Is It Finally Time To Scratch The Gold Itch? (Plus 7 ETFs To Play It)

Gold may finally be making its long-awaited move higher.

It would be understandable if you’ve given up on gold. It’s been consistently advertised as an inflation hedge or, at minimum, a downside risk hedge, but it’s largely failed to deliver on both counts.

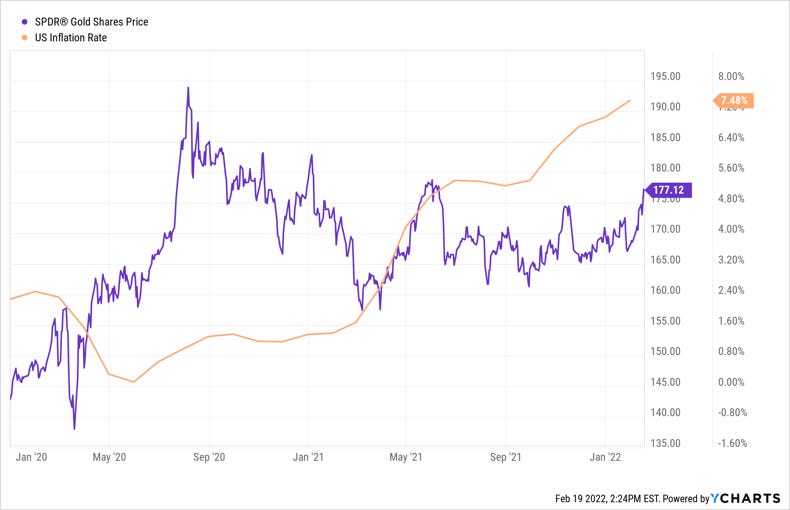

Here’s perhaps the most frustrating chart of all for gold bulls.

The inflation rate in the U.S. has been on a steady path higher since the middle of 2020, yet gold has moved sideways virtually that entire time.

Why has gold failed to move at all during an environment that should have favored it moving significantly higher? Here’s my take on why this has been the case.

To set the table, gold has largely been viewed by the market as a bear market or inflation hedge. In reality, it’s a risk hedge. It’s an asset that has a zero correlation to U.S. stocks. Sometimes it rises, sometimes it falls, but with little rhyme or reason. My research has found that gold prices have moved sharply higher with any consistency during just one market scenario - hyperinflation. By “hyperinflation”, I mean an economy with a 5%+ inflation over a prolonged period. Well, we’ve got 7%+ inflation today, so why hasn’t it worked?

I think a big reason is the use of the word “transitory”. Where prior high inflation markets were viewed as being a result of unfavorable macro conditions, the current high inflation economy was considered only temporary as a result of short-term supply disruptions and huge levels of stimulus from the Fed. Once the Fed started tightening and supply chains returned to normal, everything would fix itself and inflation would return to normal. Investors weren’t interested in gold as they normally might because they figured it was going away soon anyway.

But now, conditions are changing. Inflation isn’t considered transitory any more and investors are looking for safe haven alternatives. Normally, this would mean Treasuries, but the upcoming Fed tightening cycle has lifted the entire Treasury curve and this is no longer viewed as a good option. Some may have tried talking themselves into bitcoin as a hedge, but we’ve seen it behaving just like any other risk asset. What’s next in the bullpen? Gold.

I think gold’s latest run from $1,800 to $1,900 is due to a confluence of factors. First, investors are searching for a safe haven and don’t want to use Treasuries. Second, expectations of the Fed are about as hawkish as they can possibly get and the market is worried that we’re going to fall back into recession, as evidenced by recent Treasury spreads. Third, credit spreads are back on the rise again.

All of this, in my opinion, makes for an interesting investment case for gold. Of course, the ETF marketplace has you covered in case you want to invest in gold and there are actually a variety of ways to play it.

GLD: The Largest Gold ETF

The SPDR Gold Shares Trust (GLD) is the largest and most liquid gold fund available. If you want simple, straightforward gold exposure, this is probably the first gold ETF that comes to mind, but there are cost considerations. With an expense ratio of 0.40%, there are several other options that come cheaper. It’s large enough that trading costs are next to nothing, which makes GLD likely the better choice for frequent traders even though the expense ratio is higher.

GLDM: Same As GLD But Cheaper

The SPDR Gold MiniShares Trust (GLDM) is essentially the same as GLD, except it charges just 0.18%, less than half of its predecessor. For longer-term, buy-and-hold investors, GLDM probably makes more sense than GLD.

