Recession Watch Is Officially On

I’ll be watching the Fed meeting this week to see if they actually pull the trigger on a 75 basis point hike.

I’m amazed by the number of people still talking about how the economy is in good shape right now and there’s a relatively small chance of recession. I damn near fell out of my chair when Janet Yellen said that there was “nothing” to suggest that there will be a recession in the United States (this is the same person, mind you, that said inflation wasn’t a risk either). Even The Economist, which is a pretty good publication, said that there wasn’t a chance of recession until 2024 and even then it would likely be mild.

Folks, all of the evidence and data I saw this week tells me that not only is recession risk high right now, but it just got worse.

Let’s start with the most obvious factor - inflation. Expectations were for 8.3%. If that number hit, it would be down from its March peak for the 2nd straight month, likely fueling the argument that inflation was peaking. Instead, it accelerated to 8.6%, a 40-year high. Food inflation is at 10%, also a 40-year high. Energy prices are up 35%. Real wage growth is now down to -3%. Forget what you hear about strong wage growth. Americans are falling further behind.

If consumers are falling behind, they’re inevitably going to start spending less. Since food and gas are staples, the cuts are going to come from the discretionary side. That’s clothes, appliances, home goods and perhaps leisure and travel. And guess what? It’s already happening!

We know this because of Target’s announcement this week. They bulked up on inventory anticipating strong consumer demand throughout the summer and beyond. Only it’s not selling. Target said they have too much inventory and is going to need to slash prices in order to get it off the shelves. Margins are going to shrink. Profits are likely to get hit.

If this is happening at Target, one of the biggest retailers out there, it’s almost certainly happening elsewhere. Most of the big names already indicated that their inventories are also growing. They haven’t issued a Target-like warning yet, but I’m betting that it’s coming. Walmart would be the big one to watch, but really any large retailer would hint at further trouble on the consumer side.

Let’s not forget the housing market either. Home prices in many major cities are still at record highs, but conditions are deteriorating rapidly. You can look at any number of data points to confirm this. 30-year mortgage rates, which were at 3% not so long ago, are up to 5.5% today. Refi applications have dropped to 22-year lows as potential buyers deem housing costs to be too much. A Fannie Mae survey found that 80% of respondents said it was a bad time to buy a house. That number has been closer to 30% over the past decade. The number of sellers cutting their listing prices is up sharply this year. New home construction contracts are starting to get cancelled. This housing bubble is likely to pop very soon and will likely lead the entire U.S. economy into recession.

As far as how to play this, more conservative investments are better. If the economy begins slowing significantly, it’s likely that the Fed halts its rate hike plans and Treasuries begin returning to the safe haven asset they’ve traditionally been. I’d expect Treasuries to have some upside potential once that happens, but who knows how long it will take to get to that point. If you’re looking for an alternative, I’ve been a fan of the AGFiQ U.S. Market Neutral Anti-Beta ETF (BTAL). This fund goes long low volatility stocks and shorts high beta stocks. In market downturns, high beta tends to underperform low volatility, which would translate into positive returns for BTAL.

Either way, this is an incredibly challenging market. Follow your strategy and don’t overreact to short-term developments.

