is unlikely, but still possible.

It Would Be Significant If Growth Stocks Begin Leading

Last week was notable for where the equity market’s biggest gains came from and where they didn’t. Growth and high beta were the leaders, while energy was easily the worst performer. That’s interesting because lagging performance from growth is an indicator that investors are not enthusiastic about where the economy is heading. If energy, which has easily been the market’s best performer, starts becoming the laggard and growth starts taking over, that’s a sign that investors are becoming more positive.

It’s exactly the same trend that happened this past summer and, even though it turned out to be a failed bear market rally, taking advantage of this pivot early on could lead to above average gains in the near-term.

Falling Inflation Should Lead Bond Yields Lower, But Will It Happen?

Bond yields and inflation rates are highly correlated. We’ve seen that consistently throughout the past year. Therefore, it was logical to assume that bond yields should come back down once inflation rates started easing. We saw inflation come down in July and should see it happen again in August. But so far we’ve seen Treasury yields continue to rise.

I think part of the reason is political. Even though energy prices have come down, there’s a crisis in Europe that has energy prices soaring and OPEC is shown little willingness to help on the supply side. If energy prices could shoot higher again on a lack of supply, inflation could be pressure to move higher as well. If inflation moves higher, interest rates probably move higher too. I think the bond market is sniffing some of this out.

Tuesday’s inflation report will be the main event this week and likely spikes volatility to some degree, but I’m not sure how much it ends up changing the calculus in the grand scheme of things.

With that being said, let’s look at the markets and some ETFs.

