Powell Gets 4 More Years To Try To Steer The Fed Out Of Its Current Mess

Tech stocks are back in control as the commodities correction continues.

There’s a very defined shift within U.S. equities taking place. Cyclicals, which had been leading the market for about two solid months, have begun lagging again due to concerns about the economic growth trajectory and the potential that the Fed could speed up the taper faster than expected. Taking their place has been tech and consumer discretionary - two sectors that investors have consistently returned to when they want to get slightly more conservative but not to the point where they want to shift fully into defensives.

Small-caps have also begun sharply underperforming again along with cyclicals and other riskier asset classes. The commodities sector is in a corrective phase, broadly speaking. Crude oil, gasoline and natural gas prices continue to trade significantly off of their recent highs, but others, including copper and uranium, are also pulling back sharply.

The overall theme is that investors have begun turning mildly more cautious as the markets prepare for the return of normalized growth rates and tighter monetary policy. The problem is that the Fed has taken way too long to take action and has now backed itself into a corner in terms of how to balance extended economic growth and containing inflationary risks. The Fed should have begun tapering and even raising rates as it was clear that the economy was recovering from its initial COVID lockdown. Target rates should be correlated with growth rates. Instead, the Fed has kept rates at record lows even as growth rates had peaked and have come back down to earth.

The Fed keeps talking about transitory inflation as a way to justify keeping rates near zero, but there’s little evidence to suggest that at least part of surging consumer prices is here to stay. Does the Fed raise rates to contain inflation at the risk of possibly swinging the economy back into recession? Does it leave rates as is to keep the economy going and hope that inflation somehow solves itself? The Fed has few bullets left in the chamber and it may come down to choosing the least bad option.

