Recession Watch Is On! 5 ETFs To Protect Your Portfolio Today

These aren't just Treasury or low vol ETFs. We're looking at tail risk, options and deflation hedge strategies.

The big news of last week is that the 10Y/2Y Treasury yield spread, commonly known as the recession indicator, finally inverted and looks like it will remain there for a while. This indicator has a long history of forecasting U.S. recessions by about 18 months, give or take, when it first turns negative and stays there. That means we are officially on recession watch!

So what does this mean for your portfolio and what should you do right now?

Your first inclination might be to sell stocks and move into bonds, cash or some other defensive asset, such as gold. History shows that might not be such a good idea for now at least. In the five most recent yield curve inversions, the S&P 500 was up more than 10% a year later in four of those instances. It’s almost as if investors know what’s coming, but they still want to squeeze every last drop of blood out of the turnip.

I suspect the first thing we’re going to see from the market is a rally in long-term Treasuries. While short-term rates are still moving higher based on what it expects the Fed to do, long-term rates have flattened. That’s a result of investors believing that the Fed will begin cutting rates again in the intermediate-term. That’s also consistent with the idea that a recession could officially arrive within 18 months, if not sooner.

The overnight index swap (OIS) curve is confirming this. After expecting that target Fed Funds rate to peak at 3% sometime in the 1st half of 2023, the market is pricing in rate cuts during the 2nd half of 2023 and beyond.

I wouldn’t necessarily look to these forecasts for specificity. There’s a lot that can happen between now and then that would change these expectations (and usually does). Plus, the Fed is notoriously difficult to predict. I do, however, think the general direction of this forecast is correct and probably should be expected at this point.

The question now is how do you protect your portfolio from what is coming?

There are any number of ETFs out there that can offer protection in some form or fashion. Some just shift to defensive stocks or bonds. Others own puts on the market outright to profit when stocks decline. Here are five ETFs for investors to consider if you’re looking to limit downside risk.

Innovator Laddered Allocation Power Buffer ETF (BUFF)

I’m a big fan of this fund and “buffered” ETFs in general have seen big asset inflows over the past few years. Innovator’s buffer ETFs invest in FLEX options on the major indices that provide protection against a pre-determined level of losses in exchange for a cap on upside potential. The “Power Buffer” ETF provides protection against the first 15% of losses over the outcome period, but caps index gains at around 9% (it fluctuates depending on market conditions). BUFF holds on equal allocation to 12 monthly buffer ETFs that reset every month.

This is a great way to protect your portfolio while maintaining the ability to capture the upside in stocks in case you’re wrong. Innovator offers Buffer, Power Buffer and Ultra Buffer ETFs that provide different levels of protection and caps.

Cambria Tail Risk ETF (TAIL)

TAIL is a pure downside hedge. It buys put contracts on the S&P 500 that become more valuable as the index falls in value. It also holds most of its assets in a combination of Treasuries, TIPS and cash. While the fund will lose money more often than not (because the S&P 500 rises more often than not), it can really pay off when it’s needed the most. During the COVID recession when the S&P 500 fell more than 30%, TAIL gained more than 30%.

Global X Adaptive U.S. Risk Management ETF (ONOF)

ONOF utilizes a risk-on/risk-off strategy that invests in the S&P 500 when conditions look more favorable, but rotates into short-term Treasuries when conditions look bad. The methodology for this fund is a little more complicated than what you find in the typical ETF. The idea is that it looks at various technical indicators - volatility, MACD, moving average and drawdown - to make an allocation decision.

KraneShares Quadratic Deflation ETF (BNDD)

All attention is focused on inflation right now, but recession cycles tend to come with greater deflation risk. As the economy slows or prices rise, demand for goods and services declines and prices end up coming back down. BNDD is a fixed income ETF that seeks to benefit from lower growth, deflation, lower or negative long-term interest rates, and/or a reduction in the spread between shorter and longer term interest rates by investing in US Treasuries and options. During its brief life since its inception just over 6 months ago, BNDD has essentially matched the performance of the S&P 500 with a fraction of the risk.

