The Last 3 Rate Hike Cycles Ended Badly. This One Probably Will Too.

The Fed’s likely inability to effectively navigate the economy through this environment is what makes stocks very dangerous to own here.

With every new piece of inflation data and every market reaction from bond traders, one thing becomes blatantly clear - the Fed has really let this thing get away from them. It’s amazing to think that as of this point today, interest rates are still at 0% and the Fed will buy another $30 billion in Treasury securities in February even though the inflation rate is at 7.5%, Treasury spreads are plummeting and GDP growth expectations are getting slashed. I don’t expect to see any kind of emergency rate hike this week from the Fed, but, if it’s truly looking to solve this inflation problem, it’s going to need to hike rates so aggressively that’s it almost certain the central bank is going to overshoot. History has shown us that the Fed only acts months, if not quarters, in arrears, long after the damage has been done.

I’ve shifted my base case scenario to a 50 basis point hike in March from expectations of a 25 basis point hike. I had believed that the Fed’s first rate hike of the cycle would be a gentle one similar to what happened in 2016, when the Fed raised a quarter-point and then waited a full year before hiking again. The data, however, is so overwhelming at this point that I think they have to raise by 50 basis points and end QE immediately. Anything less would probably lead to a sell-off in equities. Anything more and the markets probably price in higher shorter-term recession risk. The Fed is really trapped at this point and is going to need to choose between inflation and growth. I don’t see a scenario in which they can have both.

The Fed’s likely inability to effectively navigate the economy through this environment is what makes stocks, in my opinion, very dangerous to own here. The Fed has launched three rate hiking cycles over the past quarter century and each one has ended in huge losses for the S&P 500.

The most recent cycle was 2017-2018, where the Fed finally started to raise interest rates following the financial crisis. It started with a single rate hike before progressing into steady quarterly rate hikes throughout the subsequent two-year period. Recessionary worries started building, first in Europe and then in the United States, in early 2018, but the Fed kept pushing rates higher. It culminated in the 2018 “mini bear” during the 4th quarter of the year that saw stock prices drop 20%. The Fed’s sharp dovish pivot pushed stock prices higher again fairly quickly, but it was another example of the central bank’s lackadaisical approach to policy.

Before that was the 2005-2006 cycle, which saw the Fed raise the Fed Funds rate at an incredibly fast pace. The housing market was hot and economic growth was solid for a while. Then growth cooled and the housing market collapsed. To be fair, the Fed did stop raising interest rates before stocks started their decline, but the excesses had already begun building by that point. Then, of course, was the tech crash. The Fed tried tightening again, but continued tightening even after sentiment had turned on tech stocks and stock prices began falling.

You can assign varying degrees of blame to the Fed in each of these scenarios, but it does demonstrate a consistent inability of the central bank to successfully strike a balance between slow, steady growth, inflation and the general health of financial conditions. The Fed has a history of a “bend until it breaks” approach and the current environment may be the most shining example of them all. Even as economic growth was recovering rapidly and the unemployment rate has falling, the Fed continued with 0% interest rates and tens of billions of dollars worth of QE. “There’s no inflation” and “inflation is transitory” were the justifications even as it seemed inevitable that all this liquidity was eventually going to lead to something negative. Inflation did show up and the Fed did all it could to talk it down, but the year-over-year rate is now at 40-year highs and may not have peaked just yet. Now, we’re nearly through an economic cycle and the Fed has just now decided to raise interest rates for the first time - into a period of economic decline and heightened recessionary risks. Maybe the Fed steers us through this, but I see no reason to believe that this likely won’t end up being a big mess again.

The bond market is already showing us that it’s very concerned about the possibility of recession. The 10Y/2Y Treasury spread has plunged to 40 basis points, its lowest level since June 2020.

As I say often, the bond market gets it right far more often than the stock market does. We’d be wise to pay attention to the signals. It’s possible stocks squeeze out more gains in the short-term if the Fed doesn’t surprise on its policy decisions, but the bill looks like it’s about to come due.