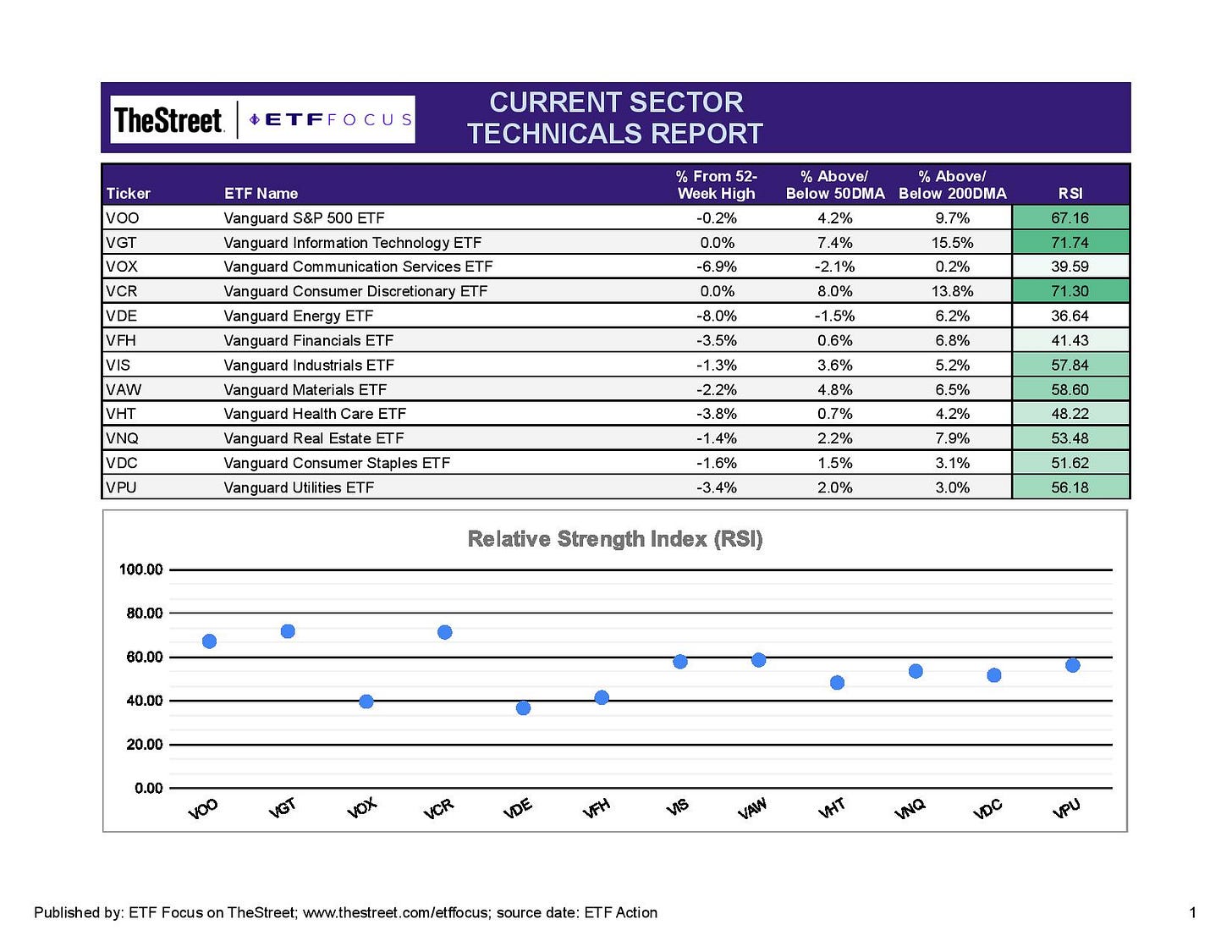

Let’s start our weekly review by taking a look at the primary market sectors.

Relative strength indicators show that the U.S. equity markets are currently being driven by tech and consumer discretionary stocks. The relatively heavy weights to those two groups is pulling the S&P 500 forward and giving the impression that the market is healthy despite several weak spots under the surface.

The communication services sector continues to struggle mightily and is right at the point of dropping below its 200-day moving average. Cyclical weakness is being driven by both energy and financials, which are both bordering on oversold territory. Lower crude demand is synonymous with a slowdown cycle, so it’s possible that we haven’t seen the end of this trend. Financials have and continue to be dependent on the Treasury yield curve. We’re seeing a flattening right now where short-term rates rise and long-term rates fall. Overall, that’s a net negative for banks and lenders and could similarly put pressure on stock prices. Industrials and materials look to be in comparatively better space, but are also trending weaker.

Not much action in defensives again. They continue to mostly lag the market as investors haven’t turned full risk-off yet. Investors seem ready to be positioned long heading into the holiday season, one in which volatility traditionally falls and stock prices rise.

