The Fed Has Been Playing With Fire. Now, It's Getting Burned

Powell and company have kept rates at 0% for as long as they possibly could, but they're now about to deal with the fallout from their poor decision making.

The Fed has been playing with fire for a while in its attempt to keep the financial markets inflated while steering the economy out of the post-COVID recession. If it had merely operated within its dual mandate of maximizing employment while keeping inflationary pressures out of control, it would have stopped buying Treasuries long ago and began raising rates a year ago. But it didn’t. Instead, it made its policy decisions with risk asset prices in mind. Anything that might rock the boat prematurely for stocks was off the table.

That worked for a while, but now the Fed is beginning to understand the consequences of kicking the can down the road.

What we’ve got today is an environment where we’re likely to see a 7% year-over-year inflation rate printed later this week, the highest reading since 1982. We’ve seen wage growth jump to around 6% as the Great Resignation continues. We have GDP growth forecasted at 3-4% in 2022. Yet we STILL have the Fed buying up Treasuries for at least another couple months and we STILL have a Fed Funds rate at 0%. If you can explain why this makes any logical sense, you’re smarter than me.

Now, however, the Fed’s hand is going to essentially be forced. Remember when Jerome Powell and the Fed Dot Plot report suggested a first rate hike in June with the plan for 3 quarter-point hikes by the end of 2022? That was only about a month ago. Today, we’ve got an 80% chance of a hike at the March meeting plus a greater than 50% chance of 4+ hikes by the end of 2022 (according to the Fed Funds futures market). The Fed is way behind the 8-ball now, it’s going to need to tighten at a much more aggressive rate and the financial markets are finally starting to react.

Let’s break down the events of last week one-by-one.

The Great Rotation Into Cyclicals & Value

Throughout the past year, cyclicals have managed to outperform only in short spurts. It usually happens when we get some indication of taper or rate hikes, but the bounce usually fizzles once the headline fades. The difference between then and now is that then we just talked about the general idea of when tightening might begin at some point 6+ months out in the future. Today, we’re talking about how tightening needs to happen NOW and it needs to be aggressive since inflation and wage growth are starting to spiral out of control.

Once we got the double whammy of some very hawkish Fed meeting minutes and a jobs report suggesting that wages were rising much above expectations, it was off to the races. Financials have long been tied to Treasury yields, so it was no surprise to see them up 5% on the week. Energy tends to be one of the most cyclically volatile sectors and its 10% gain last week on the heels of $80 oil is not too surprising either, although the extent of the gains probably was.

The biggest pivot, however, occurred in value stocks. Value outperformed growth by more than 7% last week! We rarely see that kind of shift that quickly unless there’s a massive repricing of expectations. With rates potentially rising significantly over the next 12 months, high valuations in tech and growth stocks become less justifiable and, therefore, we see the move over to value stocks instead. The decisiveness of the move was notable.

This Is A Rotation, Not A Sell-Off

This is one of the problem of a U.S. equity market where 30% of the weighting of the S&P 500 comes from just a half dozen stocks. It can mask a lot of what’s going on under the surface. The S&P 500 may have fallen 2% and the Nasdaq 100 may have dropped more than 4%, but if you read that and assume that means there was a broad market sell-off, you’d be wrong. Take a look at how several asset classes performed last week.

Financials +5%

Energy +10%

Value +2.4%

Consumer staples +0.5%

High Dividend Yield Stocks +1.9%

This was a rotation, not a sell-off. Investors moved mainly into financial and energy. Other cyclicals were still mixed. Consumer staples and utilities outperformed. Even international stocks were relatively unchanged on the week. As the FAAMG+Tesla names go, so will go the S&P 500 and Nasdaq. As a general rule, always look under the hood.