Nationwide Nasdaq 100 Risk Managed Income ETF (NUSI)

If you’ve followed my work, you’ll know that I’ve brought up NUSI several times because I’m a fan of it. This fund starts with an investment in the Nasdaq 100. On top of that it adds written call options to boost yield and purchased puts to provide downside protection. What you effectively end up with is a collar on the Nasdaq 100 that caps upside while limiting downside. It also offers a juicy 8% yield right now, which is terrific news for income seekers.

With that being said, let’s look at the markets and some ETFs.

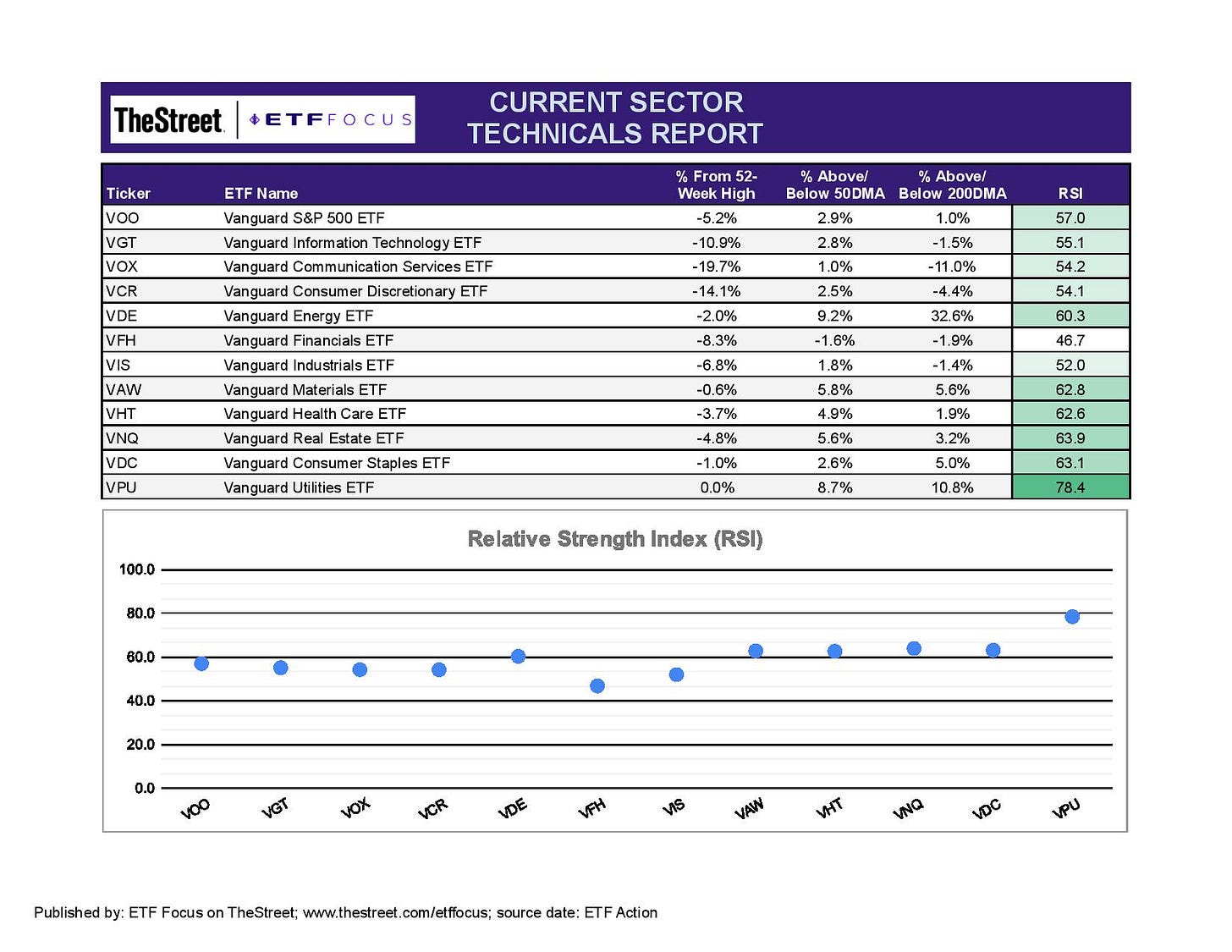

The equity markets are still looking OK here, but there’s a definite pivot towards defensive sectors happening here. Utilities have gone parabolic in the near-term having risen more than 7% in just the past two weeks and outperforming the S&P 500 by 5%. It’s in severely overbought territory, though, and probably due for a pullback or at least a pause. The other defensive are all looking good and were collectively the four best performing market sectors last week. Healthcare and real estate are still about 4-5% off of their highs, but consumer staples could establish a new high with another good week.

