Stocks Are Starting To Look Like A Trap

A strong dollar, low volatility and a rally on low volume look like a troublesome setup.

If you’ve been invested in U.S. equities over the past two months, congratulations! Since the mid-June low, the S&P 500 is up more than 15%. If you had your money invested in small-caps, growth, high beta or tech, you might have earned around 20%. After a long and arduous first half of 2022, it was a welcome relief rally for investors.

Now, it’s time to put it in the rearview mirror.

Following the June low, it looked like a nice little bear market rally. The average bear market rally is typically somewhere between 7-10%. During the tech bubble, rallies got as far as 20% before eventually fizzling out. On August 16th, two months to the day after the June bottom, the S&P 500 was up nearly 18%. If history is any guide, the current rally is nearing its exit velocity point. If the rally gets into the 20-25% range, there’s a good chance that it can keep pushing higher. If it stalls out at this point, there’s a lot of evidence suggesting we could be heading back towards 3700 on the S&P 500 .

The problem I see today is that most of the evidence is pointing towards a pullback in the near-term.

The biggest catalyst at the moment might be the Fed. Much of the recent rally has been predicated on the idea that the Fed is going to pivot away from its rate hiking program in order to address the growing risk of recession that’s building. The July inflation, which ticked lower and came in below expectations, would have seemed to cement that notion. Equity investors sure believed that was the case and have continued buying with that idea in mind.

The problem is that the Fed has given no indication it’s ready to pivot. In fact, their commentary over the past couple of weeks suggests the opposite. Powell used the term “unacceptably high” to describe inflation. Other Fed governors have pretty consistently stated that inflation is not where needs to be and the central bank will continue taking a “whatever it takes” approach to bring the inflation rate down.

Does that sound like a Fed that’s ready to make a dovish pivot?

Granted, you can take what the Fed says with a grain of salt, but its members have been sending a pretty consistent message here - inflation control above all else.

Here are some other things to consider.

