The Narrative For 2022 Is Set, But 2023 Could Be Trouble

The Fed will almost certainly raise interest rates and end asset purchases, but that could usher in a bear market 12 months from now.

Last week, we got more data that essentially confirms what we already know. The U.S. consumer is finally getting fatigued by rampant inflation and the economy is officially beginning to slow. December’s retail sales number, which showed a decline of 1.9% month-over-month, will generate arguments as to why it unexpectedly fell (holiday sales in November and higher inflation), but the bigger takeaway is that slowing global economic growth is here. It’s expected that the U.S. economy will have grown by about 6% in 2021, but will slow to about 3.5% in 2022. Omicron is likely to blame for at least part of the December retail sales miss as consumers probably stayed home, but the days of big post-recession growth are likely over. The current rotation out of growth stocks confirms as much in investors’ eyes.

This is what I think we know for sure in 2022.

The Fed is going to raise interest rates multiple times. I was originally in the camp that thought there was going to be 3 hikes - June, September and December - but now I’ve moved into the 4 hike camp. I know it’s not guaranteed, but I think a March hike is a done deal as are hikes in June and September. December is the only one I have minor questions about given that it’s a long time from now and the Fed has historically hit the brakes at any sign of trouble. They seem pretty firm in their tone now, but a faster than expected slowdown or a bear market could cause them to do some second-guessing.

GDP growth will slow towards 3% from around 6% in 2021. Even in a slowdown scenario, this is still growth above long-term trends, so any recession talk this year seems pretty unlikely. The real risk is the economy slowing to closer to 2% in 2022. That would probably require a more prolonged period of negative real wage growth that results in consumers actually spending less money. December’s -1.9% print could be the beginning of a larger trend.

Inflation peaks at around 7% and before declining closer to 3% by year-end. That number may creep just a little bit higher before all is said and done, but I think this is about as high as it gets. As the low base effects wear off and current supply chain issues begin to ease, this should fall to a more manageable level in 2022 and probably fairly close to the Fed’s 2% target in 2023.

If taken together, we’re looking at an economy featuring 3-4% GDP growth and 3-4% inflation by year-end. In a vacuum, those are numbers that can support higher equity prices, but, of course, we don’t live in a vacuum. The Fed will be aggressively raising interest rates during this time, which is traditionally a bad time to do so if both inflation and growth are slowing. The risk is that the modest growth & modest inflation environment for 2022 turns into a zero-to-low growth & zero-to-negative year-over-year inflation environment. That would mean the Fed went too far, too fast and would need to probably do a full-on about-face on policy. If that were to occur and we start heading towards deflation, I wouldn’t be surprised (and almost expect) stocks to fall by 20% or more.

Early earnings reports from the big banks suggest that may be where we’re headed. JPMorgan Chase and Goldman Sachs are already down 10% from their 2022 highs. The common factor between the two reports? Higher than expected expenses, mostly in terms of staffing and compensation. If this is more of a widespread issue (and it seems fairly reasonable that it could be), then the earnings landscape for much of the year could be setting up for disappointment and that rapidly slowing growth thesis begins to look more likely.

I don’t think that means anything imminent is likely to occur. Despite losses in large-cap, growth and tech stocks during the first few weeks of the year, volatility levels look mostly contained. If the VIX remains around the high teens to low 20s range, that could be a dip buying opportunity for traders. If volatility picks up or credit spreads start widening (no immediate indication of that either), the warning sirens will start to go off.

With that being said, let’s look at the markets and some ETFs.

