The Fed's Mixed Messaging & Why It Puts The Markets In A Dangerous Spot

The markets have gotten incredibly over-dovish, but the Fed’s mixed messaging suggests it doesn’t have a good grip on the current environment at all.

Investors have gotten about every Christmas gift they could have possibly asked for over the past couple of months. They’ve gotten confirmation that the labor market is still strong and adding hundreds of thousands of jobs every month. They’ve gotten evidence that inflation is still coming down and getting slowly closer to the Fed’s target of 2%. Consumer spending remains surprisingly resilient.

But most of all, they heard the magic words from Jerome Powell that they’ve long been waiting for - rate cuts in 2024!

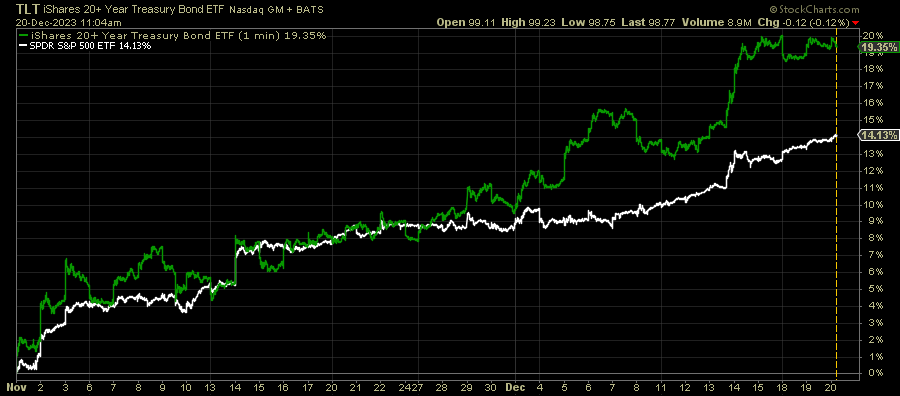

The last 8 weeks have been sort of a nirvana that’s created a rally in almost everything. The SPDR S&P 500 ETF (SPY) has gained more than 14% since the beginning of November. Growth, tech and high beta stocks have done even better with gains of 20%+ not uncommon.

One thing, however, hasn’t gotten as much attention. That’s the fact that long-term Treasury bonds, as measured by the iShares 20+ Year Treasury Bond ETF (TLT), have done even better!

This is important because I think it gives us some pretty telling insight into where investors’ minds are at right now.

It’s clear that the rally over the past couple of months in Treasuries has been a function of what investors think the Fed is going to do with interest rates in 2024. They started rising in anticipation of a potential Fed pivot and rallied even harder when they got it last week. There’s no real flight to safety aspect to this move, just a reaction to the Fed’s monetary policy plans.

While Powell indicated that the Fed was currently expecting to cut rates three times in 2024, investors think they’ll be cutting even more.

The 10-year Treasury yield has already dropped from its October peak of 5% to around 3.9% today, the equivalent of 4+ rates cut getting priced in. If you look at the Fed Funds futures market, the outlook gets even more dovish!

Traders there are pricing in a 71% chance of AT LEAST 6 quarter-point rate cuts in 2024!

To say that investors have gotten way ahead of themselves here is an understatement. In the short-term, that alone justifies a correction in both stocks & bonds to put market expectations back in line with what the Fed is telling us. Granted, their track record in seeing conditions 12 months into the future is poor to put it charitably, but still.

My bigger concern, however, is longer-term. The markets have gotten incredibly over-dovish, but the Fed’s mixed messaging and the way it seemingly plans on handling the balance between employment, price stability and interest rate policy suggests it doesn’t have a good grip on the current environment at all.

Is The Fed Worried About A Recession Or Not?

This is the ultimate question that I think needs to be answered. The markets sure don’t seem worried about a recession at the moment. If you look at the current 2-3% GDP growth rate and 4% unemployment rate, it’s pretty easy to see why.

Expand your world view beyond just those two numbers and there’s a stronger case to be made. Inflation, while it’s certainly come down, could take another year or more to get back to the Fed’s 2% target (and we could still see inflation go back up before it comes down). Credit is contracting. Consumers are maxed out on debt. Corporate bankruptcies are on the rise. It’s far less of a rosy picture that shows there are pressures building under the surface.

