The Fed Tightening Cycle Is Here, But Will It Work?

Raising interest rates heading right into a rapidly slowing growth cycle leads to high recession risk.

After first signaling it back at the December FOMC meeting, this week will mark the official launch of the Fed’s monetary tightening aimed at combating the rampant inflation that is ravaging the global economy. Earlier this month, the Fed made its final multi-billion dollar Treasury purchase, ending the QE process that had been in place since the start of the COVID pandemic. To say that the Fed has been behind the ball in managing economic conditions would be a huge understatement. Inflation is at a 40-year high, the COVID recession recovery began all the way back in Q3 2020 and still the Fed refused to budge off of ultra-loose financial conditions. Tightening should have begun at least a year ago and now the Fed will essentially be forced to choose between focusing on growth or reigning in inflation, but not both. They’ve indicated that inflation control is the primary goal, which is what I think swings the economy back into recession likely at some point in 2023.

Can the Fed manage to pull a rabbit out of the hat and raise rates, bring inflation back down and keep the economy from falling into recession? I’m very skeptical.

At this week’s FOMC, it’s almost guaranteed that Powell will raise the Fed Funds rate by a quarter-point. The May meeting, however, will give us a good idea of how aggressive the Fed plans on being in going after inflation. The February inflation data, which reported a 7.9% year-over-year increase in prices, changed expectations again. Pre-release, the market was pricing in 6 quarter-point hikes. Post-release, that number is 7. It also changed expectations for the May FOMC meeting, which had calling for another quarter-point increase, but is now pricing in a 50-50 chance of either a quarter-point of half-point increase.

By that point, we’ll have an initial Q1 GDP reading, which right now is expected to come in at 1.7%, down significantly from Q4 2021’s 7% print. The Russia-Ukraine conflict is the big wild card here. The longer it drags on, the greater the impact to the global economy. $100+ oil is going to keep inflationary pressures high and GDP growth forecasts low. I expect consumer spending to continue slowing regardless of inflation readings and that could be the biggest catalyst to whether or not recession can be avoided.

The 10-year/2-year Treasury yield spread, commonly known as the recession indicator, has dropped all the way from 1.3% back in October to 0.28% as I write this. Once this number slips into negative territory, that’s historically meant that a recession is likely within about 12-18 months. Credit spreads continue to be worth watching. They’re starting to drift higher as well, meaning investors are turning more defensive and requiring a greater yield premium for the risk being taken. Utilities and gold have been relatively strong over the past 2-3 weeks. There’s a move towards safety taking place, but it doesn’t feel yet like investors are giving up. There’s an underlying negative sentiment to be sure, but I think we’d need to see a sizable move lower in Treasury yields to confirm a larger sentiment shift. So far, we’re seeing the opposite.

The clear catalyst for a short-term rally in risk asset prices would be an end to the conflict in Ukraine. That would signal and eventual, although not immediate, easing of energy and commodity prices and a deflationary pulse that’s been missing for nearly a year. Of course, we have no idea when that will be and may be unwise to position your portfolio heavily for it given the wide potential range of outcomes.

Can the Fed steer the ship safely in the meantime? I believe they’ll certainly take the steps necessary to bring inflation rates back under control, but doing so heading right into a rapidly slowing economy is a dangerous exercise and one not likely to end well. We still have time to let this situation play out and a lot could happen between now and the end of the year. I’m skeptical though and still believe that the Fed could pivot dovishly and signal and end to rate hikes or possibly even a rate cut in 2023. It sounds strange, but the eurodollar futures market is already pricing in a rate cut by the ECB at some point in 2023. If recessionary risk eventually becomes high, central banks may choose to pivot their focus back to growth from inflation.

With that being said, let’s look at the markets and some ETFs.

