The Time Is Right To Target Higher Yields For Your Portfolio Cash

Yields of up to 1% on cash alternatives are available for minimal additional risk.

With the world’s attention firmly on what’s going on in Ukraine and the market’s fairly volatile response to it, I want to instead focus on something that I think is worth paying attention to again - dividend yield.

For years, interest rates on standard government and corporate bonds have been at or near record lows. Money market funds yield nothing. You may be able to earn more than 1% on a bank CD if you’re willing to keep it locked up for a while. Even large-cap stocks and long-term bonds have had trouble yielding more than 2%.

The environment has changed this year. Now that it appears the Fed is getting ready to launch an aggressive rate hiking cycle, the interest rate environment has at least modestly improved, especially for shorter-term bonds. If you have cash sitting in your portfolio either waiting to be put to work or just doing nothing, it hasn’t really mattered. Yields were near 0%, so there was no need to even think about it really.

Those days, however, are in the past. Today, you can move your cash up to high quality ultra short-term bonds and earn up to 1% with only a minor amount of additional risk. They don’t aim to deliver 100% preservation of principal in the way that money market funds do, so there is some credit risk or interest rate risk that could result in some share price fluctuation. In my opinion, however, the extra yield you can gain more than makes up for any additional risk taken.

I wrote about this today on TheStreet (which you can read in full HERE) and offered up 6 ETFs that fit the bill as high quality cash alternatives that can yield up to 1%.

In almost every case, the current yield on the fund is higher than the fund’s duration. As a refresher, duration is a measure of a security’s interest rate sensitivity. In theory, a security with a duration of 3 years would be expected to rise or fall in value by 3% for every 1% move in interest rates. If you’re looking for safety, a lower duration is better.

In each of these cases, the ETF could experience a fairly adverse move in interest rates and still manage to stay above the breakeven mark. Using VUSB as an example, if interest rates were to rise by 1%, the fund could be expected to lose 1% of its value. The fund yields 1.05%. If you were to hold the fund for an entire year and these values were to remain the case throughout, the total return on investment would still be 0.05%, really no worse than if you were to hold your cash in a money market fund.

Of course, there’s no guarantee that you’ll come out ahead with an ultra short-term bond ETF. These funds did experience some significant declines during the early days of the COVID shutdown, so there’s still a small possibility that you could lose money. Overall, however, I feel that yields have climbed enough over the past several months that it’s now worthwhile to at least consider them again if you’re looking to get a little yield boost on that cash that’s just laying around.

With that being said, let’s look at the markets and some ETFs.