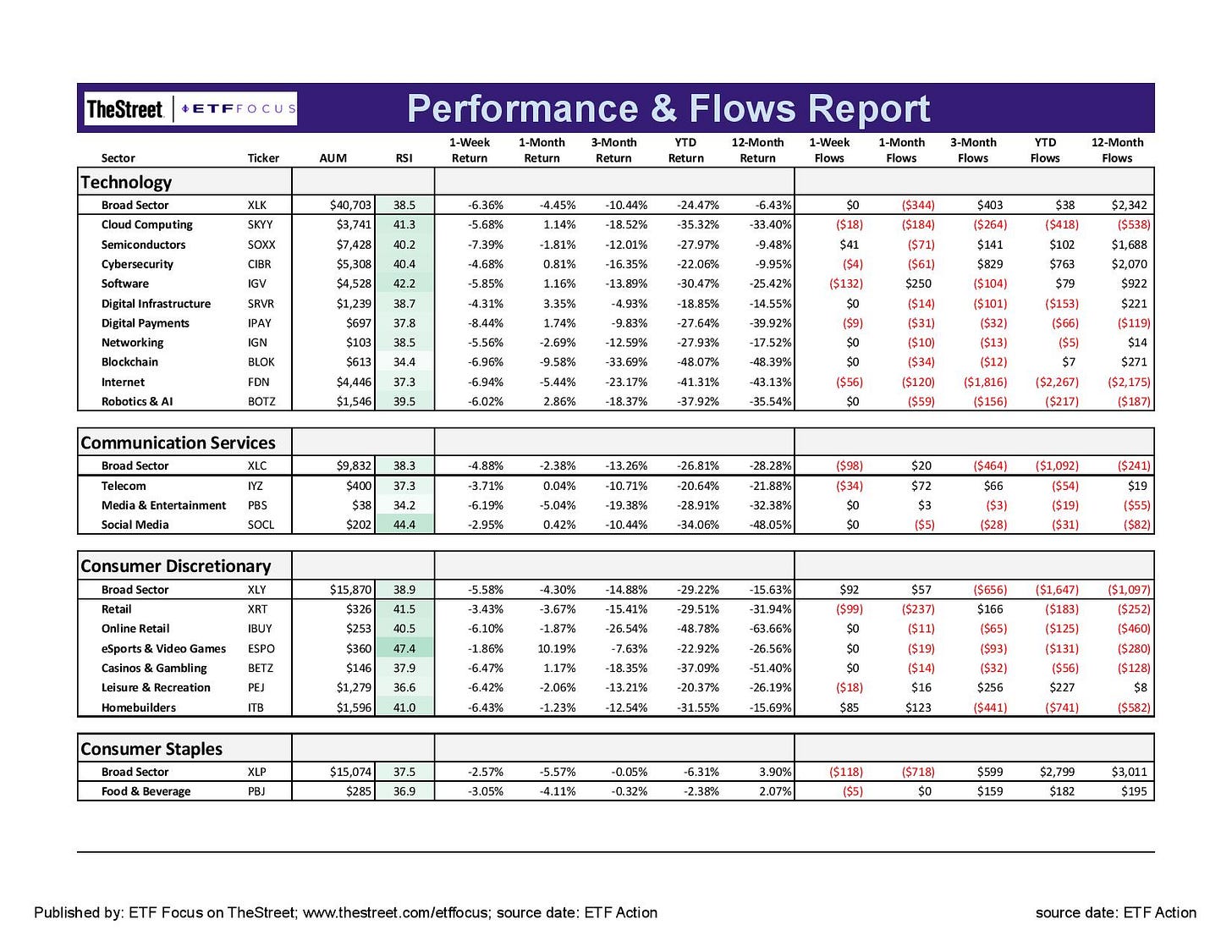

ETF Sector Breakdown

With that being said, let’s look at the markets and some ETFs.