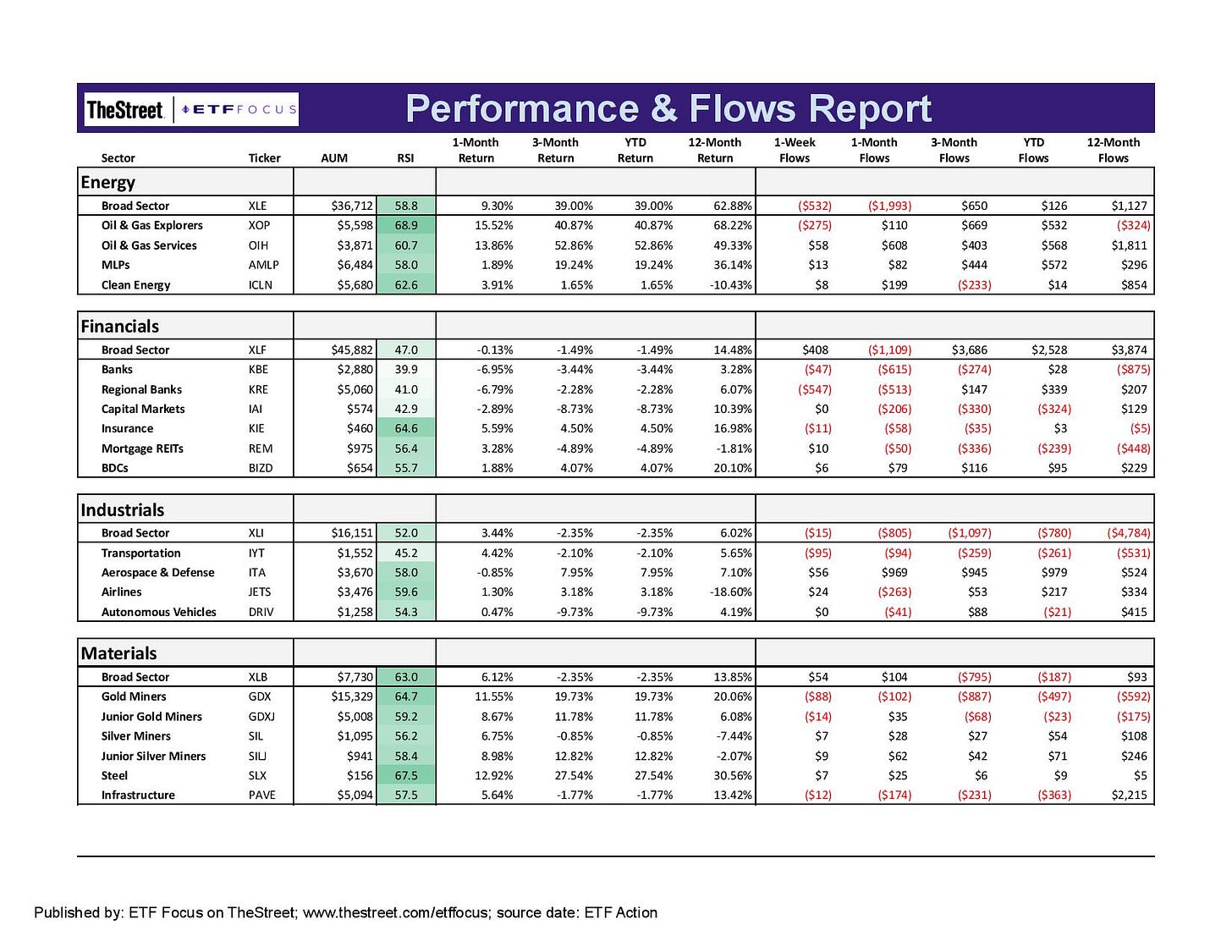

Cyclicals are turning into a bit of a mixed bag. Energy looks like it’s starting to weaken, although conditions look like they could be setting up for another move higher. The markets have been trading on the belief that negotiations between Russia and Ukraine could lead to a peaceful resolution, but we’ve seen little evidence that things are actually progressing in that direction. Financials are definitely breaking down. Higher interest rates are generally good for banks, but the yield curve inversion has traders worrying about the impact of a potential future recession more than the net margin benefits.