With that being said, let’s look at the markets and some ETFs.

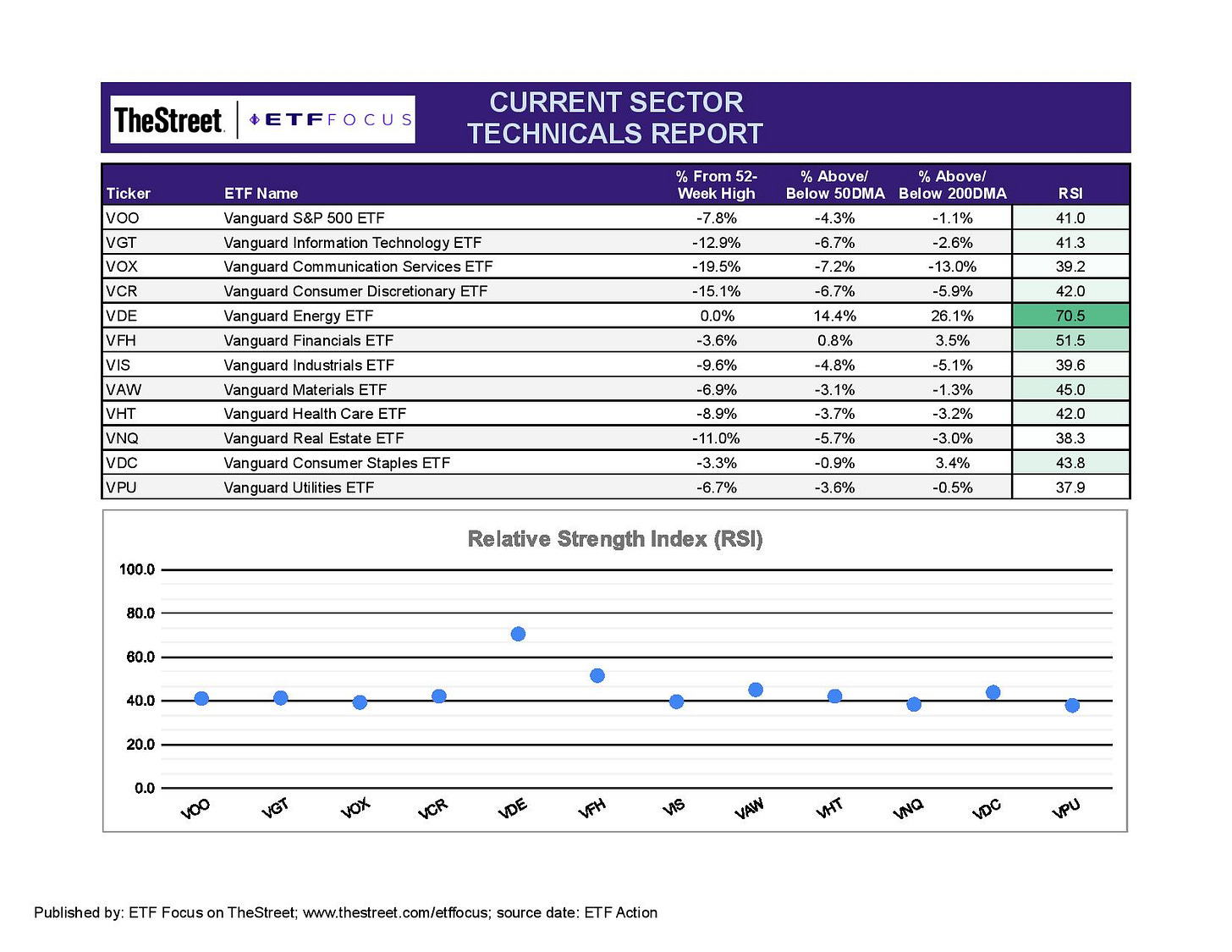

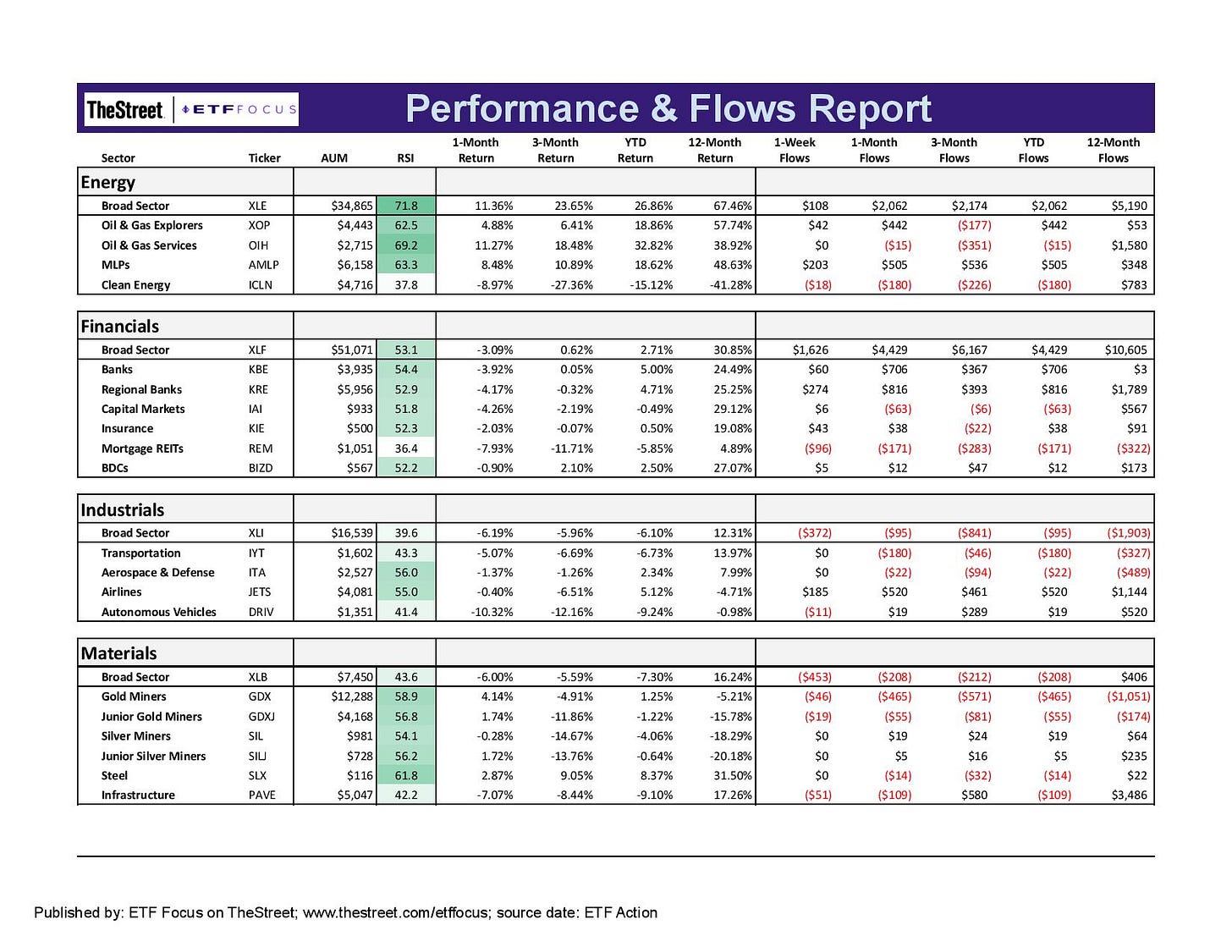

The energy sector remains the only one demonstrating any real strength right now, although financials made a nice move last week as the 10-year broke the 2% level. Market sentiment appears to be favoring cyclicals for the time being with industrials and materials posting a good week. If Russia does indeed invade Ukraine, we’ll have a bearish pulse for equities as a whole, but energy prices likely keep rising in such a scenario, so maybe energy stocks survive some of the damage.

