The Market Rejected Powell's Attempt At Reflating Stock Prices. This Is Not Insignificant.

It's the strongest indication yet that investors don't want to hear from Powell anymore.

If you like market volatility, you probably loved last week. The Fed meeting that occurred during the middle of the week provided all the fireworks that were needed. The post-meeting Wednesday rally followed the Thursday turnaround was one of the biggest 2-day swings the market has seen in years. All told, the Dow traded in a range of more than 1,600 points. The VIX has closed above 30 for the 7th time in the past 8 trading days.

The Fed meeting provided the impetus for last week’s volatility, but we have one person in particular to thank: Jerome Powell.

He took the opportunity to give risk assets a boost with one simple sentence. “A 75 basis point increase is not something that the committee is actively considering.”

The markets had been pricing in a 50 basis point increase at the May meeting and a 75 basis point hike at the June meeting. Investors hearing the Fed wasn’t considering a 75 basis point hike began thinking that it might be off the table in June as well. Fewer rate hikes would be bullish for risk assets and stock prices took off.

There was one problem though. They couldn’t hold on to Wednesday’s gains.

It’s tough to ascribe reason to any single day’s trading action, but this one seemed pretty clear. If investors were dreaming about stocks staging a comeback rally on Wednesday, it seems like they came to their senses on Thursday.

This is an important point to bring up because it stands in contrast to how we’ve seen the market behave over the past few years. Whenever the Fed had taken a dovish tone, whether it’s indicating that interest rates would remain lower for longer or stating that QE would continue indefinitely, the equity market always rallied.

Not this time though. The markets bit on the carrot that Powell had dangled, but they spit it right back out.

The reaction itself was entirely appropriate. The markets are expecting the Fed Funds rate to hit 3% within the next year. Whether or not Powell says a 75 basis point increase was on the table for the June meeting, the Fed is still going to be raising rates significantly for the next several quarters. The overall narrative never changed. The Fed Funds rate is moving significantly higher. The Fed balance sheet will begin winding down. The economic slowdown is happening quickly and recession may yet be on the horizon. A 50 basis point hike or a 75 basis point hike at the June meeting doesn’t change that.

For the first time in a long time, the markets roundly rejected Powell’s attempt at dovishness.

This reinforces how negative sentiment is in risk assets right now. If we’re looking for silver linings, extreme bearishness could be a sign of capitulation. If that’s the case, we could be setting up for an environment where risk assets stage an oversold rally. If equities rally, it could open the door for a rebound in bonds as well, where the 10-year Treasury yield has risen by 150 basis points just this year.

Beyond a near-term dead cat bounce, I’m skeptical of where risk assets are headed throughout the remainder of 2022. If inflation starts coming back down to earth, that will no doubt be a net positive for risk assets, but the economy would possibly still be headed towards recession. Environments where interest rates are rising sharply in an economy that is slowing quickly usually don’t turn out well.

It’s an interesting (and well-earned) indication of the market’s lack of confidence in Powell. The overwhelming consensus is that the Fed has been way behind the curve in adjusting monetary conditions with changes in the economy. Powell’s words used to inspire a short-term reaction in the financial markets. Last week’s action tells me that investors don’t want to hear it any more.

ETF Sector Breakdown

With that being said, let’s look at the markets and some ETFs.