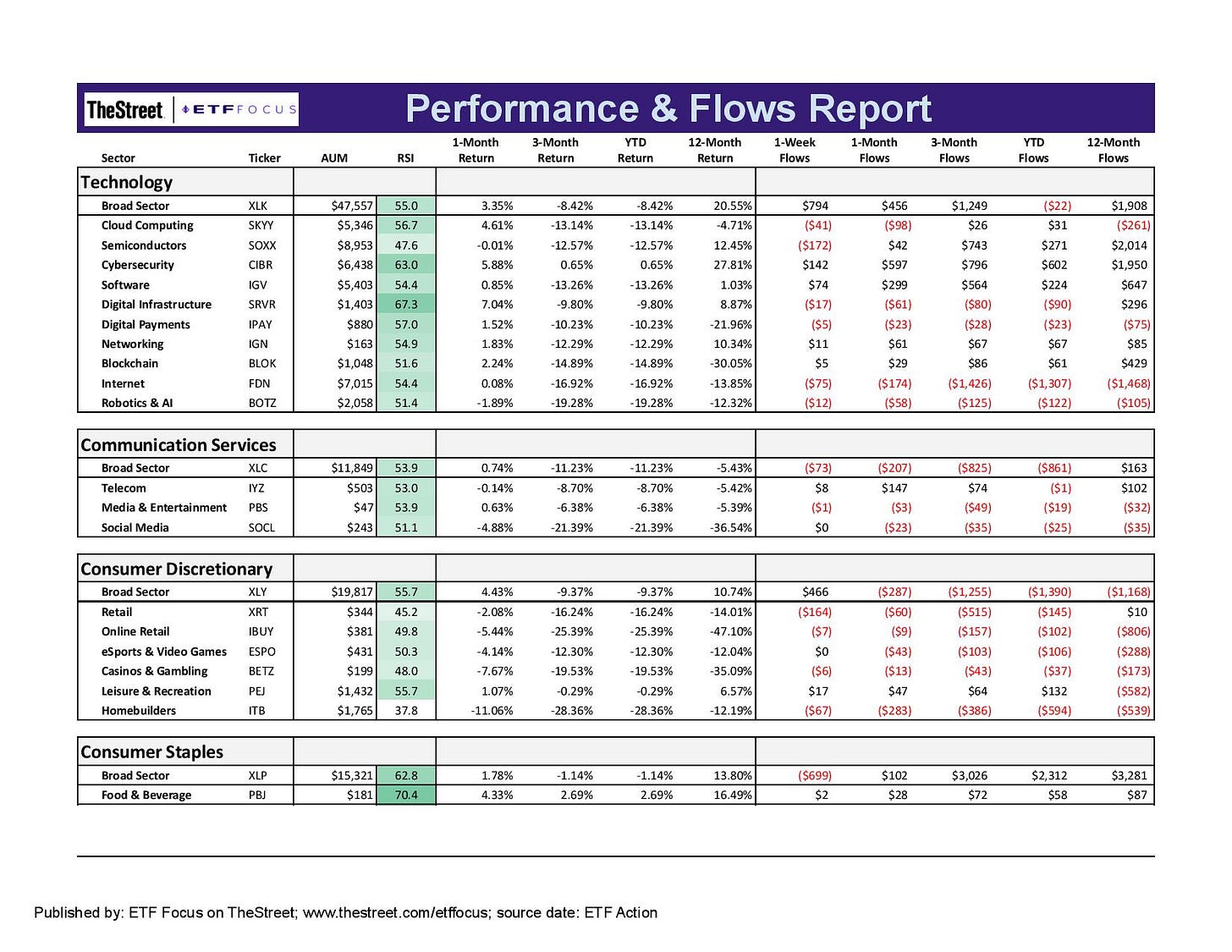

Growth sectors are at least starting to balance a bit here. Tech has been outperforming a little bit over the past 2-3 weeks, but nothing that indicates a major comeback. Consumer discretionary and communication services are volatile but struggling to establish a direction.

Tech has had a nice little run lately, but it’s not yet enough to suggest that it’s ready to lead again. Rising interest rate expectations will continue to deflate valuations and that will have almost no choice but to put downward pressure on the FAAMG stocks. Cybersecurity and digital infrastructure will likely maintain a level of support as long as the Russia/Ukraine war continues.

Communication services looks like the worst might be over in the near-term. Social media stocks have been a steady underperformer, but will likely see a nice bounce this coming week thanks to the news that Elon Musk is taking a big stake in Twitter. There’s probably still a bit of excess to be worked out here, but I think much of the damage is already done.

Recent U.S. personal spending data suggests that inflation might finally be having an impact on the consumer. Discretionary stocks have staged a nice recovery following four straight months of underperformance, but I suspect the downward pressure will resume. Inflation is high, growth is cooling, stimulus cash is gone and it looks like recession is coming. Not exactly a recipe for success.

Energy is still hanging on to short-term strength here, but this is almost certainly due for some pullback. Energy stocks remain volatile and oil prices will likely head lower again whenever the Russia/Ukraine conflict reaches a resolution. With the economy slowing and expected to continue slowing, some of the support for cyclicals will start to fade. The one exception at this point has been materials, which continue to outperform industrials and the rest of the market. This sector is still getting a bounce from the commodities space, particularly from precious metals miners and steel stocks.