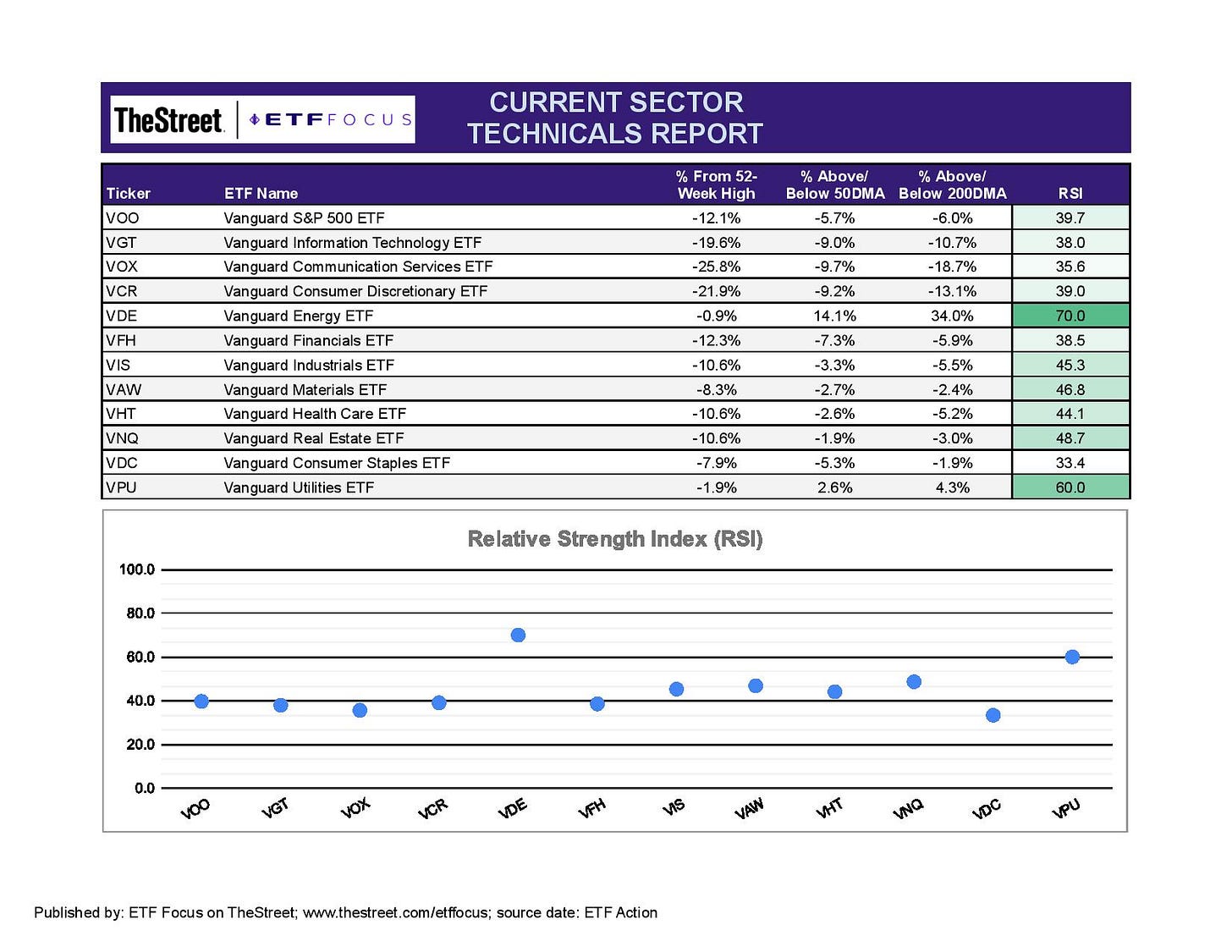

We know that energy stocks continue to be the unquestioned leading sector of this market. Beyond that, we’re seeing the greatest relative strength coming out of the defensive sectors right now. When I say “relative”, I mean demonstrating modestly more short-term strength than growth and cyclical sectors, but most defensive sectors are squarely in neutral territory. Utilities stocks are finally making a larger move higher after toying with the notion for a couple of weeks. They take the mantle from consumer staples, which had been steadily outperforming the market since November before posting a huge 5% loss last week. Inflation is the likely culprit there as consumer goods companies may not be able to pass sharply higher agricultural commodity prices on to consumers right away.

