Stocks Are Optimistic, Bonds Are Not. Which One Is Right?

The recent rally for the S&P 500 looks great, but falling Treasury yields raise a red flag.

If you’re an equity investor who’s been riding out this year’s bear market and have managed to avoid the temptation to sell, congratulations! Since the middle of last month, you’ve seen the S&P 500 rise by about 9% and the Nasdaq by 11%. Bear markets usually come with intermittent rallies and it’s a good reminder how good old fashioned buy-and-hold can have benefits.

We can argue that stocks were due for a bit of a rally given how negative sentiment and performance have been this year. I think what we may be seeing here is investors reacting to what is looking like the end of the Fed rate hiking cycle this year. Throughout 2022, we’ve seen inflation rates soar and the Fed attempt to quickly catch up to get it back under control. The problem is that there was no understanding of where the ceiling might be. With inflation and interest rates moving sharply higher, there was little reason to be overly optimistic about stocks.

Today, the end may finally be in sight. I think what we’re looking at now is a 75bp hike this week, a 50bp hike in September, 25bp hikes in November & December and that’s it. Then, I think we’re looking at rate cuts again by the middle of 2023. Stocks, we know, react favorably to loosening financial conditions and I think they’re starting to sniff that out now. Stocks won’t turn when the economic damage is finally over. They’ll start moving higher ahead of it and the trigger is probably when the Fed pivots (or gives hints that they’re thinking about it).

The bond market, on the other hand, isn’t nearly as optimistic. As of the middle of June, the 10-year Treasury was yielding nearly 3.5%. Today, that number is at 2.8%. If the short end of the curve is reflective of central bank activity, the long end is representative of economic activity. The 3-month Treasury yield is still gently moving higher, but not nearly at the furious pace it was earlier in the rate hiking cycle. Short-term Treasury traders think the Fed isn’t quite done yet. Long-term Treasury traders see recession ahead and are positioning themselves more defensively.

So, which one is telling the right story? Is it stocks or bonds?

I’ve often said that the bond market is right more often than the stock market. I think that’s the case here too. Looser conditions are beneficial for equities, but it doesn’t overshadow the fact that most economic indicators right now are signaling that we’re heading full speed towards recession. Plus, we don’t know yet how bad it might get. The real estate sector in China is looking like it’s in real trouble. The housing market in the United States is already going bust. Companies are laying off again. Some emerging economy governments are already defaulting on their debt. This may not be a run of the mill recession in the immediate future.

I wrote about Treasuries becoming a real opportunity later this year just a couple weeks ago. I still think that’s the case now. Investors should be paying attention to what the bond market is saying.

With that being said, let’s look at the markets and some ETFs.