The Treasury Market Resets

The big thing the markets will be talking about is the Treasury yield curve. Long-term Treasury yields (I pay most attention to the 10-year) have risen by 30 basis points. The long end of the curve tends to be more reflective of the broad economic outlook and conditions. What I think we’re seeing here is the expectation that growth will still look good, but inflation will be a problem throughout 2022. That tends to lead to a higher and steeper yield curve. If the economy begins slowing down quickly, expect the curve to flatten and the 10Y-2Y spread to narrow. That’s when recession risk begins to rise.

The short end of the curve is reflective of what the Fed is doing. If you look at the history of the 2-year yield, it was at 20 basis points as recently as September. Today, it’s at about 90 basis points. In other words, fixed income traders think rates are on the rise and they’re probably on the rise quickly.

Low Volatility And Quality Themes Still Lagging

Many investors think value and low volatility are synonymous, but that’s often not the case. Last week is a good example of this. Value, as mentioned earlier, was up an asset-weighted 2%+ last week. Low volatility was down more than 2%. The quality theme, which does tend to correlate more closely with low volatility, was down about 3%. Financials and energy tend to not fall into those groups as much, so it’s not surprising to see such a dichotomy between these groups.

What is perhaps interesting is that high beta only fell about 0.4% last week. Even with the Nasdaq and large-cap indices falling significantly, high beta outperformed low volatility.

The Labor Market Is Mostly In Good Shape

We can pick apart last Friday’s jobs report all we want, but it shouldn’t result in any conclusion other than the fact that the labor market is in pretty good shape. Yes, labor force participation is lower than we’d like to see. Yes, there are a lot of job openings still out there. Let’s not forget, though, that the headline unemployment rate is under 4%. It’s not a perfect labor market and there is certainly room for some improvement, but it’s not nearly weak enough to the point where the Fed should feel like it needs to delay policy action waiting for conditions to improve. The labor force participation rate has been flat for months, so there’s a real possibility that many of these workers are just never coming back. The labor market is more than strong enough today to withstand interest rates soaring all the way to 0.25%

OK, with that rant out of the way, let’s look at the markets and some ETFs.