Growth sectors continue to perform poorly as higher valuations get unwound. Last week’s data drove the markets to expect higher rates faster than originally anticipated and that will work further against stocks with higher P/E ratios. Communication services continues to underperform badly, although it’s not in oversold territory today. Consumer discretionary is still weakening as investors anticipate that high inflation rates will eventually impact consumer spending as result in a more significant slowdown in activity as we head into the 2nd half of 2022.

Commodity-linked cyclical sectors, including materials, are still performing comparatively better. Financials are weaker again thanks to sharply higher rates on the long end of the Treasury curve. This is a trend that likely continues for a while longer as the Fed finally begins tightening monetary policy conditions. European financial exposure to the Russia/Ukraine conflict could add some additional pressure to U.S. banks.

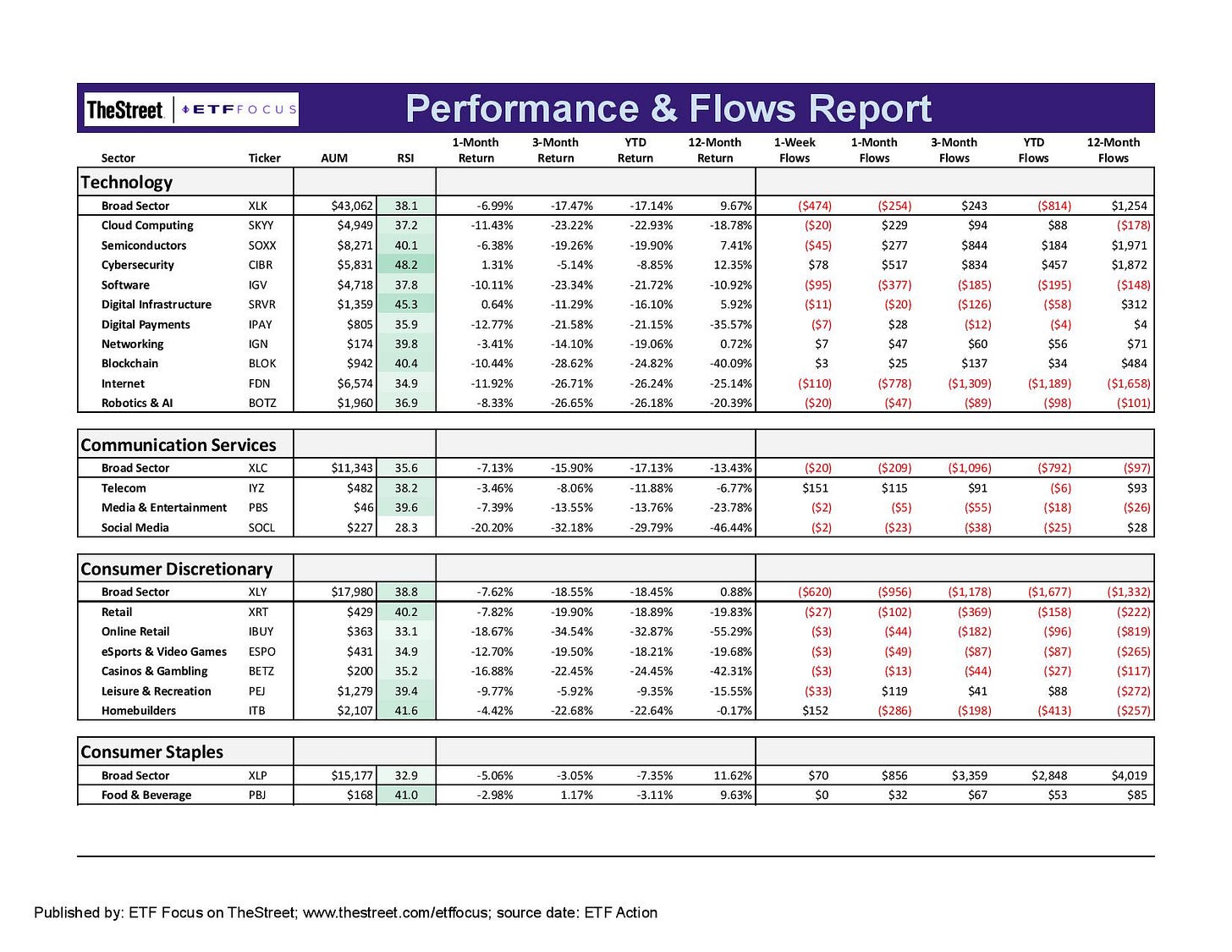

Not many pockets of strength within the growth sectors. Most subsectors are in neutral territory in relative strength terms with only the social media stocks firmly in oversold territory, having lost 20% over just the past month. Cybersecurity and digital infrastructure stocks are doing a little better and are benefiting from the narrative that cutting Russia off from the rest of the world economically could raise the threat of cyberattacks from within the country and its allies.

Many people are anticipating a spike in leisure activity coming in the warm weather months, but most of that expectation is already priced in. In fact, recent activity from the leisure, recreation, casino and airline spaces suggest that investors may be downgrading some of their expectations in light of soaring inflation and fuel prices. A lot of pessimism is showing up in net flow numbers finally as investors beginning abandoning this space in larger numbers.