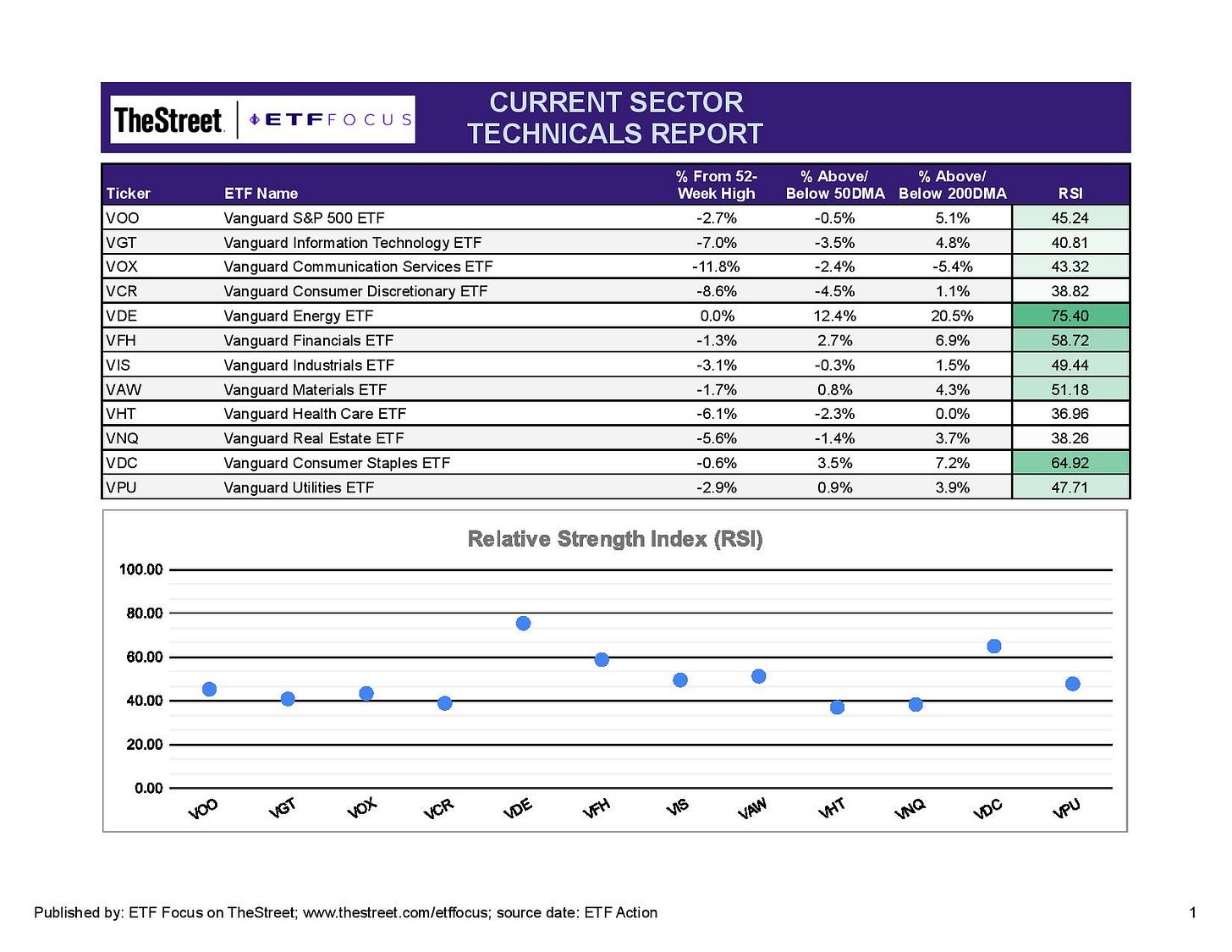

Market leadership looks pretty narrow here. The energy sector has been the runaway top performer during the early weeks of 2022, although they have moved pretty firmly into short-term overbought territory. Consumer staples is the only other major sector displaying firm strength here. Traders typically opt for utilities stocks in more of a traditional risk-off move, so I view this as more evidence that we’re still in the midst of a market rotation instead of a broad sell-off. The outperformance of staples is in line with the leadership from value and dividend stocks.

Financials were looking OK through the end of last week, but the banks have been the only real outperformer within the sector. Bank earnings look disappointing so far, so I imagine any short-term strength that’s developed is about to dissipate. Growth stocks are still looking pretty weak here as are most defensive sectors. If the cyclicals are unable to hold here, we might be entering more of a risk-off period.