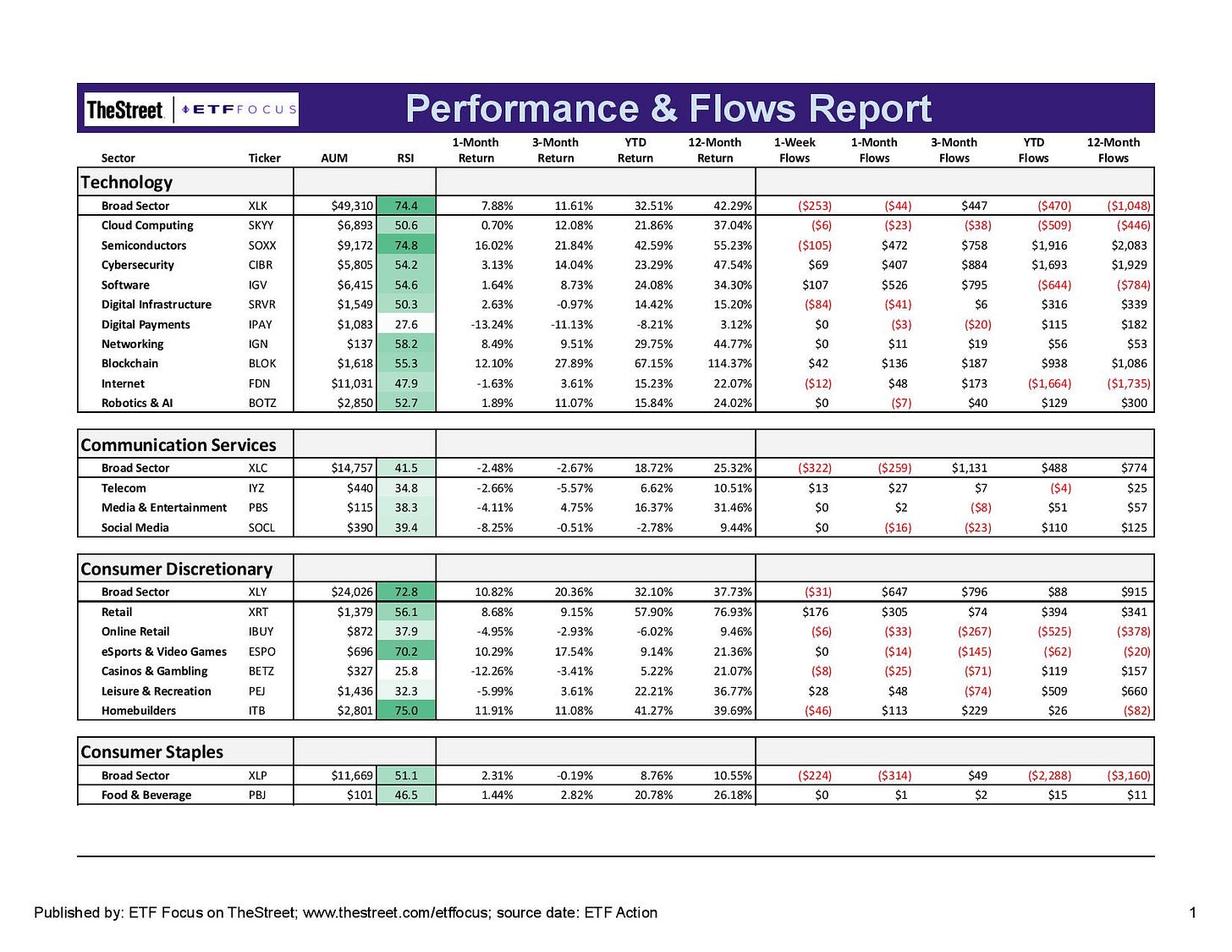

Within the tech sector, relative strength is looking pretty top heavy. Semiconductors continue to drive the gains as most subsectors look to be performing roughly average. Blockchain has done very well over the past month, but remains highly volatile as evidenced by a 6% decline last week. Digital payments is a relatively small segment of the overall sector, but has been a standout underperformer for weeks. Dip buyers may be interested in its oversold signal.

The story is the same in the communication services group. Social media stocks are still a major drag having dropped more than 3% last week again. Not much support in any area within this sector and money continues flowing out.

Homebuilders continue to rally alongside a surge in lumber prices again. The home buying market has cooled from its peak, but still looks relatively healthy as rates remain low. The more economically sensitive areas, including casino and leisure stocks, are the weakest and will likely continue to be as the global economy struggles to pick up. Online retail looks especially weak heading into the holiday season and may need to see some big numbers in order to rebound. Black Friday and Cyber Sunday sales numbers will probably result in a modest move one way or the other during the beginning of next week.

