Reader Q&A: Let's Evaluate The Week Gone By

What does the Fed do now? Is the volatility over or is it just starting? What are Treasuries and credit spreads telling us?

A little over a week ago, investors were dealing with one of the biggest equity market rotations in recent memory. After months of mega-cap tech leadership, a cooler than expected inflation report led to more aggressive rate cut expectations. With it came a resurgence in previously underperforming areas of the market, including small-caps, value and dividend stocks. Tech suddenly became the worst performing sector of the U.S. equity markets.

That seems like such a long time ago. Today, investors aren’t worried about which area of the equity market should be in the lead. They’re worried about whether they should be invested in stocks at all.

Within the past week, we’ve gotten a rate from the Bank of Japan, a weaker than expected jobs report and another pause from the Fed. The combination inspired a big yen rally and a resulting deleveraging in U.S. stocks. The markets went from normal to panicked in just a few days.

As I write this on Wednesday, conditions seem to have calmed back down (for now). The VIX is back around 27, which is still elevated and potentially dangerous, but not nearly at the levels it was at before. Equities are starting to claw back some of those losses, but the future still looks quite uncertain.

Are we headed for recession? Is the Fed behind the curve again? Is something about to break?

I spent a lot of time the past few trading days on Twitter/X sharing charts, notes and other thoughts on what was happening. As a result, I got a lot of questions (and about 4,300 new followers). So I thought I’d take some time here to review some of them and give my thoughts on what exactly happened over the past week and where we might be headed.

As always, feel free to comment on this post with any questions of your own!

Utilities Is The Best Performing S&P 500 Sector

Whenever utilities is the year’s top performer, you know something’s probably wrong with the markets. Just a few weeks ago, tech and communication services were lapping the field. Today, tech is trailing the S&P 500 and the majority of market sectors.

In my opinion, we’re entering the recessionary phase. Inflation is slowing based on falling consumer demand. The labor market is weakening. Debt levels are rising. Corporate and consumer credit defaults are rising. Regional banks are at high risk due to the commercial real estate market and housing starts are terrible. If just one or two of these were happening, you might be able to counter-argue it with other data. When all of these are occurring at the same time, we’re talking broader economic slowdown and higher recession risk.

The outlier in this is GDP growth, which is still running at a healthy 2% clip as of last quarter. This suggests that recession isn’t imminent, but we may need to see another quarter’s worth of data to confirm where things are headed.

What Are The Fed & Bank of Japan Supposed To Do Now?

I cleaned up the language here from my original tweet, but you can probably still get the idea.

Global stocks are getting destroyed by the unwinding yen carry trade. Now, the two central banks are forced to make some difficult choices. The Fed clearly made a miscue by holding rates steady last month. If they cut sharply now, they close the interest rate differential gap further and give more fuel to the fire that’s been causing this market correction. If they wait, they give the economy another six weeks to deteriorate further before responding.

The BoJ is in a similar boat. Do they hike again in order to fight off rising inflation, but risk swinging the economy into recession. Do they hold off and try to save the economy at the risk of letting inflation spiral higher? There’s no clear “right” answer, but a lot of risk if they get it wrong.

I don’t think the situation itself is inherently risk-off, but it has the potential to go that way depending upon what happens in the next month or two. The VIX has already spiked, so we know there’s a high level of fear in the markets.

I’m of the opinion that we’re more likely heading into a recession than not. In my personal portfolio, I haven’t made any shifts, but I have been buying T-bills with any new contributions to my retirement accounts for the past several months.

I wouldn’t make any massive changes here, only modest tweaks. If I’m shifting defensive, T-bills are a good option. If you want to stick with equities, consumer staples, quality and low volatility stocks make some sense. I would probably avoid anything with a high P/E and I’d avoid corporate credit. Junk bonds are one of the most overpriced areas of the market and the group likely to perform worst in a recession.

What Is The Treasury Yield Curve Saying?

You’ve probably heard a lot about interest rates and how the yield curve is inverted. This is simply saying that shorter-term maturities are paying a higher interest rate than longer-term maturities. Under normal conditions, this shouldn’t be happening due to the time value of money, but the 10Y/2Y spread has been negative for the past two years.