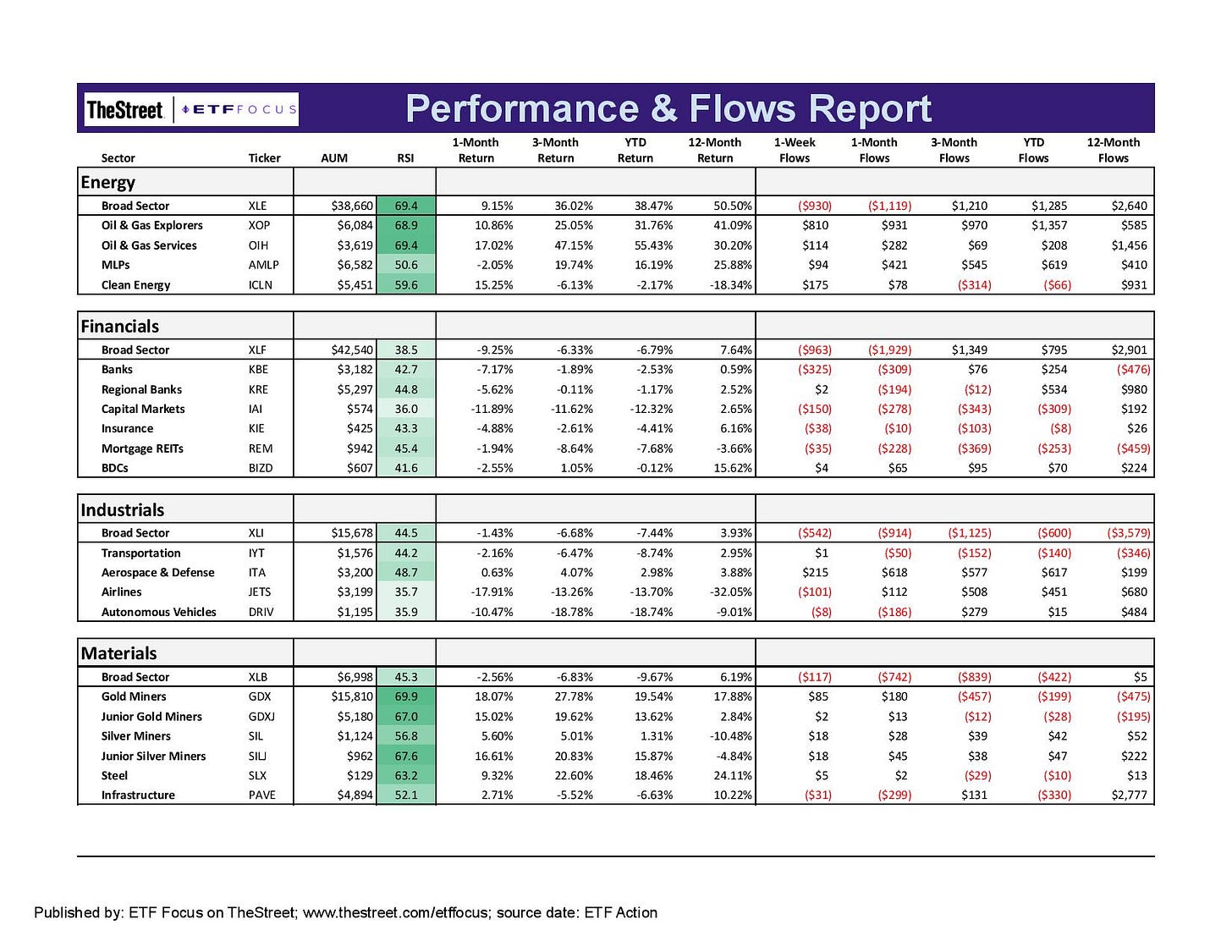

There’s nothing really new to say for the energy sector. It continues ride the wave of energy prices higher. The price of WTI crude has fallen back down to $100 from a peak of $130 earlier this month, which means we’re likely to enter a period where prices in this sector begin to normalize from a strongly overbought position. Clean energy continues to make a comeback on the narrative that high fuel prices could shift more demand to electric vehicles and cleaner energy solutions. It’s important to remember that while this is a very long-term story, clean energy isn’t going to unseat traditional fossil fuels anytime soon. If earnings or valuations contract, this group is likely to take a hit.

The strength in the materials sector is still coming from the miners. That’ll be dependent on the direction of precious metals prices from here. Gold is finally responding to inflationary pressures, although it happened only when it became clear that inflation had no definitive endpoint once the Russia/Ukraine crisis happened. I still see gold prices with more upside than downside here until this conflict ends. Other commodities are, of course, continuing to do well, but this group faces what’s likely an imminent downturn whenever the Russia/Ukraine situation comes to an end.