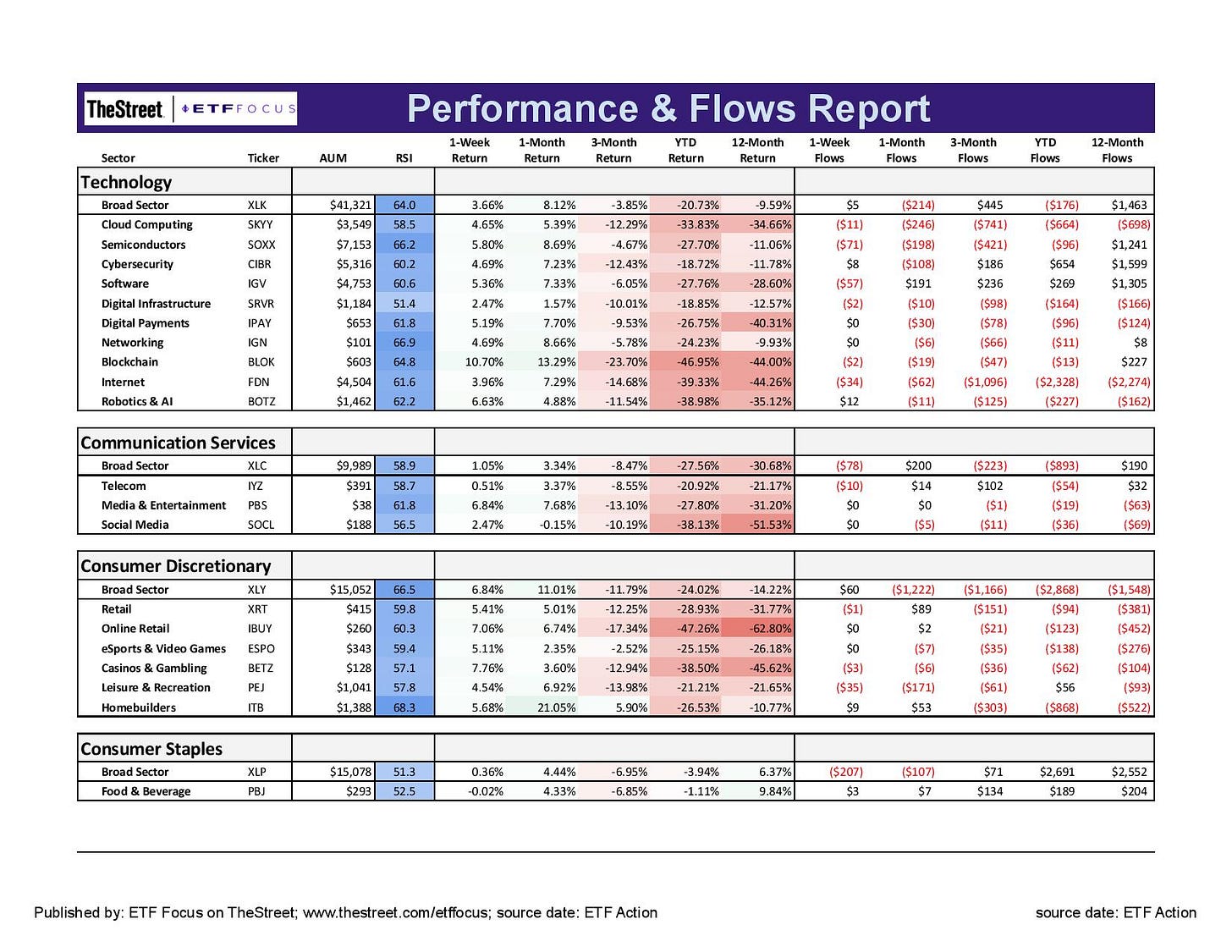

The S&P 500, as mentioned, is looking healthier here and it’s being driven by the return of growth sectors. Discretionary stocks have been beaten down handily this year and I think this recent move is an oversold bounce as much as anything. The concerning outlook for the retail sector makes me feel like 2022’s performance thus far is justified. Tech, however, looks a little more interesting. Valuations have come back down into a normal range and there’s still a lot of growth potential over the next several years in many of these areas. Granted, a coming recession will sink all boats, but I’m beginning to like the look of its risk/return profile.

Semiconductors have been leading the charge in the tech space, but most areas are looking good here. It’ll be interesting to see how the chips bill in Congress with come out. It certainly seems like it would hurt profitability on the surface, but it’s passage is unclear at the moment. Blockchain stocks had a good week, but it’s been a stomach-churning ride. Short-term measures show this group behaving twice as volatile as the S&P 500. There’s plenty of opportunity here, but who knows where the right entry point is.

The communication services sector is tough to get too optimistic about. I think we’ll learn a few things from Facebook’s and Alphabet’s earnings coming up, but Snap’s big miss, Netflix’s struggles and Twitter’s battle with Elon Musk suggest a lot of uncertainty here. Share prices have certainly reflected the highs and lows of this group, but it’s not one I’m getting behind here.