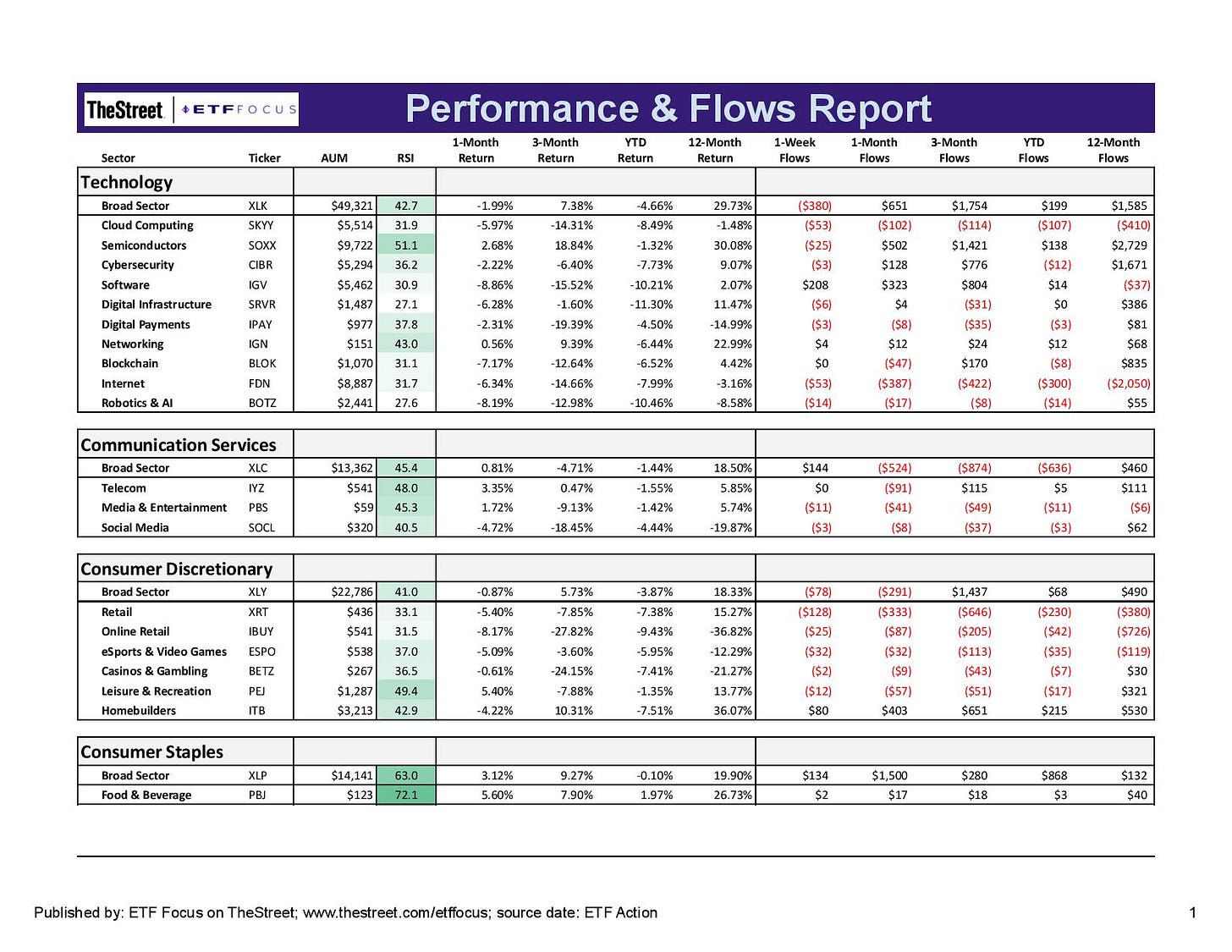

Within the growth sectors, there’s not a whole lot to like. The leisure and recreation stocks have been doing good in anticipation of the omicron variant declining and seasonal travel demand picking up. Semiconductors are still leading within the tech space, but its position as a market leader looks like it’s faded into the past. Within communication services, traditional telecoms have performed best, but not to any major degree. Short-term net flows have turned negative as well indicating that investors are abandoning their safe spots.

Flows into consumer staples, however, are looking solid following strong recent performance.