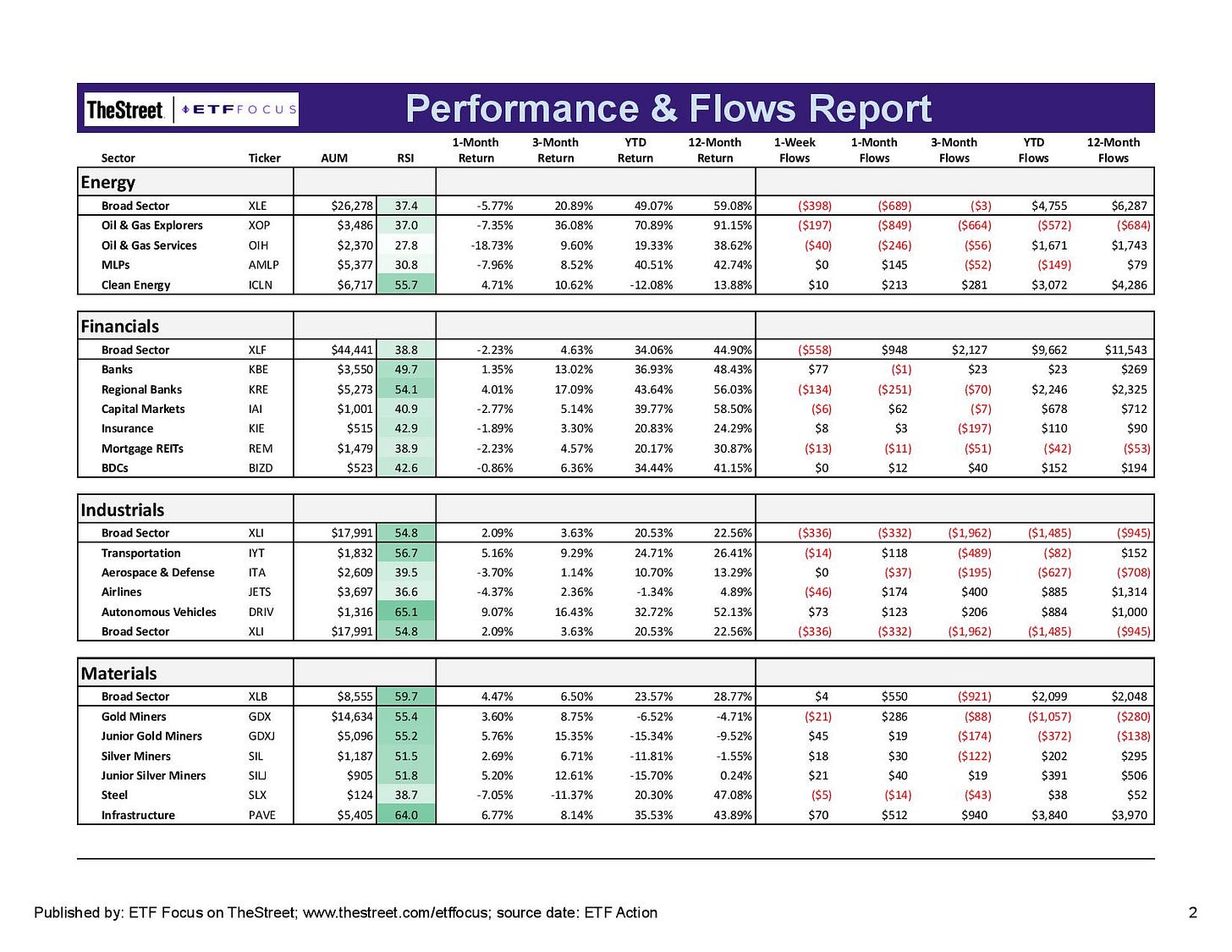

Autonomous vehicles and infrastructure are the only cyclical subsectors that are really showing any strength at the moment. Elon Musk is keeping Tesla in the spotlight, which is probably providing a modest boost for this group, while infrastructure stocks have seen a pop from the passage of the bill in Congress. Outside of that, it’s weakness across the board. Oil stocks are correcting sharply, but even the clean energy names are a mixed bag. Solar has done comparatively better, but wind energy has performed quite poorly.

Elsewhere, the financials have weakened significantly, although the banks have held up relatively well. Gold and silver miners had a moment there when inflation came in higher than expected, but it looks like that pop has already faded and the longer-term struggles of this group are set to continue.