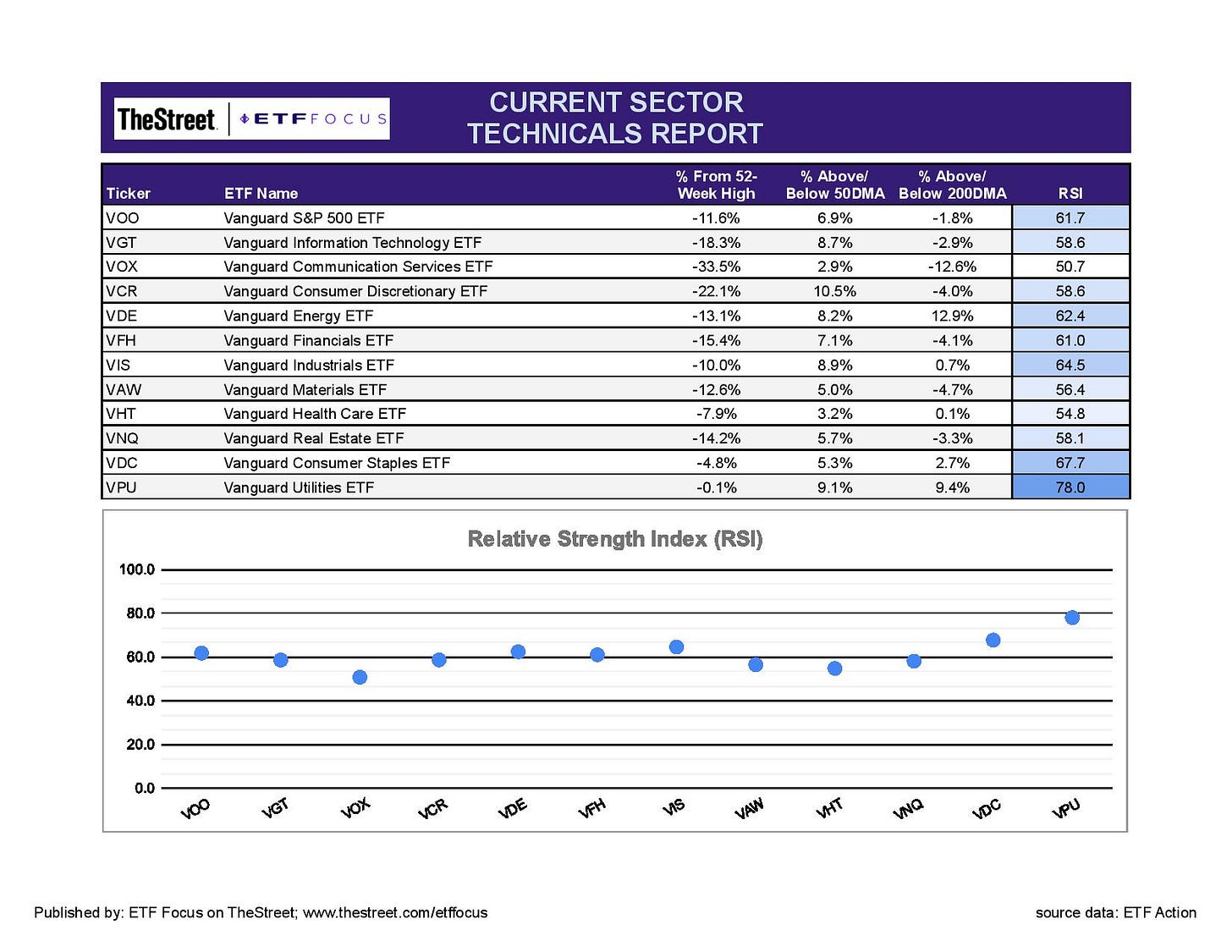

Utilities is the market’s strongest sector

Will get to the S&P sector technical view in a moment, but what it’s saying today is that this rally might be starting to turn. All of the attention has been focused on growth and high beta plays, but the sector with the highest relative strength at the moment is utilities.

Defensive leadership is usually a sign that a market rally is beginning to break down. Things were looking pretty strong from a market internals standpoint, but that changed about a week and a half ago. The leading market themes since that point? Utilities, low volatility and dividend growth. It could be a short-term aberration, but it’s not a trend you want to see if you’re long risk assets. Next week could be telling, but utilities leadership isn’t the only sign.

The dollar is retesting 20-year highs

The dollar usually reacts to what the Fed is expected to do. If the Fed is hawkish, which they are right now, that tends to lead to more monetary tightening. More tightening leads to higher interest rates. Higher interest rates draw more investor interest into dollar-denominated assets. More interest pushes the dollar higher. A strengthening dollar has been a hallmark of this environment for more than a year, but now it’s getting excessive.

The U.S. economy is in a comparatively better place than Europe and Asia, so it’s understandable that the dollar would be solid here, but it’s getting well into overbought territory. If you look over the past several decades, strong dollar rallies over periods of 6-12 months have correlated strongly with market peaks. Think the financial crisis, the tech bubble, the Russia debt crisis, even the leveraged buyout crisis of the late 1980s.

We’re at that point again.

Bond market volatility is rising, while the VIX is falling

The MOVE index, which measures bond market volatility, isn’t as well known as the VIX, but it’s just as, if not more, important to watch. Bond volatility tends to pick up in the early days of market downturns, including the tech bubble and the financial crisis. The MOVE index has been steadily moving higher since the first half of 2021, a six-month precursor to the 2022 bear market.

The index originally peaked in June, but is now starting to head higher again. A little more and we’ll be at the highest level since 2009. Last week, the 10-year Treasury yield rose by 20 basis points and is just shy of the 3% level again. Treasury bond market volatility isn’t slowing down. Global bond yields continue to whipsaw around, the victim of a tug-of-war between central bank rate hiking and recession worries. I often say that the bond market is right more often than the stock market. I think today is no exception. All of this is happening while the VIX has been steadily falling down to 20.

If it were me, I’d be very cautious about adding to risk asset positions here. Investors tend to get caught up looking at recent returns and I think it may be contributing to a sense of complacency that’s about to catch investors off guard. Bonds, the dollar, volatility, utilities and declining trading volumes all suggest that the current stock market rally is getting tired and may be getting ready to turn.

With that being said, let’s look at the markets and some ETFs.

As mentioned, utilities is currently the markets strongest sector and it’s not particularly close. It is way into overbought territory though and probably due for a pause. Consumer staples and industrials are also doing well, but there really aren’t any major market sectors showing weakness at the moment. As it has been throughout 2022, communication services stocks remain the weakest and are an extraordinary 33% below their 52-week high.