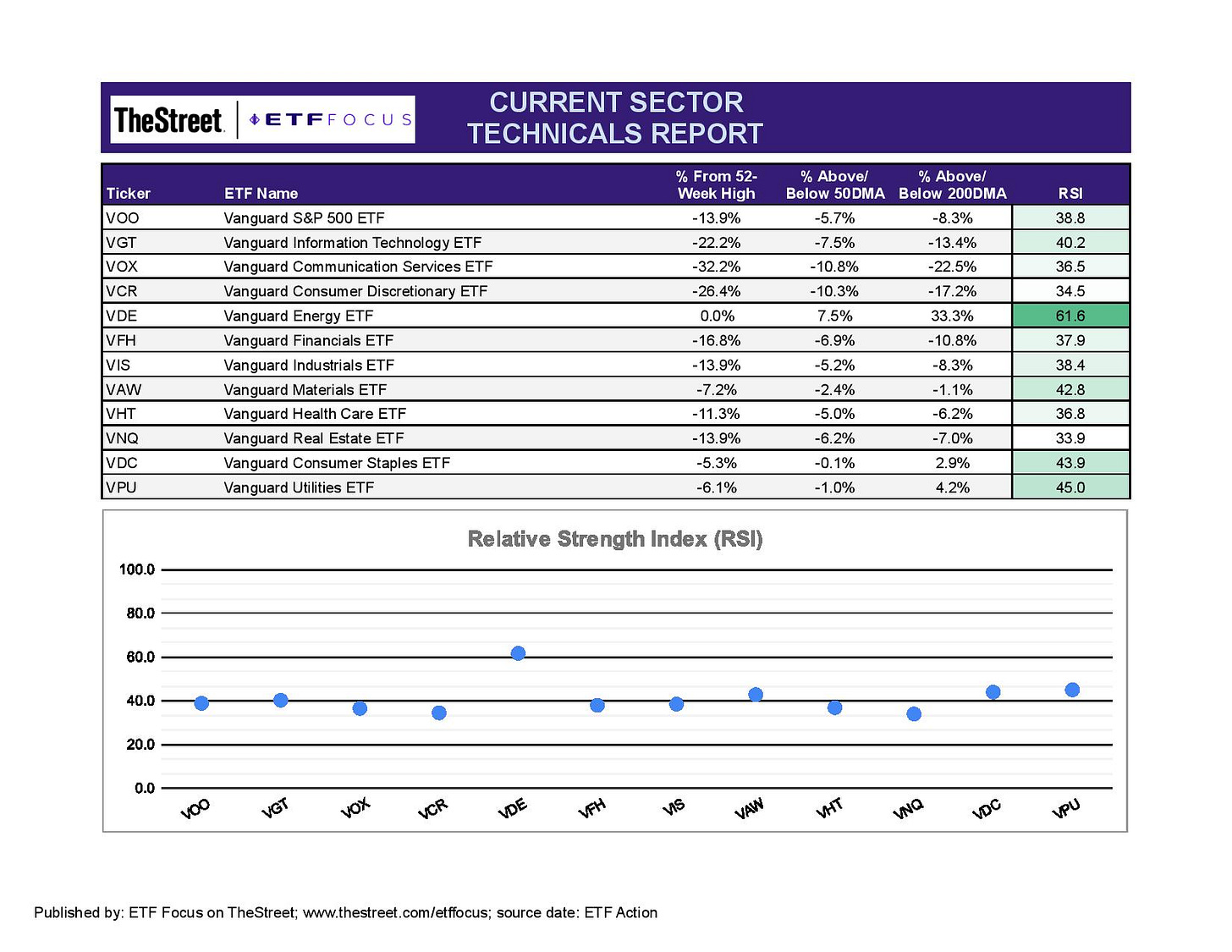

Over the past couple weeks, there were four sectors that were the clear leaders in this market - energy, materials, utilities and consumer staples. The latter two have fallen even though they’re still managing to stay ahead of the S&P 500. Materials have turned mixed as the bull market in certain commodities, notable industrial metals, is starting to fade. That leaves energy as the only one of the 11 major sectors that’s displaying anything resembling strength. The sector is still at a 52-week high and the only one within 5% of that distinction.