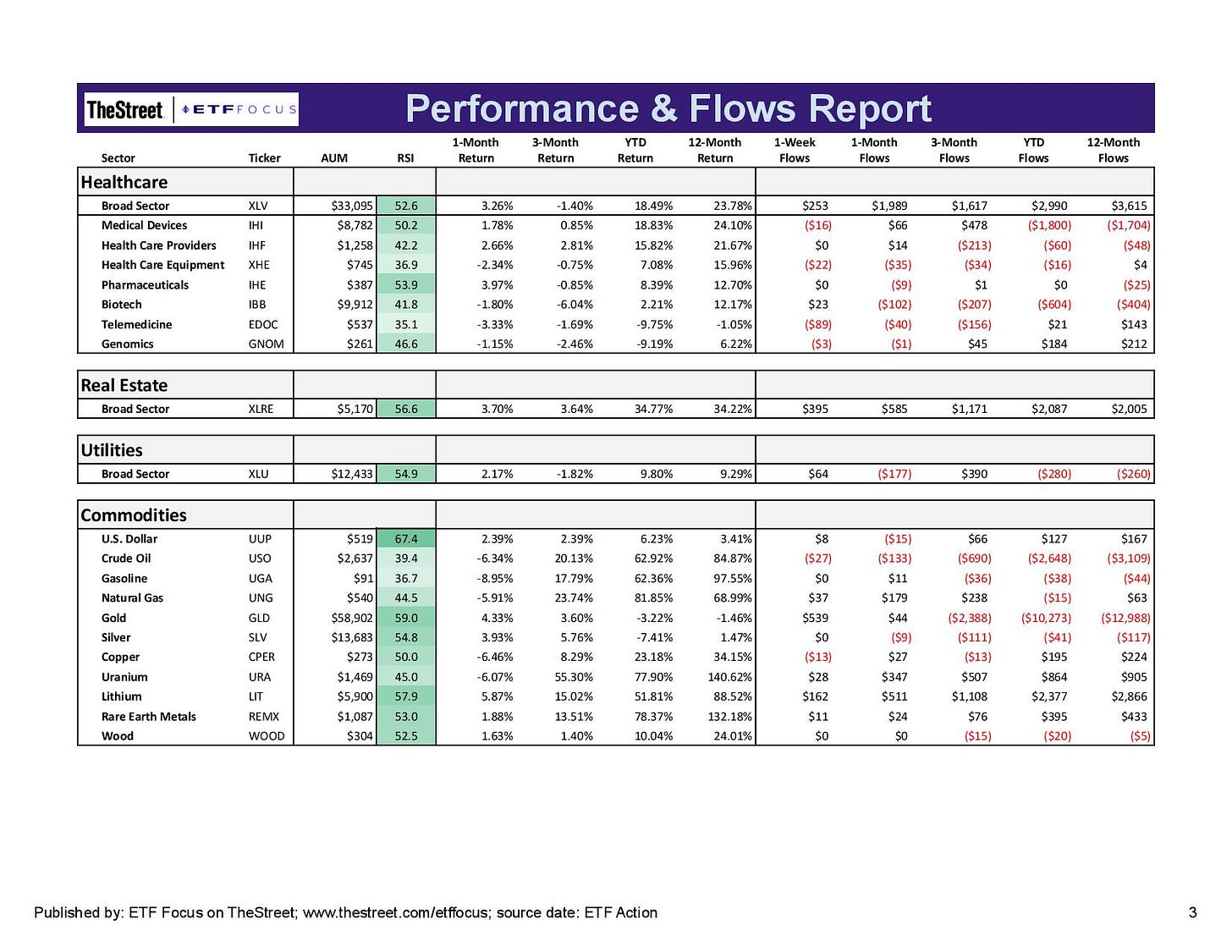

Again, we’ve seen middling performance from defensive sectors without any notable pockets of strength. The healthcare and real estate sectors have, somewhat surprisingly, seen some nice inflows over the past few months, which could add some support.

The dollar continues to look incredibly strong here and could be set to further its rally. The latest COVID outbreak developments over in Europe have already begun sinking the euro and could soon spread to the entire Eurozone. I think the dollar index moving to 100 relatively soon is a distinct possibility.

I mentioned already that energy commodities and industrial metals keep backing down off of their highs. Obviously, their directions will be very cyclically sensitive and conditions probably don’t look too favorable for them over the next several months.

Read More…

Why The 3rd Bitcoin ETF Is Better Than The First Two

Invest In The Metaverse? There's An ETF For That!

Inflation Catches Markets Off-Guard; Gold Finally Shines Again

ETF Battles: Looking For The Best Bitcoin ETF - BITO vs. GBTC

The Short ARKK ETF Launches For All The Cathie Wood Haters

5 Dividend ETFs For November 2021

Top Performing Dividend ETFs For October 2021

Why I'm Still Choosing GBTC Over BITO For Bitcoin Exposure

LIVE BLOG: Bitcoin ETF Launch Day

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!