Tech stocks underperformed for the second straight week and are threatening to end their best run since the 4th quarter of last year. The consumer discretionary sector, despite a spate of bad news from the retail sector and mega-names, such as Target and Walmart, is looking very resilient here and has yet to underperform in a meaningful way. I don’t expect this trend to continue, but there is evidence that the consumer is still in relatively good shape despite inflation problems.

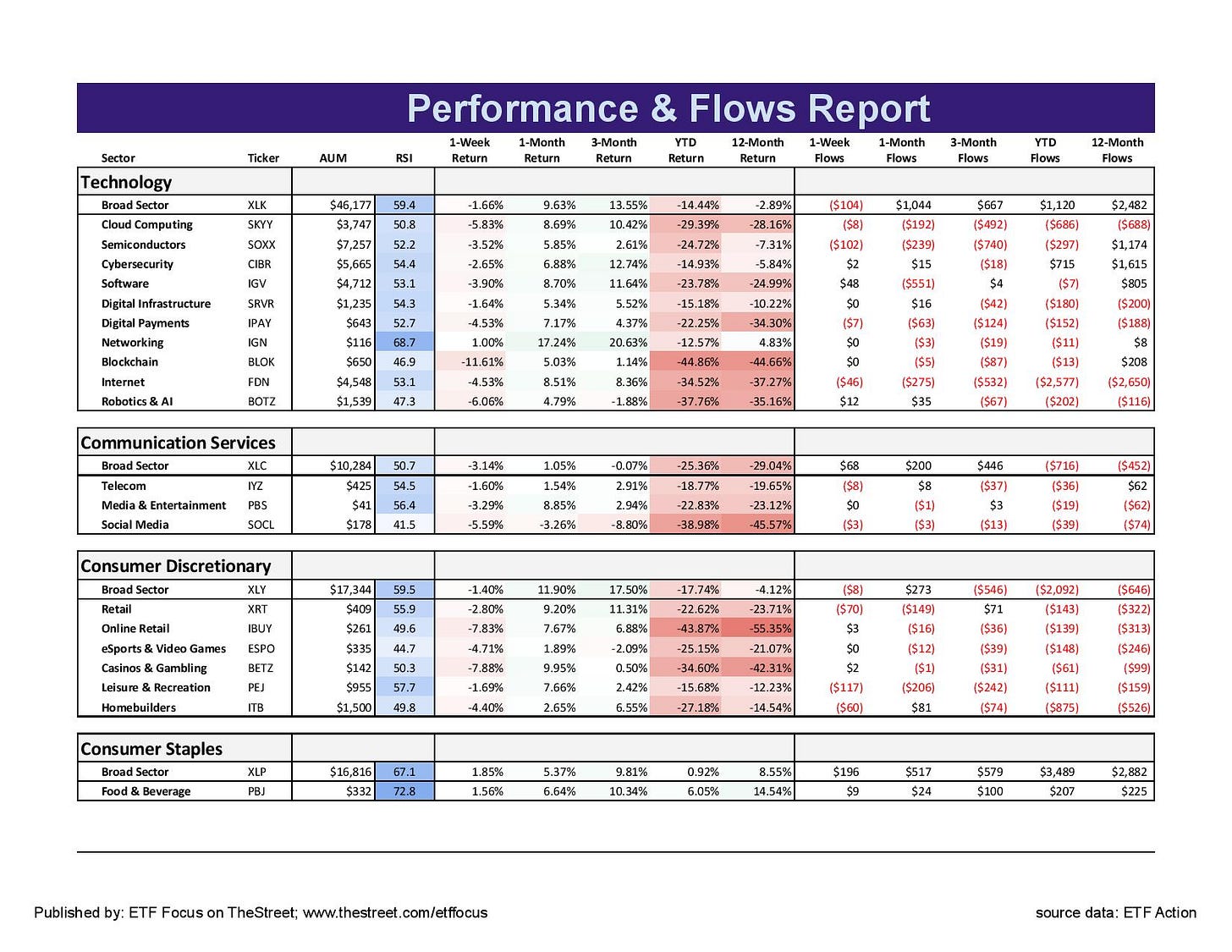

The bounce in tech stocks has, again, been driven by the large- and mega-cap names. Most of the sector’s subgroups have underperformed the cap-weighted index and doesn’t necessarily suggest that the breadth of the past month is in the strongest shape. Another trend that’s continuing is weakness within the social media space, which are no longer looking like the big growth vehicles that they were once believed to be.