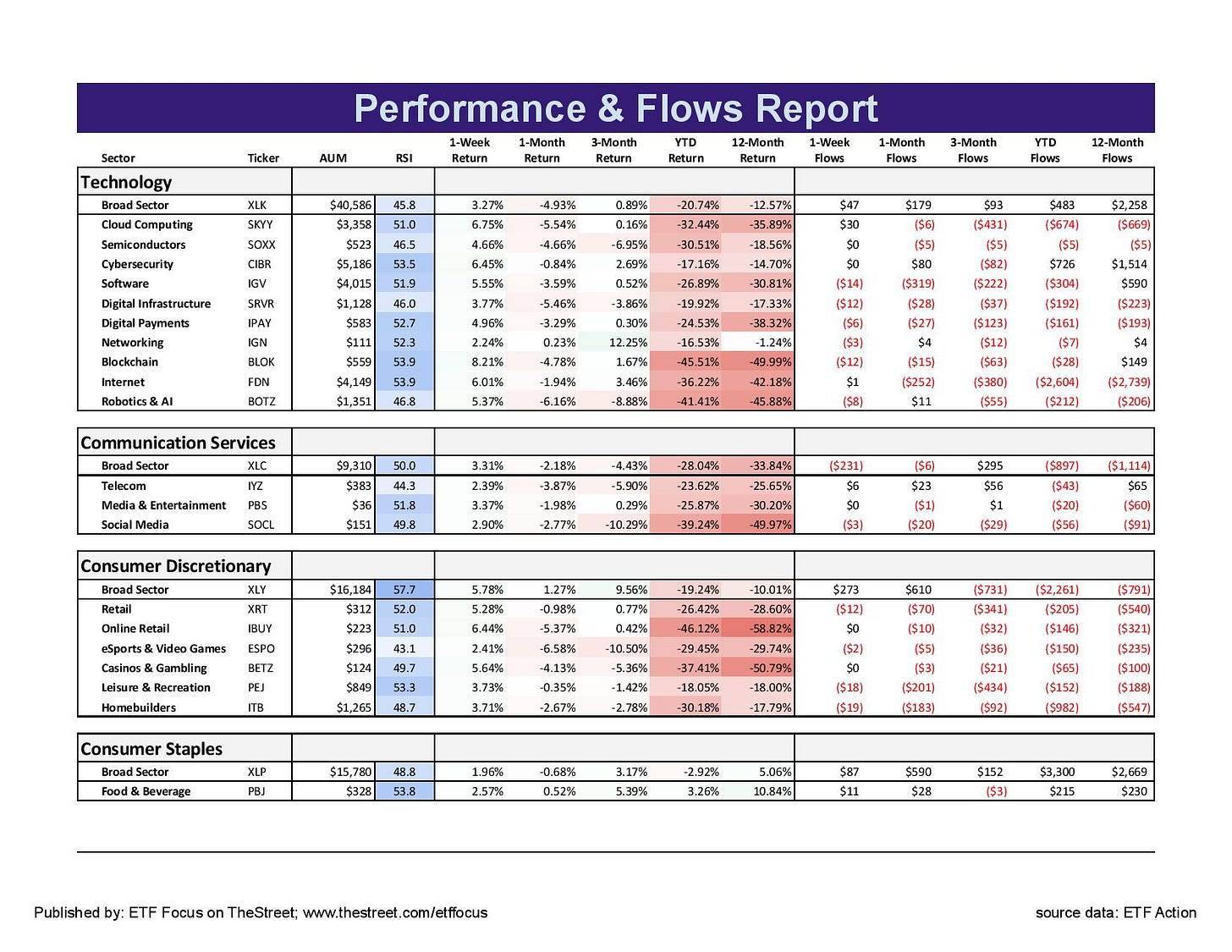

As I just mentioned, last week’s pivot from energy into growth was interesting, but only if it carries forward. We’ve seen some of these moves before, but they ended up being just a short break in a longer trend. I’m skeptical that growth makes a prolonged run here in the way they did last summer because there’s just too much going on that’s headed in the wrong direction. Utilities continue to be one of the market’s leaders, but there’s still not really a consensus leadership trend in this market. Defensives, cyclicals and growth all have their winners and losers.

The broader tech sector only matched the market at a high level, but there was a lot to like once you dig down. Cloud, cybersecurity, internet and software stocks all gained 5-6%. Tech has had a rough run since last summer’s rally and it would be a positive sign if the sector can build on last week’s gains. Also encouraging is the rebound in discretionary stocks. They had begun underperforming during the 2nd half of the summer, but have been very solid over the past couple of weeks. Any further outperformance from tech and discretionary here would be a sign that investors are growing more bullish.

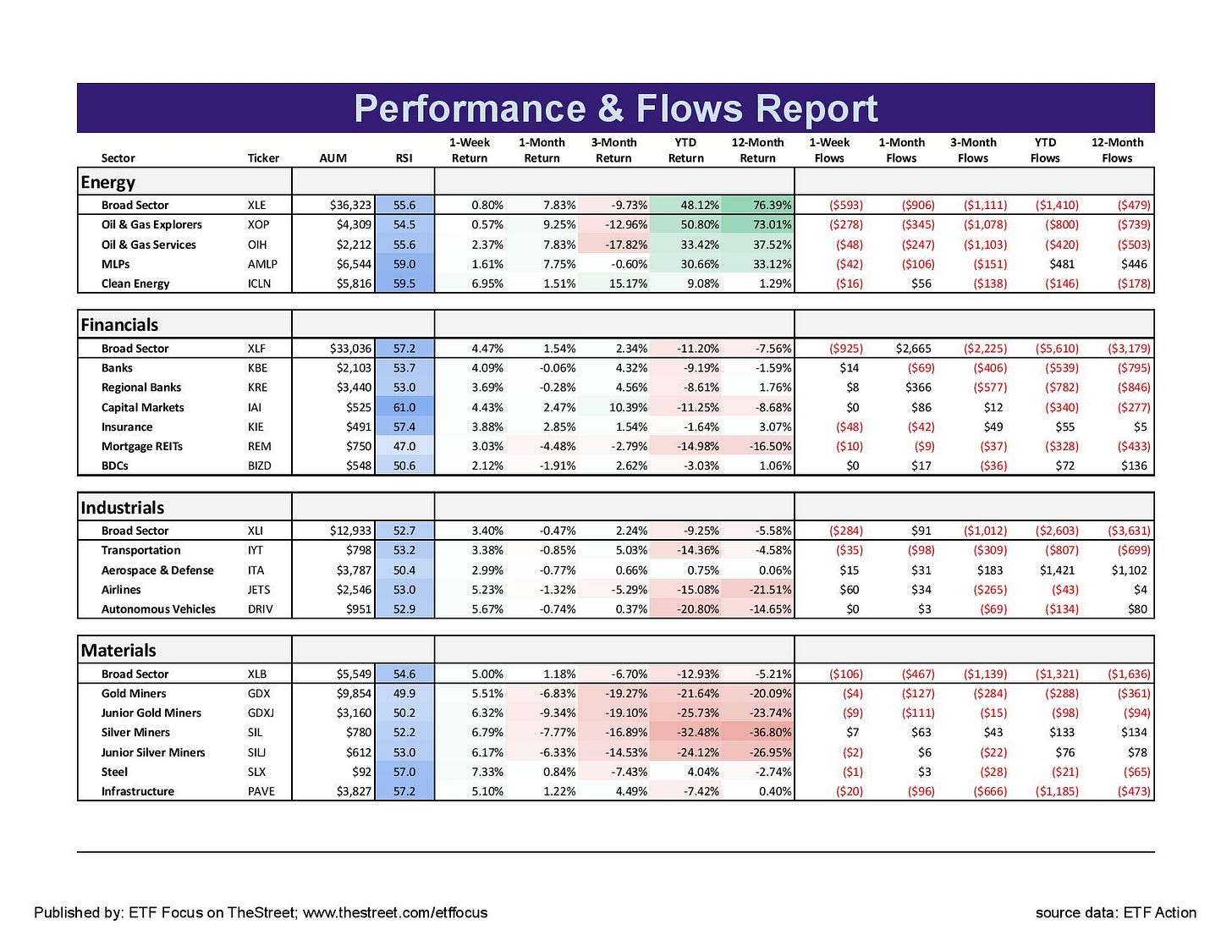

There’s also a shift happening with cyclicals. The one sector I’m finding interesting here is financials. Not only are they becoming a leader here in the United States, they’ve had a solid couple of weeks in Europe as well. Previous leaders - industrials and energy - have begun lagging a bit, although materials are still hanging in there. Cyclicals are still doing relatively well because value and dividend payers are doing relatively well, but the level of volatility concerns me a bit.