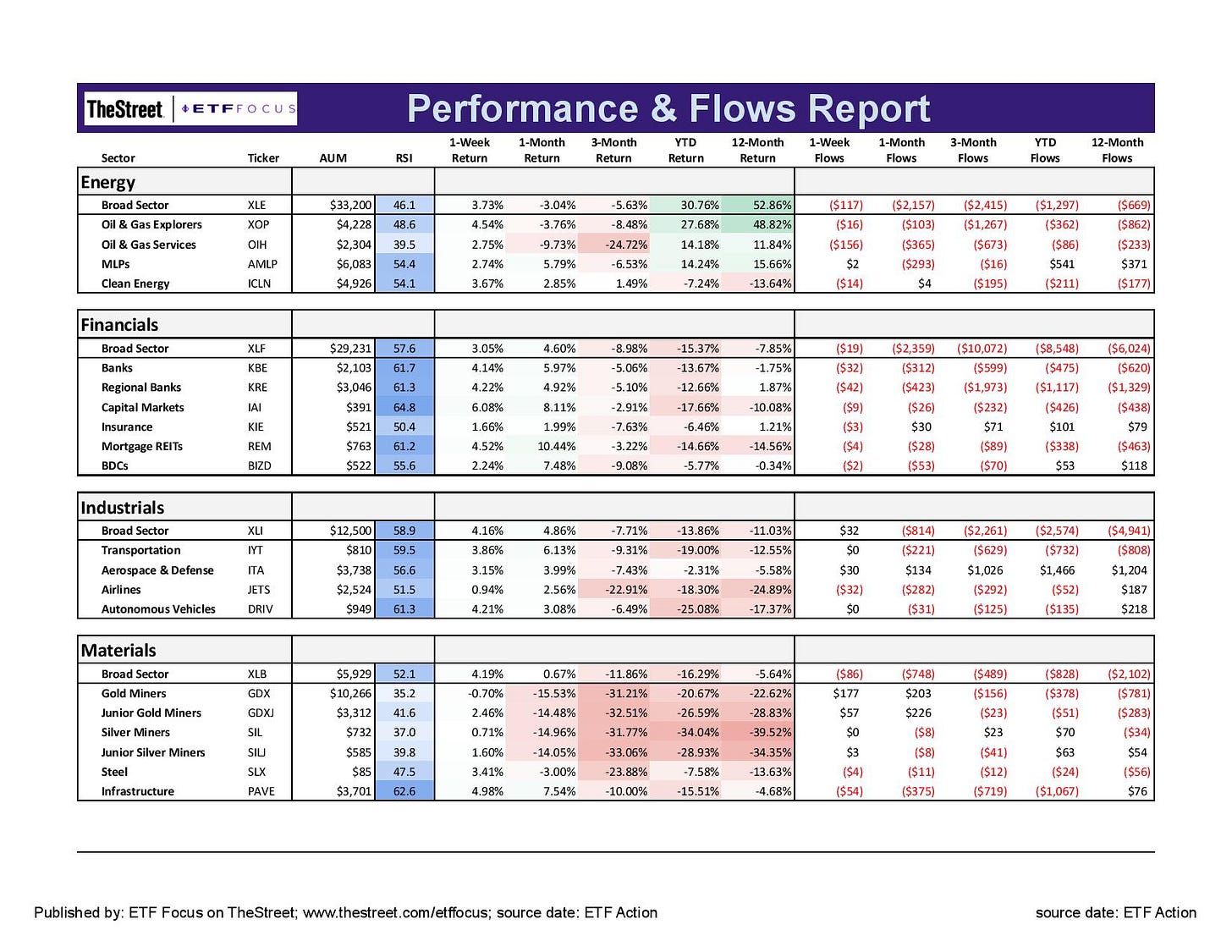

Energy is still hanging on here, but it’s not the high flyer it used to be. Natural gas prices are still on the rise, reflecting some of the risks happening between Europe and Russia, but crude prices are still well off of their highs. Surveys are indicating that it’s not COVID that’s putting downward pressure on travel demand any longer. It’s affordability. Even though I see this sector facing more struggles, there’s a fairly compelling case that there’s some downside protection here based on valuations alone. I wouldn’t give up on this sector just yet.

The earnings season for the big banks produced mixed results and told us a lot of what I think we already knew. Profits were way down. Higher interest rates helped. The investment banking side dried up. Trading revenues continue to support the bottom line. I think we’re probably going to see rates continue drifting down over the next 6 months or so and that will turn into another headwind for financials.