I’m personally of the belief that the latter outcome is more likely than the former, but I’ve been one of those in the camp that “recession is coming” for a while. Clearly, that hasn’t panned out, so take my crystal ball forecast with a grain of salt.

As far as the Fed is concerned, I’m not sure even they know what they believe any more. There are multiple conflicting signals they’ve given just over the past month that lead me to believe they could be trying to play both sides.

For instance…

Powell Goes From Threatening More Rate Hikes To Planning For Multiple Rate Cuts Almost Overnight

It wasn’t but weeks ago that Powell was trying to throw cold water on this stock & bond rally by saying that additional rate hikes were still a possibility. It seemed that they believed the Treasury bond rally was effectively doing the policy loosening for them and they wanted to prevent the bond market from moving too far, too fast.

At the December meeting, the Fed did a complete about-face. These headlines tell the story better than I ever could.

Here’s Fed member Mary Daly about two weeks before the Fed’s meeting.

Here’s the same Mary Daly earlier this week.

How do we explain this? What’s the reason for the sudden turn? What happened or what piece of information did the Fed get that made them suddenly reverse course in just a few weeks? Are they just following the bond market here or did forward-looking conditions change over the past three weeks?

What About That Pesky 4% Core Inflation Rate?

Typically, the Fed begins cutting interest rates when economic growth is slowing and inflation is below the central bank’s 2% target. If we do get a cut at the March 2024 meeting (the futures market says there’s a 79% chance of this happening), the rate cutting cycle would be kicking off with the core inflation rate at 4%.

The last time the Fed Funds rate was decreasing when the core inflation rate was at 4% or above? You’d have to go all the way back to the late 1980s. Other than in Turkey, central banks are typically raising rates during periods of above-target inflation in order to cool things down, but perhaps there’s a lesson to be learned from Turkey’s backwards monetary policy.

As inflation was climbing above 10% in 2021, the Turkish central bank decided to CUT interest rates believing that this was the way to tame inflation. All it did was help inflation skyrocket to more than 80% at its peak, even as interest rates were being cut further. This year, thankfully, the central bank has been raising interest rates aggressively, but the annualized inflation rate is still around 60%.

I don’t think we’ll see a situation nearly that ugly in the United States, but if the Fed is cutting rates when inflation is already at 4%, is it possible that inflation could get reignited and head back towards, say, 6% over the next 12-18 months? Would the Fed quickly halt its easing cycle and force the markets to undo their expectations for 6 cuts in 2024? That’s the outcome where we’d very likely see a sharp correction again in both stocks & bonds.

The Fed Is Forecasting A 4% Unemployment Rate Through 2026

This is the one thing that perhaps surprised me the most coming out of the Fed meeting. When they released their economic projections, they forecasted an unemployment rate of 4.1% through 2026.

If they truly believe that the unemployment rate is going to remain around the 4% level, isn’t that an implicit admission that they don’t see a recession in the future?

Every recession of the past 75% years has been accompanied by a surge in the unemployment rate.

Again, the Fed’s track record at seeing into the future is average at best, but it sure seems like they don’t see recession as a risk. If that’s the case, why are they planning on cutting rates multiple times in 2024? Wouldn’t it make more sense to keep rates where they are and keep pushing inflation back towards 2% since the economy’s in good shape and can handle it?

Conclusion

I don’t think we’re getting the full picture from the Fed. A few weeks ago, they were threatening more hikes. Now, they’re talking rate cuts. They don’t see a recession in the future, but they’re still going to cut multiple times.

The all-encompassing explanation, of course, is “don’t trust the Fed”. I completely agree and you can’t put much weight into what the Fed expects, but I still find it strange that they did a complete 180 on policy expectations. Plus, the plan for rate cuts without a recession seems to be contradictory.

I guess I don’t get, but we’ll find out for sure in the new year.

Catching up on all the posts while being away from my laptop and substack, wanted to say, great macro overview. Really enjoyed reading it. To me, what it seems like is that the gold and the bond market are starting to behave like a slowdown/ pre-recession, on the other hand the equity market is behaving like we are in the early phases of an expansion. It will be an interesting year next year. Happy New Year.