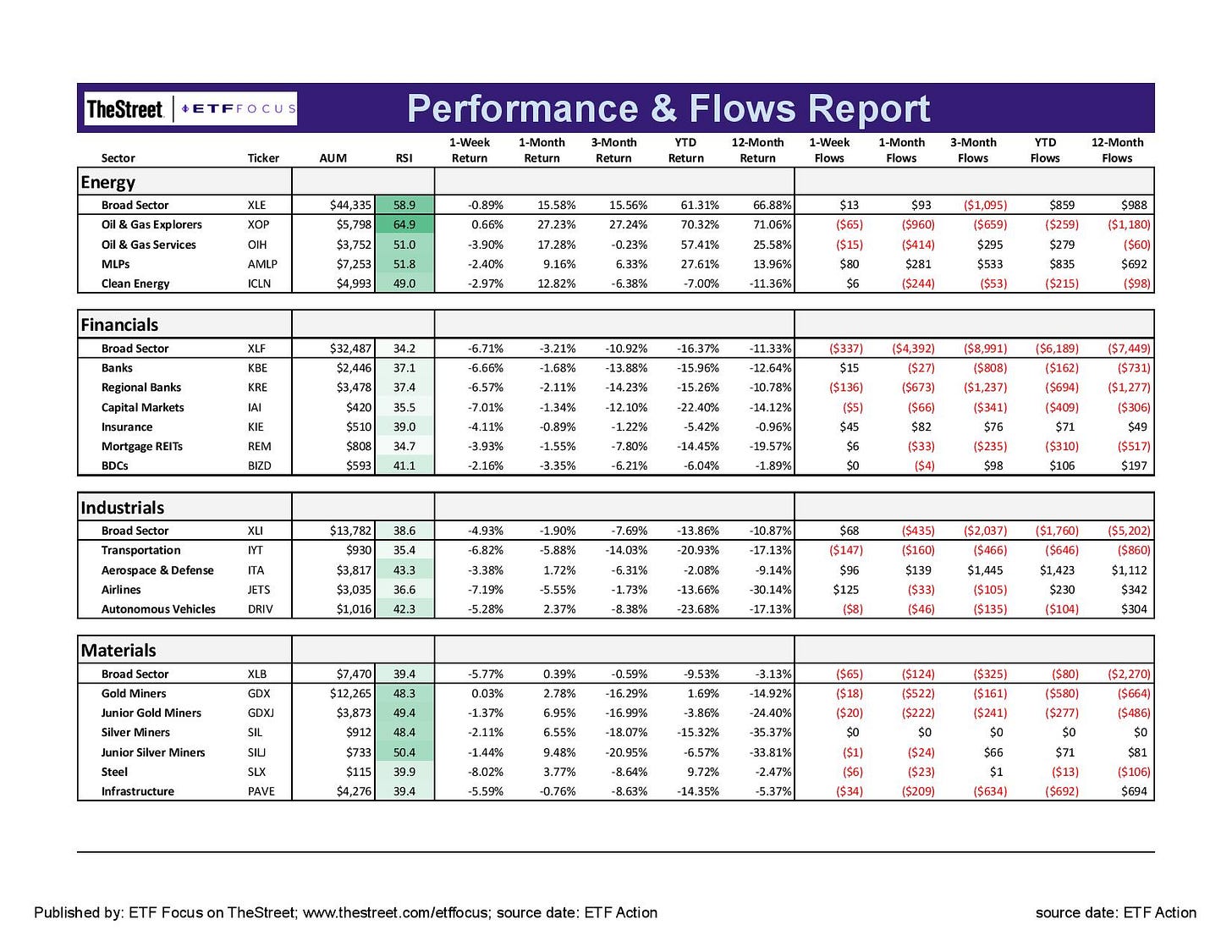

Energy stocks finally pulled back last week, but they’re the only group still performing relatively well in this market. With oil prices showing little indication that they’re ready to move back down and energy companies generating huge margins right now, it’s still reasonable to think that there’s more upside ahead. Materials, which has been possibly the second best performing sector recently, has started to back off as some non-energy commodities, especially lumber, have backed off of their highs. Energy and grains continue to drive inflation, but industrial and precious metals are comparatively weaker.