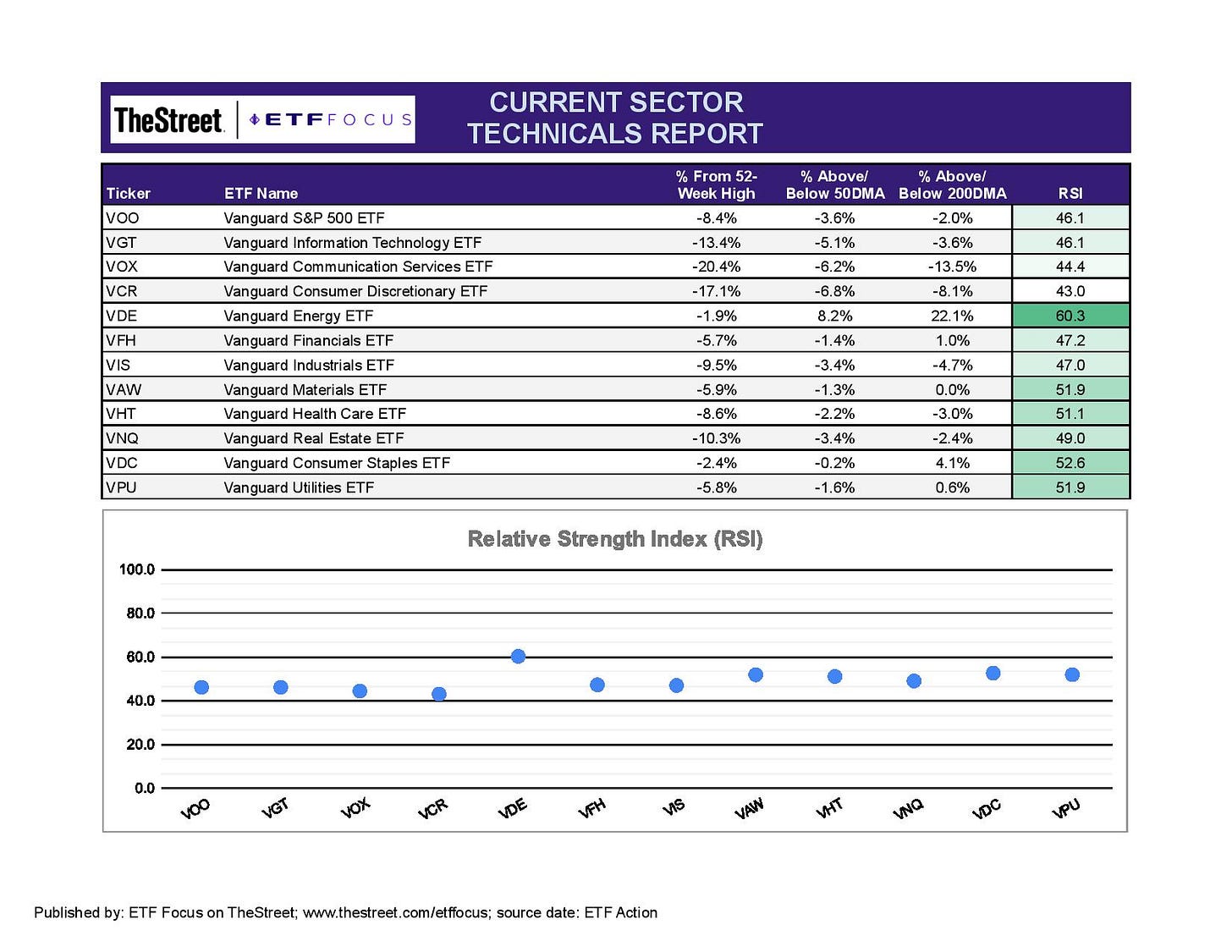

With U.S. equity prices swinging so violently over the past week, the one thing that’s stood out to me is that most sectors are kind of all bunched up in the middle in terms of short-term relative strength. Outside of energy, which is still looking a little more favorable than the others, every sector is pretty much neutral at the moment. Stocks tend to be a little more highly correlated during sharp market moves (i.e. in a big decline, everything tends to get sold off) and that could be what we’re seeing here. There’s no real discernible trend that helps us understand whether it’s growth, cyclicals or defensives leading at the moment.

One group that is leading at the moment is small-caps. That’s a good sign for anyone hoping to look for a near-term bottom following the current correction. Small-caps started underperforming in the lead-up to 2022’s pullback, so a subsequent reversal of that trend could also be a bullish sign. On the other hand, with the Russia/Ukraine situation causing so much uncertainty, both politically and financially, I’d be very careful about trying to pick any tops or bottoms or trying to identify any trends. Any further aggression or easing of tensions could result in another sharp move in risk asset prices either way. It may be better to just sit and watch for the time being.