Financial stocks are starting to turn uglier. In a vacuum, bank stocks should benefit from higher rates, but the overarching economic environment presents serious headwinds. Higher rates heading into a slowing growth cycle is likely to choke off demand for loans and spending and I think the market is reading that correctly. Some areas of the sector, such as insurance stocks, are doing well, but bank stocks will be the driver.

There was a big pivot towards defensive issues last week, which is why we’re seeing a lot of dark green in the areas of healthcare, consumer staples, utilities and even real estate. Higher rates should be a net negative for REITs, but investors continue to put more weight into its reputation as a place of relative safety in an economic downturn.

The commodities bull looks to finally be slowing in many areas. Crude oil prices have come back down to earth, but we’re still seeing a steady rise in natural gas prices. Lumber prices are plunging again. Industrial metals, such as copper, have moderated, but rare earth metals, including those used in autonomous vehicles and batteries, are in high demand.

The dollar looks to have hit a short-term ceiling around the 98 level. Much of the Fed’s tightening expectations are priced in, but there’s a lot of uncertainty still around what the Bank of Japan and the ECB might do. Japan’s yield curve control measures are killing the yen at the moment and that’s providing support for the dollar here.

Read More…

Best Performing Dividend ETFs For Q1 2022

Best Performing ETFs For Q1 2022

ETF Battles: ARKK vs. FBCG vs. GK - Which High Growth Stock ETF Is Best?

Using Covered Calls To Turn 2% Yields Into 12% Yields

The Fed Tightening Cycle Is Here, But Will It Work?

ETF Battles: What's The Better High Income Dividend ETF? JEPI vs. NUSI vs. DIVO

6 Higher Yielding Cash Alternatives For Your Portfolio

4 Vanguard Bond ETFs For Every Market

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!