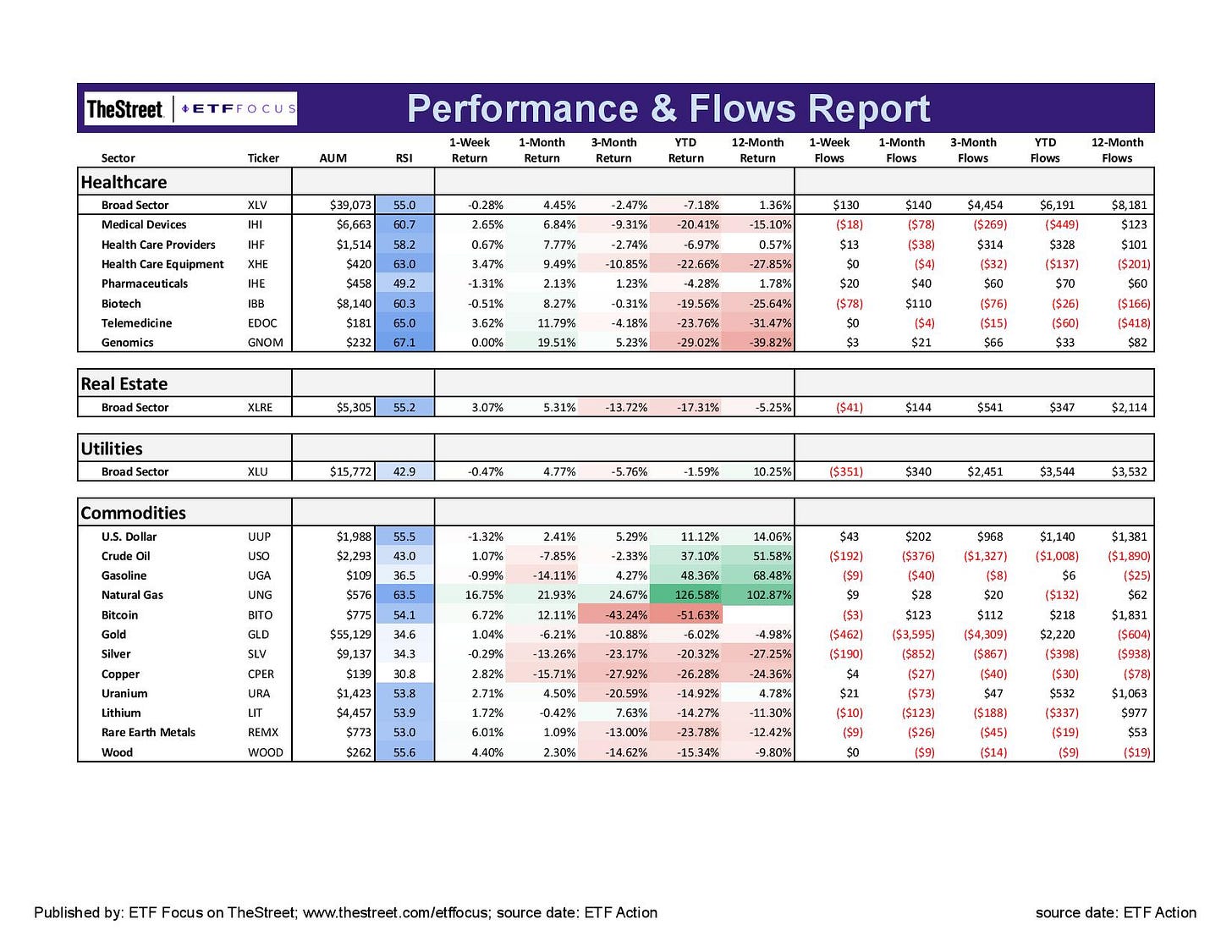

The dollar is finally getting a little competition from other global currencies. The euro got a nice bump from the ECB’s 50bp rate hike and the reopening of a key pipeline from Russia. A decelerating economy will always fuel demand for the relative safety of the dollar, but it’s certainly looking overbought here and due for a reversal.

The declines in copper and silver concern me the most. These are two heavily used industrial metals and seeing their prices drop 13-15% in just one month suggests the manufacturing sector is deteriorating rapidly. Lumber pries heading south again only confirms this notion.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!

JEPI is always optimistic. :)