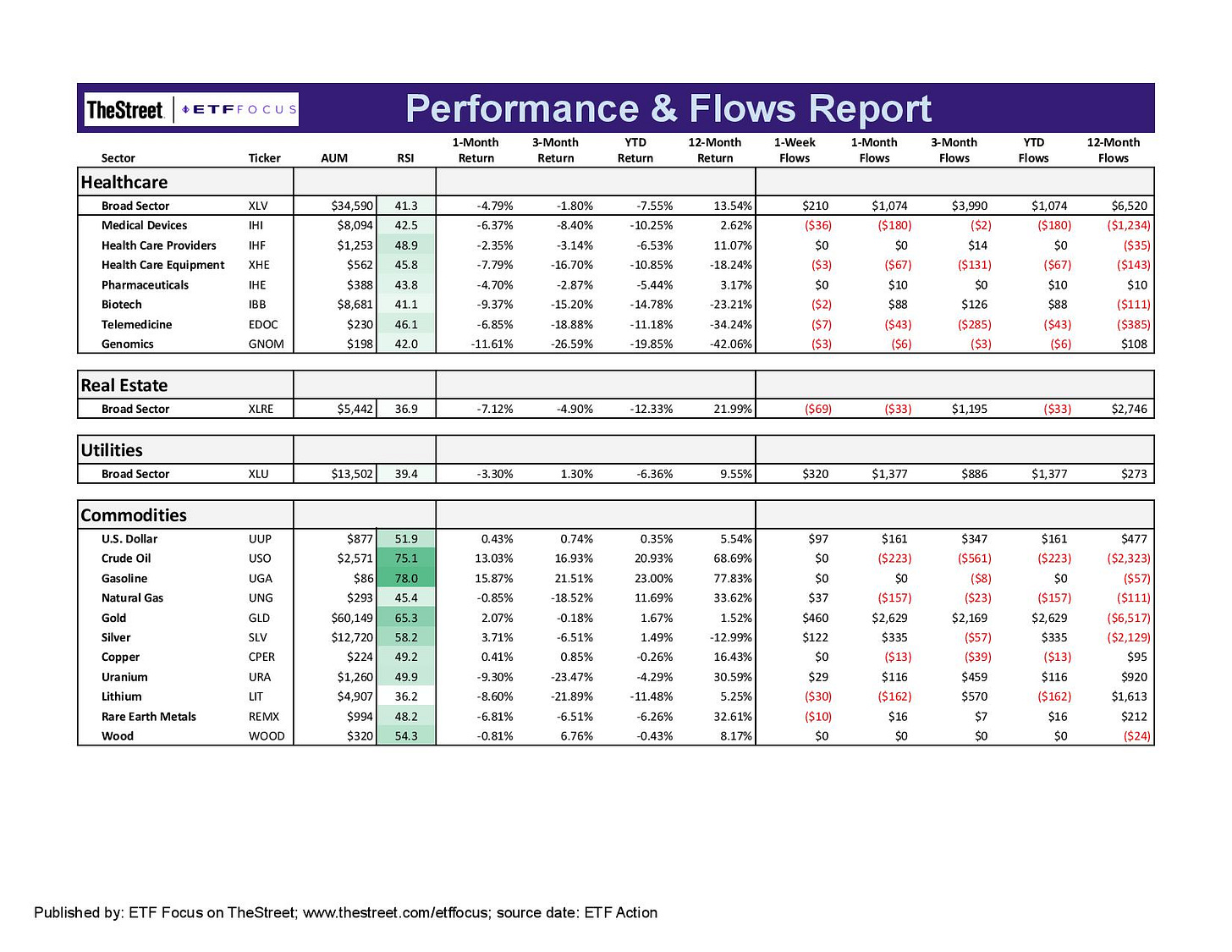

It’s mostly a mixed bag beyond. Growth and defensive sectors are mostly underperforming here, but there are pockets hanging tough. Consumer staples ticked back up, but utilities and real estate have steadily underperformed for a few weeks now and sit well off of their recent highs again.