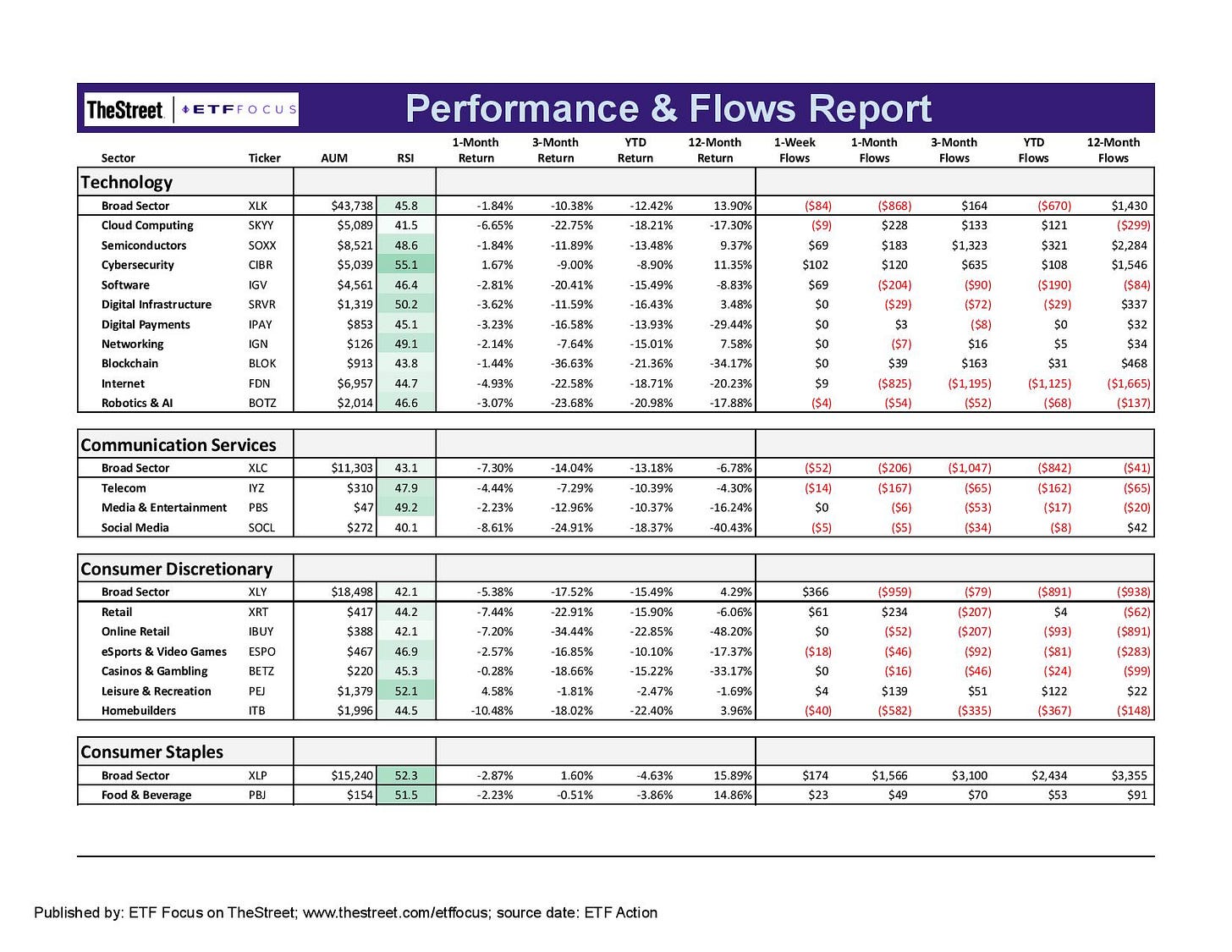

Again, if you drill down into market subsectors, there’s still almost nothing that’s either strong or weak here. The consumer discretionary sector seems to be the toughest to figure out. After sharply underperforming the S&P 500 from November through January, it rebounded and looked ready to potentially regain some of that underperformance. But last week, it was the worst performing market sector again. If you exclude inventory builds, retail sales weren’t particularly strong in January and the specter of inflation seems to suggest that a downswing in consumer activity may be imminent. I imagine that’s at least some of what we’re seeing here, but this sector seems to be as much a gamble as an investment at the moment.

Tech stocks still can’t get it going. Valuations are still getting deflated and it looks like interest rates might not be done rising, which would help turn that trend around. We’ve seen tech stocks in the past get scooped up in times of market uncertainty as something of a safe haven trade, but we’re not seeing that this time around. Communication services still has plenty of work to do to demonstrate that it’s ready to lead. This sector has been absolutely in the toilet since September and I’d be hesitant to trust it here.

Consumer staples is looking OK relative to its defensive sector counterparts, but it looks like it’s recent run is starting to fizzle out. I’m still hopeful that it has another leg in it since dividend stocks are seeing something of a revival, so I wouldn’t count a rebound out just yet.