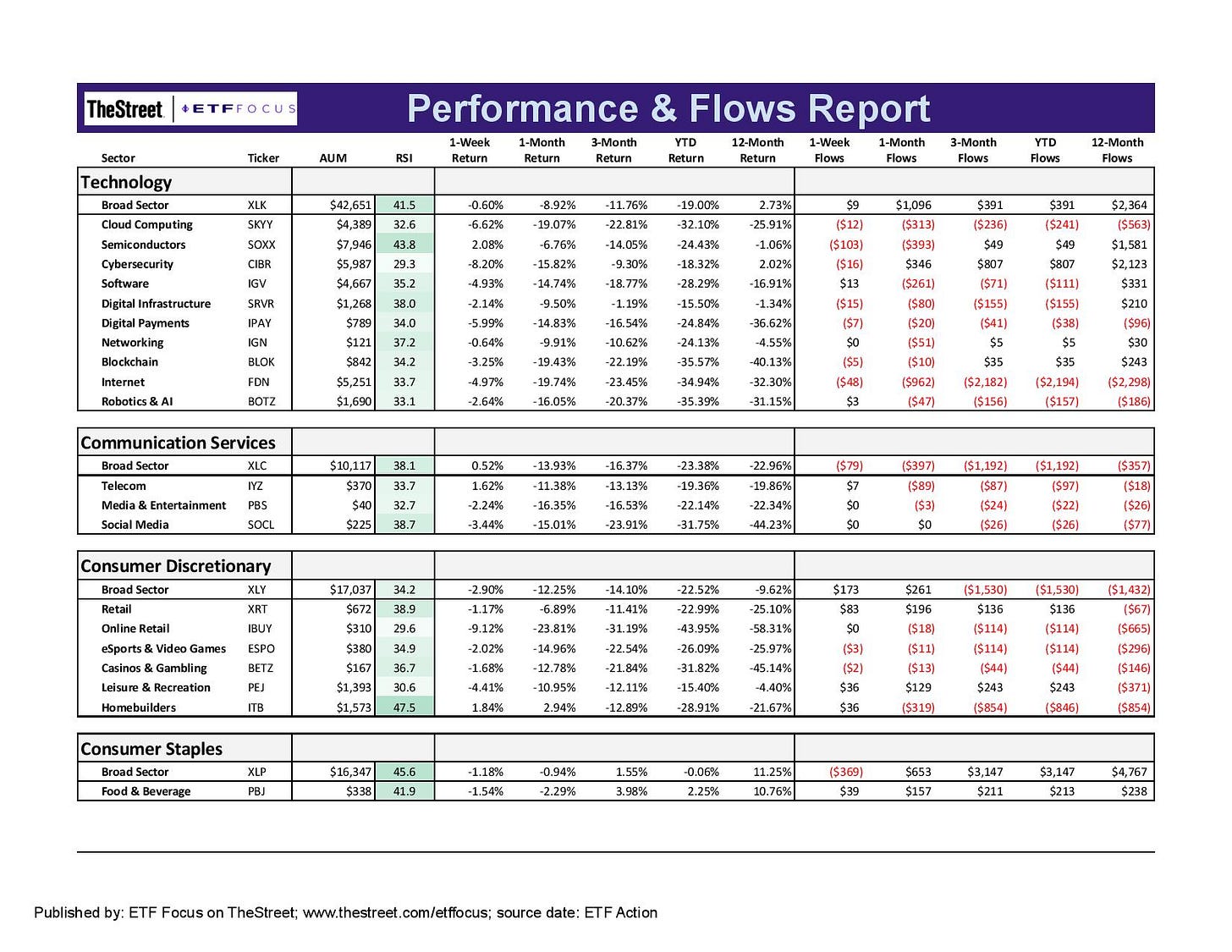

Growth sectors continue to break down hard. Higher interest rates are clearly impacting valuations here, but we’re also seeing idiosyncratic risks rising too. Amazon confirmed the slowdown we’re already seeing in retail, particularly the online channel. Apple warned of potential trouble ahead due Chinese supply chain risks. Alphabet missed on its quarterly earnings. Even the biggest names in the U.S. economy haven’t been immune to what’s happening right now and there was a lot of excess to be unwound.

There’s weakness all along the growth stock landscape, but there are a few subsectors that have flip-flopped. Cybersecurity, which along with digital infrastructure, had been outperforming the rest of the sector, has now turned into one of the weakest groups of the past couple weeks. Semiconductors had a relatively better week than the rest of the tech sector, but they’ve had some ground to make up. It’s interesting to see that inflows in the broad technology ETF remain positive even though performance has been lagging and most of the subsector ETFs have been experiencing outflows. This could be an indication that there’s still some positive sentiment here.

Homebuilders had a nice rebound last week, but I wouldn’t buy into too much. The macro backdrop for this sector is still overwhelmingly negative and the group was due to for at least a modest dead cat bounce. Home construction still appears to be strong for the time being, but it’s also driving headfirst into an environment where demand is quickly drying up. Weakness in online retail is, of course, a reflection of current consumer sentiment, but also an indication of people getting out and back into brick-and-mortar stores. There’s some unwinding from the COVID pandemic boom to be done here.

Talks of embargoes on Russian oil sent crude prices higher again and that was more than enough to reflate energy stock prices. Even as this sector continues to get pushed higher and higher, there’s a bull case for further gains as the Russia/Ukraine conflict drags on. As the summer travel season heats up, demand for crude and gasoline will remain high. Until the war in Ukraine ends, we may not see a meaningful pullback in crude oil prices.

