The Best Trade Opportunity Of 2023? It's Setting Up To Be Treasuries

Don't be scared off just by what Treasuries have done this year.

Hi everyone and welcome back to the ETF Focus Rewind!

If you’re an existing subscriber, it’s great to have you back again! If you’re not or if you’re finding us for the first time, perhaps you’ll consider becoming a regular reader!

Just click the “Subscribe” button below to get the ETF Focus Rewind for free on a weekly basis. We discuss the latest events in the financial markets through the lens of ETFs and how they impact your money!

The Treasury bond market has experienced an historically anomalous year in 2022. Slowing economic growth and the threat of recession should have pushed investors towards the safety of Treasuries, but the opposite happened. Soaring inflation and a strong (albeit late) response from the Fed sent interest rates sharply higher.

Government bonds weren’t a safe haven. They were a liability.

The result has been one of the worst years for Treasuries ever, but it’s been especially painful on the long end of the curve. At its low point, the iShares 20+ Year Treasury Bond ETF (TLT) was down more than 40% from its peak. It’s still down roughly 30% year-to-date.

If you look at that chart though, you’ll see that the month of November doesn’t look like the rest of 2022.

Long-term Treasuries are off to the races again. Sure, it’s easy to say “the economy is slowing” or “we’re getting closer to recession” as catalysts, but this belief has been in place for months and Treasuries have continued to decline. The difference now is that it finally looks like we have a consensus terminal Fed Funds rate priced into the market.

Throughout 2022, the narrative has been that of rising inflation and interest rates. Expectations for where the Fed was going to set the Fed Funds rate started out mild at the beginning of the year, but continued to climb higher and higher.

The upward trend of most of these lines in this chart, especially during the first half of the year, reflect how quickly forecasts were being revised higher. At the beginning of March, the Fed Funds futures market was essentially pricing in a 0% chance that the Fed Funds rate on March 2023 would be 2.5%. A month and a half later, the odds were nearly at 100%.

During the summer when investors were caught up in the idea that a Fed pivot was coming, Fed expectations moderated and even came down a bit. That was before Powell shot down the idea in a speech and rates were on the rise again.

But look what’s happened since mid-October. The market’s expectation for the terminal Fed Funds rate has remained roughly the same. Sure, there’s some debate about whether they stop at 4.75% or 5%, but the broader idea is that the yield curve is no longer shifting higher.

If inflation has peaked and the markets sense they know where and when the rate hikes will stop, Treasuries can begin trading on fundamentals again and not on Fed policy.

That means they can start trading on recession risk, which is exactly what I think is happening now. The terminal Fed Funds rate has been priced in and Treasuries are starting to act like a safe haven again.

There are a couple of wild cards though.

We don’t know whether inflation has peaked or not. We’ll get a better idea when the November number is released in about two weeks. Energy prices have been falling steadily for three weeks and that could be the driver behind another drop in the headline rate. The core rate might not be done moving higher yet. If the jobs number this week still looks strong and the core inflation rate in November creeps higher, Treasuries might have another leg lower in them.

While the path is important, a recession might not actually show up until 12 months from now or even longer. There’s still plenty of room for equities to rally on an actual Fed pivot in the 1st half of 2023 or some other catalyst (China reopening, peace deal in Ukraine).

In my opinion, the overall trend in interest rates for 2023 is lower. Conditions could still shift in the short-term, but I think the recession narrative controls the year and the Fed will at least be thinking about a rate cut in the 2nd half of the year even if they don’t pull the trigger.

That means Treasuries could be a potential high reward play in 2023.

How strong of a swing you might want to take at this depends on your risk tolerance. TLT would deliver the biggest returns in such a scenario, but that will be awfully volatile.

I actually like the iShares 1-3 Year Treasury Bond ETF (SHY) as having the best risk/reward tradeoff. Share price downside is still relatively limited even if rates continue moving higher, but the 4.5% yield is a really nice income opportunity just for holding.

The bear market in fixed income will likely scare off a lot of investors, but ETF flows over the past month show people already moving back in. I think this will prove to be one of the best opportunities for investors in the new year.