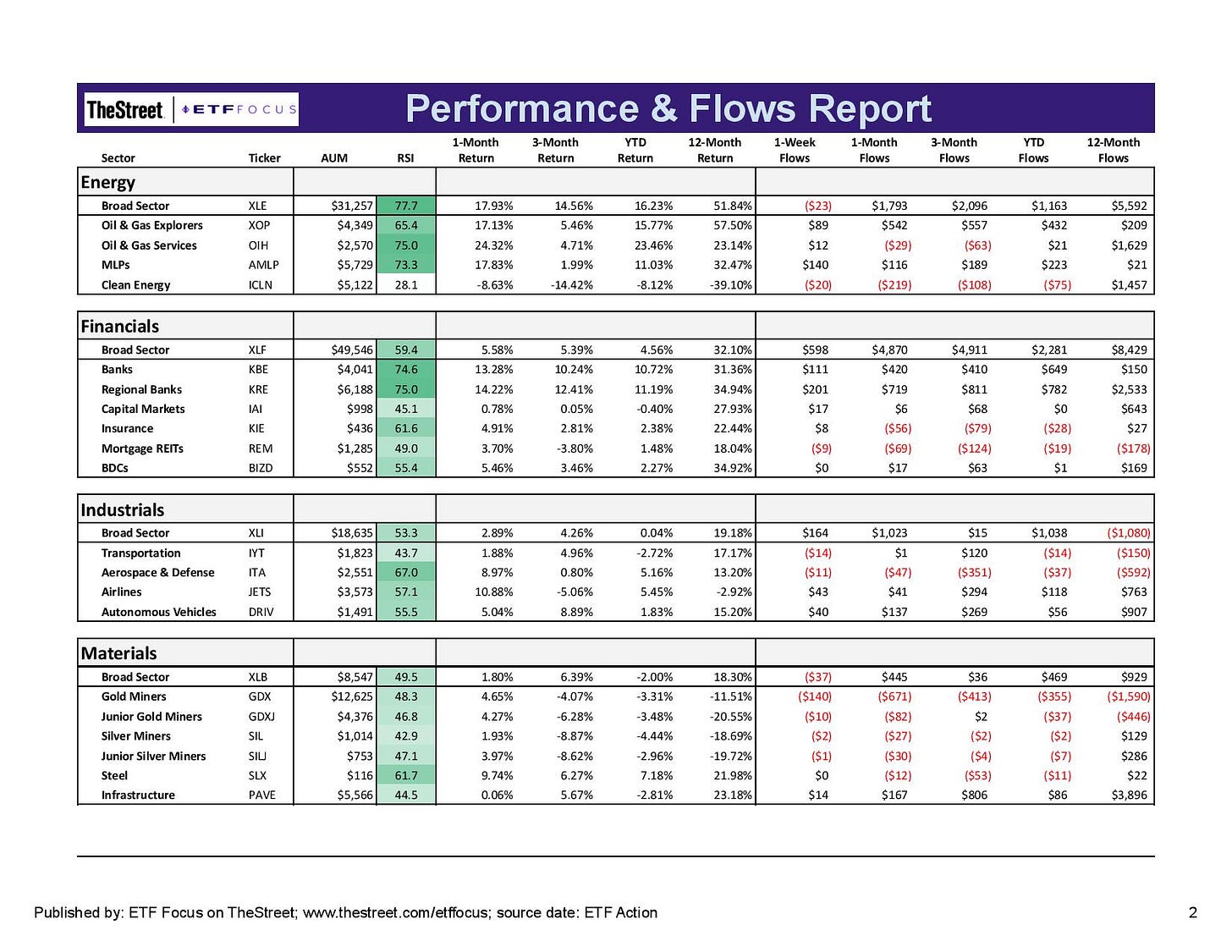

The energy sector has been the market’s clear favorite over the past several weeks with all of the major oil-related subsectors pushing higher by 20% or more in some cases. The broad energy sector, led by a combined 40% allocation to ExxonMobil and Chevron, has pushed well into overbought territory as have MLPs. Clean energy, on the other end of the spectrum, has been one of the market’s worst performers.

The performance in the financials sector, as mentioned earlier, has been dominated by the rate-sensitive banks. Other groups have been good, but not great, performers, although rising interest rates have been the tide that lifts all boats in this group. Early bank earnings results have been quite mixed, so I expect to see some of this short-term strength go away pretty soon.

Industrials and materials continue to do relatively well, even if they’re being overshadowed by other cyclical areas of the market. The precious metals miners are still struggling to get things going as gold and silver fail to generate any momentum. Industrial commodities, including lumber and steel, however, continue to look strong.