Tech continues to struggle here and is perhaps the most visible victim of the rising yield curve. This group and communication services have some of the most expensive stocks in the market and many of those are getting repriced lower right now. Earnings have mostly looked OK (save for the idiosyncratic risk of a name like Facebook), but it looks investors are no longer willing to give tech stocks a free pass.

There used to be more of a split between the haves and have-nots among the growth sectors, but weakness is pervading across almost every subsector within these groups. Semiconductors had been carrying the tech sector higher, but they’ve turned into a liability as the excess continues to burn off. There’s still high demand for chips, but the willingness to pay a premium price for it has waned. Digital payments stocks, which had been one of 2021’s worst performers, has held up better this year, but they’re still well in bear market territory. Blockchain hasn’t been able to shake itself out of its fund and volatility remains high. Casinos and leisure & recreation stocks have outperformed recently on the anticipated post-omicron bounce.

Flows have turned negative over the past month for these groups, but not exceedingly so. Consumer discretionary looks especially vulnerable to selling pressure at this point, but internet stock ETFs have seen more than 10% of the group’s assets leave over just the past month.

Cyclicals look a little more green in terms of short-term relative strength. We don’t need to beat the drum on the energy sector again since its strength is obvious at this point. I will say that with the post-omicron energy demand surge and the possibility of political tensions in Russia, there’s a definite roadmap for higher crude prices in the near-term, which could translate into further gains for energy stocks.

Financials continue to look a lot better as the yield curve rises. The flattening of the curve isn’t necessarily ideal, but it does take the pressure off of banks somewhat to find more creative and niche ways to grow revenues. Lending activity still isn’t where I’d like it to be, but the macro backdrop is improving. Materials and industrials haven’t been able to keep up with energy and financials, but the increasingly more hawkish Fed makes these sectors look more attractive.

Gold & silver miners are starting to have a moment again. Precious metals prices are back on the rise as investors looking for a safe haven are finding bonds unattractive. I still feel there’s a lot of potential in this group and last week’s 7-9% gains could signal the start of a bigger trend.

Real estate and utilities are beginning to slide towards oversold territory. Within equities, I’m seeing what looks more like a rotation and less like pure selling. The steady underperformance of utilities is being somewhat offset by investor buying, which still remains strong despite short-term weakness. Utilities has a bit better looking longer-term chart relative to the S&P 500, so I wouldn’t write the sector off just yet.

Commodities are starting to build some real momentum here. Strength is crude and gasoline is clear, but gold and silver are looking stronger as well. Lumber is still volatile and a little difficult to read. The dollar has similarly been volatile and we can thank the euro and the ECB’s hawkish pivot recently for that. Commodities as a whole look like they might be in the early stages of a breakout. This sector has struggled for some time, but the breadth of recent strength is encouraging.

Read More…

DEM: 6% Yield Opportunity In Emerging Markets

29 Energy ETFs Ranked For 2022

If You Need Downside Protection, Buffer ETFs Are Having A Moment

European Bank ETF Turns Quite Attractive Thanks To Suddenly Hawkish ECB

Facebook Nabs META Ticker From Metaverse ETF

The Fed May Be Forced To Stop Before It Hits 4 Rate Hikes This Year

ETF Battles: Which Dividend Income ETF Is Better? JEPI vs. SCHD vs. XYLD Face Off!

Quick Take: Powell Gets More Hawkish & The Market Doesn’t Like It

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!