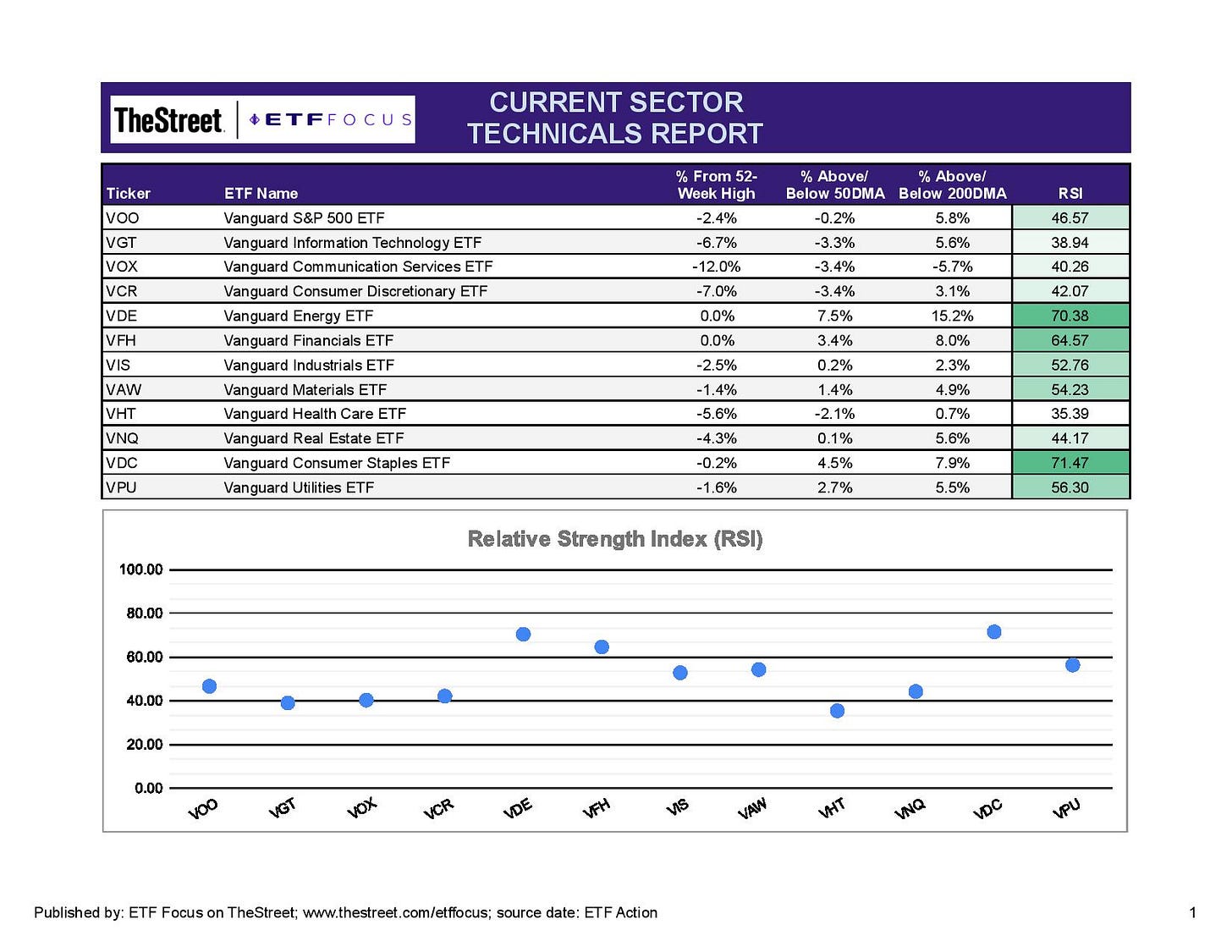

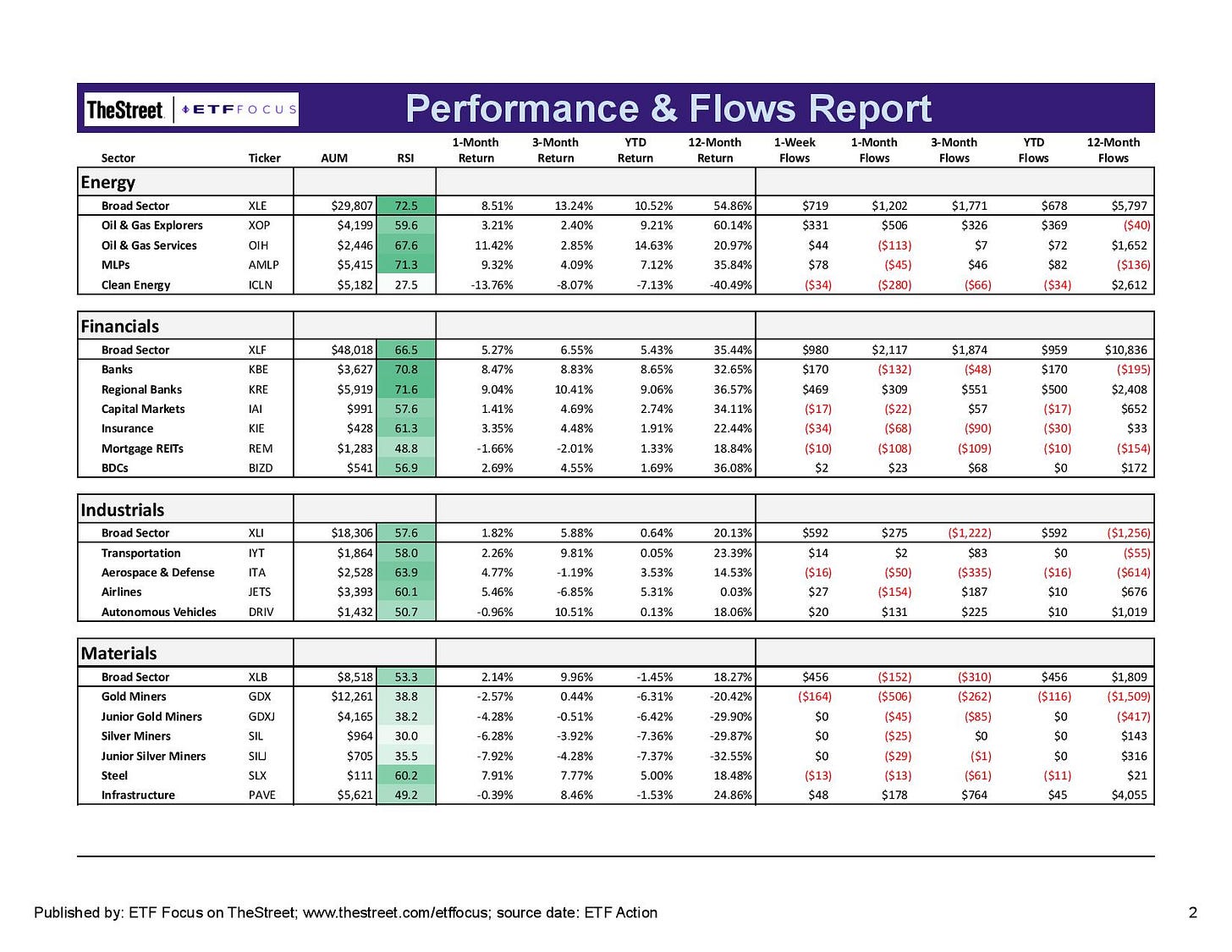

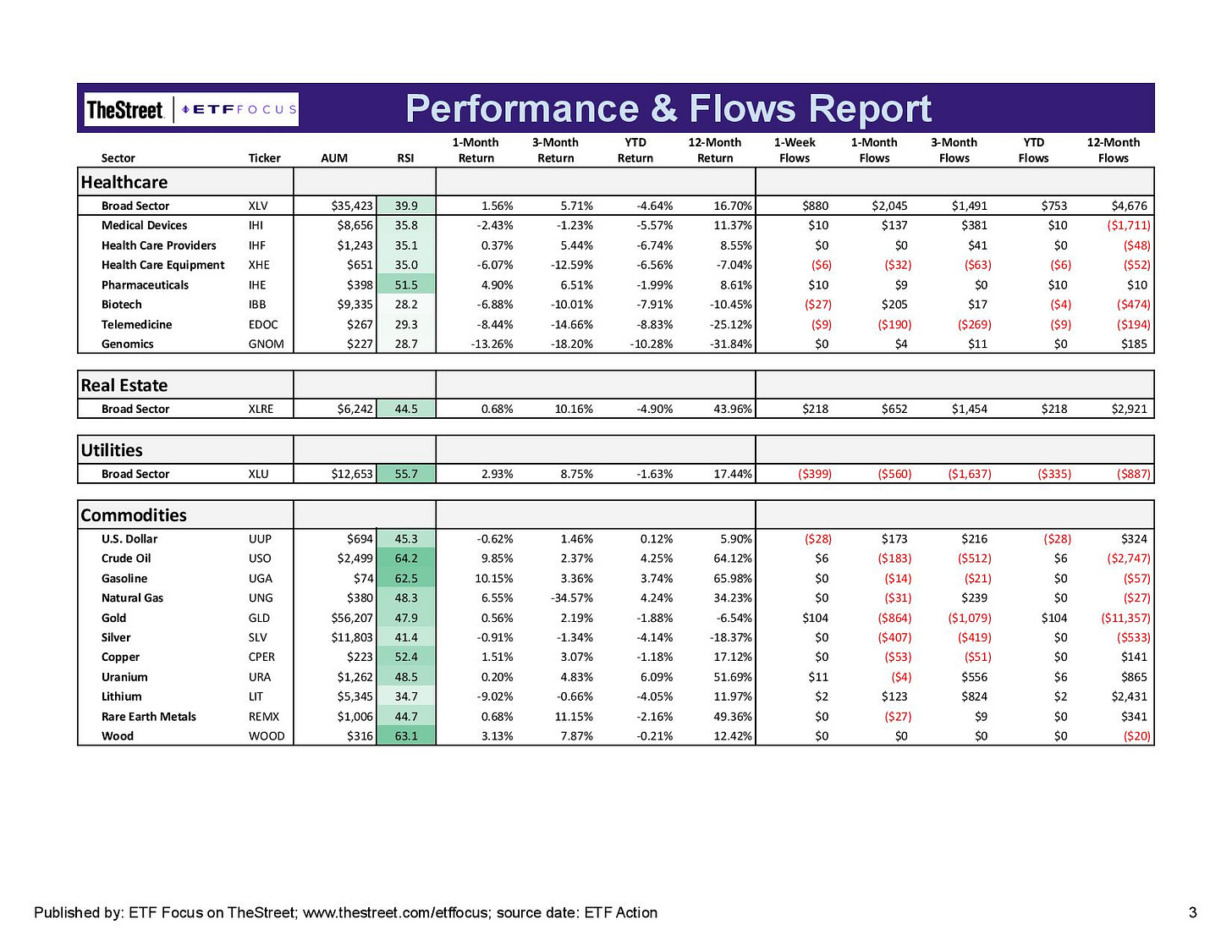

Short-term relative strength tells us pretty much what we already know. Energy and financials look quite strong, although nearing the point of being overbought. Consumer staples is still the strongest of the main market sectors as it has been for the past three months. Materials, industrials and utilities appear to be in good shape, while everything else looks particularly weak.

With growth stocks selling off last week, it’s interesting to note that the S&P 500 is now trading below its 50-day moving average, an indication that short- to medium-term sentiment has begun turning negative overall. The overall theme right now is that cyclicals and defensive sectors are good. Growth sectors are not.