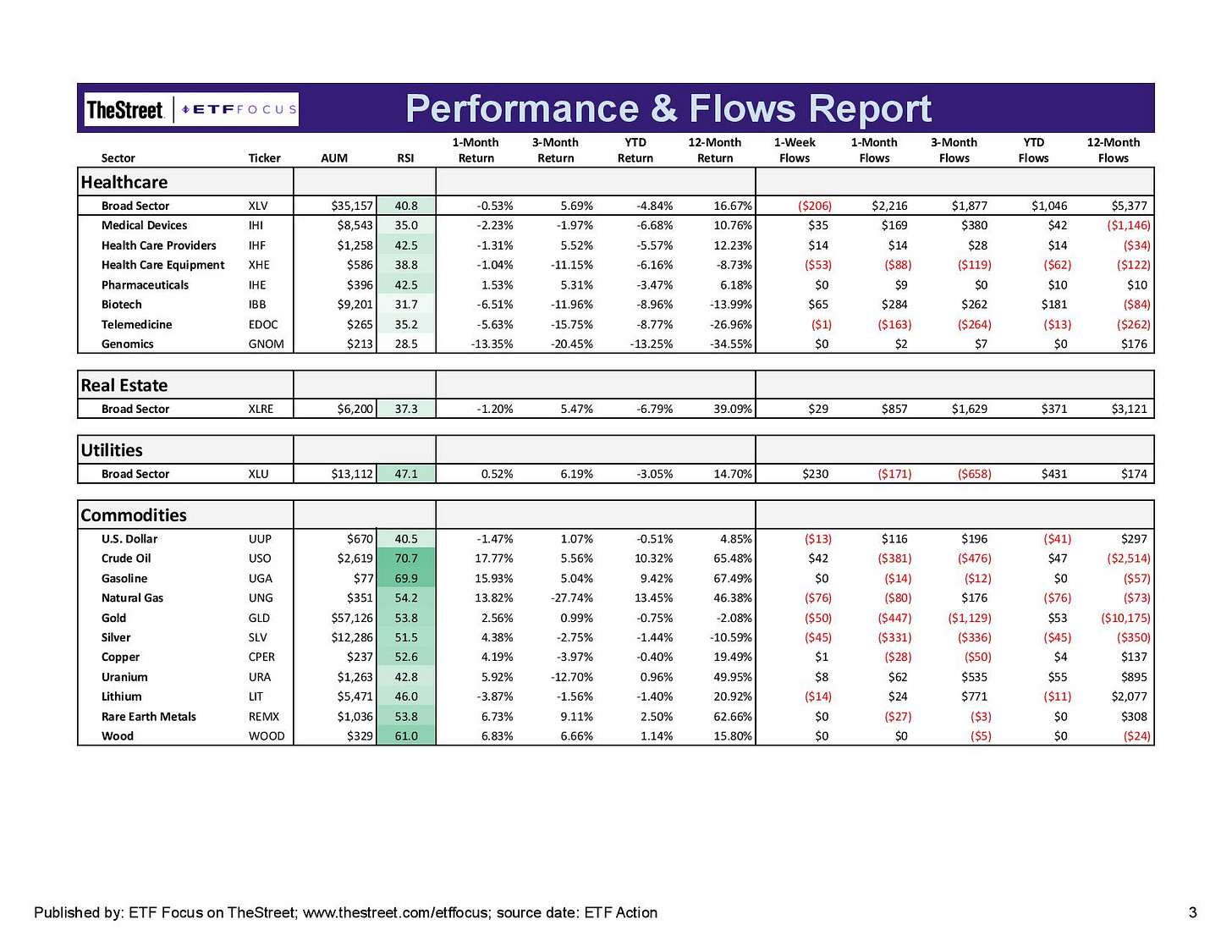

After showing modest strength, investors are mostly rotating out of defensive sectors again, save for consumer staples. Utilities, which tend to be the traditional signal of how bullish or bearish investors are at any given moment, show that they’re still favoring equities, in general, even though which areas they’re favoring are changing. Real estate will likely keep lagging here if rates move higher.

The dollar has given up recent gains and begun to reverse course. Tighter policy conditions and higher interest rates should serve to push the dollar higher, but higher global yields have been giving a boost to other global currencies, including the pound and even the euro.

Most other commodities are benefiting from the pivot to cyclicals with even gold and silver seeing a little action to the upside finally.

Read More…

Top 7 High Yield Covered Call ETFs For 2022

Top 5 Cloud Computing ETFs For 2022

The ARK ETFs Are Getting Pummeled, But This One Still Looks Interesting

This ETF Is Making QQQ Irrelevant

The Fed Has Been Playing With Fire. Now, It's Getting Burned

Top Performing Dividend ETFs For 2021

Top 7 Dividend ETF Picks For 2022

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!