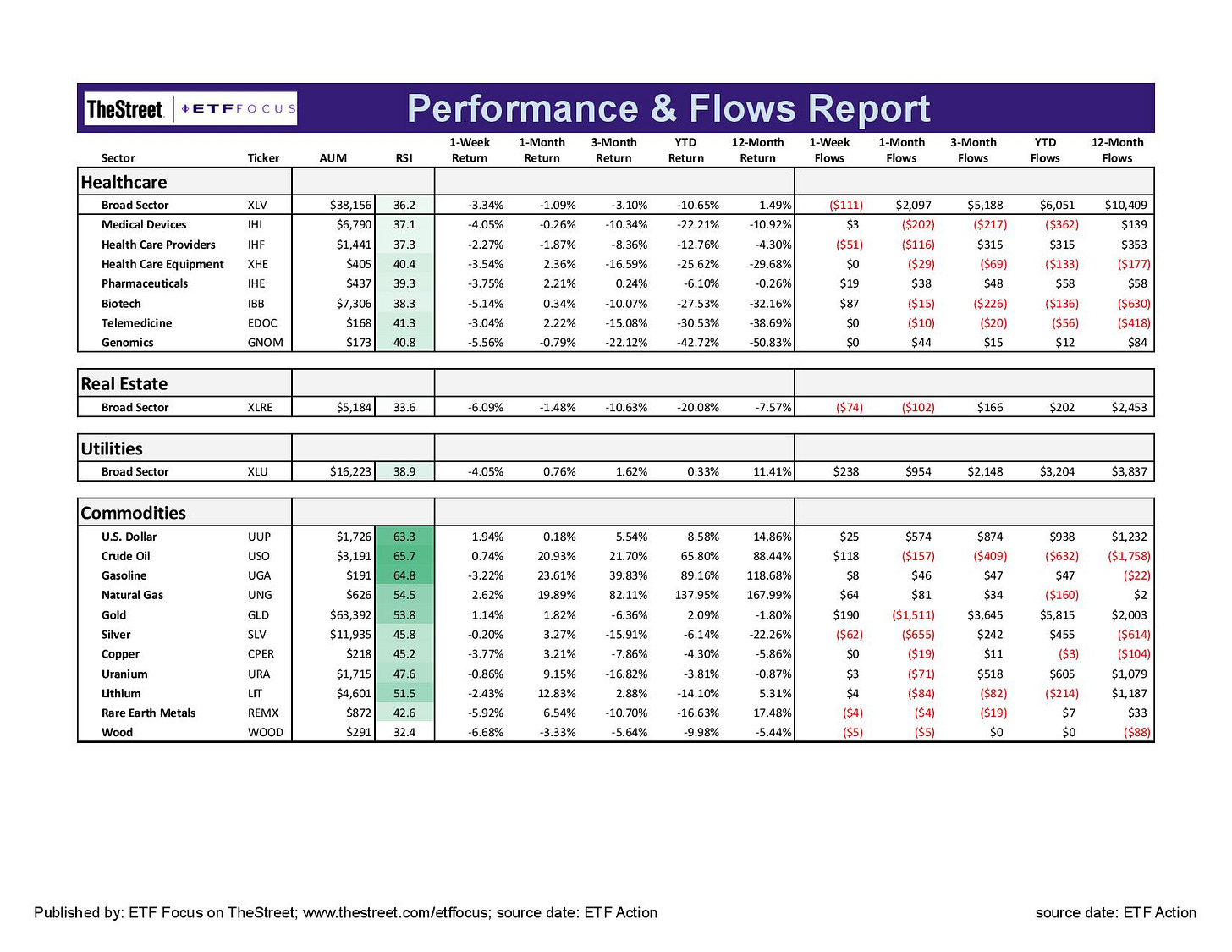

Defensive equities look like they’re finally ready to take a pause here. While the long-term outlook for equities still looks weak, I wouldn’t be surprised to see stocks post solid gains this week. After last week, a lot of the worst news - Target/retail, inflation, housing - appears to be priced in and weakness in utilities suggests investors may be getting ready to pivot. Utilities and consumer staples have been outperforming the market pretty consistently for more than six months. It might be time for conditions to shift a bit.

Investors often look to the technology sector for leadership, but I see little evidence looking at the numbers that anything is set to shift. We may get a short-term relief rally here, but there’s nothing about recent performance, flows or relative strength from any of the subsectors that indicates we should feel bullish. Consumer discretionary stocks have gotten hammered over the past several months, but it could easily get worse. Target’s warning last week should be a warning for the entire consumer and retail sector. Conditions are rapidly deteriorating due to weakness in consumer spending as well as retailers big miss in anticipating those conditions. Communication services is still starting to get a bit more defensive due to its allocation to telecom and traditional media names. Of the growth sectors, this one may be best positioned to hold up in a further downturn.

Energy is still the market’s undisputed leader, but it’s looking like the breadth might be narrowing. While every subgroup of this sector has performed comparatively well, it’s the explorers that have clearly been ahead. It’s also interesting to note that the net flows into this sector are starting to turn red, so we may be heading into a near-term peak. It’ll be worth watching the Fed meeting this week to see if they’ll actually pull the trigger on a 75 basis point hike. It still seems pretty unlikely given how the surprise would probably be taken by the market. Financials may see a bit of a pop in that scenario, but I imagine that the loan demand destruction we’re seeing right now would override that sentiment.

The real estate sector has quickly turned into one of the market’s worst performers. The reasons for this should be fairly obvious - mortgage demand is cratering and the consumer continues to weaken. The dollar is regaining its strength following last week’s inflation report. Investor nervousness has driven folks to what they know best, but it’s the idea that the Fed could act quicker and more decisively on rates that has the dollar heading higher. Lumber remains one of the weakest commodities in the market today, but outside of oil, gas and natural gas, there isn’t much particular short-term strength anywhere else in this space.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!

What a washout today. No safe havens. Stocks, bonds, TIPS, gold. All down. Seems like we could be looking at somewhere between the 3,400-3,600 range before things start to stabilize and turn around. Thanks for the informative recaps.

Bring on the recession! JEPI will get me through it.