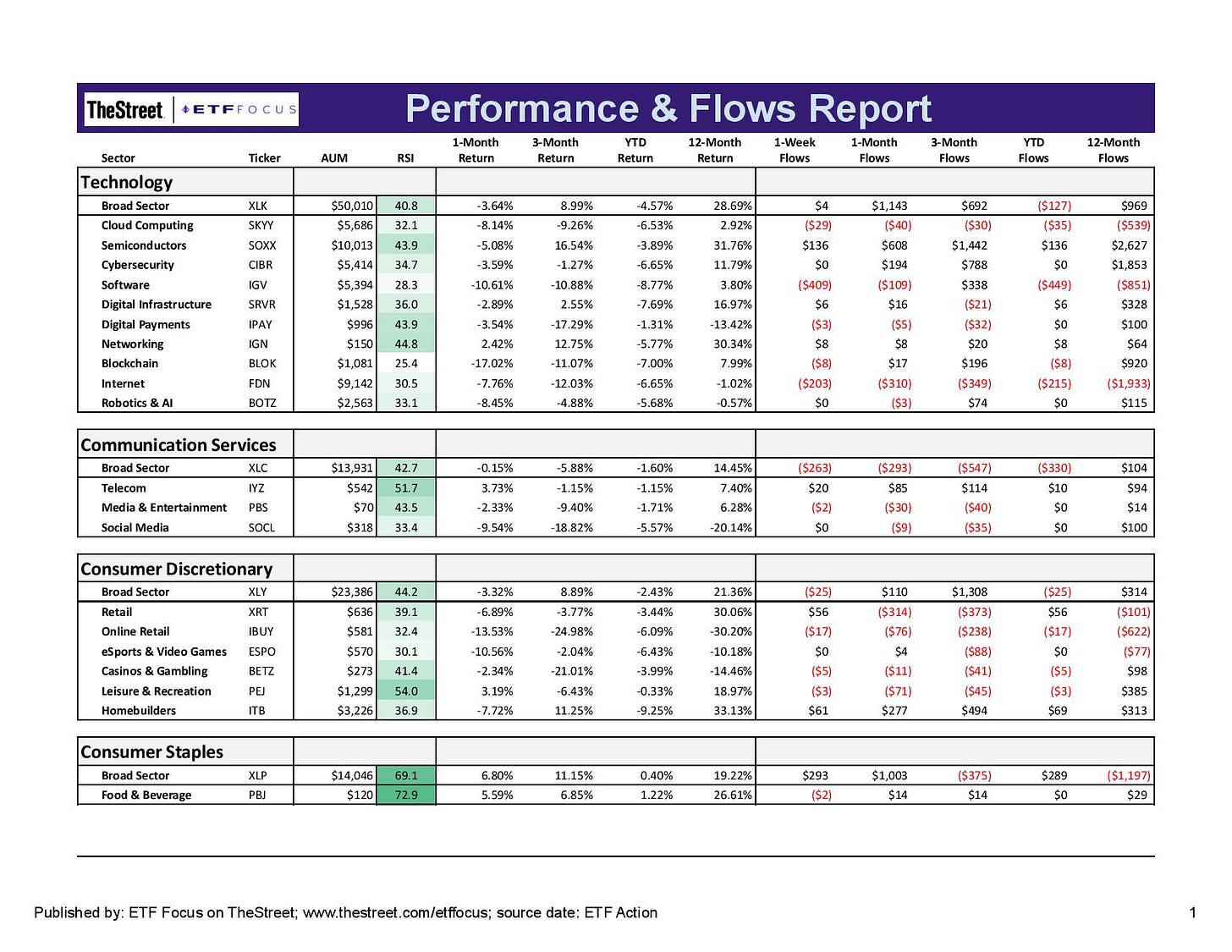

If you look across the tech, communication services and consumer discretionary sectors, there’s not much anywhere that isn’t looking weak. The more defensive telecom group is looking comparatively better, which isn’t surprising. The leisure & recreation group has been rallying on the belief that, while omicron will continue to cause some short-term economic disruptions, it won’t necessarily have long-term disruptions both in terms of health or the economy. Blockchain has gone from a position of strength to one of the most oversold areas of the market, following the lead of bitcoin and other cryptocurrencies.

The dichotomy within the energy sector is interesting to watch and follows a trend that goes back well over a year. When fossil fuel stocks move in one direction, clean energy stocks move in the opposite direction. There still isn’t a whole lot of money piling into energy and financial stocks here, but sometimes that takes a week or two to fully play out.

The gains in the financial sector were mostly coming from the big and regional banks, both groups gaining 8-9%. Other subgroups, such as capital markets and insurance companies, also posted gains, but it was the rate-sensitive stocks that performed the best.

Industrials are looking a lot better this week. They had been trending lower relative to the S&P 500 for a while, but could be poised to move higher again if the cyclical reflation trade holds. Steel producers have had a nice run recently, although gold and silver miners are still struggling as precious metals prices remain flat.

The dollar is moving back to a neutral position again. It had been rising on its “ahead of the curve” monetary policy plans, but the broad increase in rates globally suggest that other major central banks may be forced to catch up. The ECB still sounds dovish, but inflation is at 5% and the 10-year German bund yield could turn positive for the first time in two years. It may be forced to act sooner than planned as well.

Read More…

Worst Performing ETFs For 2021

Top Performing Leveraged ETFs For 2021

Top Performing Dividend ETFs For 2021

Top 7 Dividend ETF Picks For 2022

200 Large Cap ETFs Ranked For 2022

Top 6 Semiconductor ETFs For 2022

68 High Yield Bond ETFs Ranked For 2022

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!