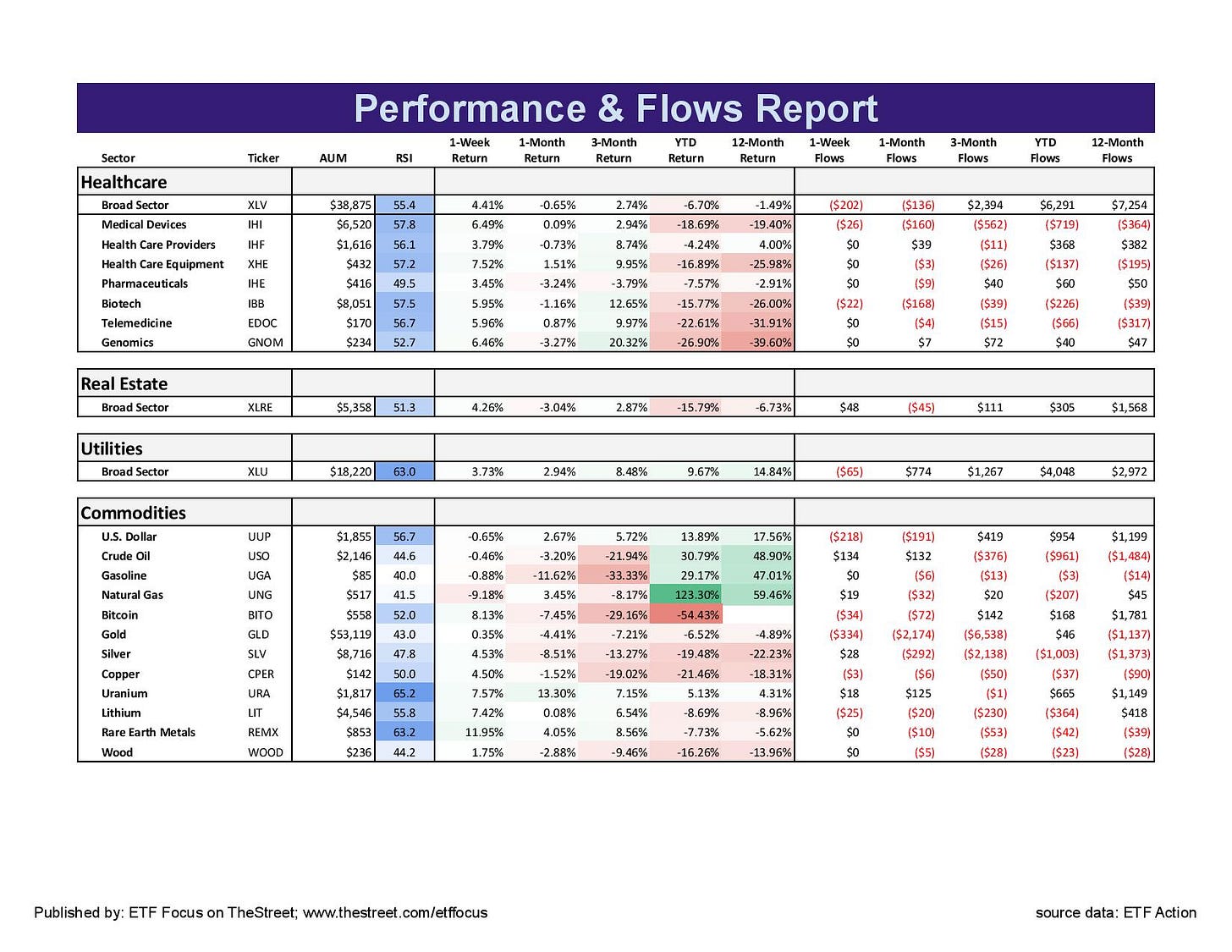

The dollar rally took a pause for at least one week, but I don’t think the rally is done. Rate hikes in Australia, Europe and Canada helped give a modest bit of support to foreign currencies, but it’s likely a blip. Given what’s happening in China and Europe, it seems unlikely that demand for dollar assets will diminish any time soon. Gold, on the other hand, is still showing no willingness to help out in this hyperinflationary environment.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!

Análisis muy interesante, como todos los que habitualmente presentas.