“Uninversion” means the spread turns positive again. Historically, this spread goes from negative to positive a couple quarters before a recession sets in (it actually did turn positive for a brief moment earlier this week before turning negative again).

This original tweet was basically a warning that recession is likely coming.

This is a fair question.

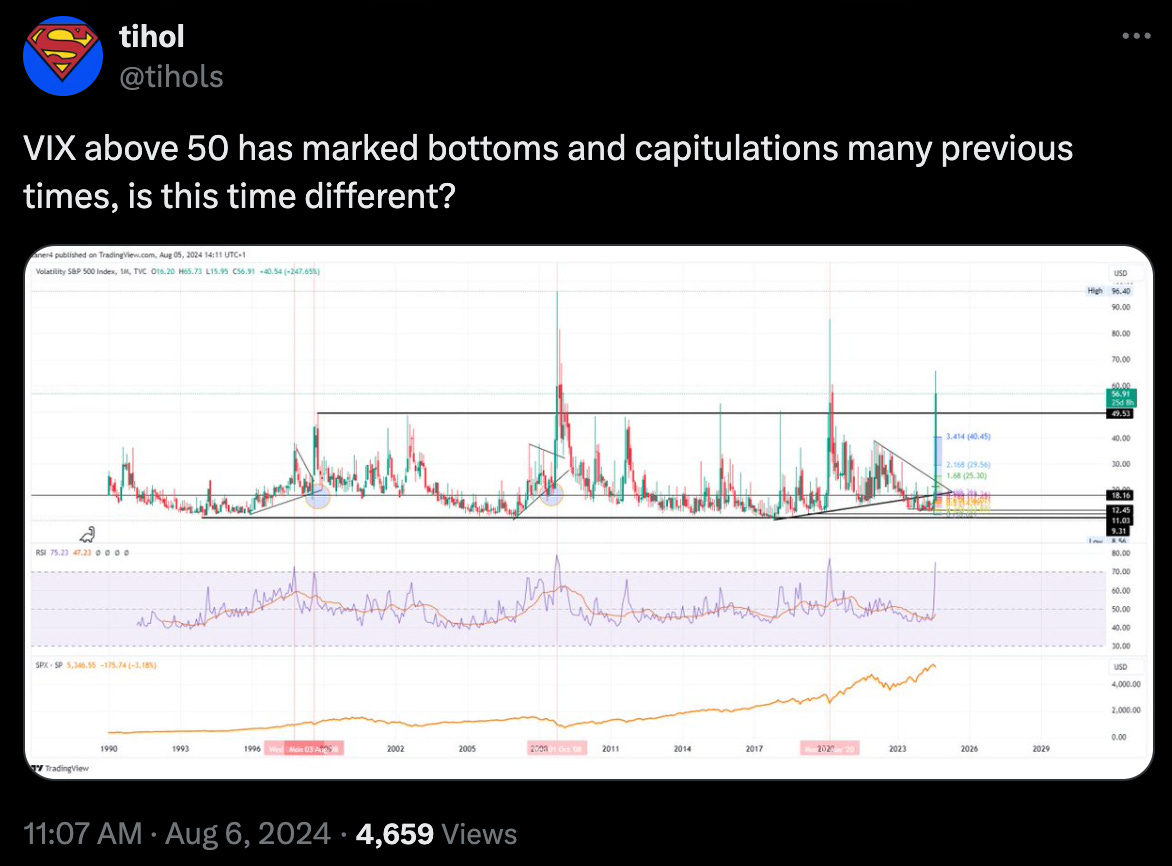

I had also pointed out that high VIX levels are traditionally the best time to buy. In effect, it’s the buy-low argument. I based this on a research paper that Michael Gayed of the Lead-Lag Report and I authored four years ago talking about using the VIX as a buy/sell signal.

Here’s the chart of forward-looking returns for all of the S&P 500 sectors based on the value of the VIX.

Essentially, it’s saying that the higher the VIX is, the better the long-term returns (returns, of course, vary depending on which sector you choose). VIX spikes correlate highly with stock market losses, as we saw this past week, and those tend to provide good buy low opportunities. If you have the stomach to pull the trigger.