Monthly flow data is showing that a lot of new money still hasn’t been moving into growth sectors outside of the big sector ETFs, such as XLK, XLY and XLC. Investors appear a little less inclined to be betting on more narrow areas of the market at the moment.

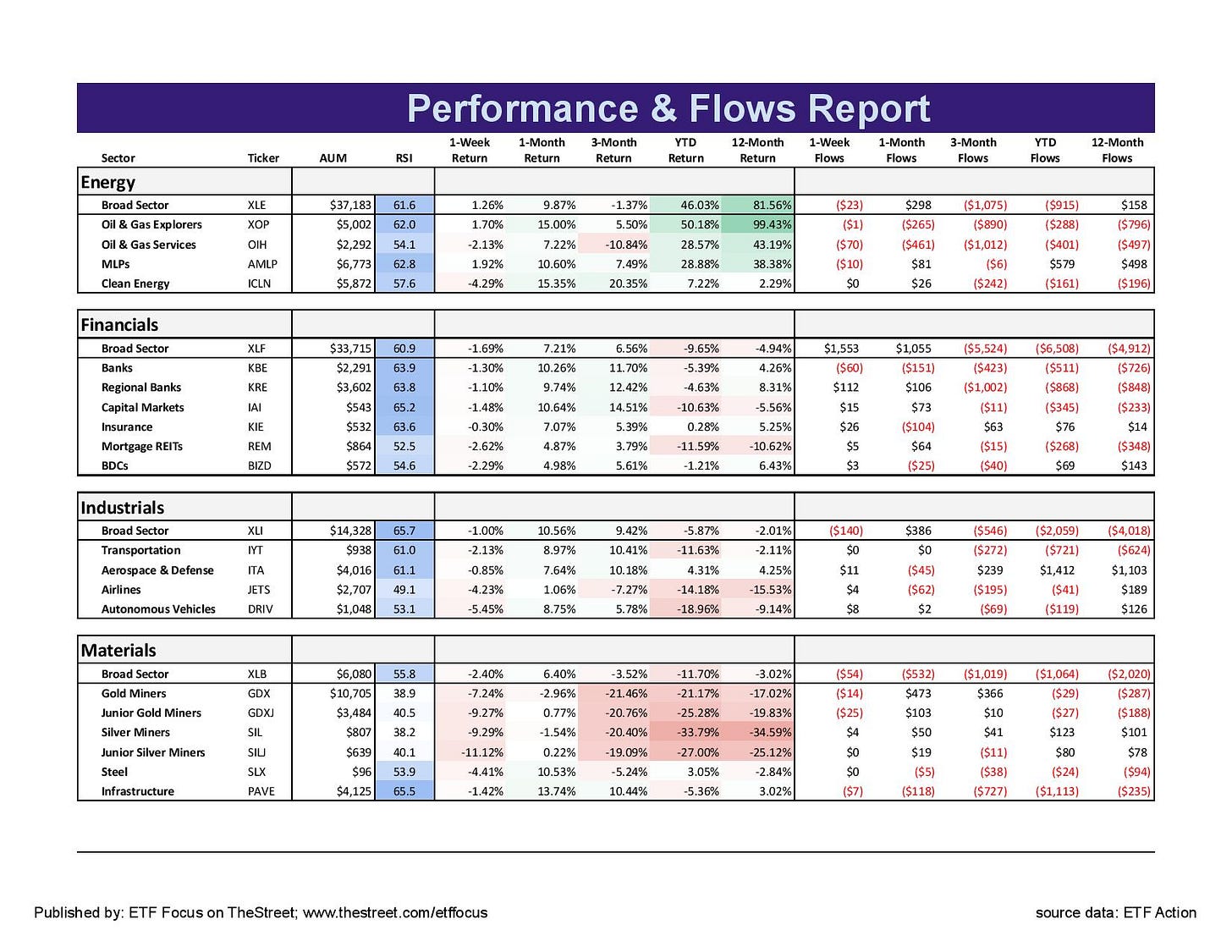

The belief in a more accommodative Fed is providing a boost for cyclicals and the gains have been pretty broad-based. The banks, in particular, have done well as interest rates have struggled making a sustainable move lower in light of recession risks. The industrials sector has been the steadiest and most consistent leader of the bunch by avoiding some of the excess volatility associated with energy and commodity prices. The greatest volatility right seems to be coming from the clean energy stocks, whose 15% return over the past month has been one of the market’s best, but has come at the expense of short-term risk.

