Powell Just Gave Stocks Permission To Retest Bear Market Lows

His firm "no pivot" commentary at Jackson Hole removed the possibility of a Fed-fueled rebound.

Jackson Hole is usually a platform for the Fed to offer up its views on the state of the economy and the world. At last week’s summit, however, Jerome Powell took the opportunity to deliver just one clear and decisive message. Don’t expect the Fed to come to the market’s rescue any time soon.

Much of the rally in stocks that took place over the two months following the June low was based on the belief that the Fed would soon end its rate hiking cycle. Since energy and commodity prices were coming down, investors took that to mean the Fed would imminently be taking its foot off the gas. Members of the Fed tried to pour cold water over that narrative, but it wasn’t until last week that they finally started to listen.

Growth stocks had been underperforming in the two weeks leading up to this, but last week helped drive home the point. The S&P 500 was down 4%, but I think it’s Treasuries that might be telling the bigger story.

Instead of bond yields rising in response to Powell’s comments, long end yields fell. Granted, they still rose on the short end, which tends to be more closely tied to the Fed, but long-term yields falling is more indicative of investors growing more concerned about recession. Most of the data right now supports the idea that a recession is probably inevitable at this point, but Treasuries have been stubborn to respond since inflation is forcing the curve higher. Last week’s action in government bonds could be an indicator that long-dated Treasuries are finally ready to run.

If Treasury yields are inclined to move lower here even though the Fed shows no signs of ending the rate hiking cycle, that could be bad news for equities. The Fed pivot was the one thing stocks were hanging their hat on. If that’s now out of the picture, there may be very little propping up risk asset prices.

Not only is the macro data troubling, corporate earnings and valuations don’t look ready to help either. Q2 ended up looking not nearly as bad because expectations were so depressed. On the other hand, S&P 500 companies collectively lowered forward guidance from Q3 all the way through the end of 2023. That puts the current forward P/E on the S&P 500 at 20. That’s on the lower end of the range going back over the past couple decades, but unfortunately it’s still on the very high end of where it’s been for the century before that. Bear markets don’t usually end at a P/E of 20 and I suspect this one won’t either. The mid-June bottom on the S&P 500 was at 3666 and I believe we’re heading back in that direction again.

With that being said, let’s look at the markets and some ETFs.