BAR: Gold Physically Held In A Vault In London

The GraniteShares Gold Trust (BAR) invests in physical gold, but adds an extra degree of transparency. The gold that is owned by this fund is physically held in a vault in London. Every bar is fully accounted for and the fund publishes the list of gold bars held on a daily basis.

OUNZ: The Option To Take Physical Delivery Of Gold

Most gold funds limit ownership of the underlying precious metal to just the shares of the trust itself, but the VanEck Merk Gold Trust (OUNZ) gives you the option of turning your shares into actual gold bars that would be mailed to you (see the process for yourself). You’d better be sure you want to do it though. The exchange fee starts at $500.

IGLD: Gold Plus Income

The FT Cboe Vest Gold Strategy Target Income ETF (IGLD) offers a covered call strategy on top of gold as the underlying asset. The fund will invest in long-term call options on GLD, while writing short-term covered calls to generate income. It writes options on just 20% of the portfolio, just enough to produce a nice yield while not sacrificing too much upside potential. Based on recent distributions, IGLD yields around 3%.

BGLD: Gold With A Downside Buffer

The FT Cboe Vest Gold Strategy Quarterly Buffer ETF (BGLD) offers protection against a pre-determined level of losses in exchange for a cap on upside gains. BGLD provides a buffer against underlying ETF losses between -5% and -15% over the period from December 1, 2021 to February 28, 2022. The return cap is currently set at 3.9%.

GDMN: Gold Plus Gold Miners

The WisdomTree Efficient Gold Plus Gold Miners Strategy ETF (GDMN) offers exposure to both physical gold and gold miner stocks in a single fund. Through the use of gold futures contracts, GDMN is able to achieve a leveraged portfolio. For every $100, the fund seeks to invest approximately $90 in the gold miners’ basket and $90 in gold futures, for $180 of total gold-oriented exposure.

With that being said, let’s look at the markets and some ETFs.