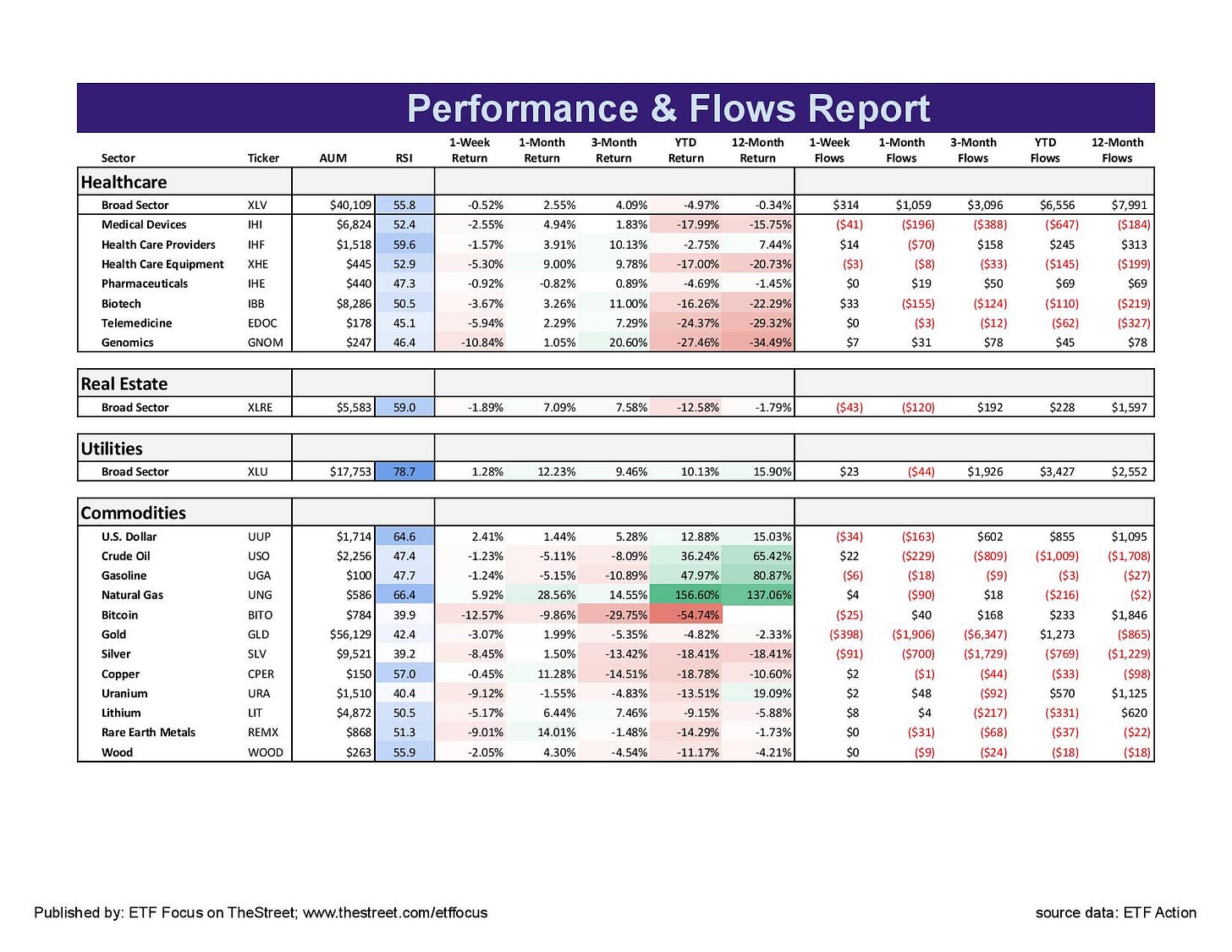

The healthcare sector has gone from outperformer to underperformer quite quickly over the past couple months. A lot of the risk could be coming from the recent Inflation Reduction Act that made its way through Congress, which has lower prescription drug prices on its agenda. Healthcare is a very headline-driven space, so it’s not surprising to see it struggling here.

Again, the utilities sector is quietly performing the best right now, a sign that risk-taking appetite is beginning to wane. The dollar has regained form and remains the global currency of choice. Given the struggles in Europe, the fact that the Chinese central bank is cutting rates and Japan is having trouble generating any economic growth, I wouldn’t be surprised to see the greenback take its current rally another leg higher.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!