If recession is coming, yes, there could be more short-term losses ahead. That’s why we focused on long-term holding periods in the paper. The stock market tends to turn higher well before a recession is over, so trying to time it is dangerous.

We don’t if or when there will be a recession. We do have the data, however, that shows the best time to buy is when the VIX is high.

Will The Fed Make An Emergency Rate Cut?

A lot of speculation arose after Monday’s plunge, including whether or not the Fed would hold an emergency session after holding rates steady just days earlier. This meeting hasn’t happened as a lot of ideas and worst case scenarios get bandied about in times like this.

First things first, I really doubt that the Fed would make a policy change between meetings unless things really start falling apart. Even if they did, it would be months, if not quarters, before the effects of those rate cuts would even be felt. The risk/reward makes it not really worth it.

Would it be a short-term fix? Possibly, but not likely. Remember, a rate cut would exacerbate the reverse yen carry trade further, which is the primary reason this correction happened in the first place. You risk doing more damage at this point.

Did the Fed wait too long? I think so. This seems like a repeat of 2022, but in the opposite direction. The signs have been there for months that a gradual easing was warranted as inflation was cooling. Powell kept using the phrase “data dependent”, which is backward-looking, not forward-looking. The Fed missed the signs and now probably needs to make 50 basis point cuts instead of 25. That tends to raise volatility, which the market doesn’t need right now.

Credit Spreads Are Sending A Warning

Widening credit spreads are one of the market’s easiest warning signs. As the bond market gets more nervous, investors require greater returns for taking on risk. Rising credit spreads are associated with market declines almost as strongly as a rising VIX.

Spreads have risen sharply in recent weeks, but they’re still modest by historical standards. When I say high yield bonds should be avoided, it’s because their risk/reward profile is very poor.

There’s a tendency to avoid or ignore what you don’t want to hear. You can ignore the message that widening credit spreads is sending if you want, but do so at your own risk.

Is Volatility Ending Or Has It Only Started?

Some people may view what happened on Monday - stocks cratering and the VIX spiking - followed by a sort of rebound on Tuesday & Wednesday as a sign that the worst is over. We’ll see in due time whether or not it is, but historically, these short-term cycles usually need time to play out.

2020 was an unusual situation, but you can see in the chart above that stocks whipsawed higher and lower for more than a month before conditions settled down. There were several huge up days that occurred throughout this period where the S&P 500 fell more than 30% from top to bottom.

The point is that sharp gains and declines are usually part of the process, not necessarily signs of a bottom.

Monday may have marked the bottom. Ask me again in a couple months!

It’s true that VIX spikes have often marked bottoms. In 2020, the VIX peaked on March 16, but stocks didn’t bottom until a week later. The big question is whether the recent spike in the VIX was a one-off or if an extended period of volatility is ahead.

Stocks don’t need the VIX in the 50s in order to correct. A steady period in the 20s, like we saw in 2022, will do it as well.

Final Thoughts

After nearly two years of steady gains, mostly in mega-cap tech, the recent pullback feels both sudden and painful. While the VIX spike into the 60s was historically unusual, it’s important to remember, as I said in one of the tweets above, that volatility is part of the deal. Long-term wealth creation should involve riding out the highs and lows because no one knows when the market is going to turn.

In the short-term, however, I do believe recession risk is high and I think that’s eventually where we’re headed (please don’t ask me for a timeframe). Some of the cracks that have been visible for a while are now starting to become more apparent. And it’s central banks that could become key in determining how bad this might get.

On timeframe, I wonder if we can bracket it a bit. Sahm rule triggered says we’re in a recession (and have been for an average of 3 months), but it takes an average of 2 months after the 3 mo/10yr uninverts for recession to manifest…which hasn’t occurred yet. If it takes a few months to uninvert that part of the curve, that puts the recession starting in January. Now we have a May 2024-January 2025 timeframe. Then stocks start to fall and average of 5 months before a recession which points to July 16 as the top prior to a December recession. Close enough.