This Utilities/Treasuries Indicator Could Be Signaling A Market Bottom One Month From Now

This level of outperformance from these two asset classes at the same time is rare.

The financial markets remain very volatile and that's led to some wide swings in performance on a week-to-week basis. While there have been a few bear market rips along the way, 2022 has featured mostly downside between both stocks and bonds.

There have been a handful of instances where traditional risk-off behavior within more defensive asset classes has occurred. This week is one of them.

While the S&P 500 and Russell 2000 are down more than 3% this week (through Thursday), both utilities and long-term Treasuries. While gains in government bonds aren't (under normal circumstances) unusual when stocks are falling, the fact that utilities are rallying even when the broader market is declining is.

When utilities and Treasuries are outperforming by this wide of a margin at the same time is downright rare. How rare? You could count on two hands how often this has occurred over the past 20 years and have fingers left over!

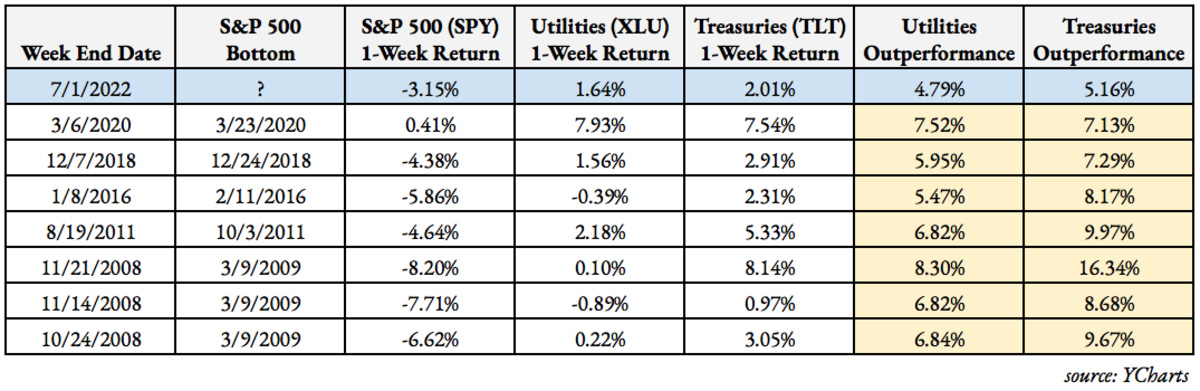

Week-to-date through Thursday, utilities are topping the S&P 500 (SPY) by 4.8% and Treasuries are outperforming the index by 5.2%. If both of these asset classes beat the S&P 500 by more than 5% this week, it'll be only the 8th time this feat has occurred since 2002!

(note: 2002 is used as the starting point since that it the inception year of the iShares 20+ Year Treasury Bond ETF (TLT), the proxy for Treasuries in this example)

The first 7 times it happened represent some pretty ominous markets.

Three occurred within a single one-month period during the financial crisis. One each happened during the 2011 market correction, the 2016 junk bond scare, the 2018 mini-bear and the 2020 COVID recession.

Of course, 2022 has already featured a bear market of its own, so this occurrence (if it were to actually happen) would occupy its own ominous period. The big question is if this means more downside is ahead.

If history is any guide, it could be indicating a market bottom just a few weeks ahead. Each instance featured further downside ahead. The financial crisis dragged on for several more months, but what's interesting is what happened in every other instance.

In 2011, 2016, 2018 and 2020, the S&P 500 bottomed within roughly a month of utilities and Treasuries outperforming the S&P 500 by 5% each.

Will it happen again? It's difficult to say because every market is unique, but it's interesting that this has happened with such consistency.