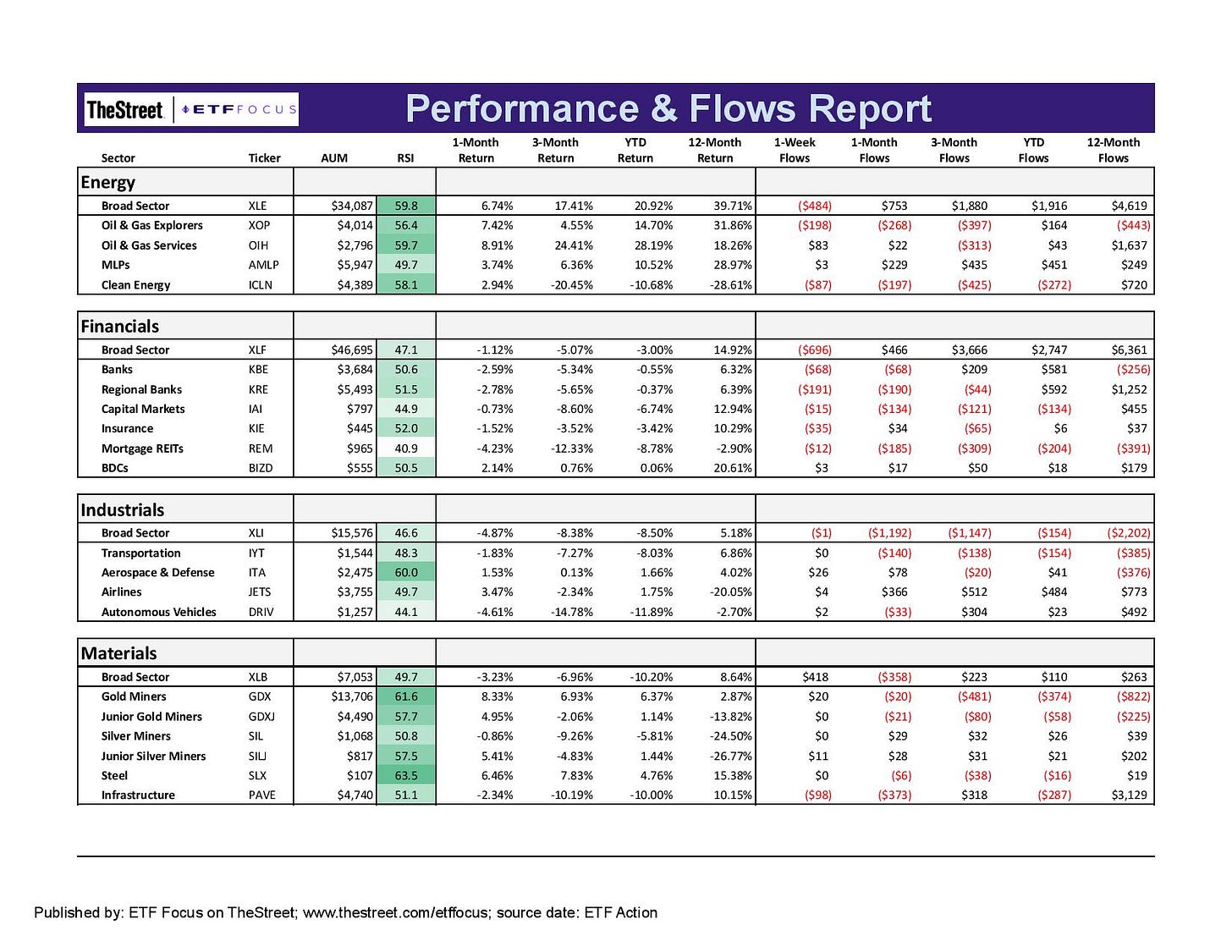

We see a little more differentiation within the cyclical sectors and it’s mostly what you might expect to see. Aerospace & defense stocks are having a nice little run following the events in Ukraine. Gold & silver miners are still looking pretty solid here as precious metals finally start behaving like the safe haven trade many believe it is. Oil stocks continue to be one of the best performing market groups as crude oil prices creep closer to the $100 a barrel mark.

Financials look like their time may be running out. Treasury yields plunged on Monday following the weekend’s events in eastern Europe. The performance of this sector relative to the broader market remains highly correlated with the direction of interest rates. Treasuries may finally be getting some significant safe haven trade interest and that’s likely a net negative for bank stocks in the near-term.