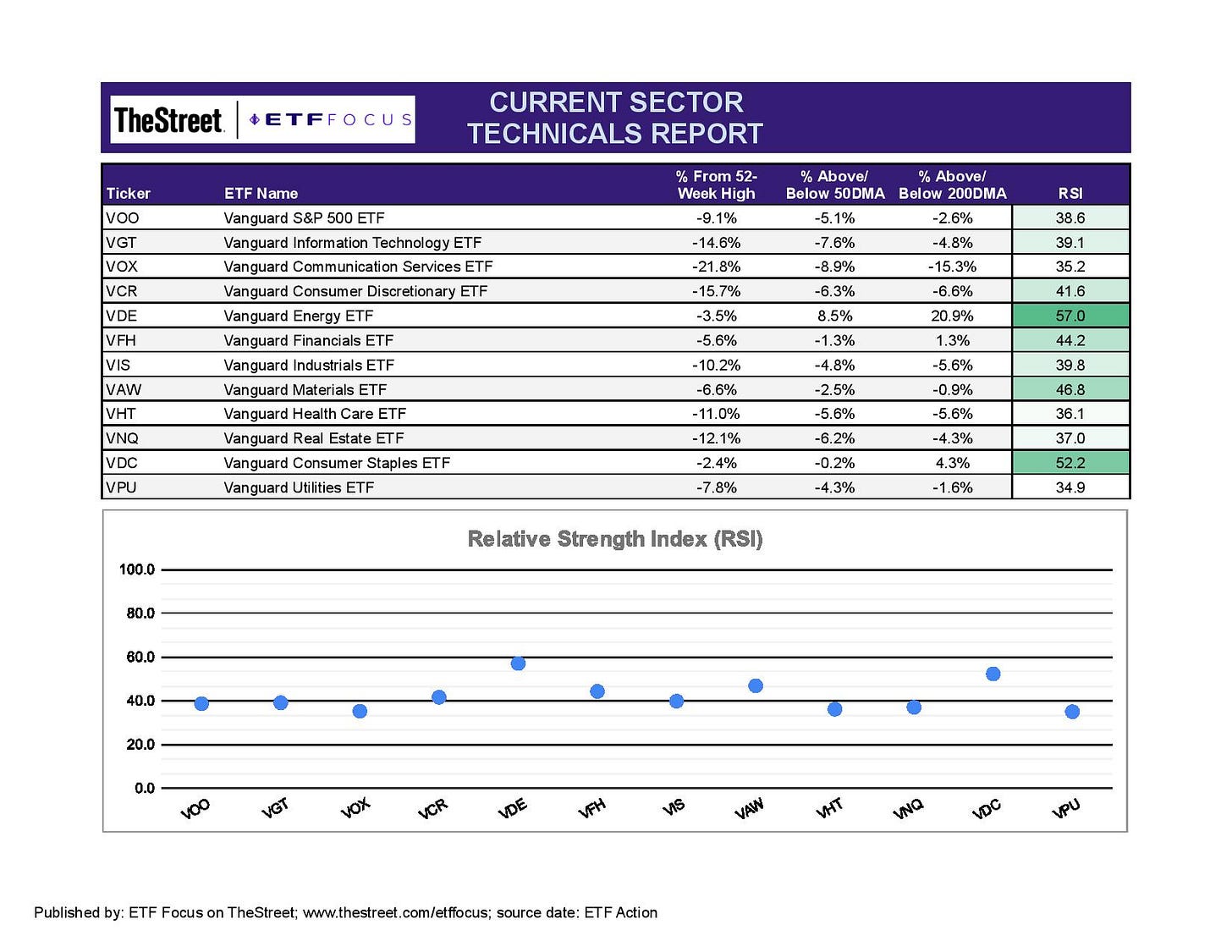

Two weeks ago, we saw strength in the energy sector and almost nothing else. Today, relative strength has balanced out somewhat, but there are a couple of clear, discernible trends. Growth and tech, which had led the markets higher throughout 2021, are one of the weakest areas. The rising yield curve is deflating some of the excessive valuations and those are largely coming from this area of the market. Cyclicals are mixed with energy still leading the way, but materials and industrials have bounced back lately. Defensive sectors are still mostly weak with the exception of consumer staples, which has been a bit of a market outlier. It’s the one “risk-off” sector that has pretty consistently outperformed this year. We’ve seen dividend stocks to comparatively well this year and this may be in line with that trend.

The weakness in defensive sectors, especially utilities, tells me that investors aren’t necessarily selling here, but more repositioning. It’s easy to see the S&P 500 down 9% and other indices down double digits from their highs and conclude that this is a significant sell-off. If that were the case, I think we’d see defensive issues - utilities, consumer staples, value, low volatility - leading the way pretty unanimously, but we’re just not seeing that. There’s certainly a negative sentiment hanging over the markets today, but not nearly as negative as many are perceiving right now.