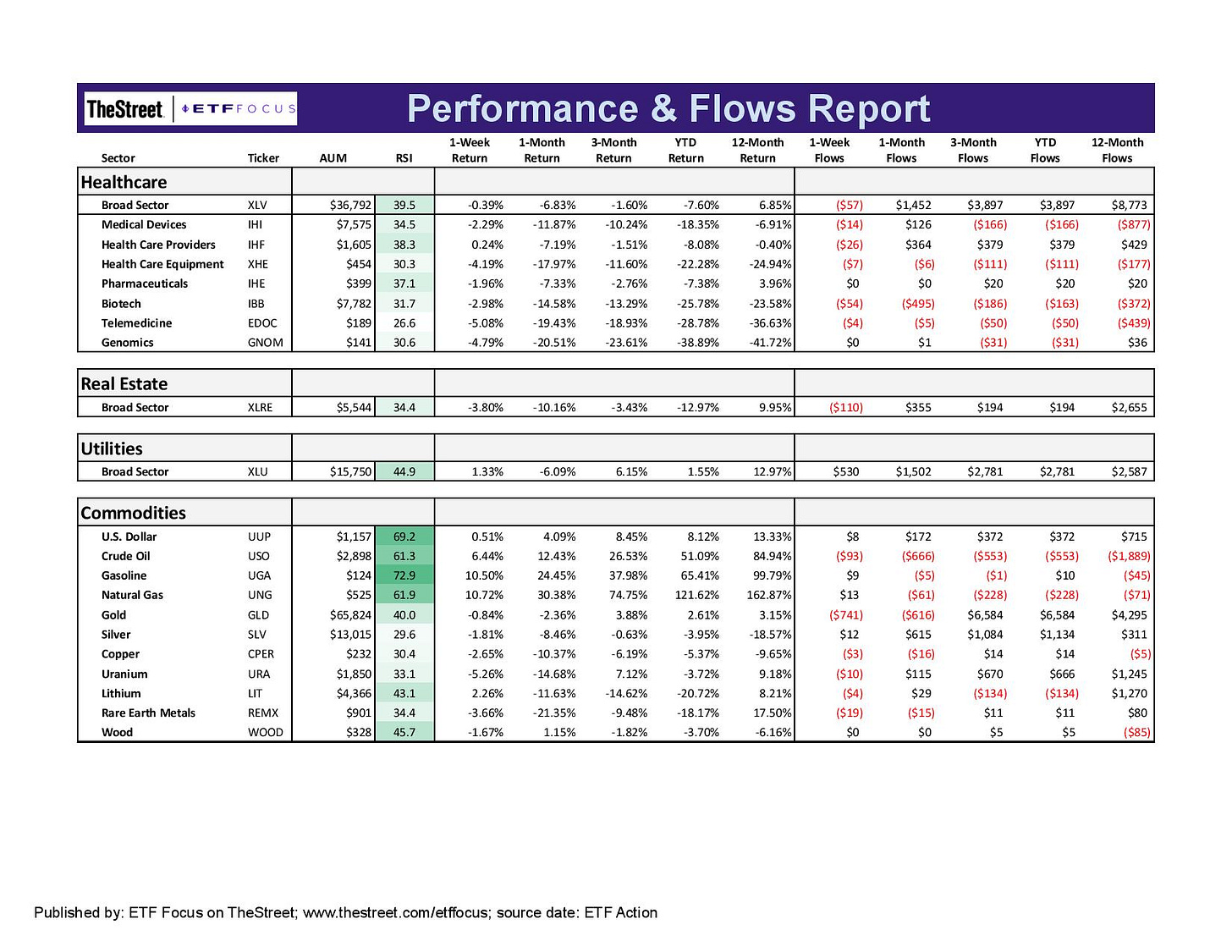

Banks are finally recovering from oversold conditions, but the environment for financials is still poor. Industrials have held up pretty well overall throughout 2022 with certain “theme” subsectors, such as aerospace & defense, doing especially well. The manufacturing data continues to trend in the wrong direction, however, and I suspect there will be some pressure on cyclicals and their ability to generate gains. Materials have cooled a bit from their outperformer status, but I wouldn’t write the sector off just yet. Several commodities have pulled back significantly from their highs, but the Russia/Ukraine situation and the supply chain issues in China could add support.

Healthcare is succumbing to some of the more speculative areas of the sector. Genomics, biotech and telemedicine are underperforming as anything of the “next-gen” variety gets sold off. The more defensive areas of the market, including consumer staples and utilities are still outperforming the broader area of the market, although the degree of outperformance has been weakening.

The dollar and crude oil have been the two asset classes to deliver big gains this year. The greenback gets the tailwind from the Fed, who plans to raise interest rates at a much faster clip than virtually all other major market central banks. That likely remains the base case until either the Fed or another major central bank makes a policy pivot and turns either dovish or hawkish.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!