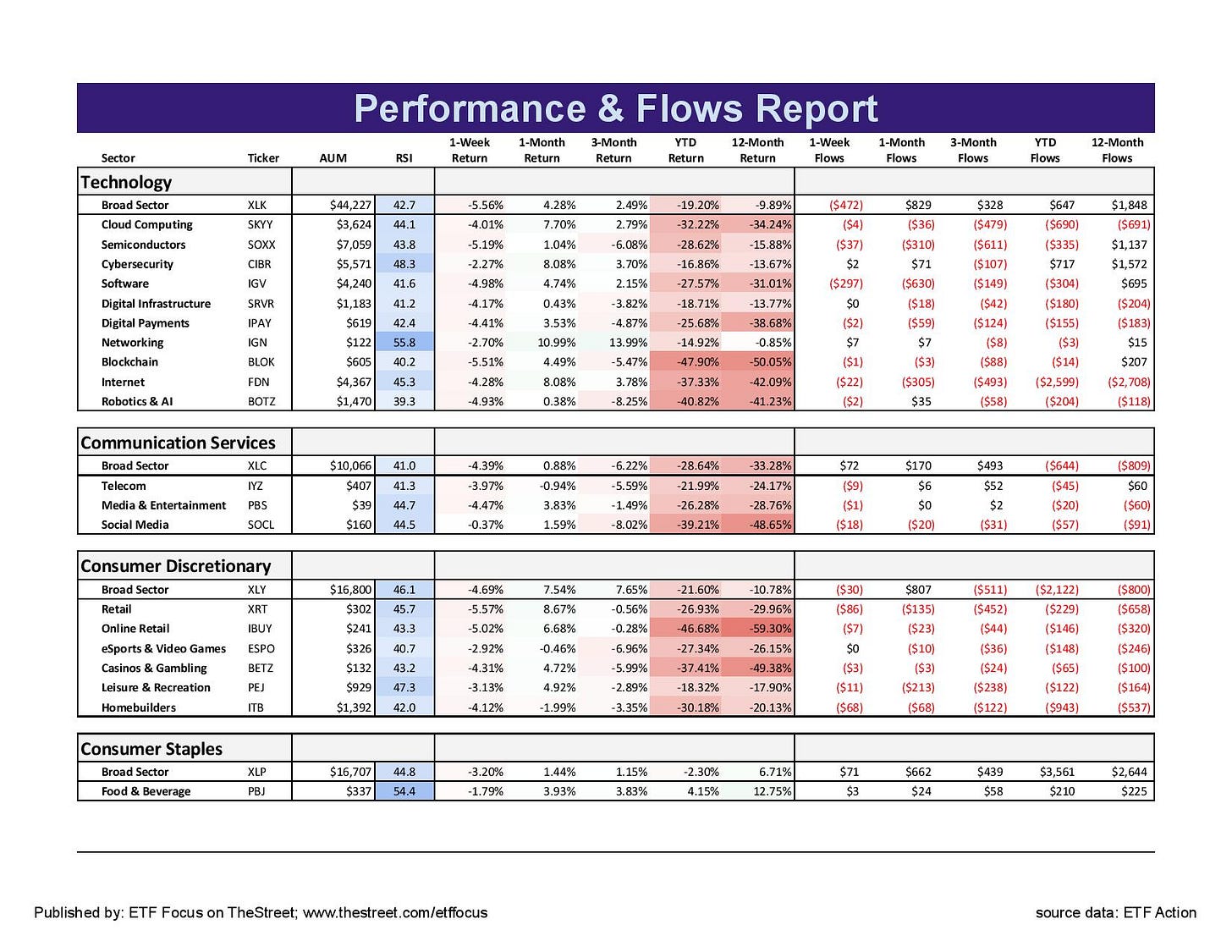

Defensive sectors took a big step forward last week with utilities and consumer staples both outperforming the S&P 500 by around 1%. Utilities, in particular, have been a consistently strong performer throughout 2022, beating the index by more than 3% in the past month and by an incredible 21% year-to-date. This has been the one sector that has consistently sent the message that equity investors shouldn’t be getting too overzealous given how the Fed is slamming on the brakes and there are both COVID and geopolitical risks to consider. Cyclicals continue to hold up relatively well here, but growth is firmly out of favor.

Tech has strung together three underperforming weeks in a row, a sharp reversal from its successful run during the summer bear market rally. Consumer discretionary stocks, which had been one of the biggest outperformers since the June bottom as well, had been hanging on much better than tech, but appears to have firmly fallen out of favor as well. Communication services, of course, has been in miserable shape for a while. Growth’s leadership throughout the summer is what helped give the bear market rally the legs that it did, but its performance over the past few weeks is a bad sign.