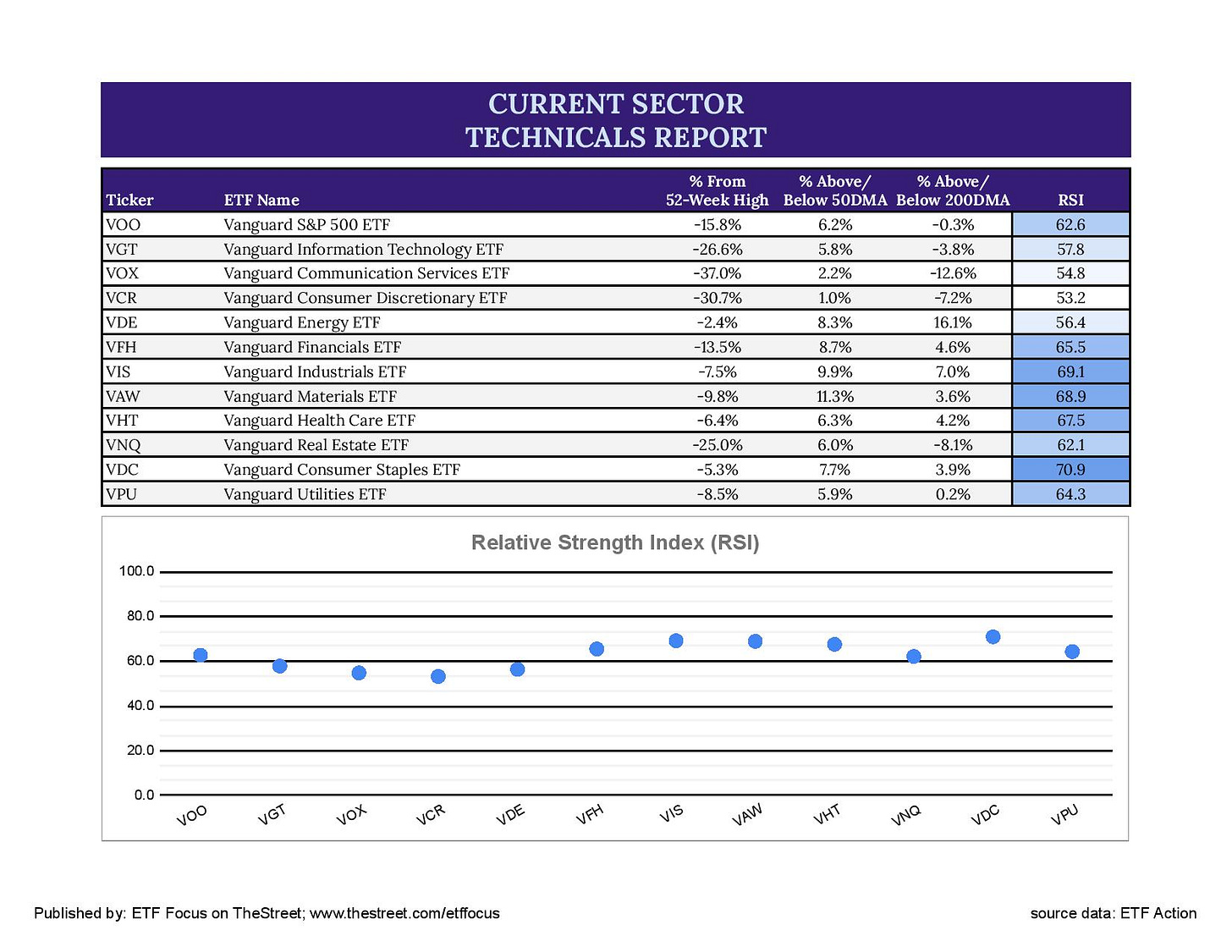

ETF Equity Sector Overview

Defensive and cyclical sectors remain the strongest at the moment even as the broader averages continue to climb higher. Utilities have actually been quite choppy recently, but healthcare and consumer staples have been steady outperformers throughout. I do have some questions about what the November inflation report will look like and believe that cautious positioning could be the best course of action in December. Dividend growth stocks could be a particularly attractive play.

Growth and tech are still having a tough time getting going and I don’t think the latest macro developments will help. The new COVID lockdowns in China could put pressure on supply chains again and add another layer of complication to sectors already struggling with revenues and earnings.

Crude oil prices have been steadily declining for weeks now. WTI crude is down from $90 to $75, touching its lowest level in nearly a year. Add in what’s likely to be lower demand from China and it looks like energy stocks are entering a period of potentially persistent underperformance.

One thing worth noting is that the S&P 500 is on the brink of moving above its 200-day moving average for the first time since April. This is a closely watched technical indicator and could ignite a level of buying if it’s able to break through and remain there.

Do you know someone who might be interested in reading this? Feel free to share it with them now!

Dave,

First of all, I agree with the premise of this post. Thank you for sharing your outlook and viewpoints, including the plug for SHY.

For consideration, I might share that I have recently added a MODEST allocation to BLV in my portfolio. Basically, the same overall theory as that suggested for adding TLT. In BLV, I am violating the "treasuries" theme and including a smattering of long-term corporate bonds. As fair warning, the risk level goes up with these, as there is a 27.0% allocation to BBB-rated bonds. On the other hand, at 14 years, the duration is a little shorter than TLT, and the 30-day SEC yield is all the way up in the 5% range. So, slightly less interest rate risk vs. introducing some level of default risk.

In my personal case, I am at roughly a 3-1 ratio of TLT vs BLV in the portion of my portfolio dedicated to long-term bonds. So, just a gentle lean into a little extra current income while (I hope) keeping my overall risk level within reason.