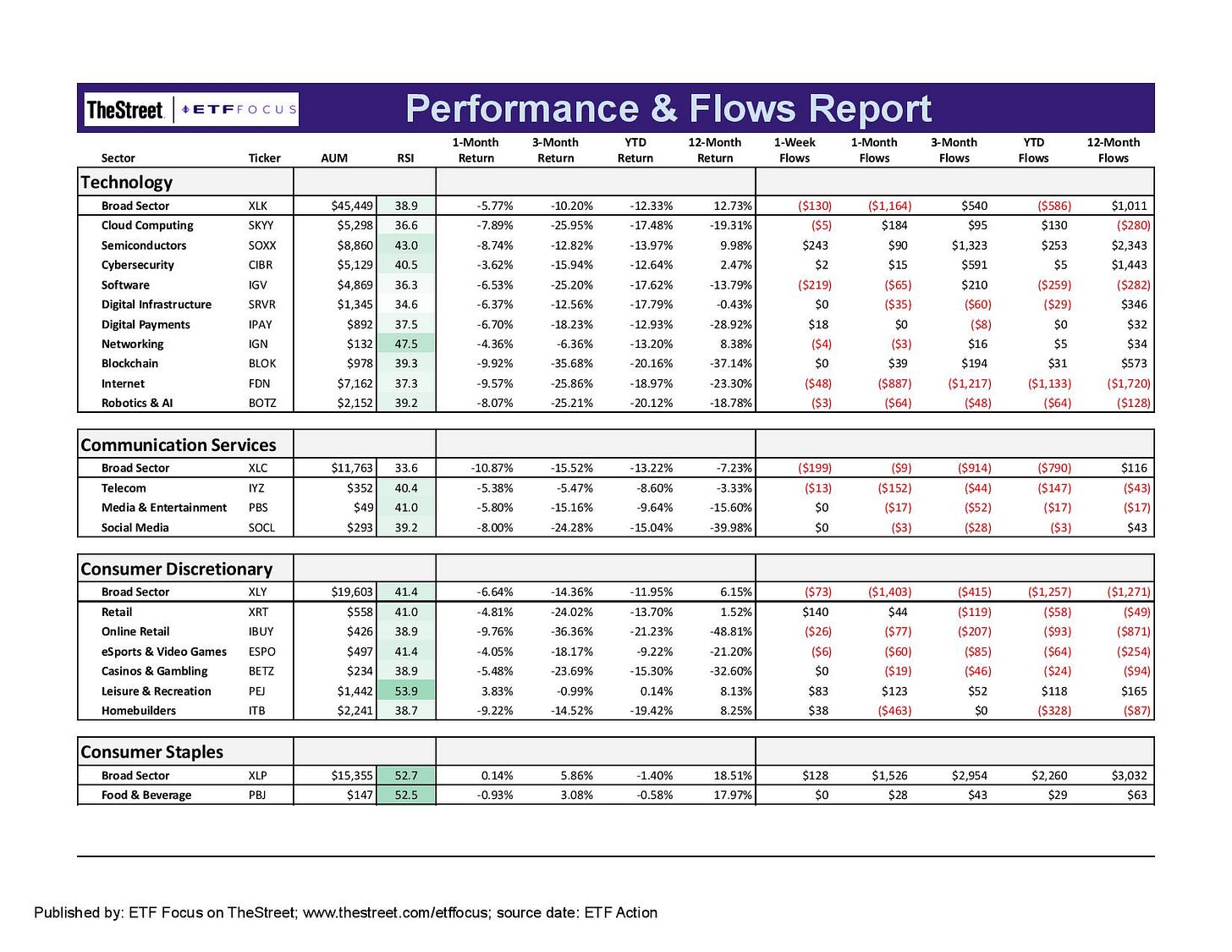

The three growth sectors - tech, communication services and consumer discretionary - are looking pretty weak across the board. There are really no pockets of strength to be found anywhere right now, save maybe for the leisure & recreation group. This group is getting a bounce from the airline stocks and there’s probably a post-omicron sentiment helping out, but that’s about it. The one thing that stands out to me is the flows from tech ETFs. They’re finally turning negative over the past month, something which hasn’t been the case throughout the last year. If investors are finally throwing in the towel here, there could be quite a bit more downside ahead.

Consumer staples has been the opposite. It’s still down about 1% on the year, but that’s far better than what we’ve seen most everywhere else. Investors have certainly taken notice to the tune of around $3 billion of net inflows on the Consumer Staples Select Sector SPDR ETF (XLP) over the past three months alone.