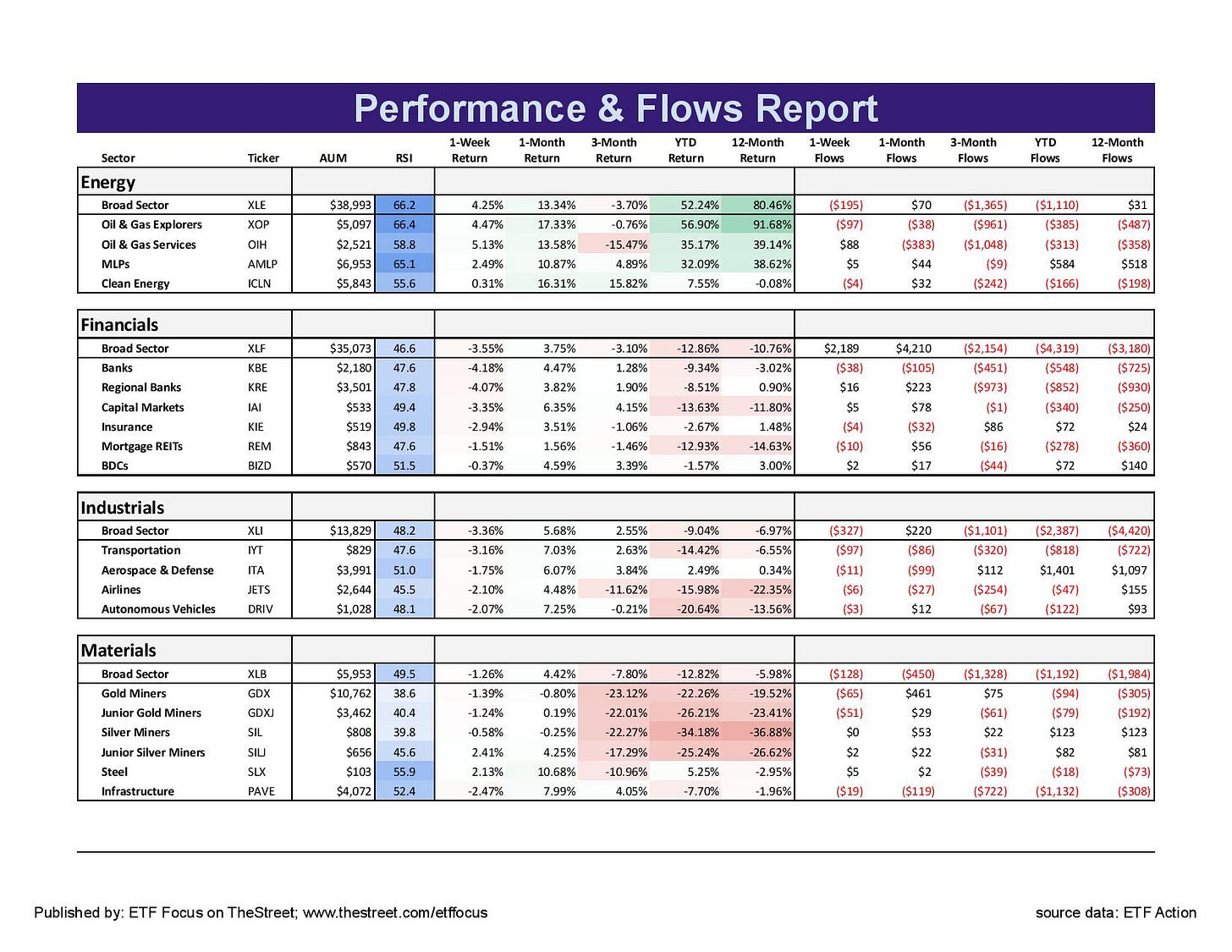

Energy stocks have had an incredible month, but it’s mainly due to geopolitical risk - the energy crisis in Europe and OPEC’s threat to keep production suppressed. While it’s not a good thing from macro and consumer standpoints, it’s been a good thing for energy stocks, which had fallen 26% prior to this recent rally. Material stocks are also recovering, while industrials continue to steadily and consistently outperform the S&P 500. It’s been a nice run for cyclicals, which are still managing to perform pretty well despite a deteriorating macro backdrop.

A couple of areas worth noting here. Natural gas prices continue to soar as the crisis in Europe looks like it might get really ugly. The strong rebound in the dollar is potentially signaling trouble for overseas markets. Emerging markets are particularly vulnerable to a rising dollar since a lot of foreign borrowing is done in dollars. Could it lead to a debt crisis in some of the more leveraged markets? I think risk is still low for now, but this is something that could slow-build over the next 12 months into something more serious.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!