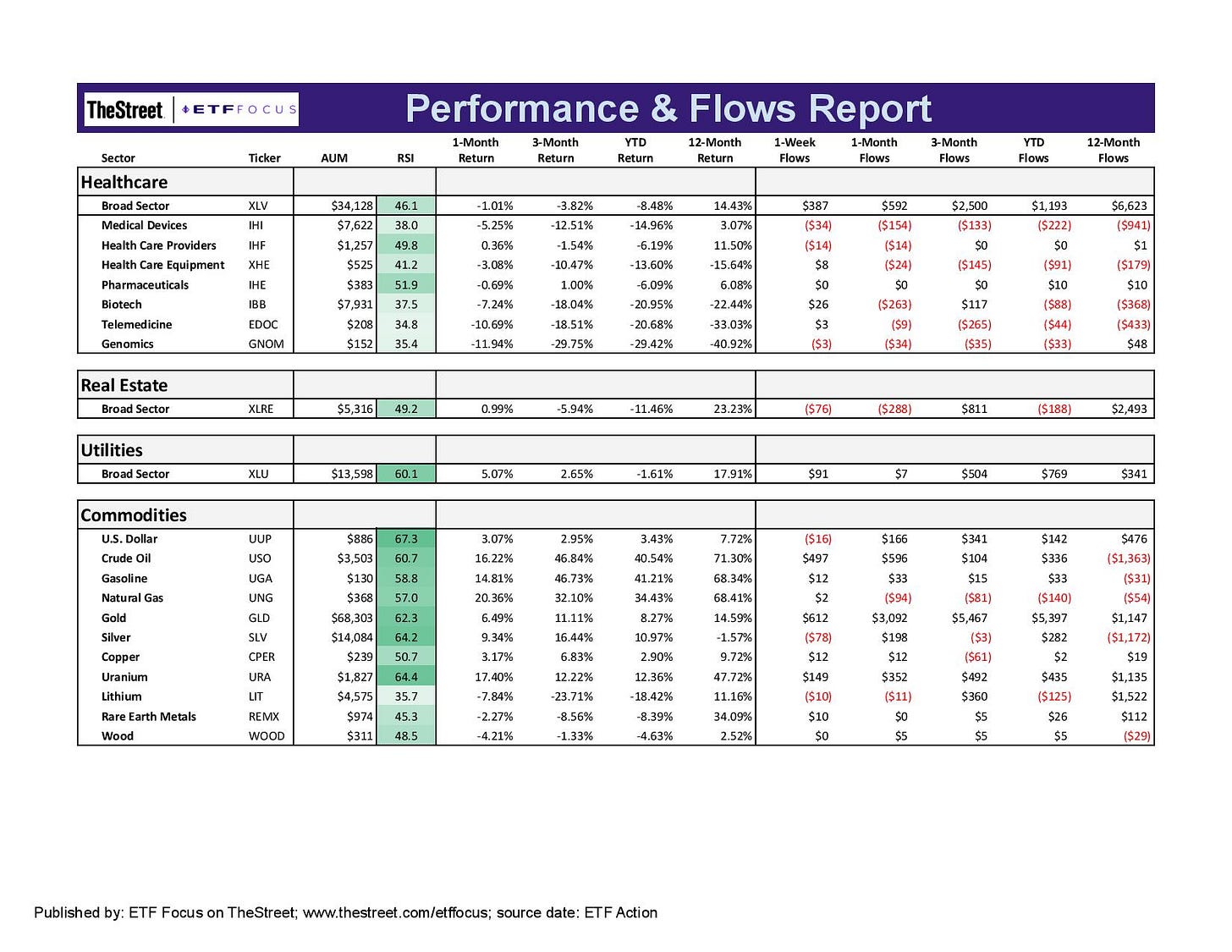

Utilities gets a lot of the attention, but healthcare has also been performing quite well here. It’s largely coming from the larger mega-cap names. Biotech is still struggling to develop any momentum and that’s likely a result of investors staying away from younger and unprofitable names. The more conservative areas of this sector, including health care providers and pharmaceuticals, are looking better at the moment and that’s likely the area of this sector that will be looked upon more favorably.

The story is mostly the same on the commodities side, although it looks like short-term sentiment is beginning to shift. Both crude oil and natural gas prices are coming well off of their highs and I think that’s a natural reaction to the huge rally over the past several weeks. I think this group will need a few more trading days to discover where the price level should be and that could lead to some more short-term volatility, but I’d expect to see some consolidation here given how far and how fast prices have risen.

Also worth watching is lumber prices. This commodity has ridden the commodities bull, but rising rates are almost certainly to impact the housing sector. This is a material that has also likely risen too far and too fast and could be poised to consolidate, possibly significantly, over the next several weeks.

Read More…

SPHB: The Real Damage Isn’t Done Yet

ETF Battles: What's The Better High Income Dividend ETF? JEPI vs. NUSI vs. DIVO

Vanguard Dividend Appreciation ETF (VIG) Has Turned Into One Of The Worst Dividend ETFs Of 2022

Top Performing ETFs For February 2022

Russia ETFs Suspend Share Creations; Premiums To NAV Shoot Up To More Than 100%

6 Higher Yielding Cash Alternatives For Your Portfolio

4 Vanguard Bond ETFs For Every Market

ARKK: Are Investors Moving Back In?

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!