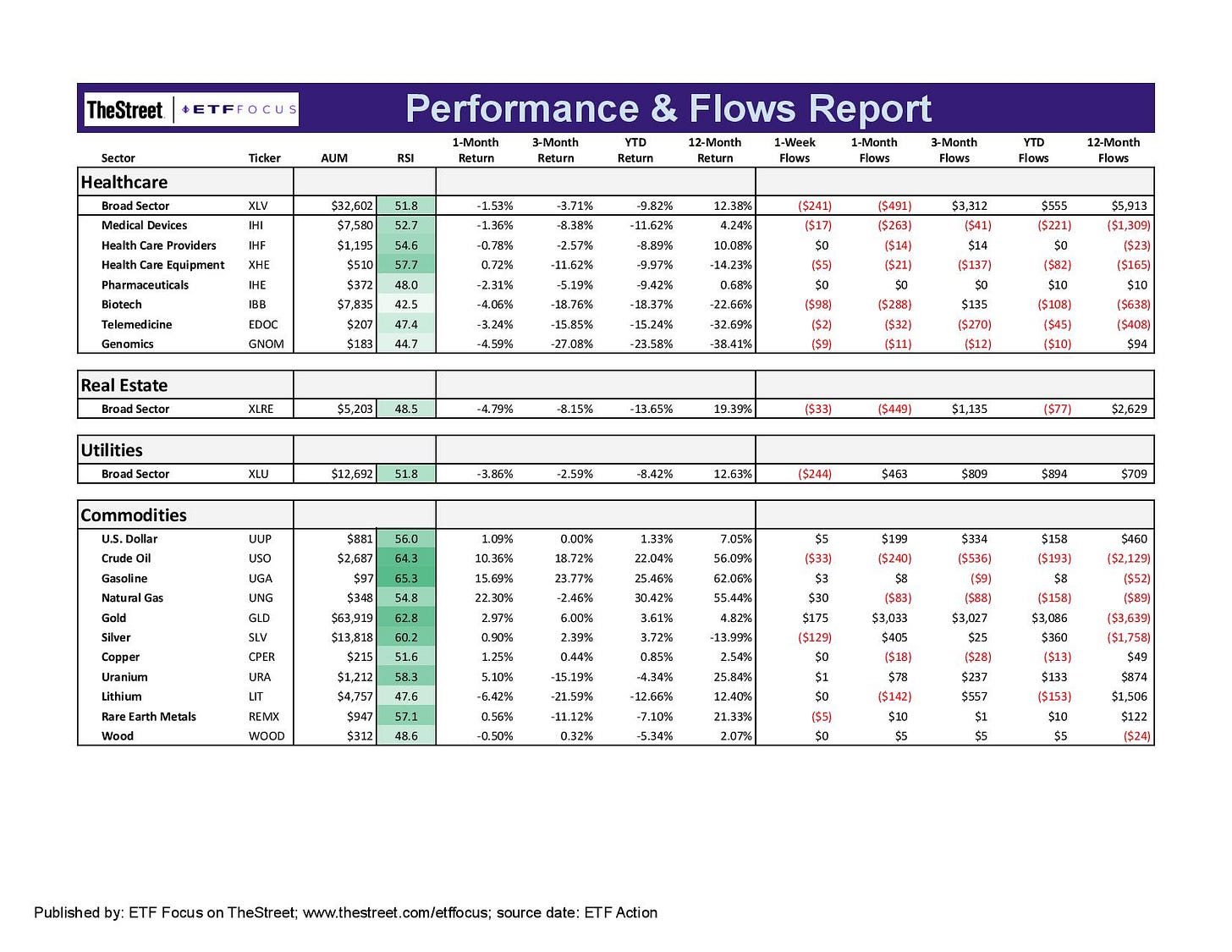

Healthcare has slowly and quietly been outperforming here. If you pull the telescope back a bit, healthcare has been outperforming since around November, albeit in a pretty choppy fashion. I think utilities is trying to make a bit of a comeback here, but I’m just not seeing a lot of strength in the move. I think if the status quo remains in Ukraine, we’re probably looking at some favorable conditions for this sector to do well, but if we see the two sides stand down, I imagine that will be very bullish for risk assets.

Commodities are still the big trade here. Many of them were already trending higher and the economic sanctions against Russia are likely to keep driving prices up. Crude, natural gas and gasoline have the biggest potential for sharp price increases if global governments decide to seriously sanction the energy sector. Steel stocks have done quite well lately. Russia is actually a big exporter of wheat. Prices there have risen by about 15% in less than two weeks. Commodities, in general, are likely to keep trending higher as long as strict economic sanctions remain in place that dry up supplies and tighten supply chains.

Read More…

6 Higher Yielding Cash Alternatives For Your Portfolio

4 Vanguard Bond ETFs For Every Market

ARKK: Are Investors Moving Back In?

ETF Battles: It’s QQQ vs. SCHG vs. VOOG! Which Growth ETF Is Superior?

VTI vs. ITOT: Comparing the Vanguard & iShares Total Market ETFs

DEM: 6% Yield Opportunity In Emerging Markets

29 Energy ETFs Ranked For 2022

If You Need Downside Protection, Buffer ETFs Are Having A Moment

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!