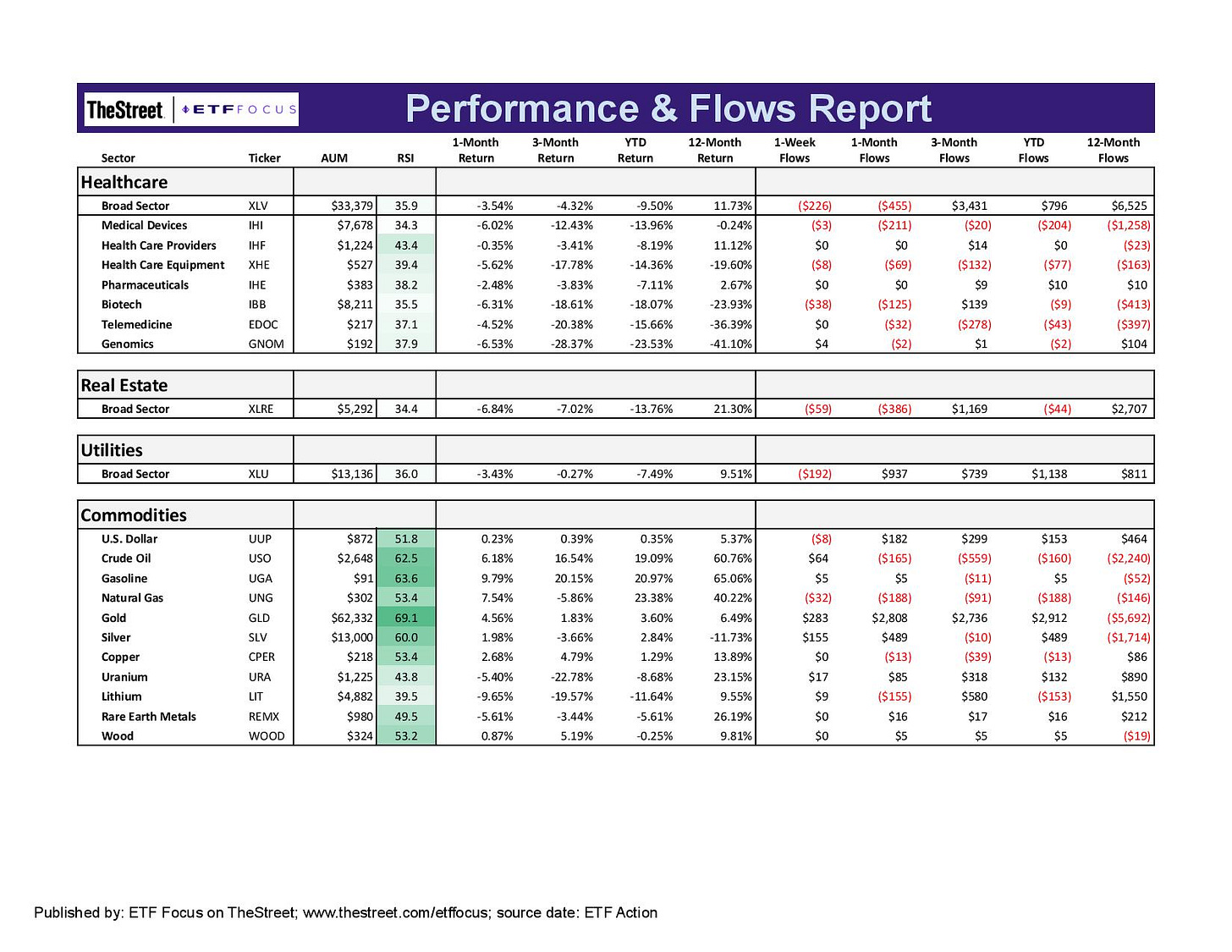

Most of the cyclical subsectors are neither bullish nor bearish at the moment, but they are generally looking better than the broader market at least in the short-term. The notable standout is the gold miners, who have generated double digit gains over the past month. I just made the case for gold earlier, so I won’t repeat it here, but I do think there’s potential for more catching up here.

Energy stocks are still looking good, but they’re going to be heavily dependent on the direction of oil prices. Last week’s 5% pullback in crude prices was a setback and the Russia/Ukraine conflict adds a high degree of short-term uncertainty. The “will they/won’t they” nature of the Russia invasion could shoot oil prices in either direction pretty quickly depending on how it plays out, so risk minimization might be the better tactic here.

The financials sector, especially the bank stocks, will remain very rate sensitive over the near-term. The Treasury yield curve had been moving in response to the Fed, but we have seen some traditional safe haven buying over the past couple weeks. If that helps put a cap on higher rates here, financials may be poised to move sideways for a while.

Healthcare, real estate and utilities are all looking pretty negative at the moment as investors are still shying away from taking more full-on defensive positions. Real estate is still getting some decent numbers from the housing market, but the trend sure seems to be that things are going to slow down throughout 2022 as rising mortgage rates help stifle demand. Utilities is the more traditional “risk-off” sector and I’m still not seeing signs of investors getting overly worried just yet.

Commodities are looking strong and building on the momentum that’s developed over the past couple weeks. Energy prices are still high and precious metals prices are on the rise. Lumber and industrial metals, such as copper, are still strong. This is potentially looking like a sector that could finally do well in 2022 after years of struggling.

Read More…

ETF Battles: It’s QQQ vs. SCHG vs. VOOG! Which Growth ETF Is Superior?

VTI vs. ITOT: Comparing the Vanguard & iShares Total Market ETFs

The Last 3 Rate Hike Cycles Ended Badly. This One Probably Will Too.

DEM: 6% Yield Opportunity In Emerging Markets

29 Energy ETFs Ranked For 2022

If You Need Downside Protection, Buffer ETFs Are Having A Moment

European Bank ETF Turns Quite Attractive Thanks To Suddenly Hawkish ECB

The Fed May Be Forced To Stop Before It Hits 4 Rate Hikes This Year

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!